Oleksii Liskonih/iStock via Getty Images

By Paul Ehrlichman

Central Banks Face Economic Conundrum

It seems that the bill for propping up a lethargic and limping COVID-19 global economy is finally coming due. The combination of direct stimulus payments to consumers and supply chains constrained by quarantine measures have resulted in inflation levels unseen for decades. Add to that a brutal war in Ukraine that has sent energy prices skyrocketing during a particularly vulnerable moment for the global energy transition, and you have an economic environment eerily reminiscent of the 1970s creating a “cost of living crisis,” particularly in Europe. As a result, the conundrum facing global central banks is growing increasingly complicated: how best to tame inflation and raise interest rates amid such economic uncertainty?

While the goal is the same, we are seeing a divergence in the tactical approaches among central banks. The U.S. Federal Reserve has settled on its answer of aggressively increasing interest rates to force supply and demand into better balance – despite, as Fed Chair Powell acknowledged in his Jackson Hole speech, “some pain to households and businesses.” The result has been the worst bear market for sovereign bonds in a generation.

The European Central Bank has echoed the Fed’s call for aggressive interest rate increases yet has slightly hedged this approach by delaying the shutdown of its quantitative easing (QE) and bond purchasing programs. The logic is that as peripheral European bond yields advanced beyond the 4% threshold, policymakers would be able to limit any sharp increases in interest rates and would have greater flexibility to respond to rapidly evolving market conditions. The irony is that QE, along with a zero interest rate policy (ZIRP) – designed to inflate asset prices, prop up faltering economic activity and steady financial markets – are the very programs that have inflamed our recent boom and bust cycles.

Alternative Tactics Gaining Traction

Japan and the U.K., meanwhile, are pursuing an approach of monetizing support for the real economy. This involves two tactical differences from the Fed’s approach. Firstly, these countries are using expansive fiscal stimulus to bolster consumer spending and provide funding for energy and infrastructure investments. Secondly, since this stimulus will require increased borrowing on the part of governments, both central banks have taken steps – generally buying bonds – to suppress the rise in long-term interest rates. Japan was the first adopter of this approach, employing “yield curve control” to facilitate large deficit spending while keeping real interest rates negative. Similarly, newly appointed U.K. Prime Minister Liz Truss has pledged support for consumer subsidies and public investment equating to roughly 6% of the country’s GDP. Further, the Bank of England announced it would begin buying long-dated government bonds to help “restore orderly market conditions,” leading to speculation that further yield curve control could be not far behind.

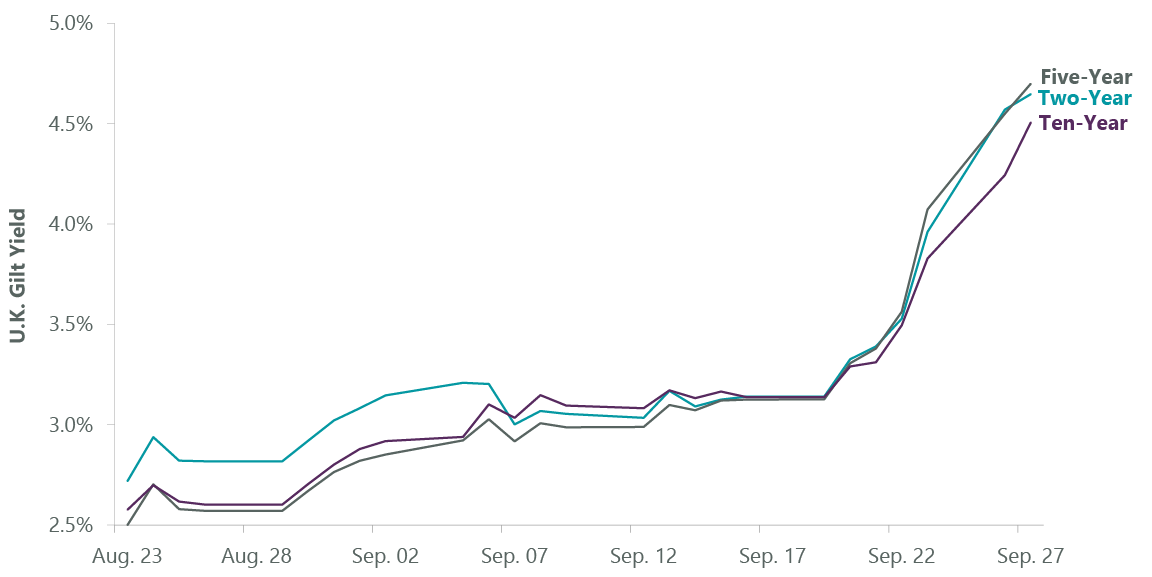

However, this path is not without controversy, as it involves exchanging an economic crisis for a currency crisis. The pound and the yen have taken the brunt of the external adjustment, and relatively lower long-term interest rates have resulted in both currencies falling to multidecade lows relative to the U.S. dollar. As commodity prices and gold denominated in yen surge to new highs, many investors have expressed skepticism of Japan’s bond buying amid a significant decline in the yen and rising deficits. However, we believe the widening gap in bond rates between Japan and other developed nations indicates that a reversal of the decline in the yen is on the horizon. In the U.K., the interest rate of the 10-year gilt has more than tripled over the past year. While a higher yield would normally attract capital flows, strengthening the currency and, in the U.K.’s case markets, we are skeptical that fiscal spending and lower taxes will support growth. If Truss follows through with her proposal for substantial fiscal subsidies, we find it likely that some form of yield curve control would be needed to forestall a seismic economic shock.

Exhibit 1: U.K. Borrowing Costs are Soaring

As of September 27, 2022. Source: Bloomberg, ClearBridge Investments

Amid this uncertainty, investors have been quick to flee to the most defensive sectors of the market and brace for recessionary impact. However, we are finding good opportunities within the scariest markets. Particularly within Europe and the U.K., cyclical sectors such as industrials and real estate have fallen to historically low relative valuations. While these sectors most exposed to the economy and the impact of higher interest rates would undoubtably endure short-term pain, investors have been quick to overlook how the balance sheet strength of high-quality companies would help sustain them in the event of an economic recession. Should the approach that the U.K. and Japan are following succeed, the goods and services provided by cyclical companies will be required to sustain the rebound in economic activity and continue long-term trends like the global energy transition.

Despite the near-term challenges, we believe the course of monetary stimulus alongside some form of yield curve control will increasingly be the preferred method of global central banks to solve the current economic conundrum. This combination affords policymakers the flexibility of numerous economic levers with which to fine-tune their response to emerging economic data, while also acting to help decrease the burden of the massive debts their countries have accumulated over the past decade.

The Fed’s policy of combatting inflation solely through interest rate increases can be successful only if it is accompanied by a total commitment to persevere through substantial economic tribulation, which few policymakers have the fortitude to do. Achieving the goal of taming inflation by raising interest rates amid such uncertainty will require greater global cooperation, liquidity injections from fiscal stimulus and greater yield curve control measures. Japan and the U.K. are leading the way, and it is worth watching if other countries will follow.

Be the first to comment