DarrelCamden-Smith/iStock via Getty Images

We’re nearing the end of the Q4 Earnings Season for the Gold Juniors Index (GDXJ), and one of the most recent companies to report its results is Jaguar Mining (OTCQX:JAGGF). While the company finished the year on a high note (Q4: ~22,900 ounces produced), Jaguar saw production slide 8% year-over-year while costs soared 16%. The good news is that output will bounce back this year; the bad news is that costs will remain elevated. At a ~10% free cash flow yield following a massive correction in the stock, Jaguar is no longer expensive, but I still don’t see enough margin of safety at US$3.50 per share.

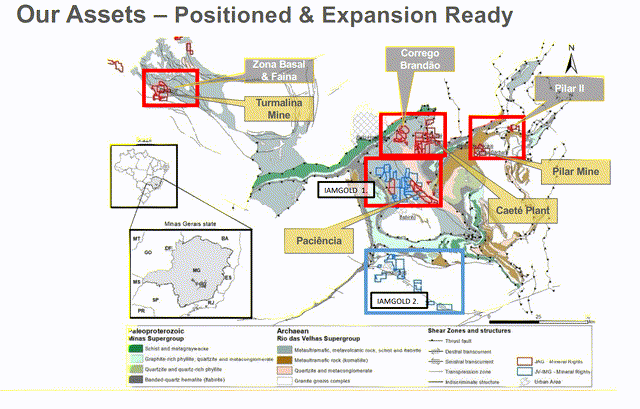

Jaguar Mining Operations (Company Presentation)

Last week, Jaguar Mining released its Q4 and FY2021 results, reporting quarterly production of ~22,900 ounces at all-in sustaining costs [AISC] of $1,127/oz. This translated to a single-digit increase on a sequential and year-over-year basis and helped push production above the 83,000-ounce mark for the year. Unfortunately, production still came up well short of guidance and FY2020 levels due to COVID-19 headwinds that led to absenteeism, and FY2022 has started on a softer note due to weather-related headwinds (torrential rains/flooding) and impact from Omicron. Let’s take a closer look below:

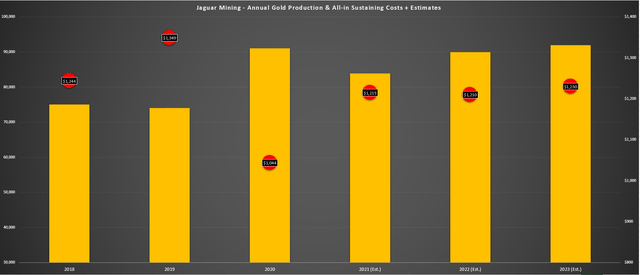

Jaguar – Annual Gold Production & Costs (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Jaguar had an exceptional year in 2020, growing production to more than 90,000 ounces and enjoying a significant decline in AISC. This was attributed to much higher grades at its Turmalina and Pilar mines and helped push costs to a multi-year low. Unfortunately, a year of headwinds related to COVID-19 reversed much of this progress last year, with production declining 8% to ~83,800 ounces while costs soared to $1,215/oz. If this increase were purely a function of fewer ounces sold, this wouldn’t be an issue. However, this is not the case.

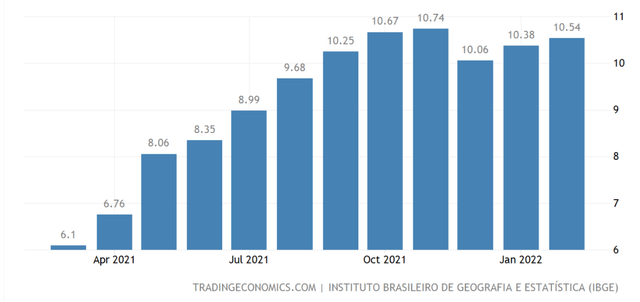

As noted by Jaguar, costs have risen sharply due to inflationary pressures, and the added headwind this year is fuel, with costs rising sharply in this category as well. While these issues are persistent sector-wide, producers in Brazil are being harder-hit due to the elevated inflation readings relative to many other nations. In fact, Brazil’s inflation has remained above 10% for six consecutive months, hitting a peak of 10.7% in November. So, while higher production this year (~90,000 ounces) would have clawed back some of the margin losses, the higher inflation rate is offsetting these gains.

