cokada

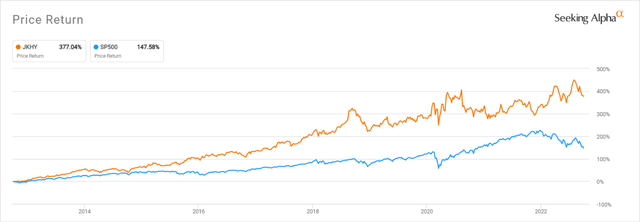

One of the industry’s top players in the core banking sector is Jack Henry & Associates Inc. (NASDAQ:JKHY). The business has provided solid returns over the last ten years, returning 18.76% CAGR, compared to the S&P 500s return of 15.18%.

One of the more obscure fintechs, Jack Henry, trades in a niche industry and doesn’t make much noise in the media or among investors. However, if we look closer, we find a great business well-run by an excellent management group.

Jack Henry offers some of the stickier core banking products in the industry; for a deeper look into the finer points of the business, check out my previous article.

Jack Henry operates out of four segments:

- Core

- Payments

- Complementary

- Corporate and Other

Jack Henry works with almost 8,400 financials, particularly credit unions and banks with less than $50 billion in assets. It provides its customers (banks) with customizable solutions to meet their customers where they need help.

Regarding sticky platforms, Jack Henry boasts an almost 99% retention rate among its customers as core banking customers remain reluctant to change platforms.

Core banking remains the nuts and bolts of banking, offering account management, ATMs, loans, and daily transactions. I consider it the banking systems plumbing. Financials remain reluctant to switch because of the costs associated with training and high upfront costs.

Jack Henry remains third in the core banking world despite its core banking moat, behind Fiserv (FISV) and Fidelity National Services (FIS). Despite the lower ranking, Jack Henry remains a power player in space.

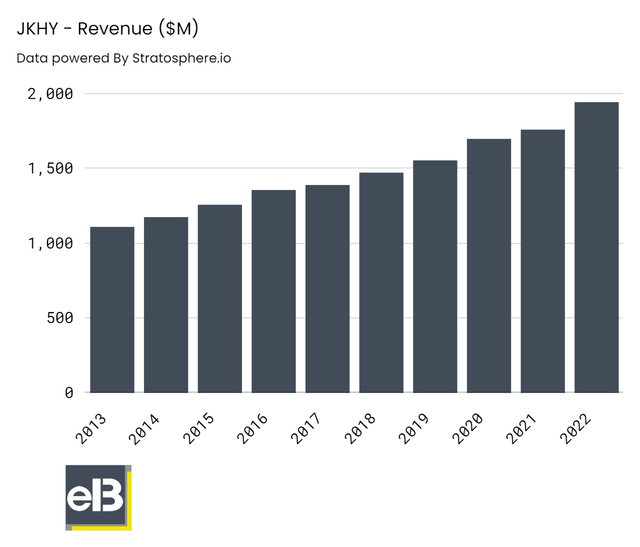

Revenues

Jack Henry is still committed to the idea that consistency is the key to success. While all of its larger competitors made significant mergers in 2019 that broadened their operations into new regions, Jack Henry has strengthened its competitive position organically.

Overall, I believe this strategy should enable Jack Henry to keep its substantial moat and perform marginally better than its larger competitors.

David Foss, the CEO, reported in the 4th quarter earnings call that the company produced record revenue, operating income, and record bookings.

Jack Henry saw revenue increases of 7% for the quarter, with deconversion fees dropping 37% YoY. Even though the drop impacts the company’s quarterly performance, they are net positive for Jack Henry’s long-term.

Over the past few years, Jack Henry has excelled, growing revenues from $1.39 billion in 2017 to current levels of $1.94 billion, a CAGR of 6.89%. What’s particularly impressive is the growth continued through the pandemic.

Over the past ten years, Jack Henry has grown revenues by 5.84%; while not super impressive, slow and steady wins the race.

Source: Stratosphere.io (Stratosphere.io)

Digging a bit deeper, we see across the board; each segment saw growth YoY:

- Core processing – 10%

- Payments – 10%

- Complementary solutions – 11%

|

Thousands |

2022 |

2021 |

% Change |

|

Core |

$ 622,442 |

$ 564,096 |

10% |

|

Payments |

$ 707,019 |

$ 642,308 |

10% |

|

Complementary |

$ 561,211 |

$ 505,928 |

11% |

Source: Jack Henry filings

Jack Henry has benefited from recent acquisitions, but most revenue growth continues organically. The company has executed over 34 acquisitions since 1999, with the most recent acquisition of Geezeo in 2019 for $37.7 million to help boost digital financial management.

