Darren415

It’s Thanksgiving this week, and despite the mad world we are living in, I still have plenty to be thankful for. This week I passed 4,000 followers, which is more than I would have guessed when I started writing about a year ago. A lot has happened in the market over the last year, and 150 articles later, I have learned a lot about a bunch of different companies and markets in general. Before I get into today’s article, I wanted to thank all of you who take the time to read my articles. None of this happens without you, as cheesy as that may sound. This week I plan to cover several of the new holdings for Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) that I find interesting, starting with Jefferies Financial (NYSE:JEF).

Investment Thesis

Jefferies Financial is a diversified financial services company with a market cap of $8.5B. It also happens to be a recent addition to Berkshire Hathaway’s equity portfolio. Shares have had the common Buffett bump in the last couple weeks and are up about 10%. Even so, shares are still fairly cheap at 11.4x earnings and have a dividend yield of 3.2%. The company also continues to buy back stock at an impressive pace and has significantly reduced shares outstanding over the last five years. While they won’t be immune to an economic downturn, shares of Jefferies could provide solid returns from an interesting mix of multiple expansion, earnings and dividend growth, and buybacks.

Overview

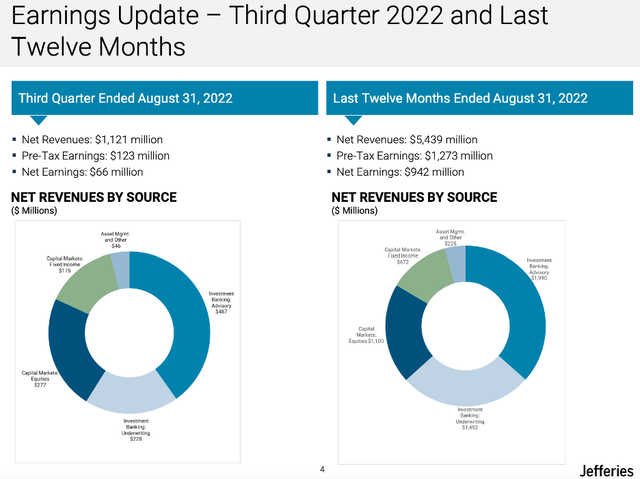

Jefferies is a diversified financial services company, with its fingers in all the usual financial pies. Investment Banking, between advisory and underwriting services, made up approximately two thirds of the company’s revenue. The next biggest piece is the capital markets business, which leans slightly towards equities over fixed income. The last sliver is made up of asset management and other.

While the results aren’t nearly as good as they were in 2021, Jefferies has still managed to put together a solid year so far. I’m curious to see how each segment will handle a possible economic downturn. While this article is focused on Jefferies and their business and stock, I believe things could get bumpy over the next year or so in the economy. Despite that, shares are still fairly cheap, even after the recent Buffett bump when Berkshire’s position was announced.

Valuation

Many investors follow Warren Buffett and the Berkshire Hathaway portfolio. While I just track it out of curiosity, many investors buy shares, which is why you often see large jumps when the company announces new positions in the portfolio. It happened most recently with Taiwan Semiconductor (TSM), and Jefferies was no exception as shares are up about 10% in the last couple weeks.

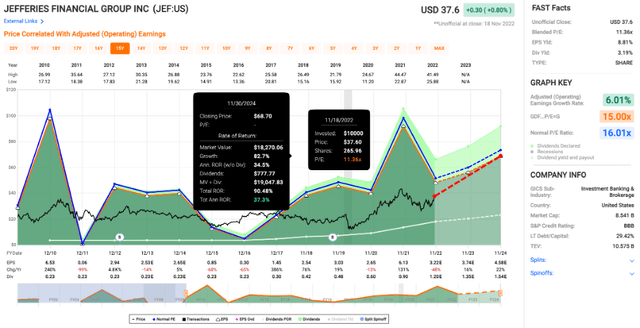

Price/Earnings (fastgraphs.com)

Shares currently trade at 11.4x earnings, which is below the 16x average multiple since 2010. If the estimates are accurate and earnings grow at a double-digit rate over the next couple years, investors should easily be able to get double digit returns with some multiple expansion. To be perfectly honest, I think there is a lot of uncertainty about what is coming down the road with the economy and the financial system. Even if Jefferies doesn’t increase earnings like it is projected, I think the company could provide solid returns for investors. When you throw in a dividend yield over 3% and buybacks and there is a lot to like about Jefferies, even after the recent share price increase.

Dividends & Buybacks

Jefferies has had solid dividend growth since they started hiking the dividend in 2017. The dividend growth has been even more impressive since 2020. The company has doubled the quarterly payout from $0.15 to $0.30. While I don’t think we will see a repeat of that, I think we will probably see some dividend growth in the next year or two. Jefferies has also been buying back stock at a solid clip.

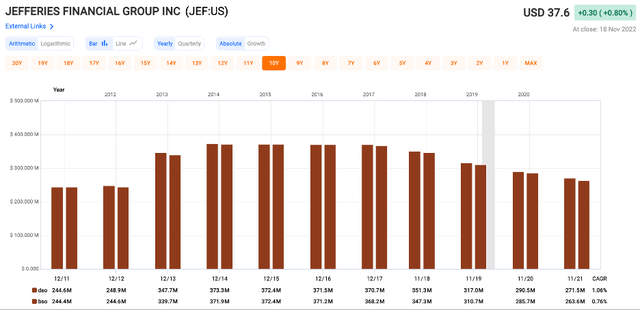

Shares Outstanding (fastgraphs.com)

Shares outstanding peaked in 2014 and have been declining steadily since 2017. At the end of 2021 they had bought back 100M shares, and that pattern has continued in 2022. For the first nine months of 2022, they repurchased another 21.7M shares for $739M at an average price of $34 per share. In September, they bumped the share repurchase authorization for the fourth time in 2022. At the time, there was $250M remaining on the authorization. For a company like Jefferies with a market cap of $8.5B, this is pretty impressive. My guess is that the buybacks will continue at an impressive rate and continue to drive share count down.

Conclusion

There is a lot to like about Jefferies, and Berkshire Hathaway’s recent purchase brought it onto my radar as well as many other investors. The company’s diversified business segments should allow it to weather an economic downturn, even if earnings do decline like they did from 2021 to 2022. The valuation is still attractive at 11.4x earnings, and if earnings start to increase as projected, we will likely see some multiple expansion moving forward. If you are more focused on dividends, Jefferies also provides a 3.2% yield that has seen impressive dividend growth over the last couple years.

They might not have a long track record of dividend hikes like some companies, but the last five years have been good for income investors as the quarterly dividend has tripled. The company is also returning a significant amount of capital to shareholders via buybacks, which are set to continue for the foreseeable future. If you are looking for a financial company to add to your portfolio, Jefferies might be a solid choice and could provide double digit returns from a combination of dividends, earnings growth, and multiple expansion.

Be the first to comment