RonFullHD/iStock via Getty Images

Investment Thesis

Janus International Group, Inc. (NYSE:JBI) is an American building solutions provider based out of Temple, Georgia, United States. In this thesis, I will analyze JBI’s Q3 FY22 results and its future growth prospects. I will also be analyzing its valuation at current price levels and its growth potential. I believe JBI is undervalued at current price levels, and investors should not miss this opportunity to buy this growth company at a cheap valuation.

About JBI

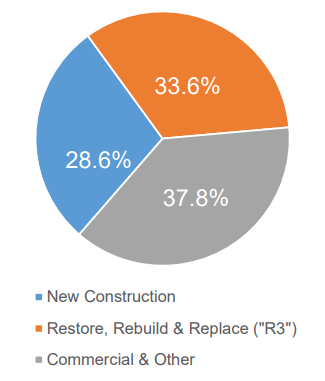

JBI is a leading producer and supplier of turn-key self-storage, swing and roll-up doors, relocatable storage units, and other industrial and commercial building solutions globally. Its business can be segregated into three business segments; commercial & other, R3, and new construction. The commercial and other segment accounts for 37.8% of total revenues, followed by R3 at 33.6% and new construction at 28.6%. JBI has a diversified product portfolio catering to multiple building solutions, from doors to security systems. Some of these products include self-storage roll-up doors, smart entry systems, mass-relocatable storage units, and commercial sheet doors.

Investor Relations JBI

Q3 FY22 Results

JBI recently posted third-quarter results beating the market EPS and revenue estimates by a staggering 29% and 13.5%, respectively. The company experienced growth across all business segments. As per my analysis, the commercial & other segment proved to be the outperformer, with a remarkable 58% y-o-y revenue growth and improved profit margins. JBI is on a significant growth track, and I believe this momentum is likely to continue even in the coming quarters.

JBI reported total revenue of $262.5 million, up a significant 40% compared to $187.8 million in Q3 FY21. As per my analysis, the primary revenue driver was the strong sales experienced by the commercial & other segment. The thing that I find most impressive is that the company experienced 35.5% organic revenue growth y-o-y. This reflects that the demand for the products remains strong and witnessing consistent growth. I believe the integration of the activities with the recent acquisitions by the company also contributed to revenue growth. They posted a gross profit of $96.8 million, up 55% compared to $62.2 million in the same quarter last year. The gross profit margins saw a considerable improvement from 33% to 37% y-o-y. I think the company did a great job in the cost control department, and the cost of sales grew just 32% despite strong inflationary headwinds. The operating margins also experienced significant improvement growing from 13.5% to 20.5% y-o-y. I believe the cost-cutting measures coupled with higher volume in sales resulted in improved margins for the company. JBI reported diluted EPS of $0.22, up a solid 120% compared to $0.11 in the corresponding quarter last year. The net profit margin for Q3 FY22 was 12.3% compared to 8.2% in the same quarter last year.

Overall, I believe the company performed exceedingly well on most of the parameters. The revenue saw significant organic growth driven by consistently strong demand. The gross, operating, and net profit margins witnessed a remarkable improvement which I believe is a big positive for a growth company like JBI. The company revised the FY22 outlook and provided a solid FY22 guidance with revenue estimated to be in the range of $990-$1010 million and adjusted EBIDTA in the range of $218-$225 million. I think the company will easily achieve these targets, given the exponential growth that they are experiencing across all business segments

Key Risk Factor

Increasing Interest Expenses: As of October 1, 2022, JBI reported long-term debt of $701 million against cash and cash equivalent of $55.3 million. They incurred $11 million in interest expenses compared to $7.6 million in the same quarter last year. The interest expenses increased despite the long-term debt being flat, around $701 million y-o-y. This reflects that the rising interest rates are putting a dent in the company’s profit margins. I believe a further interest rate hike would negatively impact the company’s performance in the future. JBI is a growth company, and growth companies generally have high debt liability to support growth and expansion. However, investors should consider this risk before investing in JBI.

Quant Rating and Valuation

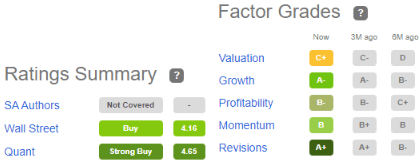

Seeking Alpha

JBI has a Quant rating of strong buy, which reflects its growth potential. It has an A- grade for growth which I believe perfectly reflects the company’s growth trajectory in the recent past. It has a B- grade for profitability which I think can show a significant improvement in the coming quarters. The B and A+ grade in momentum and revisions reflects that the company is consistently outperforming and exceeding its targets. JBI has a C+ grade for valuation, which I think doesn’t adequately depict the company’s valuation. I believe JBI is undervalued at current price levels.

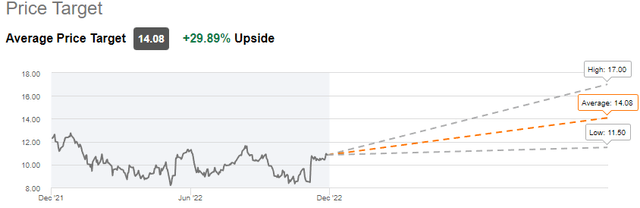

JBI is trading at a share price of $10.8, a YTD decline of 11.9%. It has a market cap of $1.6 billion. JBI is currently trading at a forward non-GAAP P/E multiple of 14.6x against the industry standard of 17.25x. This reflects that JBI is undervalued compared to industry standards. Even if we look at the PEG multiple, which is a better evaluation method for growth companies, we realize that it is trading at a forward non-GAAP PEG multiple of 0.98x compared to the industry standard of 1.5x. A PEG ratio below 1x is considered good for growth companies, and it reflects that the company is undervalued. The Wall Street analysts have an average price target of $14.08, representing a 30% upside from current price levels. I believe that undervaluation at current price levels coupled with a solid growth trajectory makes JBI a great investment opportunity for value investors.

Conclusion

JBI posted impressive third-quarter results with improved profit margins and solid revenue growth. The commercial & other segments led the revenue growth experiencing a strong customer demand. I believe the company will likely continue this momentum in the coming quarters, and the revised revenue guidance reflects the same. The company is trading at a cheaper valuation compared to the industry standards, and I believe it is a good opportunity for investors looking for growth companies at a reasonable valuation. It does face the risk of increasing interest expenses due to high debt, but the overall risk-reward profile of the company is quite favorable. After considering all its growth and risk factors, I assign a buy rating for JBI.

Be the first to comment