Nordroden

Investment Thesis:

Jervois Global Limited (OTCQX:JRVMF) had an impressive run from 2019 to early 2022 driven by a strong management team that shrewdly acquired battery metal (cobalt and nickel) assets in Idaho, Brazil and Finland. The company has moved beyond a miner to a more integrated business model that will mine, process, and trade (not always its own material) these important battery metals. I believe the positive stock price movement during the period and investor optimism was warranted given the logical and impressive growth of the company, however, it was also largely a pre-revenue stage company at that point and hard to measure fundamental value apart from NPV projections on its various projects. That changed with the acquisition of Jervois Finland Cobalt refinery (formerly Freeport Cobalt).

Q2 2022 was respectable but not spectacular and Jervois lowered 2022 full year guidance. The market has reacted by selling off the stock. This is the blessing and the curse of having actual operating results to report to the market. That said the overall investment thesis for the company remains intact if you believe that there will be rising demand for battery metals (think Electric vehicles) and that the west (USA and EU) would like to diversify supply away from China and related Congo. I have a hold rating on the stock given the overall market weakness and risk of global recession, I think that many stocks including Jervois could do poorly in the short term. Longer term I think that the Jervois investment story will hold together well given the logic of the approach and the shrewd management team. For those looking to enter the name, however, there may be a better entry point given the overall market weakness and reaction to latest results.

Price Chart and Action

The chart below depicts the bullish 18 month run in Jervois stock price from $0.14 in July 2020 to $0.74 on April 19, 2022. Since then, the stock has traded poorly and currently trades at about $0.28.

JRVMF Price Chart (Fidelity.com)

Review of Q2 2022 Financial Results

Currently Jervois derives its revenue and income from its Jervois Finland Cobalt refining facility. Jervois faced some market headwinds in Q2 2022 that caused its results to be softer than anticipated and Jervois lowered sales and EBITDA guidance for full year 2022.

Here are some key items that negatively impacted results.

- Battery demand in China weakened by Covid lockdowns in China.

- Ceramic pigment demand was down, and this tends to be highly price sensitive market segment.

- June maintenance of Jervois Finland facility slowed production.

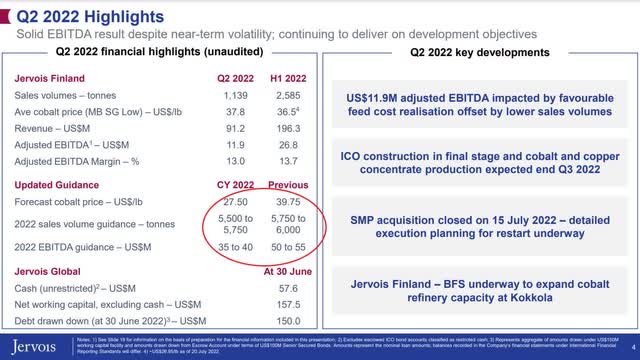

- This slide shows the Q2 results and guidance for remainder of 2022.

Jervois Q2 Results and Guidance (Jervois 2Q Financial Results Presentation)

