chameleonseye/iStock via Getty Images

Thesis highlight

I believe Janus International (NYSE:JBI) is fairly valued today. That said, the market opportunity is huge here, with a long runway of growth ahead. So long as JBI can continue to execute by growing through organic and M&A means, it should be a good business to invest in at the right valuation.

Company overview

JBI provides door replacement and self-storage restoration services in addition to self-storage and commercial industrial doors, portable storage units, etc.

For the purposes of this post, I will be focusing on JBI’s self-storage division, which is the company’s bread and butter and where I think it has a competitive advantage.

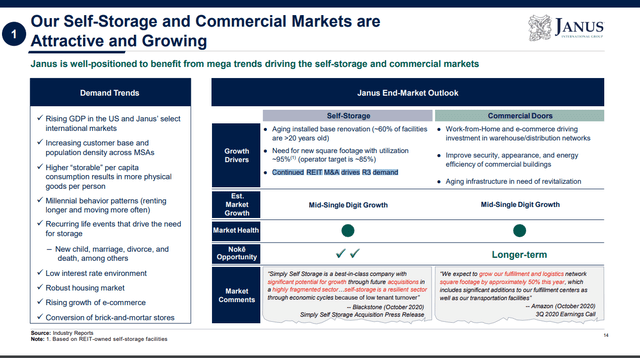

Self-storage is an attractive market

To give a brief background, self-storage facilities let customers rent out storage space on a monthly basis, with the option to move in whenever they’re ready. Simply put, self-storage units provide a hassle-free option for personal and commercial storage needs. There are essentially two types of self-storage facilities:

- Institutional, such as a REIT or other returns-driven operator of scale owning and/or managing facilities in a prime location.

- Non-institutional facilities such as those located outside the top 50 U.S. MSAs and are single-story, non-climate-controlled facilities owned and/or managed by smaller private operators.

While REITs only make up about a third of the self-storage market, that third is significant. REITs are a big part of JBI’s growth, in my opinion, because they often buy self-storage facilities that already exist. This creates a need for remodeling services to bring the properties’ branding in line with REIT standards.

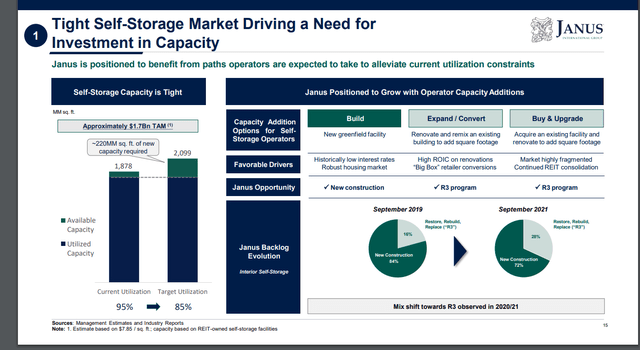

The demand and supply dynamics in the self-storage industry are unique and attractive, in my opinion. Increases in population and the proportion of households that own their homes have been major drivers of self-storage demand in recent years. Since the major self-storage REITs are always over 90% full, it is clear that the current supply of self-storage units is far below what it has been in the past.

It seems like a simple case of supply and demand to me. Increases in self-storage capacity will likely be needed in the future due to current high occupancy rates and expected rising demand. There are many ways to build out new self-storage facilities, and Janus is at the forefront of this industry, having developed the most comprehensive product offering and unique end-to-end solutions for both institutional and non-institutional operators.

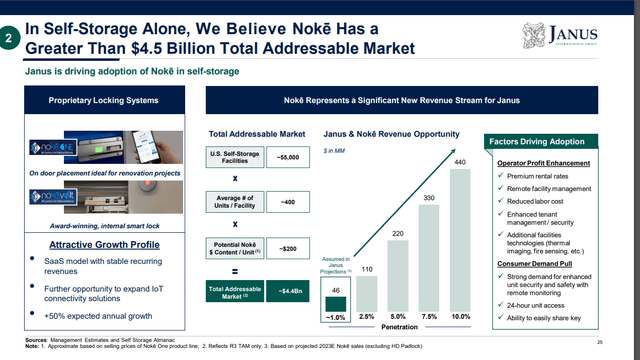

The TAM for the self-storage industry in the United States is estimated to be $4.4 billion, with 55,000 facilities, according to the investor presentation in August 2022. In other words, if we use that number as a benchmark, JBI has a lot of room to expand.

