hrui/iStock via Getty Images

JinkoSolar Holding Co., Ltd. (NYSE:JKS) is the world’s largest solar module manufacturer by volume. The Chinese company is recognized for its powerful and highly efficient N-type solar cell technology that is in strong demand globally amid an accelerating transition toward clean energy solutions.

We last covered the stock back in March, noting 2022 was setting up to be a breakout year. Indeed, the latest quarterly results were highlighted by record sales and positive earnings momentum, with a continued growth outlook. Our update today recaps recent developments while reaffirming a bullish position. We like JKS as an industry leader supported by overall solid fundamentals that still trades at a discount to solar peers.

JKS Earnings Recap

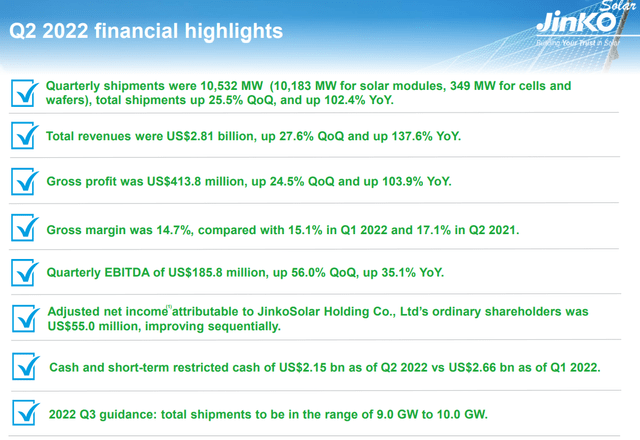

The company reported its Q2 earnings on August 26th with an adjusted net income of $55 million or $1.11 per share, up from $0.89 in the period last year. A GAAP net loss of -$93 million included the impact of an accounting change in the fair value of convertible notes.

While the gross margin at 14.7% ticked lower from 15.1% in Q1, blamed on inflationary cost pressures, the bigger story was quarterly EBITDA reaching $186 million, up 35% year-over-year. The increase in underlying profitability included the top line momentum, as total revenues of $2.8 billion climbed 28% from Q1 and 138% y/y. The trend corresponded to quarterly shipments of 10.5 GW across solar modules and cells for wafers, up 26% q/q and 102% y/y.

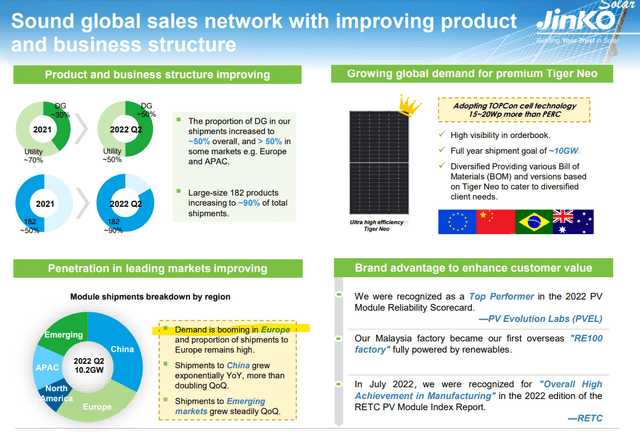

The comments from management have been encouraging for a continued growth runway amid “booming” demand in Europe while shipments to China are up exponentially. A trend this year has been a climbing proportion of sales towards distributed generation (DG) solar projects representing 50% of the business compared to 30% in 2021, while “utility” applications have lost some space.

Jinko explains that the shift towards “large-size” products has helped with operational and financial efficiencies. For context, JinkoSolar maintains a manufacturing facility in Malaysia and the United States serving the core regions. A separate wafer manufacturing facility in Vietnam is still ramping up in support of more premium N-type technology.

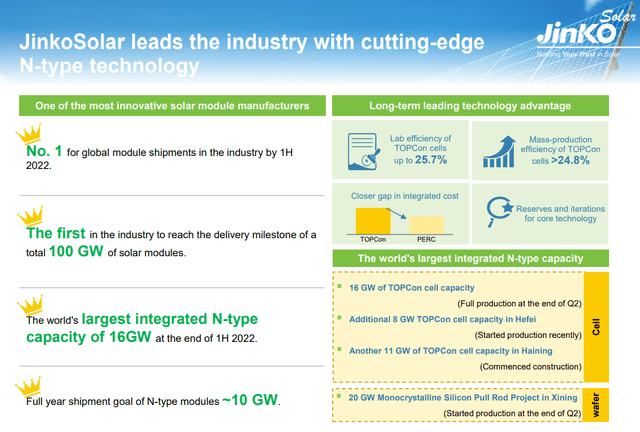

One of the attractions of JinkoSolar is its perceived technological advantages as a differentiator. The company made headlines in April for achieving a technical breakthrough for its 182 mm N-type solar cell setting a world record with a maximum conversion efficiency of 25.7%. The independent industry testing group “PV Evolutions Lab” named JinkoSolar as a top performer in its annual 2022 PV Module Reliability Scorecard

In terms of guidance, JinkoSolar is targeting full-year 2022 shipments between 35GW and 40GW, considering 10.5GW in Q2 up from 8.4GW in Q1. The expectation is that N-type solar cells represent more than 25% of global shipments by the end of the year. Other positives include a scale benefit with the tunnel oxide passivated contact solar (TOPCon) technology, narrowing the cost gap towards the last generation passivated emitter and rear contact (PERC) systems.

Finally, we note that Jinko ended the quarter with $2.1 billion in cash against $3.8 billion in total debt. The net debt position at $1.7 billion is down from $2.1 billion in the period last year. The climbing earnings level has also improved the net debt to last-twelve-months EBITDA leverage rate towards 2.3x from 3.7x in Q2 2021.

