da-kuk/E+ via Getty Images

Jackson Financial (NYSE:JXN) has performed horrendously since I wrote my last article. The stock is down 34.3% and 33.29% including dividends. Although I knew that the stock would be volatile, I didn’t expect the price decline to be as large as it was given how cheaply the stock is valued. Jackson stated in their Q1 2022 press release that “the decline in the current quarter net income reflects a higher level of embedded derivative gains in the prior-year period due to stronger equity market returns, partially offset by reduced freestanding derivative losses in the current quarter, which were also the result of stronger relative equity market returns in the prior-year period.”

I had been watching Jackson closely and I bought more JXN on June 15, 2022, with the rationale that an investment-grade company is now trading at less than the cash on its balance sheet. Although Jackson must have a large cash balance due to the nature of its business, I see any company trading below their cash balance, I consider them to be very cheap.

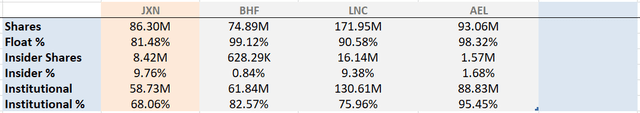

Shareholder Structure

I’d like to start by examining the shareholder structure.

Ownership Overview (Seeking Alpha)

Jackson has strong insider ownership and a high percentage of institutional ownership. I’m not such a fan of the large institutional ownership as these companies typically will cause undue volatility when entering or exiting. Insider ownership is very encouraging, especially when paired with insider buying.

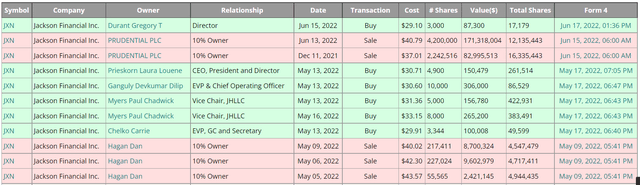

Insider Trading Jackson Financial (Insider Arbitrage)

Dan Hagan has been actively selling off his position since the beginning of 2022 and Prudential PLC (PUK) has stated that they will be looking to offload their position at opportune moments which I believe is creating a headwind for Jackson.

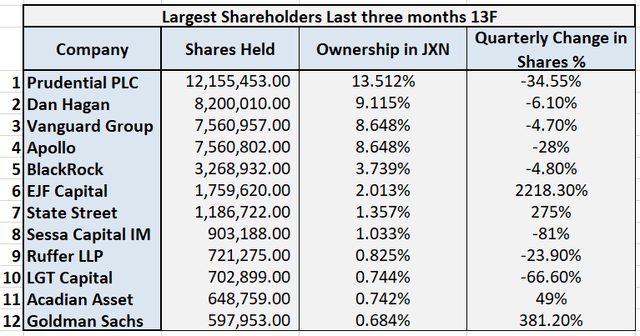

Below you can examine the largest owners of Jackson. If our numbers differ, I did play with these numbers a bit adding in the latest released transactions and aggregating from multiple sources.

Major Owners Jackson Financial (MarketBeat, WhaleWisdom, Insider Arbitrage)

Comparables

For the valuation, I’ve kept most of the same metrics for people who have read my last article to compare where Jackson is today. I have added non-GAAP operating earnings, as this shows a better representation of the business operations. I haven’t removed book value per share for consistency. I’ve also removed AIG and AFG as both companies sold their annuities business to MassMutual. I also added Brighthouse Financial (BHF) which is Jacksons closest peer.

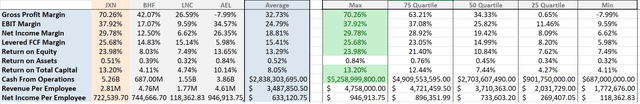

Profitability

Peer to Peer Profitability (Seeking Alpha)

Jackson still leads in profitability by a large margin compared to its peers with a spread of ~28% over its closest competitor for gross profit margin. Jackson also leads with a net income margin of ~30%.