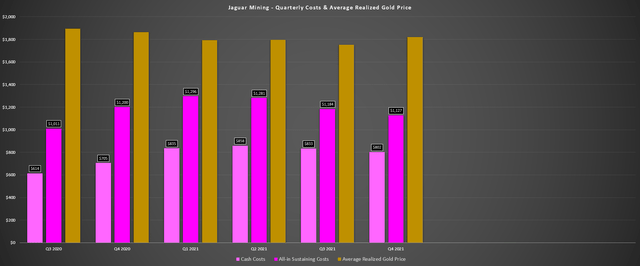

Jaguar Mining – Quarterly Costs & Gold Price (Company Filings, Author’s Chart)

As shown in the chart above, cash costs soared to $802/oz in Q4 2021, up 14% year-over-year despite slightly higher production. Meanwhile, all-in sustaining costs soared to $1,127/oz, which was down year-over-year, but benefited from much lower sustaining capital in the period. On a full-year basis, Jaguar’s cash costs soared to $831/oz, and AISC spiked to $1,215/oz. While the increase in cash costs was partially due to increased development meters, a large portion of this increase was related to inflationary pressure. This partially explains why the company has guided for a similar cost profile in FY2022 (~$1,200/oz) despite higher production.

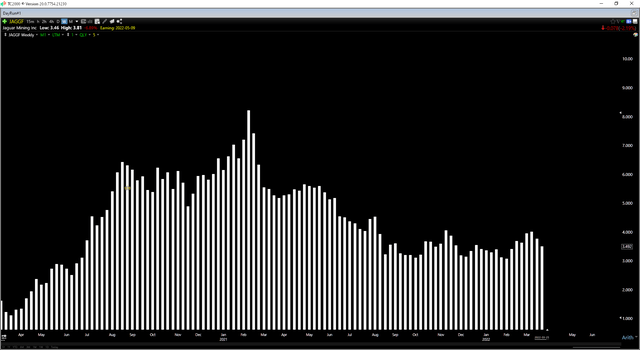

Jaguar Mining Weekly Chart (TC2000.com)

While these costs are not that bad compared to other junior producers like Great Panther Mining (GPL), McEwen Mining (MUX), and Pure Gold (OTCPK:LRTNF), they are well above FY2020 levels. This means that it will be difficult to increase margins on a two-year basis for Jaguar. The reason is that even with the benefit of a higher gold price, cash costs should come in closer to $800/oz, up ~$150/oz from FY2020 levels. So, while some investors might believe that the stock belongs back at its previous share price of US$8.00 reached in 2020, I would strongly disagree.

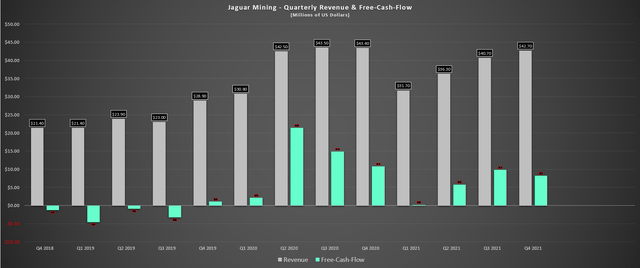

Financial Results

Moving to Jaguar’s financial results, it’s no surprise that revenue declined 5% year-over-year due to the lower production, with annual revenue sliding to ~$151.5 million. This dip in revenue combined with much higher costs led to a significant decline in Jaguar’s free cash flow generation. While free cash flow was down only 20% in Q4 to ~$8.2 million, it slid to just $24.1 million in FY2021, down from ~$49.4 million in FY2020. The 50% decline in annual free cash flow certainly made the stock less appealing from a free cash flow yield standpoint.

Jaguar – Quarterly Revenue & Free Cash Flow (Company Filings, Author’s Chart)

Meanwhile, from an AISC margin standpoint, Jaguar saw its margins decline to $575/oz, down from $701/oz in FY2020. This was even though the company enjoyed a higher average realized gold price of $1,790/oz, a nearly $50/oz tailwind. Given the much lower free cash flow generation, Jaguar didn’t see much improvement in its cash balance year-over-year, ending the year with $40 million in cash and ~$32 million in working capital.

So, was there any good news?

While the financial results certainly left a lot to be desired, though much of this was out of Jaguar’s control, the company will continue to pay its quarterly dividend of C$0.04. Assuming the company does not revise its dividend lower, due to its more aggressive growth plans, this would represent a dividend of ~US$0.128. This translates to a ~3.6% yield, well above the peer average for all producers, and especially junior producers. The other good news is that the company has unveiled a 5-year growth plan with the hope of growing production above the 130,000-ounce mark.

