josefkubes/iStock Editorial via Getty Images

Today, we are back to comment on Japan Tobacco’s (OTCPK:JAPAY) quarterly results. This year, we already analyzed the company three times, providing a sell rating target with a publication called Not Our Cup Of Tea. After an additional 15% decline in the stock price level, we decided to move our rating to neutral, also taking into consideration the negative Russian impact on the company’s account. However, looking at the latest company announcements, we are more positive. Japan Tobacco recently released a few important updates that will sustain its share price development:

- A collaboration agreement with Altria for Ploom commercialization in the US. The United States is the most valuable market for reduced-risk products;

- Related to point 1), the agreement was enforced by a Joint Venture called Horizon. Japan Tobacco’s equity stake is set at 25% with the remaining part to Altria. Positive were the words from JT’s CEO emphasizing that “we are bringing together the marketing, innovation, research & development and science capabilities that Japan Tobacco has developed over the years, with Altria’s science, U.S. regulatory experience and vast infrastructure, to create a very strong proposition for the U.S. adult smoker“;

- Ploom X expansion in the UK;

- 31/10/2022 – A dividend upwards revision which is expected now at 188 yen compared to the previous guidance of 150 yen. The company is now yielding more than 7.5%.

JV between Altria and JT (Japan Tobacco Q3 results presentation)

Q3 results

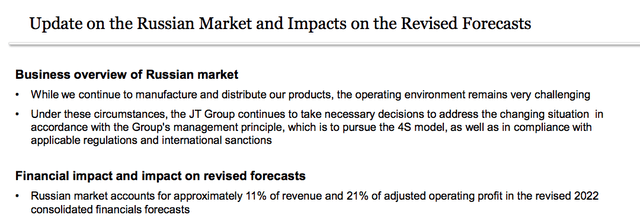

Before analyzing the quarter accounts, as a memo, we should report that almost 20% of Japan Tobacco’s total operating profit is coming from Russia. Looking at the presentation, the company has been quite vague in communicating what’s next, and they are not disclosing if they are looking for strategic options.

Japan Tobacco Russia development (Japan Tobacco Q3 results presentation)

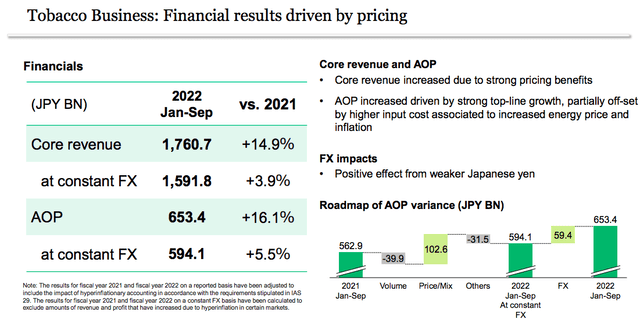

To sum up, the Japanese cigarette company reported a good set of numbers, with financial indicators up on a yearly basis thanks to an important acceleration in Q3. As also happened in Q2, the company’s main driver was a favorable FX development that supported its sales exports. Looking at the detail, the combustibles volume slightly decreased and was totally offset by reduced-risk product higher sales. On the margin side, as usual for tobacco companies, price increases were more than the underlying cost basis. Therefore, Japan Tobacco reported a good number at the EBIT level and was able to increase its 2022 operating profit guidance (and also its dividend projection).

Japan Tobacco tobacco highlight business (Japan Tobacco Q3 results presentation)

Conclusion and Valuation

At the constant exchange rate, we should report that Japan Tobacco lowered once again its sales. Russia’s EBIT is too important to go unnoticed and despite the latest positive development, based on a P/E ratio of 10x, we still confirm our neutral target price.

Be the first to comment