First mover advantage with a huge range of products and solutions

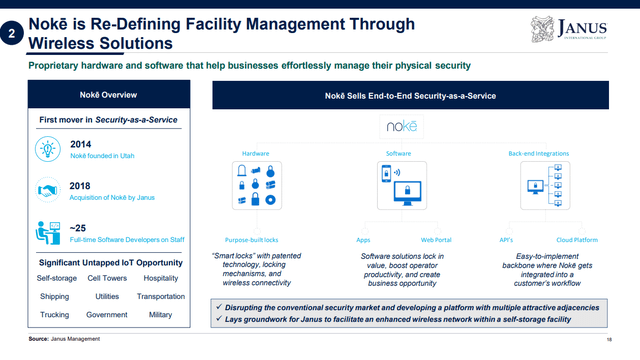

For a long time, NOKE (JBI’s self-storage brand) has been hard at work developing a wide variety of innovative technologies, software, and solutions for the self-storage industry, which lacks adequate options at the present time. JBI has disrupted the traditional security market by providing security-as-a-service, built on a platform with features that provide compelling ROI for clients’ facilities and R3 retrofits.

Those investments were smart moves, in my view. JBI’s smart locking systems and other proprietary hardware make it easier to manage security, and the company can now integrate remote networks with a self-storage facility, creating a new market niche with significant entry barriers and little competition.

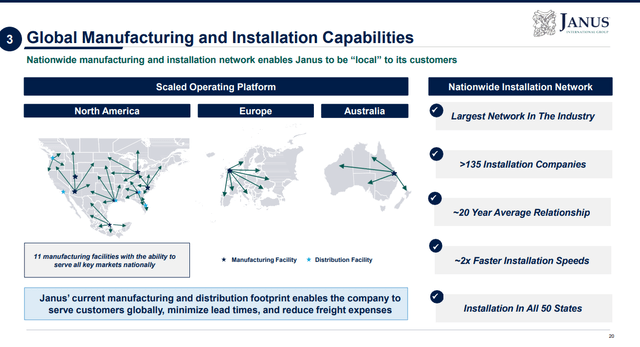

Gaining an early foothold in the hardware and smart locking system markets has helped JBI immensely, but the company’s management has also been astute enough to realize the importance of catering to a diverse set of customer needs by offering a wide variety of products and services through a vast distribution system of independent contractors. In my opinion, the success of JBI depends on its ability to attract a wide variety of installers, as this increases the likelihood of a timely and effective rollout for end users. Since JBI’s turnaround time decreases in direct proportion to the number of installers available in any given market, the latter is ideally expanding. At the end of the day, this results in a happy customer who remains a loyal patron.

JBI’s manufacturing facilities in the United States are located in key hubs, which aid deployments in addition to the company’s installers. Because of JBI’s extensive manufacturing and distribution network, I am confident that they can efficiently serve customers all over the world while keeping transportation costs and lead times to a minimum. As a new entrant into the market would need to pour a lot of money into getting up to speed, I’d say that this scale advantage provides a strong moat.

Overall, they can compete for complex, high-profile contract opportunities because they provide a comprehensive suite of services and offerings across a wide network and deliver highly configurable solutions at various scales.

JBI offers a mission critical solution at a cheap cost

Typically, JBI products are the last components installed on a property before the operator can begin making money from it. This, in my opinion, has emphasized the significance of self-storage because it has increased the cost of failure for JBI’s solutions and increased customers’ reliance on JBI’s comprehensive national and international manufacturing and distribution networks. In addition, the cost of JBI products is negligible in comparison to the overall price of a building or an R3 retrofit. Two benefits result from JBI’s location in the value chain:

First, JBI has some bargaining leverage when it comes to setting prices because its product is only a small part of the final product. Because of the importance of the service, customers are usually willing to pay a premium.

