StockByM/iStock via Getty Images

Overview

The Japan Equity Fund (NYSE:JEQ) is on my radar as a vehicle to maintain exposure to Japan while shopping for individual stock picks in 2023-2024. I am comfortable accumulating this closed-end fund (“CEF”) if the discount to NAV rises to 15% or if Japan’s market drops in the coming months. I am bullish on Japan because of factors like company management and increased global expansion and am less concerned about macro concerns like currency depreciation, demographics, and weaker economic data. I also think the Japanese stock market could receive more attention in the coming decade.

Macro and Equity Performance

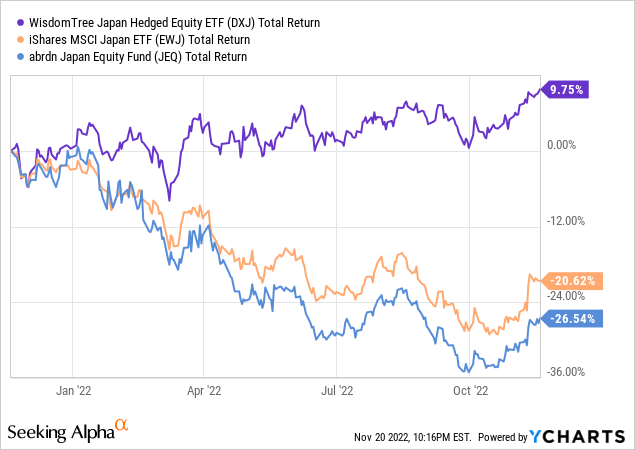

Many bearish points on Japan focus on demographics and macroeconomic factors, such as the high-aged population, inflation, and weak performance of the yen this year. The market is already down around 20% in the past year, and experienced a 30% maximum drawdown during the past year. Two important observations: The iShares Japan Hedged Equity Fund (EWJ), which hedges the currency risk, has massively outperformed. Closed-end funds, like the Aberdeen Japan Equity Fund, typically experience stronger declines during bear markets, which results in a strong discount to NAV.

A contradictory bullish view is that Japan is ahead of most countries in innovation (12th out of 48 high-income countries) and global reach. The weaker demographics and domestic data can be offset somewhat by the fact that many companies are innovative and highly present in other markets. Japanese companies can indirectly capture growth in other emerging markets. Larger listed companies in Japan derive around 17% of their earnings from China. Furthermore, the Japanese stock market derives 45% of its revenue from countries outside Japan. This percentage is roughly in line with other Asian economies such as South Korea and Singapore (50-52%).

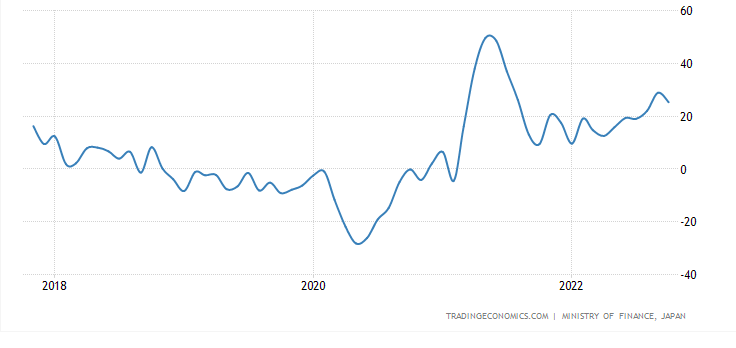

Export growth in Japan has been healthy this year, despite the overall decline in economic growth in Japan. Exports have been growing at over 25% in 2022, as motor vehicle exports have recovered. The export growth of cars was hit particularly hard in 2021, as car export growth fell by 37% YoY in October of 2021, while overall exports were 9.1%.

Export Growth

Trading Economics

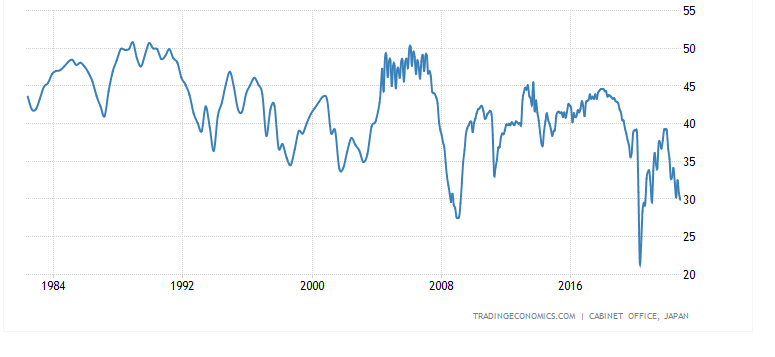

Consumer confidence is still near a multi-decade low. Retail sales have increased slightly for seven consecutive months in a row, but issues like wage growth are stalling consumer confidence, as wage growth is unlikely to outpace inflation.

