halbergman/E+ via Getty Images

Through a successful acquisition strategy and accretive reinvestments into its core business over the years, John Bean Technologies (NYSE:JBT) has enjoyed a track record of consistent earnings growth. In essence, JBT features the typical characteristics of a long-term industrial compounder with one key distinction – none of its business lines (FoodTech and AeroTech) is at risk of being disrupted anytime soon. Its latest financial targets emphasize the runway, with higher growth and margin targets post-COVID set to drive ROIC to an industry-leading 15% (ex-M&A). Plus, the news of JBT management exploring strategic alternatives represents a potential upside catalyst. Not only could JBT shareholders benefit from a more focused set of businesses post-spinoff, but with AeroTech margins targeted to hit >14% in the coming years, there is significant sum-of-parts value to be unlocked. An in-line multiple for the AeroTech business (based on industrial compounders such as Danaher (DHR), HEICO (HEI), Roper (ROP)) would imply the market is assigning little value to the FoodTech business, despite its long-term compounding potential.

FoodTech Tailwinds Buoy Updated Financial Targets

For JBT, little has changed since Q4 2021, as order and backlog trends remain at record highs amid increasing capex trends at the customer level – particularly in the food production end-market. Tyson Foods (TSN), for instance, has called out rising worker turnover and absenteeism as key issues in recent quarters, leading to operational disruptions throughout the value chain. Even with additional pay increases, these issues have not abated, and given the current labor market tightness, management has accelerated investments in automation, particularly for more complex, higher-turnover jobs. The resulting automation efficiencies can then be redeployed elsewhere throughout its facilities, driving TSN’s $1bn productivity savings target by 2024 ($300-$400m in 2022). This increased focus on automation is occurring elsewhere in the food production value chain as well, presenting a favorable read through for JBT alongside secular tailwinds such as an expanding global middle class and a shift in emphasis on food safety standards.

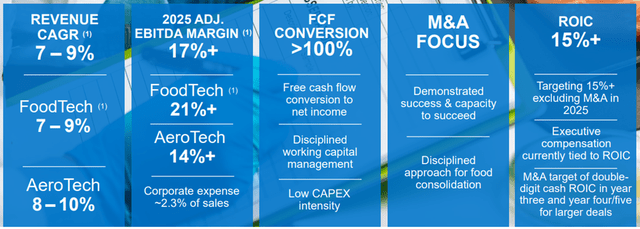

This backdrop plays nicely into JBT’s mid-term financial targets, which comprise organic growth of 7%-9%, ROIC of >15% (ex-M&A), >100% free cash flow conversion, and >17% adjusted EBITDA margins. If we were to include potential M&A contribution, the EBITDA target moves even higher by $100-$150m. By segment, JBT is on track for $2.5 billion in FoodTech sales at a >21% EBITDA margin (including M&A), with AeroTech segment sales of >$700m at a >14% EBITDA margin (corporate expense at 2-3% of sales). Given the steady growth path, a $10/share EPS scenario by 2025 seems well within reach – even from the ~$5/share base in 2022 – solely based on the base case growth plan (including M&A). Given JBT’s track record of post-M&A integration, there could also be upside from layering tuck-in acquisitions into the global JBT platform. Successfully unlocking >20%/year EPS growth should re-rate the valuation multiple from the currently depressed levels (caused by a temporary dip in operating performance due to COVID-related headwinds).

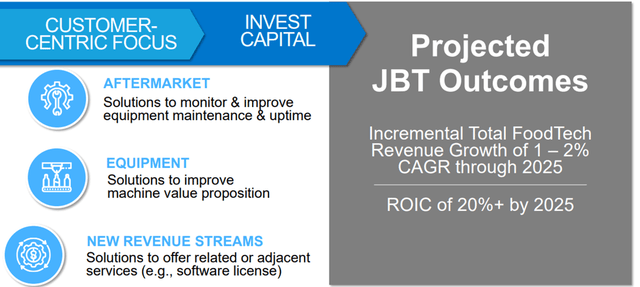

A Stickier FoodTech Revenue Base With “OmniBlu”