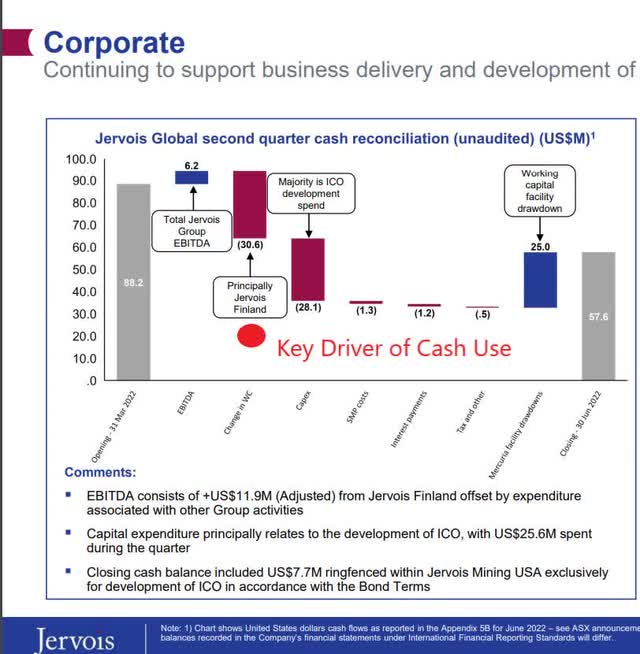

Cash Flow was also impacted by the headwinds listed above this was driven by a sizeable increase in inventories that resulted in about -$30m USD in cash use and was the biggest negative driver in change in cash. Jervois CFO James May stated on their 2Q Earning call that June 30th, 2022 should represent the high point for the year for working capital for the year. A reduction in inventories will help cash on hand moving forward.

Jervois 2Q Cash Flow Chart (Jervois 2Q Financial Presentation with author edit)

The Adjusted EBITDA numbers were decent for the quarter, however, I believe what worried investors is the lowering of guidance for cobalt price, sales volumes, and full year EBITDA from $50-55 million to $35-40.

EBITDA and Adjusted EBITDA does not take into account debt servicing costs, and this is important as the growth at Jervois has been helped by debt financing. Let’s take a closer look at their debt and the terms as well as projected cost per year.

$100m Bond Facility for construction of Idaho Cobalt Operations (ICO)

- $100m drawn at June 30, 2022

- Maturity Date: July 20, 2026

- Collateral: First priority security of all assets of the issuer (Jervois USA), essentially all assets of ICO

- Non-amortizing – bullet payment at end of term

- 12.5% Annual rate paid bi-annually.

- The annual cost of payments for this bond $12.5m

$150m Working Capital Facility (Mercuria) –Jervois Finland

- Originally facility was for $75m but was expanded to $150m on June 3, 2022.

- $100m drawn at June 30, 2022

- Maturity Date: December 31, 2024

- Collateral: First priority security over all material assets of Jervois Finland, including inventory, receivables, collection account, and shares in Jervois Finland.

- Interest Rates is LIBOR +5%

- Estimated annual cost (current 1-year LIBOR rate 3.81%) is $8.8m; would go to $13m+ if/when fully drawn.

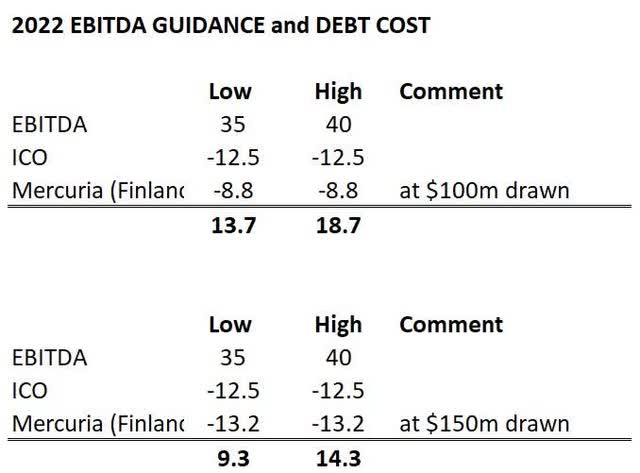

- Adding debt cost back into 2022 guidance shows relatively small absolute margins.

Source for Finance/debt facilities: Jervois Quarterly Activities Report to 30 June 2022

The chart below gives an idea of 2022 Jervois EBITDA guidance and annual debt servicing cost.

2022 EBITDA guidance and Debt Cost (Author’s chart from Jervois financial reports)

In fairness this analysis burdens the entire financing of Idaho Cobalt Operations against Jervois Finland and Idaho Cobalt will have its own standalone commercial operations likely in 2023 (more on that below). It also seems likely that the Sao Miguel Paulista (“SMP”) cobalt and nickel refinery in Brazil will require additional funding but is expected to be operation in late 2023.

