Marko Geber/DigitalVision via Getty Images

Investment Thesis

Although John Wiley & Sons, Inc. ((NYSE:WLY)(NYSE:WLYB)) has surpassed the $2 billion annual revenue threshold, the softness in student enrollment and anticipated economic slowdown are weighing down the overall outlook for FY2023. With over 215 years in operation and 28 years of consecutive dividend increases, the company is well positioned to handle these challenges. It plans to remain focused on its core education development business for career-oriented students and corporate clients, scaling back M&A activity, and expanding its open publishing footprint. Investors looking to invest in a company that has successfully weathered the turbulent market environment in the past should consider investing in WLY and WLYB.

Background

John Wiley & Sons, Inc. is one of the oldest brands in America, starting operation in 1807. The company’s revenue now exceeds $2 billion annually, 83% of which is digital, tech-enabled, and 58% recurring. The company also offers over 1900 valuable journal brand publications, digital content courseware, tech-enabled degree programs, and on-the-job training. Company organic revenue grows at a rate of around 5% per year. The company is uniquely positioned to capitalize on the continual increase in annual R&D spend, which has tripled over the last two decades from around $726 billion to $2.4 trillion.

Business Headwinds

The main headwinds to John Wiley & Sons, Inc. are as follows:

- Softness in university enrollment lowers the core student base of the company.

- Students and teachers continue to be impacted due to COVID-19 lockdowns in various geographic locations.

- Geo-political instability continues in various regions where the company operates.

- Transitioning from print-oriented to digital content has cannibalized print revenues from students, schools, and universities.

- With 50% of the revenue generated overseas, foreign exchange headwinds affect the bottom line because of the continued strength in USD vs. rest-of-world currencies.

Business Tailwinds and Growth Catalysts

The tailwinds associated with the company are as follows:

- Attracting more clients by delivering career-connected education.

- Attracting more corporate talent development clients who subscribe to multiple services simultaneously. This segment grew at the rate of 70% YoY in 2022.

- Expanding research publications output by leveraging the open publishing Hindawi platform (acquired in 2021).

- Strategically focusing on expanding the portfolio of publications to include high-demand jobs and careers.

- Continually expanding direct-to-student marketing through XYZ media (Acquired 2021).

FY2022 Earnings Review

John Wiley & Sons, Inc. ended its FY2022 on June 15th, 2022. Here are some key highlights from the earnings call:

- The company beat earnings estimate by 11% and revenue by 1.75% Y/Y.

- The company plans to maintain its level of investments in current products but to slow the pace of acquisitions until the macro-fundamentals show improvement.

- Anticipated EBITDA will continue to remain at around 12 to 15%.

- The debt-to-EBITDA ratio for the company is 1.6, down from last year’s level of 1.7, and management is committed to maintaining this ratio at 1.6.

- The company also continued the trend of 28 consecutive years of dividend increases, with a yield of approximately 2.6%.

- Share repurchases accounted for about $30 million in cash outflow from the business, with up to $200 million authorized.

FY2023 Projections

On a constant currency basis, John Wiley & Sons, Inc. expects the following from FY2023:

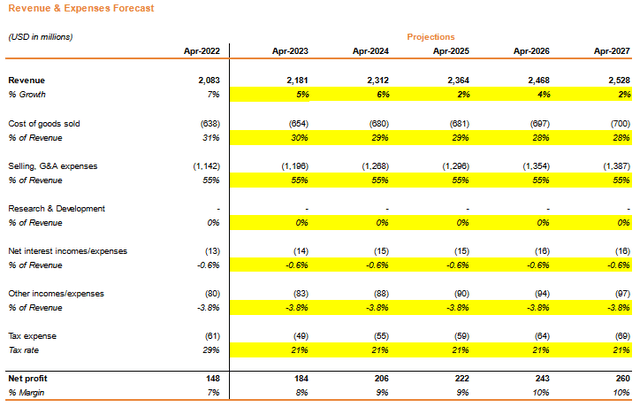

- The company’s revenue growth of around 5% was primarily driven by additional revenues from organic sales, research segments, and corporate clients.

- EBITDA is expected to be around $425 – $450 million, remaining relatively flat for FY2022.

- EPS is expected to decline from $3.70 to $4.05, down from $4.16 in FY2022.

Q12023 earnings are anticipated on 9/1/2022, and management is expected to provide updates to their projections. Additionally, investor day is scheduled in 2Q2023, where management will provide guidance on the company’s future course.

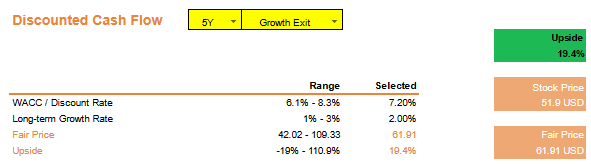

Valuation Update

With strong macro-headwinds, foreign exchange impacts, mid-single digits growth, slight EBITDA compression, and declining EPS, John Wiley & Sons, Inc.’s price target has been lowered from around $80 per share to approximately $62 per share, as shown below.

Price Target (Source: Author) Revenue Projection (Source: Author)

Investment Risks

The main risks to the company’s operating plan are muted consumer spending for 2H2022 and 2023. If this scenario plays out, the cyclical enrollment challenges faced by the company will worsen, revenue will decline, the EBITDA margins will compress further, and EPS will be lower. In response, the management has issued guidance factoring in some of these risks. It is fully committed to monitoring the situation closely and making the necessary adjustments to deliver on the projections.

Conclusion

Over the last five years, John Wiley & Sons, Inc. has transitioned a significant portion of its business towards capitalizing on lucrative career development, corporate talent development solutions, offering degree programs, and direct-to-student marketing. The company has also expanded its presence into open publishing. Although the company faces some near-term headwinds, with an operating history of 215 years and 28 consecutive years of dividend increases, WLY and WLYB are good choices for investors with any time horizon.

Be the first to comment