Olemedia

A category of stocks that I have enjoyed reviewing during this market downturn is busted IPOs that debuted in the public market in the last 18-24 months. Many of these companies were lucky enough to price their IPO at incredibly high valuation and therefore raised quite a lot of capital that might turn out to be a boon for long term growth, assuming that the underlying business is sound. Today I am reviewing JFrog Ltd. (NASDAQ:FROG), a tech small-cap that came public in September 2020 priced at $44 per share, raising about $350 million in the process; since then, the stock was basically cut in half and sits now at a price of $23.80, actually rebounded from a 52-week low of $16.36 per share that was hit in summer. The company operates in a very interesting niche and it immediately got my attention as it has always been Free Cash Flow positive, a rare sight among tech growth stocks. However, the current valuation does not offer sufficient margin of safety as it implies a lot of growth ahead which could be potentially impacted by a multitude of factors, especially macro headwinds. Moreover, the company relies extensively on stock-based compensation which further impacts shareholders’ return.

JFrog is a pioneer in its niche

JFrog pioneered the concept of Liquid Software. The company offers access to an end-to-end, universal DevOps Platform that fills the gap between applications’ development and its deployment to the end user. Nowadays businesses rely extensively on software for any type of operation; additionally, this software needs to be updated ever more frequently to not only enhance its features, but also to maintain its security against bugs or external threats. Companies around the world struggle every day with maintaining their software up-to-date, risking cyberattacks that rely on known vulnerabilities of software applications that have not been updated.