This brings us to the crux of the issue in understanding Jervois. It now has actual operating results which in my mind were reasonable and roughly in-line with average prior results for the facility from 2018-2021 of $38m EBITDA.

One issue is that Jervois guided to higher results based on market demand and higher cobalt prices. The other issue is that there are now actual numbers to assess and it’s not a pre-revenue purely growth story anymore. That said Jervois still has two major components to their plan that are nearing completion and add to the overall scope of the operation. In addition, I contend that Jervois has been extremely shrewd and logical in its acquisition of its 3 main pillars (Jervois Finland, Idaho Cobalt Operations, and Sao Miguel Paulista). In a strange way market weakness may end up benefiting them if they see another growth opportunity on the cheap.

Update on Idaho Cobalt Operations

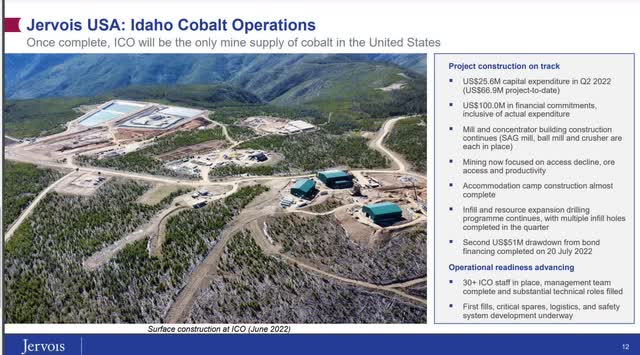

Jervois has continued to make progress to make this mine operational. Jervois has now drawn the full $100m bond/loan to fund construction of the mill and mine and expect to have the property commissioned and begin operations in Q3 2022. They will sell both copper and cobalt from this facility and some of this cobalt will likely eventually end up at their Sao Miguel Paulista refinery when it is ready.

Here is a snapshot of current progress.

Jervois 2Q Update ICO (Jervois Corporate Presentation)

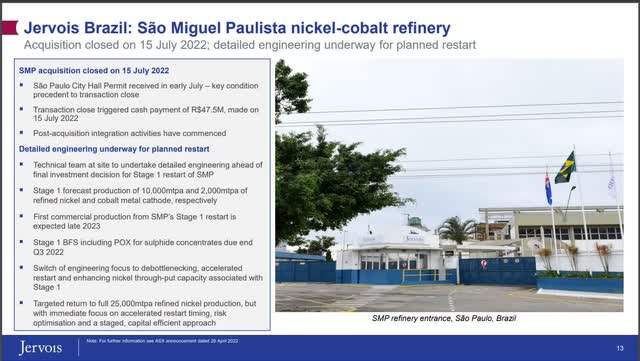

Update on Sao Miguel Paulista

Jervois closed acquisition of the Sao Miguel Paulista (“SMP”) facility on July 15, 2022 following permit grant by Sao Paulo city hall. Jervois released results of a “Stage 1” Bankability feasibility study (“BFS”) for SMP on April 29, 2022. Here are some highlights:

- Stage 1 would be 10,000 mtpa (million tonnes per annum) of nickel and 2,000 mtpa of cobalt refined at the facility. This is stage 1 because nameplate capacity at the facility is 25,000 mtpa refined nickel and 2,000 mtpa refined cobalt.

- NPV for Stage 1 production is US $141 million with the following assumptions:

- 8% discount rate

- $US 8.00/lb nickel and US $25.00/lb cobalt price

- Capital project costs at $55m

- Estimated Average Annual EBITDA of US $30M

Jervois 2Q Update SMP (Jervois Corporate Presentation)

Valuation:

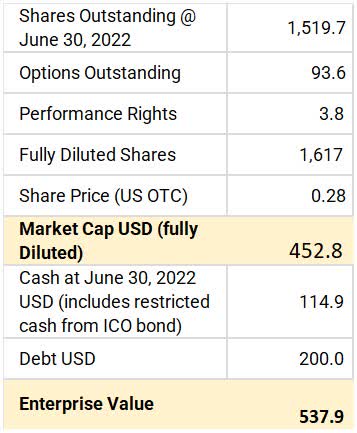

I have written about Jervois in the past and my last write up (link here) built upon other previous work in assessing the value of Jervois based on published NPV studies (from bankability feasibility studies) and an assessment of Jervois Finland based on an EBITDA multiple valuation. I will do the same analysis starting with Capital Structure including debt and a “sum of the parts valuation”. The new addition here from the past work is the BFS NPV for “Stage 1” of the Sao Miguel Paulista refinery and the additional debt incurred at Jervois Finland as well as an updated capital structure.

