Melissa Kopka

Jack in the Box (NASDAQ:JACK) is a challenger fast-food chain. It recently bought Del Taco, another challenger in tex-mex fast food to Taco Bell, to take advantage of backends and managerial synergies. The company is optimising on the franchise side, so there’s been some YoY pressure, but overall sales are growing. Also, we think synergies are pretty low hanging, and that some major input cost pressures are going to subside. JACK is pretty cheap for a fast-food chain, and the relatively staple nature of their sales reassures us of a margin of safety in this issue. Still, this profile of investment doesn’t have enough of an edge for us, so we look elsewhere.

FY 2022 Moving Parts

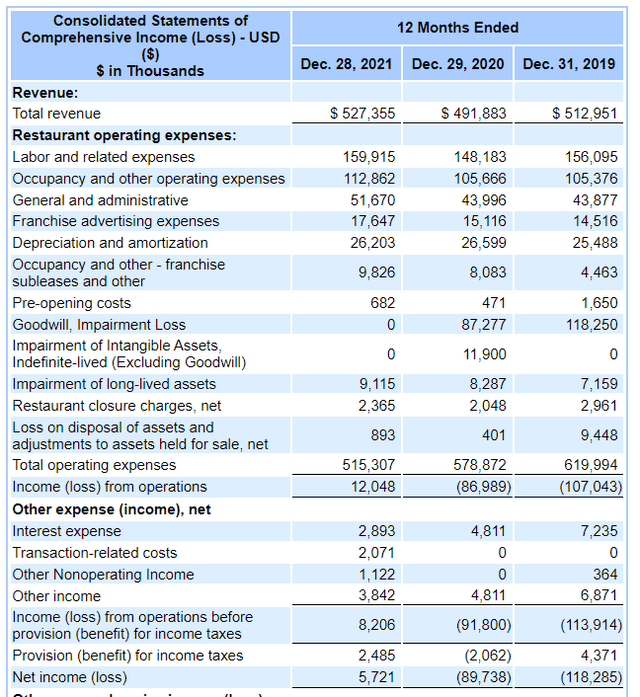

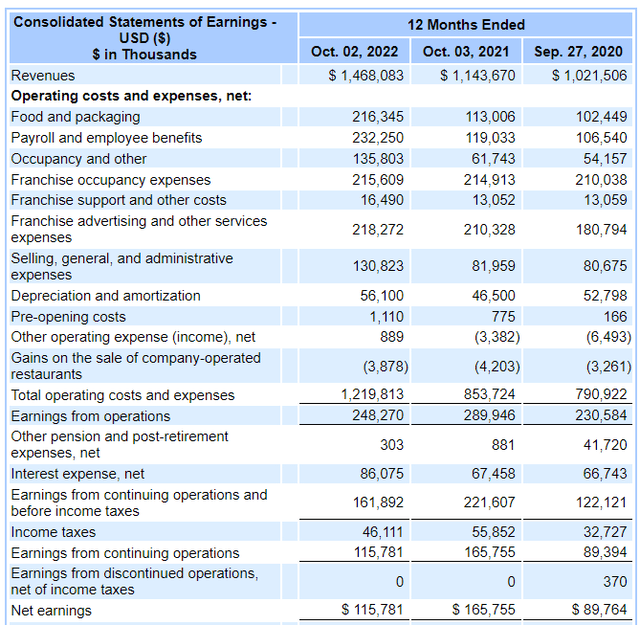

There are a lot of moving parts to JACK’s results, but the big context is the Del Taco acquisition, which has been consolidated for two quarters into JACK’s results. As a previously publicly traded company, this was its 2021 FY Income Statement.

It was not a profitable company, so the acquisition which valued TACO’s stock at $450 million wasn’t margin accretive. The plan is operational improvements and easy, low-hanging backend synergies.

SG&A was around $50 million for TACO in 2021, and in 2022 it would likely be $60 million due to labor inflation. Two quarters of consolidated results mean $30 million contribution from TACO into JACK’s results.

There was clearly some inflation from JACK’s independent operations, and it’s coming from labor inflation. Labor shortages were a real problem in the fast food industry, especially because of stimulus checks, which affected minimum wageworker incentives the most. The guidance by management in 2023 is $160-$170 million in total SG&A. A lot of that is investments in POS and other operational improvements, as well as tackling ‘munchie’ hours from the other 9 to 5 shift, serving odd-houred eaters. Still, going from $130 million to $160-$170 million can be accounted for by just a full year contribution of TACO G&A. This means that a good deal of synergies is coming in already in 2023 – we estimate about $10-$20 million, but think that it can go as high as $40 million in total cost synergies once TACO is fully integrated and optimised. About 10% of SG&A is also coming from some non-recurring legal and insurance bloat. It will go away.

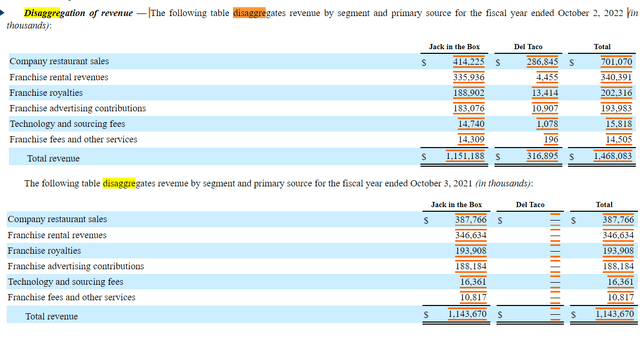

Revenue disaggregations are important here:

Revenue Disaggregation (sec.gov)

For JACK, there was YoY overall improvement in sales, but franchise revenues took a hit. This is because there were net franchise closures for the company. Owned operations performed better and there was improvement in sales from volume improvements, as ‘baskets’ got larger, but also from about 10% pricing hikes, which management believes was the best they could do.

Bottom Line

Management is probably being conservative around labor expectations. The end of the stimulus check should be good for companies like JACK. Their markets are pretty low ticket, and not all that discretionary. Fast-food is a great industry in that regard, there’s good retention. Being able to have longer shifts and man more of their new locations, which have been delayed in their construction by the way, should be a major positive in addition to fast labor turnover meaning no sticky-downward effects when it comes to wage revisions where possible as the minimum-wage labor market re-equilibrates.

The other thing is we estimate about 30% reduction in SG&A on a terminal basis, which translated into 20% operating earnings improvement just on synergies and non-recurring expense retreats. That’s alright, considering there will also be other operational improvements, assuming they work, and continued organic growth with new locations and marketing efforts with Mark Hamill as the JACK spokesperson. Jack trades now at a 10x EV/EBITDA. We think that the effective multiple is about a 7-8x, which is cheap for fast-food, and this is being quite conservative. We have to admit though that the lack of accretion in the acquisition shows. A 20-30% improvement in EBIT and EBITDA only brings the operating income 10% of 2021 levels, which is alright but not fantastic. A 2.59% dividend yield is also nice.

There’s something to this stock, but it has a duo of challenger brands – not on the level of McDonald’s (MCD) or Burger King (QSR). Mid-cap is generally pretty undervalued, and there are opportunities, so we are keeping an eye on this one, but in general, we think the chances of huge outperformance are still a bit limited, especially since there’s an execution bet here with analysts reacting really strongly to margin performance.

Be the first to comment