ablokhin

Shares of JB Hunt (NASDAQ:JBHT) have fallen about 11% over the past year. Most of this decline occurred after a late March warning that the freight industry faced a recession. Two quarters later, and JB Hunt continues to perform quite well. Nonetheless, shares remain lower as economic concerns continue, leading some to believe the worst is still to come even as dire predictions fail to materialize. At current levels, I view the stock as attractive and would be a buyer, particularly given strong Q3 results.

In the company’s third quarter, revenue rose 22% to $3.84 billion. JBHT does not take fuel risk, instead passing its fuel costs to its customers. Given higher gasoline and diesel prices, the fuel surcharge rose considerably, and revenue growth excluding this was 12%. Operating income rose 32% to $362.7 million, showing nice margin expansion considering that that fuel revenue increase doesn’t drop to the bottom line. EPS rose 37% to $2.57. These results were well ahead of consensus, which was for EPS of $2.46. Unsurprisingly, shares are up about 3% after-hours Wednesday on this news.

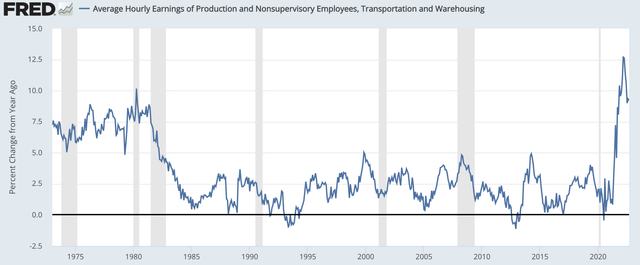

The one headwind worth noting is that labor costs increased from 22.6% to 23.1% of revenue. There have been countless stories about trucker shortages, and higher wages in the sector. In fact, in the logistics sector, wage growth hit a record over the past year, even above the late 1970s when inflation was out of control for a sustained period. We are starting to see these wage pressures improve, but they remain high. Efforts by the Federal Reserve to cool the labor market may actually help companies like JB Hunt. Still, the fact the company is generating 30+% earnings growth even with this cost pressure speaks to how strong demand is.

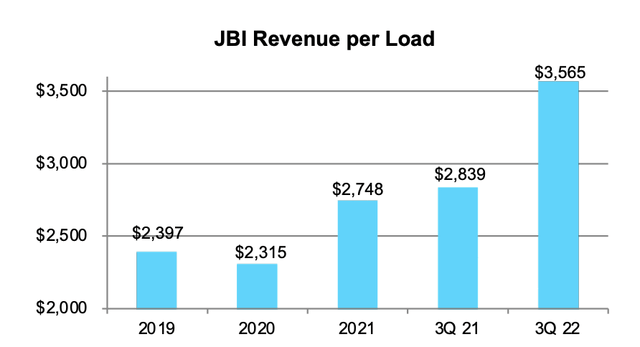

JB Hunt’s most import unit is its intermodal business (‘JBI’), which is 60% of operating income. As it owns the largest fleet of containers, it generally gets priority loading and unloading at major rail terminals, making it easier to acquire and retain customers. It also has announced a strategic partnership with Burlington Northern, with JBHT investing to expand its fleet and BNSF increasing processing capacity as they integrate operations to provide quicker loading/unloading times for customers, which should increase throughput, making its offering even more attractive relative to peers.

In the quarter, JBI generated 30% revenue growth and 31% income growth. Intermodal volumes rose 4% while pricing per load was up 26% (still up a strong 17% ex fuel), and the company saw acceleration during the quarter, exiting at the best rate since early 2021. These pricing increases are impressive, and with volumes improving during the quarter, the outlook for Q4 feels strong. Nothing in these results points to an imminent recession in the US economy. As you can see, the revenue JBHT is receiving per intermodal load is up nearly 50% from pre-COVID levels. Demand is outstripping supply, and pricing power is really strong.

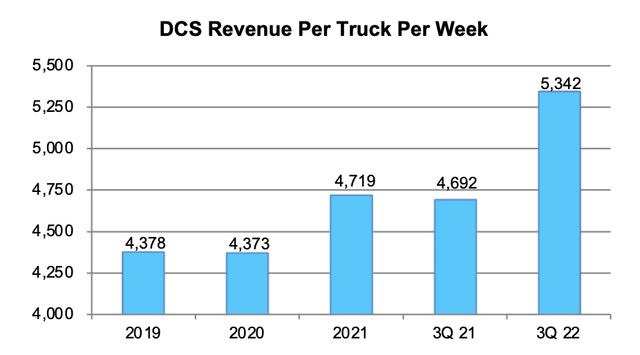

The same is true in JB Hunt’s second-biggest unit, Dedicated Contract services (‘DCS’) which accounts for 28% of JBHT’s operating income. In this unit, JB Hunt helps manage a customer’s logistics. It assigns drivers dedicated to work on only that account, and beyond just driving the trucks, JB Hunt may also assist with loading, unloading, operating forklifts, etc. By assigning the same drivers, relationships are formed that makes the logistics process operate more smoothly and efficiently.

This customized, more holistic experience is working. DCS revenue was up 34%, translating to 32% income growth. JB Hunt grew its DCS fleet by 18% (or about 1,800 trucks) and boosted productivity per truck by 14% (6% ex-fuel). Many of its contracts contain inflation-indexed price escalators, which is why margins have held up. Customer retention was over 98%, speaking to the better customer service JBHT can provide by assigning dedicated drivers. As with its intermodal unit, pricing has been strong with the average truck generating nearly 20% more weekly revenue than in 2019

Its other businesses like outsourced trucking and last mile fulfillment account for the remaining 12% of the company, and they all reported significant revenue growth with its truckload business the strongest. JB Hunt’s two primary businesses performed strong, and its minor units all grew nicely. Put simply, this company is firing on all cylinders, and it is well positioned to earn over $9.75 a share in 2022 with this strong third quarter in the books.

Its cash flow performance is also particularly impressive. Typically, as JBHT grows the fleet like 2014 and 2018, it burns free cash flow, and then it can ramp the cash flow up in years its pare backs cap-ex. Given the growth in its DCS fleet and commitment to build out intermodal capacity, cap-ex has nearly doubled this year to $1.02 billion, yet it still has generated $350 million in free cash flow year to date.

Impressively, by investing in the fleet, the value of its property and equipment has risen by $640 million this year to $4.7 billion while debt is down about $60 million to $1.24 billion. A larger fleet enhances future earnings power, and to do this entirely out cash flows rather than debt actually makes JBHT a financially stronger entity better positioned to weather a potential downturn. With its excess cash, it also has repurchased about 1.5% of its shares this year.

The logistics sector remains significantly undersupplied, and so operators have material pricing power, leading to strong profits, and remarkable cash flow even amidst large cap-ex programs. Perhaps unsurprisingly given this backdrop, there have been some M&A rumors in the space. Now J.B. Hunt operates a more asset-light business than Ryder System (R), but it is important to note that Ryder has faced reported M&A interest, which could support the broader logistics sector.

With a growing fleet, strong customer retention, upside as its BNSF partnership is implemented, and potential for moderating wage costs, JBHT’s outlook is strong, and its operating performance has been remarkable. 10% earnings growth next year toward $11 per share is entirely plausible, and as cap-ex normalizes, this is a business that can generate closer to $800 million in free cash flow, enabling larger buybacks. While it may not return to its March heights, the fears of a freight recession that have depressed shares should ease, and given its asset-light model, I can see shares returning toward $200 or 18x forward earnings representing over 15% upside.

Be the first to comment