Jervois Capital Structure at June 30 2022 (Author chart from Company financial information)

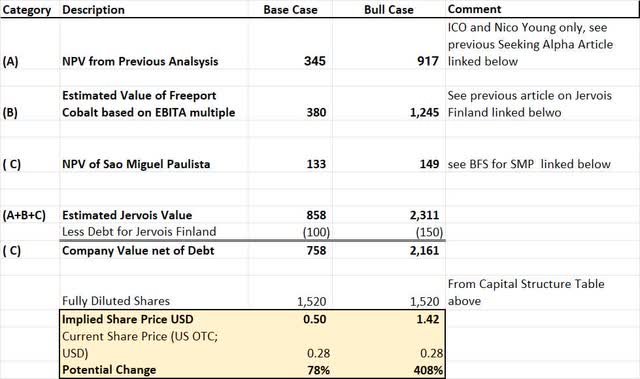

Here is a “sum of the parts” valuation building on what has been analyzed before.

Jervois Sum of the Parts Valuation (Author’s chart based on Company information)

Please note that I only include debt for Jervois Finland because in theory the debt for ICO is already factored into the BFS that was done for that. I would also note that there is significant value factored in for the Nico Young (nickel) property in Australia based on a 2019 PEA ($180m US / or ~$0.11 per share factored above) but the project is still contingent upon strong nickel prices and additional financing. This also gives zero value to the properties they control in Uganda which likely have some value but are still not developed.

For reference here are links to the analysis and or BFS that is associated with each of the sum parts above.

(A) Idaho Cobalt Facility and Nico Young (NPV from BFS)

(B) Jervois Finland (EBITDA multiple valuation)

(C) Sao Miguel Paulista (NPV from BFS)

Risks:

- Jervois is still in growth mode and will require external capital to complete Sao Miguel Paulista and possibly for operational needs at ICO and Jervois Finland. To the extent funding is not available this would significantly impact Jervois. Further capital raises could negatively impact shareholders.

- Jervois is focused on the battery metals Nickel and Cobalt and its results are largely dependent on strong demand for these metals. This is particularly risky during a global recession.

- Jervois only has one operating unit (Jervois Finland) and is in the process of getting ICO and SMP operational. To the extent it is not successful for any reason this would negatively impact the name.

- Jervois Finland results were on the lower end of expectations and could face near term headwinds. This might negatively impact share price given it is currently the only operating unit for Jervois.

- China demand for battery metals and world-wide adoption of electric vehicles are important sources of future demand for Jervois. Any disruption to demand here would negatively impact results.

Summary:

Jervois share price has retreated significantly in recent months after a strong run from 2000 to early 2022. Q2 results while respectable were not outstanding and 2022 full year guidance was revised downward. These are the operating realities of now having revenues, costs, and margins to report to the market as opposed to exciting but not yet operational business units. I sold a large portion (90%) of my shares at around ~$0.37 (US OTC) as I sensed weakness in the market and thought that many names would be affected but particularly smaller ones such as Jervois. That said I did retain a portion of my shares and will look to accumulate on further weakness which I think is possible. Longer term I think the combination of a solid and unique business plan and a strong, experienced, and shrewd management team will continue to increase the size of Jervois and drive good results. For the patient and risk tolerant investor I believe that Jervois is a good long-term investment. I will look to add on further weakness which makes entry point more attractive. I welcome comments and critiques. If you like my work kindly hit the like button and follow me for further updates.

Be the first to comment