Is JKS A Good Stock?

There’s a lot to like about JinkoSolar within one of the hottest industries in the market. While solar power was already climbing within the global energy mix over the last decade, there is a sense that the energy crisis this year as the price of oil and gas reached record highs added additional urgency toward renewable alternatives.

Indeed, the U.S. recently passed a climate change bill, technically named the “Inflation Reduction Act of 2022”, that included upwards of $369 billion over the next decade between tax credits and direct investments toward renewable energy technology including solar. In Europe, the effort to reduce reliance on Russian energy resulted in a new strategic plan to target 400GW of solar PV by 2025 and almost 740GW by 2030. The forecast for solar deployment in Europe at a total of 40GW compares to 27GW in 2021, with JKS representing a material portion of those figures.

The point here is to say that JKS is well-positioned to capture what are major secular tailwinds. The understanding is that the industry growth will need to accelerate over the coming year to reach the targets. While many different companies will play key roles in this global proliferation, JinkoSolar stands out for its scale and established infrastructure.

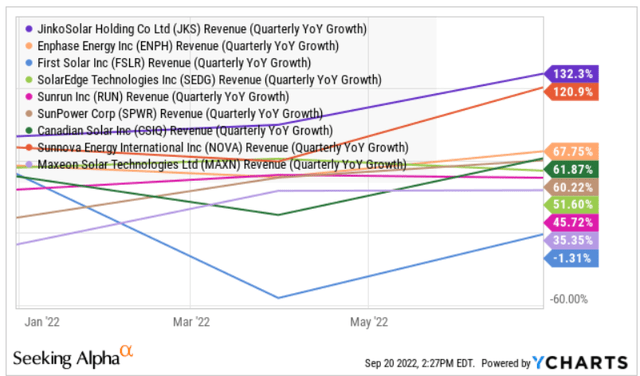

It’s telling that JinkoSolar’s top-line growth in Q2 was the highest among a diversified group of major solar companies. Keep in mind that its position as a pure-play module/panel manufacturer is relatively unique compared to other firms focusing on solar energy systems, storage solutions, residential roof solar applications, or related technologies. In some cases, these companies may be utilizing Jinko panels for installations.

The other side to the discussion is the fact that JinkoSolar is a Chinese-based company that adds unique risks and likely explains the market’s apparent risk aversion. We note that JKS has persistently traded at a valuation discount compared to its U.S. and developed market peers. Going back to 2021, the concern among Chinese stocks is the government’s heavy hand on the regulatory environment, with some arbitrary restrictions on various industries.

The way we’re looking at JKS is that the company has a few factors playing in its favor. First, its position within renewable energy likely avoids the more socially controversial areas of internet and commerce that have been subject to a regulatory crackdown. Notably, JinkoSolar’s work advances China’s own clean energy goals.

The other positive in the company’s profile is its U.S.-based manufacturing facility in Jacksonville, Florida. The subsidiary can work independently of the China operation, avoiding some of the harsher trade barriers to serving the North American market. It’s also encouraging the news in recent months that the U.S. Government and China had reached an agreement to improve accounting transparency. As it relates to JKS, the stock can benefit from generally improved sentiment towards Chinese companies beyond macro volatility.

Putting it all together, our take is that JKS remains undervalued considering its growth momentum and underlying profitability. According to consensus estimates, JKS is trading at a forward P/E of 14x against the 2022 EPS forecast of $3.91. For 2023, another 62% earnings growth towards $6.35 implies a one-year forward P/E of 8.7x.

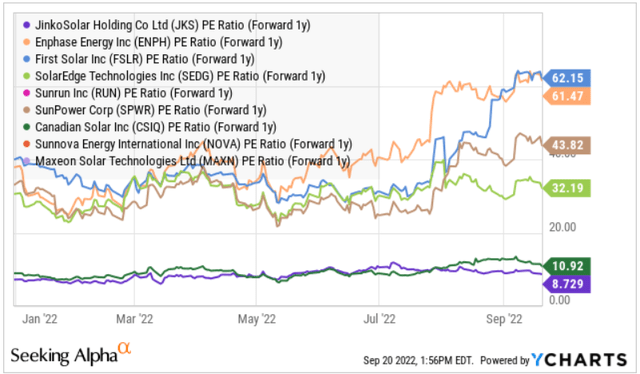

We’ll focus on this last metric, recognizing that many other solar stocks are not currently profitable but are expected to reach positive EPS by next year. By this measure, JKS appears to offer good value compared to Canadian Solar Inc. (CSIQ) at 10.9x, or even SolarEdge Technologies, Inc. (SEDG) at 32x. First Solar, Inc. (FSLR) has the highest premium trading at 62x its 2023 consensus EPS. JKS is attractive in this group with its international exposure.

JKS Stock Price Forecast

One of the challenges this year has been several supply chain disruptions including the availability of polysilicon adding to costs. The bullish case for the stock is that as the margin pressures ease, JinkoSolar has room to outperform current earnings expectations. Accelerating global demand for solar deployments supports a positive long-term outlook for the stock.

We rate JKS as a buy with a price target for the year ahead at $75.00 representing a 12x multiple on the current consensus 2023 EPS. This was a level the stock briefly traded at in late June, which we believe can be reclaimed over the next few quarters.

In terms of risks, a deterioration in the macro environment beyond the baseline would likely add volatility to all financial assets. Weaker than expected sales by JinkoSolar for the second half of the year would also open the door for a leg lower in the stock. Monitoring points include the gross margin along with trends in shipments to various regions.

Be the first to comment