Consumer Confidence in Japan

Trading Economics

Equities Bouncing Back

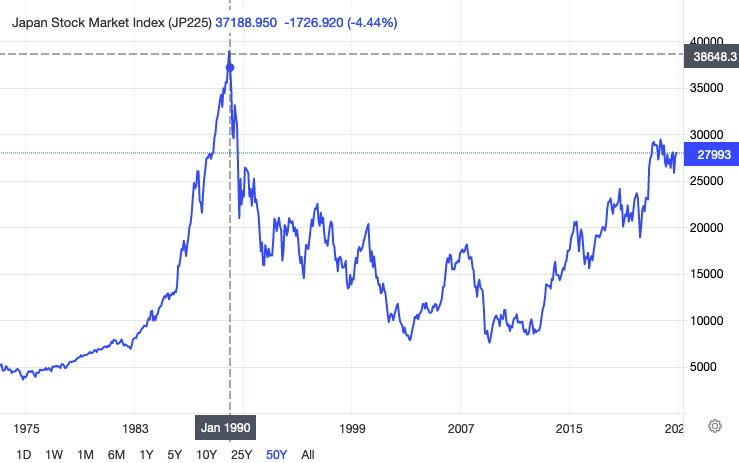

What is much more interesting than Japan’s current economic performance and challenges is the history and future outlook of Japan’s capital markets. Japanese equities have still had trouble bouncing back from the peak experienced during the 1990s. If you initiated a position in early 1990, you would still be holding a loss.

Trading Economics

This poor performance, coupled with weaker corporate governance and economic challenges, resulted in lower retail participation. Furthermore, 38% of the companies listed in Japan are not formally covered by any analysts. This is not to mention that the view of Japan’s “unfavorable” demographics has dominated a lot of the negative narrative.

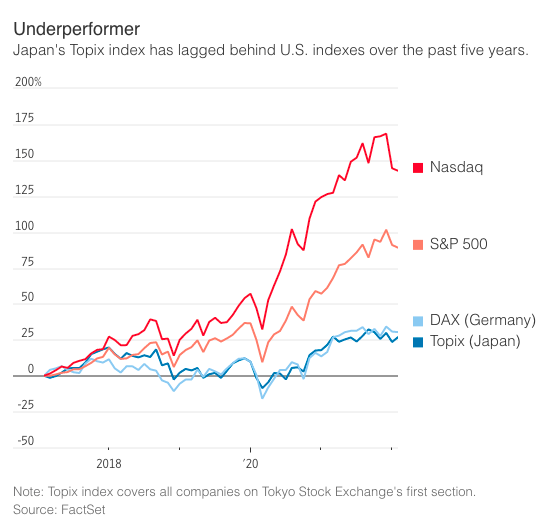

MSCI Japan has not had an annual decline exceeding 14% since the GFC and has delivered double-digit returns during five out of the past 10 years. However, Japan’s stock market has underperformed in the MSCI World Index in 10 out of the last 13 years. In the short term, investors are likely to be bearish on Japanese equities, primarily due to a weaker yen, slower growth, and concerns over demographics/domestic consumption.

One trend to note is that corporate governance upgrades that were planned in the 2010s are now about to be implemented in the coming years. This could help increase interest in the market, once macro risks abate. Companies that I have been following, including Takeda Pharma and Japan Tobacco, are excellent stock picks because of their going global initiatives. Takeda currently has a laser focus on emerging markets, which will be a significant part of revenue by 2030.

Other cases like Japan Tobacco show how companies can grow as they lose domestic market share, by gaining market share in both developed and developing countries. Economic and supply chain issues have caused some Japanese companies to rethink overseas business strategies and to change supply chain strategies, but companies are still finding success.

Retail Interest

One trend to monitor moving forward is increased retail interest in Japan’s stock market. The number of individual shareholders rose to nearly 60 million, which was an approximate 33% increase from 2008 levels. Other listed companies have set up shareholder rewards programs to encourage more retail participation. So, while things have improved since 2010, and Japan has not had terrible performance for a decade, the market is still lagging behind the United States and other markets.

WSJ

Japan’s stock market used to account for 40% of the world’s total value in the 1980s, trading at 5x book, due to strong global interest. I don’t anticipate a return to these levels, but do think it’s strong for Japan to trade at a discount to other global markets.

