xijian/iStock via Getty Images

JinkoSolar Holding Co., Ltd. (NYSE:JKS) is one of the world’s largest solar module manufacturers, recognized for its high-efficiency N-type cell technology. The attraction here is that solar panels are in high demand worldwide with an ongoing shift towards renewable energy. Indeed, the company recently reported its latest quarterly result highlighted by strong growth which beat expectations while offering positive guidance for the year ahead. We are bullish on JKS and see 2022 as a breakout year for the company that will benefit from a ramp-up in production and higher earnings.

Is JKS a Good Long-Term Investment

While Chinese stocks have captured a reputation as high risk and poor investments, it’s important to note that JinkoSolar has been an exception to the theme. The stock was up over 10% in the past year, in contrast to a 34% decline in the iShares MSCI China ETF (MCHI) while also ahead of the global solar industry benchmark considering the Invesco Solar ETF (TAN) which is down by 15% over the period. Part of this outperformance considers the fundamental strength of the company with recurring profitability and a leadership position in what remains a hot sector.

The challenge for Chinese stocks, in general, has been this concern in the market that a regulatory crackdown aimed primarily at the technology sector and internet companies will end up limiting growth and earnings. On the other hand, we make the case that JinkoSolar is strategically important to the government’s environmental ambitions and clean energy policies thereby making it relatively less exposed to restrictive regulations.

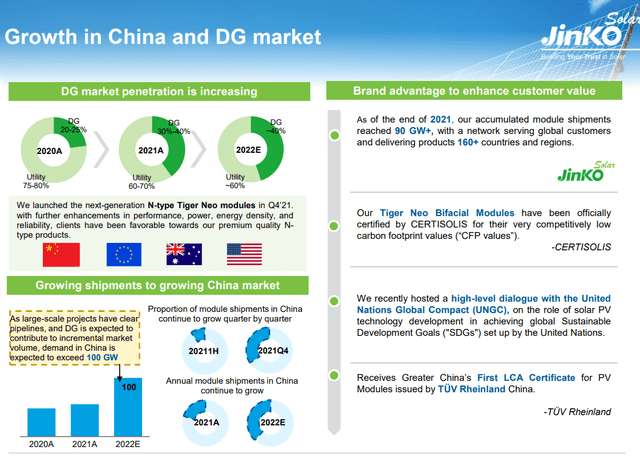

China plans to increase the amount of power purchased from clean generation sources from 28.2% in 2020 to 40% by 2030. Simply put, solar is a large part of that commitment which will require significant supplies of solar panels representing a positive operating backdrop for JinkoSolar which already has a leading market share in the country.

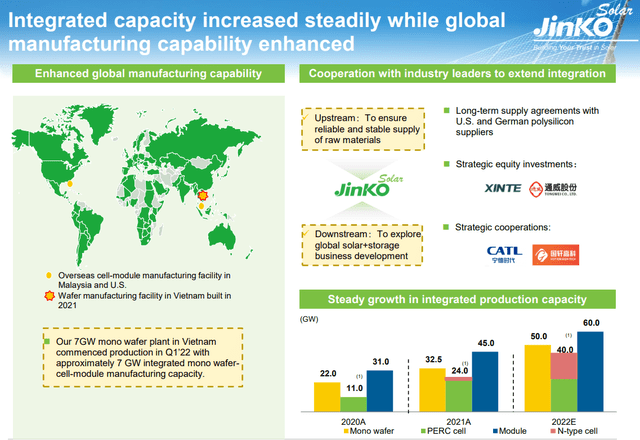

Keep in mind that the company is globally diversified selling products in over 160 countries. Governments around the world are incentivizing solar, with the technology also now getting an incremental boost in interest in the high oil and gas price environment. The company controls a manufacturing facility in the United States and serves utility, commercial, and residential markets worldwide.

China represented approximately 34% of sales in the last quarter and is now a high growth market considering an expected increase in the share of non-utility scale distributed generation systems. The setup here is for continued opportunities allowing JinkoSolar to grow and consolidate its market share over the long run.

JKS Key Metrics

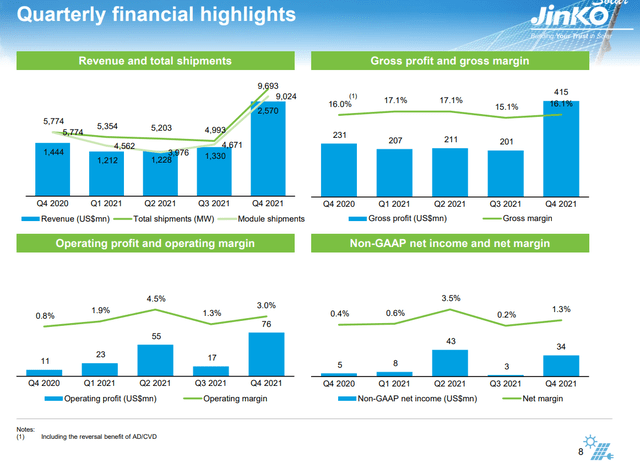

The company reported its Q4 results on March 23rd with non-GAAP EPS of $0.67 which missed expectations by $0.23. Management explains that logistical challenges including shipping costs pressured margins in the period, although it believes this can improve going forward. The real story was revenue of $2.6 billion which climbed by 74% year-over-year and also beat expectations by $430 million. Quarterly EBITDA of $183 million climbed 80% from the period last year.