Second, as a result of the high cost of failure and the critical nature of the products, customers are often hesitant to make a change or switch to a different provider. Keeping that connection open opens the door for additional services and products that JBI can offer, such as the installation of Internet of Things devices.

Proven acquisition strategy

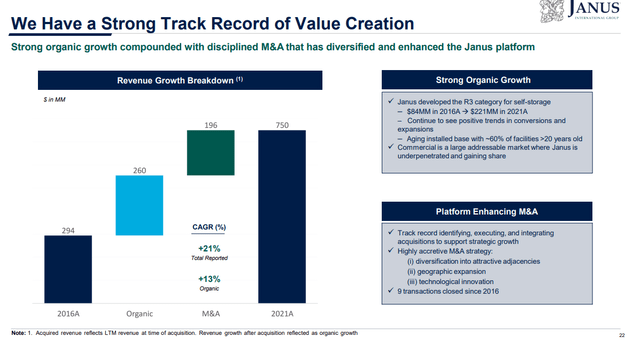

The JBI management team has a history of finding, implementing, and incorporating acquisitions that help the company grow strategically. JBI appears to follow a highly accretive acquisition strategy that places a premium on diversifying their portfolio into logical adjacencies and expanding into new geographies, as evidenced by their previous purchases: M&A, based on the numbers, boosted revenue growth by more than 60% between 2016 and 2021.

In addition, I think it makes more sense for JBI to acquire assets rather than construct in the self-storage space so that it can capitalize on its extensive network of manufacturers and installers. With this, the lead over the competition would grow even larger.

Valuation

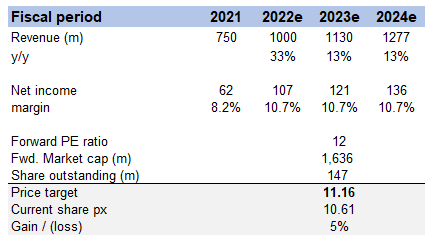

My model suggests a price target of $11.16 in FY23. This assumes that revenue will continue growing as organically as it has historically, at 13%, and the forward earnings multiple will be 12x in FY23e.

Own valuation

Given the large market size, I believe JBI can maintain its 13% growth rate after my FY22 estimates (which are based on management guidance). I did not include M&As in my growth projections because they are difficult to predict. Any benefit from mergers and acquisitions would be welcome.

I assumed a flat net margin going forward, similar to FY22, because I expect JBI to reinvest in the business for growth or R&D.

In terms of valuation, I believe JBI will continue to trade at 12 times forward earnings. That said, JBI used to trade at a higher multiple, and I believe it has the potential to trade higher if JBI continues to outperform the market by acquiring value-accretive assets and thereby juicing growth.

Risks

Nature of industry tends to force down prices

It is common practice in the construction industry to award projects through open bidding. Contract prices and profit margins are vulnerable to downward pressure from Janus’ constant competition for project awards based on pricing and other factors. We are no longer in a zero-interest-rate environment, and I do not anticipate a return to that situation in the near future. If this occurs, private firms may act irrationally by offering absurdly low prices in an effort to expand their customer base (funded through cheap debt). Since private competitors care less about profits than a publicly traded company like JBI, the odds are stacked against JBI in such a situation.

Acquisition strategy might be a drag if not executed properly

Acquisitions have been a strength for JBI, and while the company’s management team has done a great job so far, that may not always be the case. The number of potential targets shrinks as interest rates rise. If the strategy is not as profitable as it seems, my worry is that management will try to impose it anyway.

Conclusion

I believe JBI is fairly valued today. The market potential is enormous, and there is plenty of room for development. At the right price, JBI should be an attractive investment if it can maintain its current rate of organic and M&A growth.

Be the first to comment