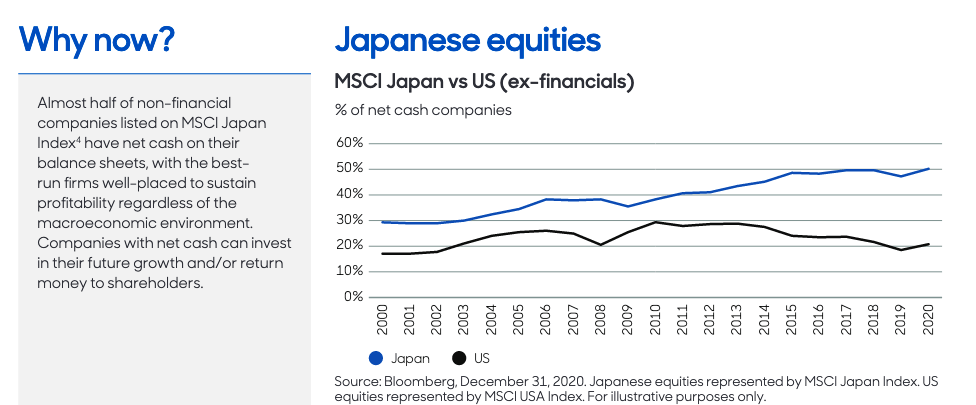

Valuation and Healthy Financial Position

Japan equities trade at a 17% discount to world equities on a P/E basis, and at a 53% discount on a price-to-book basis (Japan trades at 1.3x book). Nearly half of Japanese listed companies have a net cash balance on their balance sheet, which is much higher relative to countries like the United States.

JEQ

The cost of capital for companies in Japan is also very low, which is a benefit for larger companies targeting global expansion. For example, I noted that Takeda’s average cost of capital was 2% and that 98% of this was at a fixed rate.

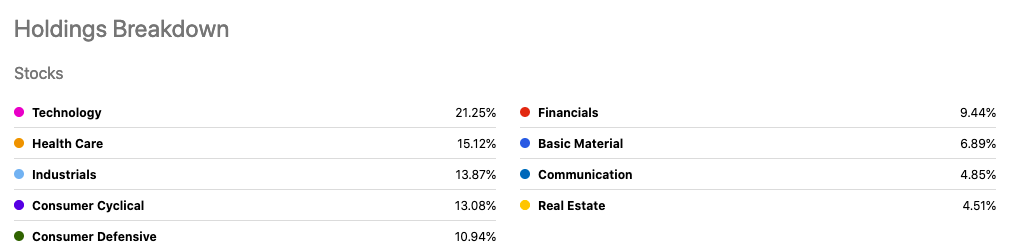

Industry Weighting

One relatively favorable aspect of Japan-focused funds is that they have a comparatively lower weighting in financials. The iShares MSCI Japan ETF similarly has around 10% of its assets invested in financials. This is worth considering when comparing Japan’s valuation to that of other Asian countries, as consumer, healthcare, and technology companies typically command a premium to the index.

JEQ/Seeking Alpha

This is one factor that investors may overlook if they merely take a quick glance at the valuation in Japan relative to other markets.

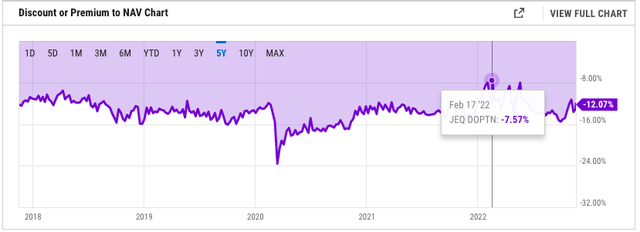

Discount to NAV and fees

One of the main reasons I prefer this fund over other Japanese exchange-traded funds (“ETFs”) is because this closed-end fund trades at a significant discount to NAV. This can work in your favor if you slowly accumulate your position during market pullbacks, buying at larger discounts each time. It is just important for one to be prepared to underperform the index in the short term due to the increased volatility of this closed-end fund. This fund currently trades at a 12% discount to NAV, which is attractive on a historical basis. As of the end of Q3 2022, the fund traded at 17.3x earnings, while the Topix trades at 13.4x earnings. The expense ratio of 0.85% is relatively higher than that of other Japan-focused ETFs.

I am very comfortable accumulating Japan Equity Fund at a discount to NAV below 15%, but a 12% discount to NAV is still attractive on a historical basis. Japan Equity Fund very rarely trades at less than an 8% discount.

I plan to have Japan Equity Fund represent around 50% of my investments in Japan, and then adjust this to 20-30% as I find new companies.

Be the first to comment