JFrog 3Q Earnings Presentation

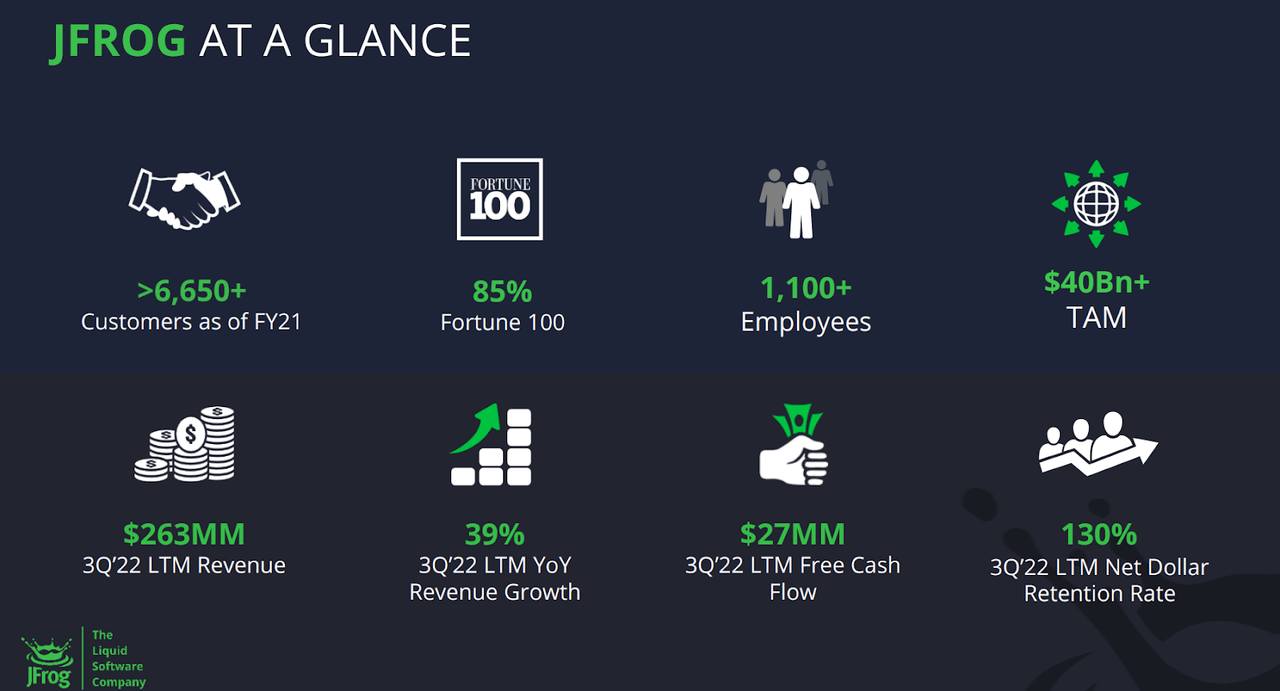

JFrog sells its tools through Software-as-a-Services subscriptions. It relies both on a community-driven, freemium model approach and on a dedicated sales team to approach new potential developers and sign new contracts. Developers and businesses can utilize some of JFrog offerings for free and then upgrade to a paid tier if they want to adopt more modules and expand their usage. In short, JFrog will benefit and grow by both increasing its customer base, as well as managing to expand the revenue generated by each customer over time. As of now, JFrog succeeded in both metrics as the customer base is steadily increasing while net retention rate sits comfortably at 130%, meaning that on average existing customers spend 30% more a year after signing the contract with JFrog. Another clear testament of quality is also that as of December 2021, JFrog recorded 6,650 customers including 85% of Fortune 500. Clearly JFrog is attracting primarily enterprise customers, big businesses that find it difficult to update their software across their thousands of employees’ terminals and devices. At the same time, it is beneficial to know that no single customer accounted for more than 1% of revenue in 2021.

Third quarter 2022 review: good results and some headwinds noted

JFrog 3Q Earnings Presentation

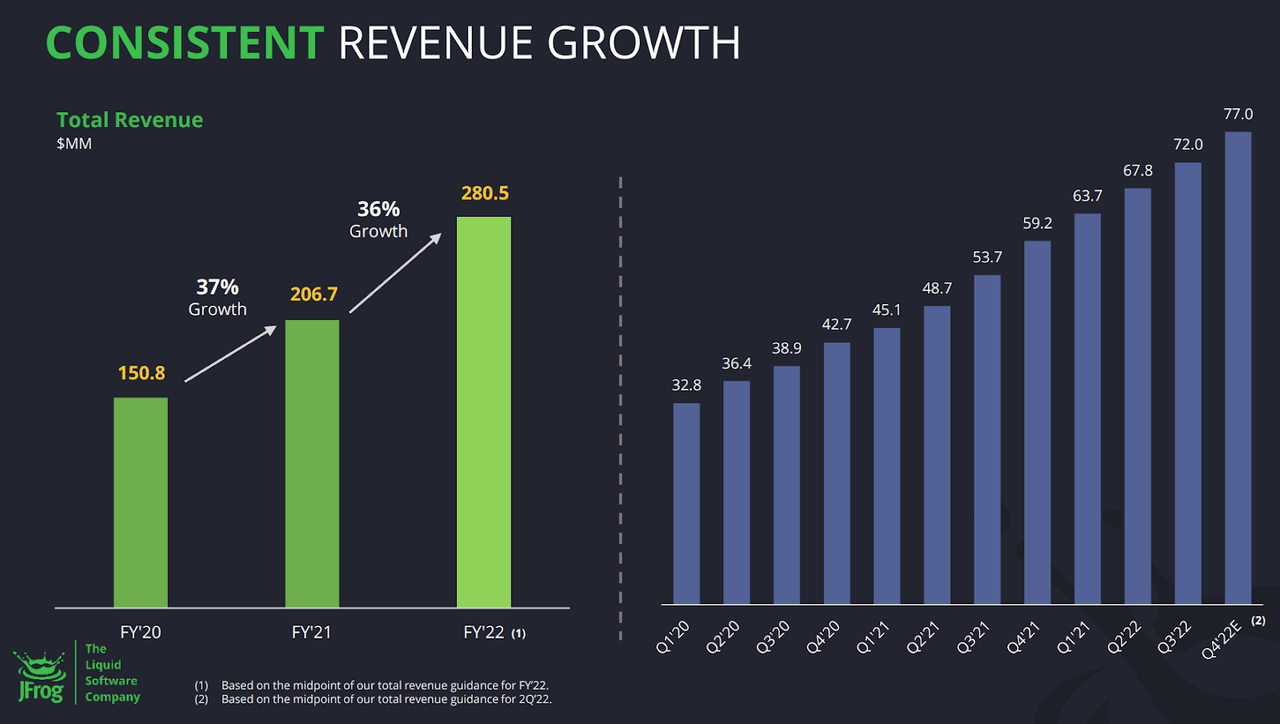

JFrog reported 3Q earnings on November 2 and the results were quite good. Total Revenue grew 35% to $72 million, while Cloud Revenue grew 60% YoY to $21 million. Customers with Annual Recurring Revenue of $100,000 or more grew to 696, 49% increase. Customers with $1 million in ARR also grew 29% YoY. Excellent results on net dollar retention rate which was still at 130% for the last 4 quarters even during tough times, when many other tech companies are showing signs of slowdown. Despite that, management has highlighted how JFrog is not immune to the macro economy:

With our business efficiency and growing market demand for DevOps and security holistic offerings, we are positioned well to face macroeconomic headwinds. […] However, JFrog is not immune to these macro-driven headwinds, and we continue to see longer sales cycles, additional budget approval requirements and project delay […]

We are pleased with continued growth momentum in our SaaS business despite some optimization of usage by our customers that we experienced during the quarter. We saw customers adjusting their usage patterns to get some cost savings as well as utilize better pricing by moving from PayGo subscription to minimum annual commitments.

Non-GAAP Gross Margin was pretty much stable at 84.2% in the third quarter compared to 84.5% a year ago. The company expects Gross Margin to be stable between 83% and 84% in the near future however on a long term it should be expected that the business will operate at low 80s as cloud revenue becomes more and more prevalent in the revenue mix.

GAAP Operating Expenses are quite high considering that they came in at 82% of revenue, same share as last year. However, on a Non-GAAP basis (primarily excluding Stock-Based Compensation) the company generated $1.2 million of operating profit for a 1.7% operating margin, compared with 2.5% a year ago. FCF was once again positive at $3.8 million. The balance sheet continues to be in great shape with the cash position consistently expanding, now at $434 million of cash and short term investment while also having no long-term debt.

Overall a good quarter for a company in the early stages of its growth. Operationally there is a lot to like: revenue is growing fast, the customer base is expanding, retention rate is consistently very high and quarter over quarter the company is generating positive free cash flow which is exactly what it should do. The big elephant in the room as always is Stock-Based Compensation. As every other growth company in the tech space, JFrog is heavily relying on SBC to reward its employees. As a result, current shareholders have been diluted around 5% over the trailing twelve months; this is an obvious headwind that needs to be accounted for when assessing a potential investment as it will directly impact shareholders’ return. However, it allowed the company to be consistently FCF positive over the past 5 years so the question is always the same: is the company allocating the retained capital correctly? In other words, is such high SBC and shareholder’s dilution laying the foundation for long-term gains? Given the good results that FROG is posting I believe the answer is yes, but again shares’ dilution needs to be accounted for when assessing an investment.

Valuation and key takeaways

Valuing growth companies is always a very tricky exercise. How to value a company that is funding a big portion of its operation through the issuance of new shares and is not currently interested in maximizing its profits? What I like to do in these cases is reviewing long term targets that management set for the business, if any. In this case FROG is projecting long-term free cash flow margins of 30%, although no specific time frame has been provided for reaching this goal. Quite the opposite, FCF Margin has been trending down from 17% in 2020, 11% in 2021 to the current TTM result of 10.3%, hence the company seems quite far from reaching the target. Moreover, management has specified in the call that they don’t feel ready to guide in any way for 2023 given the macro uncertainties, which leads me to think that they might expect some weakness that will further push down the road the target for 30% FCF margin.

At the moment stock is valued $2.3 billion which equates to a premium Price to Sales ratio of 8.91. By assuming 30% revenue growth for the next 5 years, the company will reach $1 billion in revenue by 2027 and $300 million of FCF if it manages to hit the long term margin target as well. If that will be the case, current prices imply a Price to 2027 FCF of 8 which would be obviously cheap and could mean a reprising upward of the stock price by at least double, but a lot has to happen for that to materialize. If the company does not grow as fast and misses the hefty profitability target, current prices do not offer material margin of safety in my opinion, especially considering how during the past two years FCF margins have been trending down. And this is even before considering the impact of high stock-based compensation.

Overall, I like the business and the way it is managed, however current prices do not offer sufficient margin of safety. Nevertheless, operationally it seems like a very sound and efficient business which deserves to be followed closely should the price come down substantially from current levels.

Be the first to comment