Jaguar Mining – Production Upside From Assets (Company Presentation)

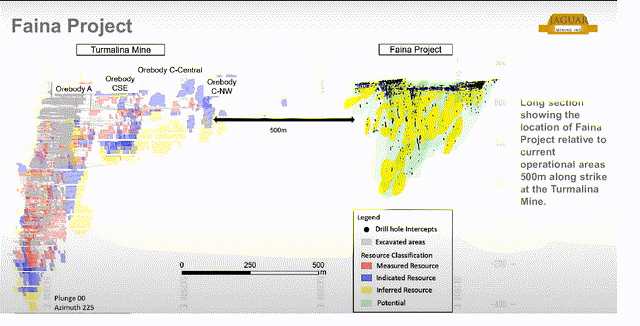

Looking at the map above, we can see that Jaguar has identified multiple growth opportunities. Its three most advanced options that will move towards Pre-Feasibility work include Faina, Zona Basal [ZB], and Cerrago Brandao [CB]. Jaguar noted that it expects to publish a resource for near-surface oxide potential at CB and ZB by April, while Faina already has a high-grade inferred resource base of ~420,000 ounces at an average grade of 7.2 grams per tonne gold. Notably, Faina lies less than one kilometer along strike from Turmalina and could complement the production profile here with its much higher-grade material, pending a positive economic study.

Faina Project (Company Presentation)

In order to support Jaguar’s growth plans, the company expects to increase its exploration and growth budget by more than 80% this year to $27 million, with the goal being to increase production by an incremental 45,000 ounces over the next five years. Assuming a production profile of ~90,000 ounces, this would translate to 50% production growth, and place the company in the higher echelon of the junior producer space. Based on 2024 estimated production, Jaguar would leap-frog peers like Pure Gold Mining (OTCPK:LRTNF), Superior Gold (OTCPK:SUPGF), and Orla Mining (ORLA).

Suppose this translates to lower operating costs, which are difficult to forecast post-2024 due to Brazil’s torrid pace of inflation. In that case, Jaguar Mining should command a slightly higher multiple relative to its peers. While this outlook is encouraging, we’re still a few years away from this coming to fruition, and for the time being, Jaguar continues to be a high-cost producer in a country where inflation is running rampant. Hence, while the future might be bright, I think there are many more attractive bets near-term. One example is Alamos (AGI), which also expects to grow output by 50% by 2025/2026, but will simultaneously enjoy a 30% decline in costs.

Valuation & Technical Picture

Based on an estimated ~76 million fully diluted shares at the end of 2022, Jaguar trades at a market cap of ~$266 million at a share price of US$3.50, or an enterprise value of ~$236 million. Based on FY2021 free cash flow generation of ~$24 million, this leaves the stock trading at a free cash flow yield of ~10%, which is a reasonable valuation for a junior producer with a growth component. However, with Brazil’s inflation levels well above that of the average nation, this is taking a toll on Jaguar’s costs, with Jaguar’s AISC expected to come in ~10% above the industry average in FY2022.

Brazil Inflation Rate (TradingEconomics.com, Instituto De Geografia E Estatistica)

Generally, when it comes to junior producers, I prefer to buy at a minimum of a 16% free cash flow yield, especially if they are operating in less favorable jurisdictions, and have higher costs than their peer group. Even if we assume Jaguar manages to generate ~$30 million in free cash flow this year, the stock would need to decline below US$2.90 to meet this criterion, which is well below current levels. So, while I don’t think the stock is expensive by any means, I don’t see the margin of safety as large enough to justify entering new positions either.

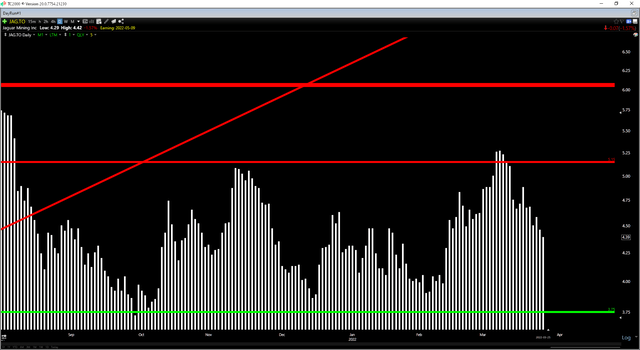

Jaguar Mining Technical Picture (TC2000.com)

Moving to the technical picture, Jaguar Mining has a confirmed resistance level at a share price of C$5.15 [US$4.12], with the stock running into selling pressure in this area yet again. Meanwhile, the next strong support level doesn’t come in until C$3.75 [US$3.00]. This support area would line up near the low-risk buy zone from a valuation standpoint near US$3.00, where the stock would offer a ~15% free cash flow yield. So, if we were to see Jaguar dip below US$3.00 and undercut its support level, I would consider this a buying opportunity from a swing-trading standpoint.

Jaguar Mining Operations (Company Website)

Jaguar Mining had a decent finish to 2021, and despite Omicron and weather-related headwinds, the company still expects to deliver into its FY2022 production guidance. Meanwhile, the company has outlined an achievable growth plan, with the potential to grow production to more than 130,000 ounces by 2026. However, higher-cost Tier-2 jurisdiction producers are riskier than their peers, and I prefer a meaningful margin of safety to account for this added risk. At a ~10% free cash flow yield, I don’t see enough margin of safety just yet, but I think the valuation would become more compelling at US$3.00 per share.

Be the first to comment