As part of its efforts to enhance the JBT digital footprint, management’s 2022 margin and free cash flow guidance embed $14-15m of additional corporate expense and $45m of capex spend. A large portion of the allocation will go toward the rollout of “OmniBlu,” a digital proprietary cloud-based architecture that leverages machine learning to customize use cases and analytics across the food supply chain. The increased customization should widen JBT’s moat and, thus, the FoodTech recurring revenue base to the >50% target defined by the Elevate 2.0 initiative (~300bps higher than the current ~47% contribution). Success here should have a twofold effect – it makes JBT’s revenue stream more sticky and increases the aftermarket component (i.e., where JBT makes its highest returns). In effect, the ~$60m spending in 2022 alone is guided to deliver a ~25% ROIC = significantly higher than the 10% three-year ROIC hurdle for M&A. Thus, a full rollout of “OmniBlu” through the entire FoodTech customer base should drive a significantly more accretive profile over time.

Ample Growth Potential And Strategic Optionality In AeroTech

The AeroTech segment also boasts an impressive base of recurring revenues, mainly from aftermarket parts, products, and services. Given that most of JBT’s products are high-ticket items with lifespans lasting many decades, each sale creates a range of future cash flow streams. The AeroTech growth trend will likely not slow down anytime soon – most industry data points remain very bullish post-COVID, with passenger miles on the rise, along with airport expansions and upgrades. Perhaps most importantly, cargo volumes are on an uptrend amid growing e-commerce activity. To capitalize, JBT has ramped up its investments in areas like the automation of boarding bridges via its JetDock solution, allowing for a more seamless operation of boarding bridges (e.g., by moving the bridge with a simple button push). At a time when COVID-induced headwinds are weighing on labor availability, the productivity benefits from JBT’s offerings should accelerate adoption and potential AeroTech revenue streams ahead.

While AeroTech is a quality business in its own right, JBT plans to conduct a strategic review of the business by next year. This could mean a spinoff or divestiture amid a 2023 aerospace recovery, likely allowing JBT to maximize shareholder value. Transaction costs and potential dis-synergies need to be accounted for, but I suspect the benefits from a more focused FoodTech business and the potential value unlocking from a separation more than compensates for the costs. On the latter point, I’ve assumed an in-line multiple for the AeroTech business in a sum-of-parts valuation framework and backed into the implied FoodTech valuation (see table below). This exercise reveals a significantly undervalued implied FoodTech valuation based on the current JBT market cap, highlighting the value creation potential in a spinoff scenario.

|

USD ‘Million |

Comments |

|

|

Enterprise Value |

4,060 |

As of April 14th Close |

|

(-) AeroTech @ 30x fwd EV/EBITDA |

2,790 |

Industrial Consolidator Comps (Danaher, HEICO, Roper); Elevate 2.0 EBITDA Target |

|

(-) Transaction Costs @ 10% of AeroTech EBITDA |

279 |

Capitalized at Target EV/EBITDA Multiple |

|

(-) Net Debt 2024E |

223 |

|

|

= Implied FoodTech EV |

768 |

|

|

Implied FoodTech fwd EV/EBITDA |

1.8x |

Elevate 2.0 EBITDA Target |

Source: Author, JBT Disclosures, Market Data

Quality Compounder With A Catalyst

Overall, JBT is quality. It not only has a solid foothold in two industries (via FoodTech and AeroTech) with secular growth drivers but also benefits from a clear runway for further penetration and expansion via accretive reinvestments and M&A. Plus, the JBT management team is one that has demonstrated its capabilities in executing the Elevate 1.0 playbook, and thus, the Elevate 2.0 playbook should continue to work well going forward. In the meantime, the AeroTech business is being assessed for strategic alternatives (to be completed by H1 2023), which could unlock substantial sum-of-parts value even if a split-off only commands an in-line multiple. In sum, JBT offers investors many ways to win at these levels.

Be the first to comment