Total solar shipments in terms of megawatts reached 9,693MW, up 68% y/y and also 94% compared to Q3. This was achieved through the launch of Jinko’s latest N-type “Tiger Neo modules” in Q4 that have received a positive response from customers for their premium quality. As mentioned, much of the strength is coming from China where JKS is uniquely positioned to meet growing demand from distributed generation. From the earnings conference call:

As distributed generation gradually becomes the main driving force for newly added installations in China, the sector is expected to increasingly contribute to incremental market volume, encouraged by incentives from the one and policy framework that guides the country’s climate action and action plan on peak emission and other policies. We are optimistic about China demand will exceed 100 gigawatt in 2022, and we expect the shipments in China market to further increase in the 2022.

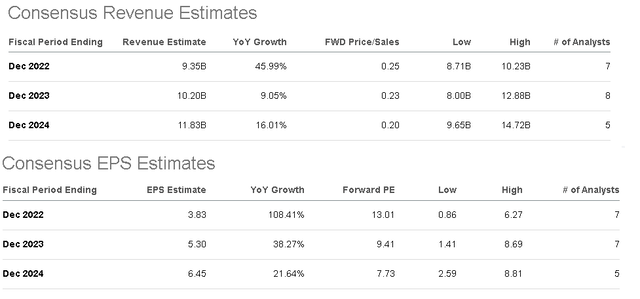

JinkoSolar is guiding total shipments in 2022 to reach 35GW to 40GW globally compared to 25.6GW in 2021. The midpoint target implies 46% revenue growth which is also the consensus estimate for sales in 2022. The market also expects EPS to more than double to $3.83 compared to $1.84 in 2021. The forecast is for the earnings momentum to continue with EPS climbing 38% in 2023 and again 22% in 2024.

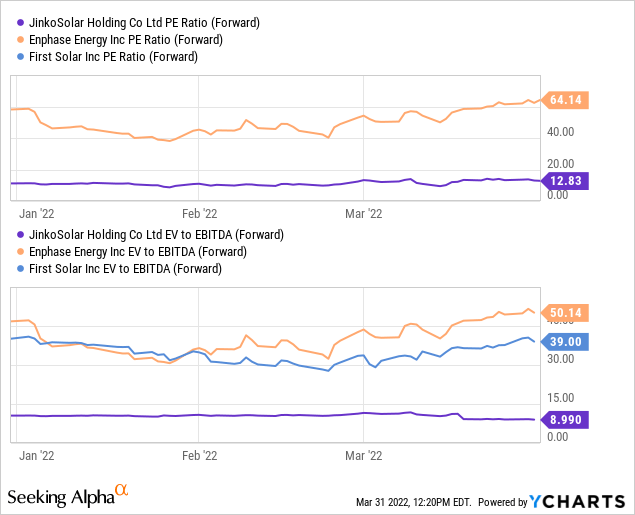

In terms of valuation, JKS trades at a forward P/E of just 13x which represents a large discount to the broader solar industry considering many companies are not currently profitable. For context, Enphase Energy, Inc. (ENPH), which is recognized as one of the most valuable solar companies specializing in solar power storage systems, trades with a forward P/E of 64x. First Solar, Inc. (FSLR) which manufactures solar panels in the United States is not expected to generate positive EPS this year but trades at a premium in terms of its forward EV to EBITDA multiple at 39x compared to just 9x for JKS.

Again, much of this spread is based on JinkoSolar’s “China discount” and the risk aversion towards the region. Recognizing every solar stock has its differences, we can call JKS the value pick in the group.

Is JKS a Buy, Sell, or Hold?

We rate JKS as a buy with a price target for the year ahead at $70, representing an 18x multiple on the current consensus 2022 EPS. Our thinking here is that the company can end up outperforming expectations over the next few quarters based on strong demand, leading to a series of revisions higher to earnings estimates that can be positive for the stock.

From the chart above, we’re also observing that shares have consolidated their large gains from 2020 but now show strength with a series of higher lows. The potential that the stock rallies above $60 as a key technical level can drive renewed momentum to the upside.

In terms of risks, JinkoSolar remains exposed to the macro environment, including trends in the Chinese economy. Deterioration to the global growth outlook or disappointing sales trends can open the door for a leg lower in the stock. The regulatory environment including potential import restrictions on solar panels globally or broader trade tariffs can also impact the business. The volumes of solar modules shipped and the company’s operating margin will be key monitoring points this year.

Be the first to comment