Falcor/E+ via Getty Images

The Q1 Earnings Season for the Gold Juniors Index (GDXJ) begins next week, and one of the most recent companies to release its preliminary results was Jaguar Mining (OTCQX:JAGGF). Unfortunately, the results were not great, with Jaguar tracking at just ~18% of its guidance mid-point, with Q1 production affected by flooding and absenteeism. While Jaguar is confident that it can meet the lower end of guidance, local currency strength is a new minor headwind that will make it challenging to meet its cost guidance mid-point. So, while Jaguar is reasonably valued, I think there are more attractive bets elsewhere.

Jaguar Mining Operations (Company Presentation)

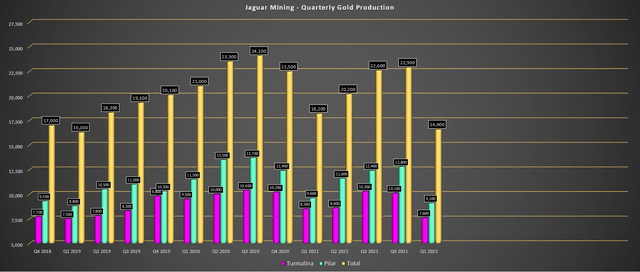

Jaguar Mining released its preliminary Q1 results last week, reporting quarterly production of ~16,600 ounces, its worst quarter for consolidated production in more than two years. This was related to rising COVID-19 cases that led to elevated absenteeism, with 60 people absent in 3 weeks, up from zero absenteeism as of December. Meanwhile, intense flooding resulted in a brief shutdown of both its Pilar and Turmalina operations, with the company noting an additional ongoing impact on infrastructure in the region. Let’s take a closer look at the quarter below:

Production

The chart below shows that this was not a great start to the year for Jaguar, with production down 8% year-over-year despite being up against very easy year-over-year comps. The lower production at Pilar resulted from lower throughput at slightly lower grades, with the asset producing just ~9,100 ounces of gold, down from ~9,600 in Q1 2021. Meanwhile, at its smaller Turmalina operation, Jaguar reported production of just ~7,600 ounces, down more than 11% year-over-year due to fewer tonnes processed, albeit at slightly higher grades (3.10 grams per tonne of gold vs. 2.84 grams per tonne of gold).

Jaguar Quarterly Gold Production (Company Filings, Author’s Chart)

The silver lining was that despite the headwinds, the company completed an impressive amount of development, with ~2,600 meters of total development, up 30% year-over-year. Jaguar also drilled 60% more meters in the period, with ~25,800 meters drilled, which should support continued resource and reserve growth, which is key to unlocking organic growth and bolstering its reserve base. However, while the solid underground development progress is encouraging, the company now expects to come in at the lower end of its FY2022 guidance of 86,000 to 94,000 ounces, likely marking a second year of missing its guidance mid-point.

Costs & Margins

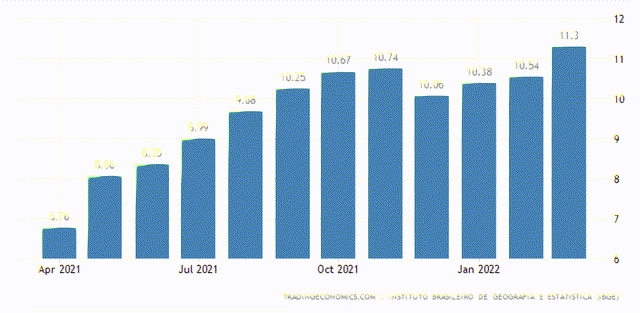

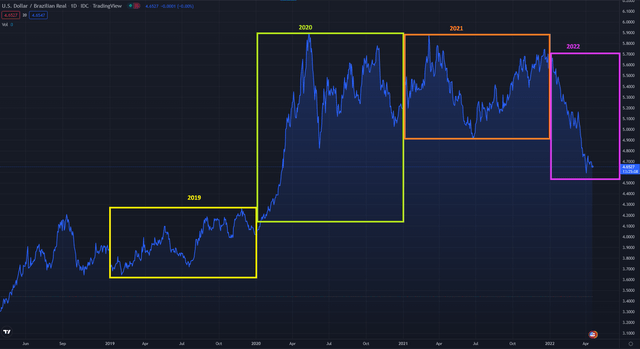

Normally, I wouldn’t be too concerned with a slight miss on production, especially in a rising gold price environment, given that the gold price would pick up some of the slack from a cost and sales standpoint. However, one new headwind has arisen, and another has worsened, making it much more difficult for Jaguar to meet its cost guidance mid-point of $1,200/oz. This is the fact that the Brazilian Real has been strengthening against the US Dollar (UUP), which is Jaguar’s local currency, given that it operates in Brazil. Meanwhile, inflation readings in Brazil are off the charts, clocking in at 11.3% in March.

Jaguar Mining – Production, All-in Sustaining Costs & Forward Estimates (Company Filings, Author’s Chart)

As shown above, Jaguar was already set to see a year of lower production at 15% higher costs in FY2022 vs. FY2020. This was based on expected gold production of ~90,000 ounces at $1,200/oz costs vs. ~91,100 ounces at $1,044/oz (FY2020). However, with production expected to come in at the lower end of guidance, we could see gold production of just ~88,000 ounces at nearly 20% higher costs of $1,230/oz. Assuming these figures are not beat (~88,000 ounces at $1,230/oz), it would wipe out much of the expected margin expansion from the higher gold price, assuming an average realized gold price of $1,900/oz this year.