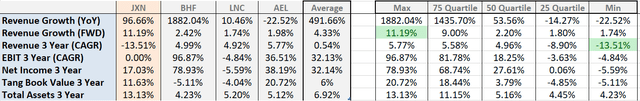

Growth

Peer to Peer Growth (Seeking Alpha)

The growth story has slowed but the company is still posting strong results. The company is forecasted to continue to grow revenues in the double digits. I expect people to start to leave risk assets and put their money into minimal risk investments making this growth assumption reasonable. Brighthouse Financial has shown explosive growth over the past few years but is expected to slow down going forward. I’m expecting the drivers that benefit Jackson will benefit Brighthouse as well.

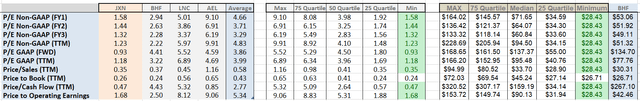

Valuation

Peer to Peer Valuation (Seeking Alpha)

Jackson is still the cheapest stock in every relevant section. When comparing Jackson to Brighthouse (closest peer), Jackson trades at about half of the valuation of Brighthouse. Even when examining Price to Operating Earnings, Jackson still only trades at 1.68x. I still believe that this is very low for a boring investment-grade company. Something not in these charts is that Jackson has $2.674 billion in cash and equivalents on their balance sheet and currently has a market cap of $2.470 billion. A market cap to cash and cash equivalents of 0.92x.

Catalysts

Shareholder Returns

Jackson is aiming to return between $425 and 525 million to shareholders this year. This is roughly the equivalent of 17-21.5% of the company in one year. The shareholder returns consist of a quarterly dividend of $0.55 giving a yield of ~7% and a share buyback of up to $338 million.

Rising Rates

Annuities companies generally perform better in a rising rates environment as their products will generate a higher yield for customers, thus making them more attractive. At the same time, annuities are often preferred over bonds as they do not go down in price as bonds do in a rising rate environment. As the central banks across the Western world are raising the overnight rate, they were seeing the yield on annuities rise, and this should result in further inflows to annuities.

Geopolitical Uncertainty

Further demand is being created by market instability and geopolitical uncertainty as investors look for safe havens. As the Russia-Ukraine conflict continues and tensions continue to increase, investors should continue to look for safety. Annuities are on par with a life insurance policy in terms of safety. For many investors who desire income from their portfolio, an annuity makes more sense than a life insurance policy. An annuity also tends to hold its value better than bonds. These factors are appealing to investors and savers with low-risk tolerances.

Headwinds

Inflation

Inflation effectively works as a tax on your capital, diminishing your total return. Realizing this may make an annuity investment significantly less attractive, as, in real terms at least, many investors will be booking in a real loss. It makes them even less attractive to the bulk of individuals buying annuities who are retirees that will use the payments to live on and may need their investment to extend for a long time. Jackson does specialize in this type of investment and has multiple risk management techniques to mitigate these risks, but the basic inflation risk will remain in many investors’ minds.

Asset Market Decline

Declining prices in the asset market will prove to be a headwind to Jackson for two reasons. The first is that the company’s share price will struggle to rise when the overall market is declining. This is especially true with a high percentage of institutional owners who may look to sell to strengthen their balance sheets. The second is the effect of declining bond and mortgage prices. These make up the majority of the assets held and for the most part they are hedged. If you examine their earnings presentation though, if we start to see a crash in risk assets instead of the orderly selling we’ve had, this will be negative.

Conclusions

Jackson Financial is the most profitable company in its sector, is growing at a double-digit pace, maintains an investment-grade balance sheet, and, is planning on returning between 17% and 21% of the company to shareholders. This company will have earnings volatility and I’m expecting swings in the stock price as institutions continue to accumulate and sell shares. In the long term, I believe the setup is here for Jackson to deliver significant shareholder returns. For these reasons, I’m once again rating Jackson Financial as a Strong Buy.

Be the first to comment