Brazil Inflation Rate (TradingEconomics.com, IBGE)

Unfortunately, inflation rates in Brazil continue to climb, though, which could put a further dent in all-in sustaining cost margins [AISC] margins, with higher labor, fuel, consumables, and materials costs. As the chart above shows, inflation hit a new high of 11.3% in March, which is one reason I’ve warned against owning Jaguar and Great Panther (GPL), given that they are already above-average cost producers and they’re having to combat above-average inflation readings, with Brazil having some of the highest inflation rates globally.

US Dollar vs. Brazilian Real (TradingView.com)

Finally, it’s important to note that while high inflation is not doing Jaguar any favors from a cost standpoint, the local currency isn’t either. The chart above shows the sharp rise in the US Dollar vs. the Brazilian Real in 2020 and the higher average currency rate in 2021, which was a tailwind for Jaguar vs. 2019 levels. Unfortunately, this tailwind is not becoming a headwind, with the currency sitting at 4.65 o 1.0, well below the AISC guidance range that assumed a US$1.00 / Brazilian Real 5.50 exchange rate.

Given the lower expected gold sales due to the weak start to the year, a strengthening local currency, and above-average inflation, Jaguar is not in great shape, especially if the Brazilian Real continues to trend higher. This could lead to AISC margins coming in below $665/oz in FY2022, which would be flat vs. FY2020 levels ($663/oz), meaning that Jaguar would have a lower production profile at similar margins.

Obviously, this outlook (lower production at flat margins) is not ideal, especially among junior producers where one needs a key differentiator to justify owning them vs. diversified producers. In Jaguar’s case, there is no differentiator like high growth on the immediate horizon, unlike names such as Karora and K92 Mining (OTCQX:KNTNF) which boast double-digit compound annual production growth. This was one reason why I noted to sell the stock in late 2020, given that it would have very difficult comps ahead from a margin standpoint.

Valuation & Technical Picture

One argument for owning Jaguar is that the stock is reasonably valued, and there isn’t any disputing this, with the company trading at a market cap of ~$275 million at US$3.70 with ~74.2 million fully diluted shares. This is especially true when the company has a plan for organic growth, with the potential to grow production to ~130,000 ounces by 2026. However, while this organic growth plan could contribute to lower costs company-wide, we’re still several years away from this growth, and the market isn’t likely to re-value the stock for growth that’s years away.

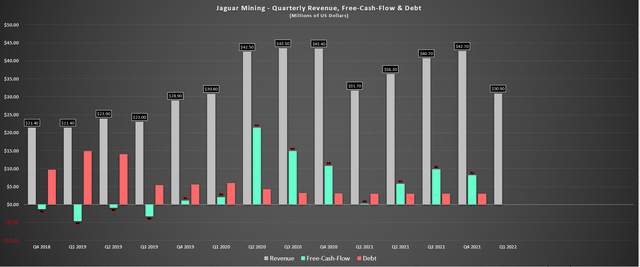

Meanwhile, looking at the financial results, Jaguar may have a decent balance sheet with ~$30 million in cash, but free cash flow is down sharply from its peak in FY2020. Given the increased capital expenditures and higher operating costs, returning to these levels won’t be easy. In fact, based on FY2021 free cash flow of $25 million, Jaguar trades at a 9% free cash flow yield, which is not what I would consider cheap for a junior producer. Investors might argue that this figure will improve substantially due to the higher gold price. Still, as I’ve pointed out, this is partially offset by strengthening local currency and double-digit inflation.

Jaguar – Quarterly Revenue & Free Cash Flow (Company Filings, Author’s Chart)

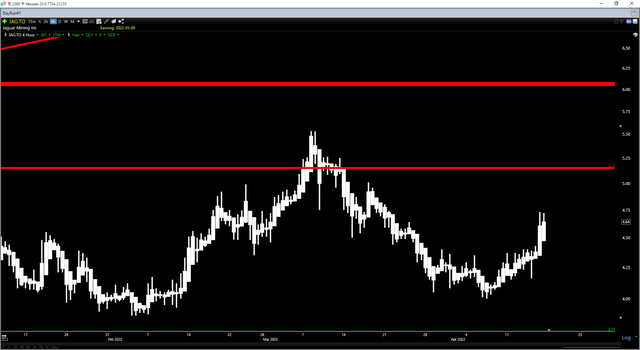

Looking at the technical picture, we can see that Jaguar has rallied sharply off its lows and is now sitting in the upper portion of its trading range. This is because the stock is trading at C$4.64 [US$3.71], vs. an expected trading range of C$3.75 [US$3.00] to C$5.15 [US$4.12], translating to a reward/risk ratio of 0.58 to 1.0. Generally, when it comes to juniors producers, I prefer at least a 5 to 1 reward/risk ratio to justify starting new positions. This large hurdle is essential to offset the risk of owning smaller producers where any issues are magnified.

JAG.TSX Daily Chart (TC2000.com)

Just because the stock does not meet my buying criteria, which would require a dip below US$3.15, does not meet that the stock can’t trade higher. However, I think there are better opportunities than Jaguar, with dozens of producers to choose from sector-wide. This is because if one is willing to wait until 2026 for growth, I think Alamos Gold (AGI) is much more attractive, given that it operates in Tier-1 jurisdictions (~80% of production) and trades at ~3.6x FY2026 free cash flow estimates.

Jaguar Mining Operations (Company Filings, Author’s Chart)

Jaguar had a tough start to FY2022, which was out of the company’s control, and given the decent development progress, it should be able to bounce back quickly. However, with production tracking to the low end of guidance and inflation rates plus the strengthening Brazilian Real being headwinds, costs are likely to come in well above $1,200/oz at the mid-point of guidance. This means limited margin expansion vs. 2020 levels in a period where the best producers are enjoying margin expansion. To summarize, while I see the stock as a decent swing-trading opportunity at US$3.10, I don’t see any reason to chase the stock here at US$3.70.

Be the first to comment