For the full year, the company saw:

- 52 competitive core takeaways, with 10 of those exceeding $1 billion in assets

- 54 contracts signed to move on-premise core clients to the cloud

- 165 new Banno digital customers

- 58 new clients signing up for card processing

In July, Jack Henry surpassed 7.2 million users of the Banno Digital Banking platform and surpassed 7.7 million users at year’s end. In two years, the company has grown 150% since 2020.

That remains significant for Jack Henry because the more users on the platform, the more revenue they can generate. As Jack Henry continues to move more and more of its customers to the cloud, the more revenue it can generate.

As of the year’s end, the company also announced a new acquisition of Payrailz, enhancing Jack Henry’s payments-as-a-service. The acquisition will help grow the digital payment capabilities and help simplify payments and modernize Jack Henry’s offerings.

Core banking and payments continue to drive the bus for Jack Henry. The company will grow its core banking services as it continues innovating and improving technology.

Banks typically are slow to change, and with Jack Henry’s strong customer base and moving those banks to the cloud slowly; they will continue to drive more revenue.

The cloud gives banks lots of flexibility in switching between hardware, and operating systems, ensuring they will always have their systems up and running. If one server fails, the software automatically opens another server, allowing for easier continuity.

Many of Jack Henry’s customers have long-term contracts with them, five to ten years, which helps smooth out the revenue. It also gives them a long-term generation of revenue and the ability to build long relationships.

Another benefit for Jack Henry is the open-source banking APIs they offer. The open source nature allows banks to use multiple vendors if they so choose, and over time Jack Henry remains confident they will win the deal.

The stickiness of their core platform, long-term relationships with their customers, and the superior technology they offer allow them to retain customers and go out and win new clients.

And as its platform grows, they continue to innovate and update their payments offerings and win new deals with existing customers.

Jack Henry plays well in their niche and has become the dominant player in their space, allowing them to grow steadily.

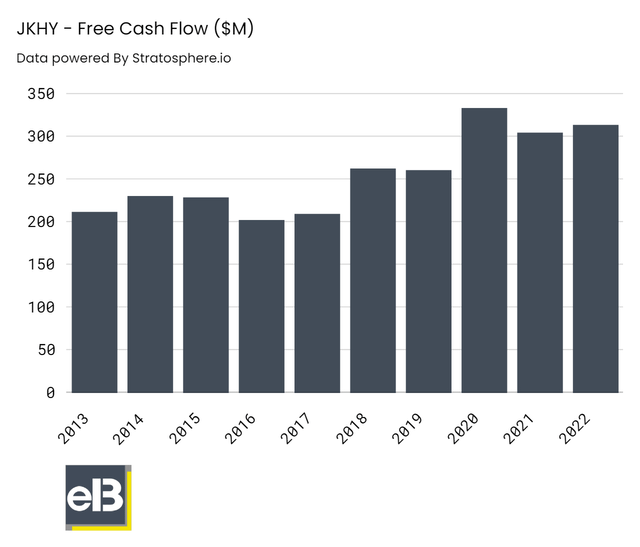

Cash Flows

Jack Henry’s operating cash flow for the fiscal year increased to $504.6 million from $462 million last year, principally due to a higher net income of $51.4 million than the prior year. Jack Henry’s company reinvested to the tune of $191.4 million in a combination of capital expenditures, purchases, and capitalized software.

Jack Henry had $313.3 million in free cash flow, which is operating cash flow, fewer capital expenditures, and capital software, plus adding back net proceeds from asset sales. The conversion of net income was 86%.

Jack Henry reported two major reasons regarding working capital which were responsible for the growth.

Jack Henry saw an increase in receivables of $35 million YoY, with a third of that increase stemming from increased average monthly billings for recurring revenue. There were also timing issues with collections regarding annual maintenance.

The other culprit for the increase in working capital was prepaid expenses which grew by $26 million. Of the $26 million, $20 million related to the increase in prepaid commissions related to the strong contracting they had in the previous year a good problem to have.

Jack Henry would have experienced a free cash flow conversion of over 100%, excluding these one-off items.

Over the last ten years, Jack Henry has grown 4.01% CAGR, again slow and steady wins the race.

Capital Allocation

The management team at Jack Henry has always been comparatively steady, and the business tends to promote from within. In 2016, David Foss, a Jack Henry employee of more than 20 years, took over as CEO in place of Jack Prim, who had served in that capacity since 2004, and CFO Kevin Williams, who held his post since 2001, recently announced his retirement plans.

All-in-all, Jack Henry retains management for a long time, and the continuity leads to operations and capital allocation stability.

In terms of its strategy for M&A, Jack Henry most obviously sets itself apart from competitors.

Fidelity National Information Services (FIS) and Fiserv (FISV) have strengthened their positions through a long line of significant mergers and acquisitions (Worldpay and First Data). More recently, through acquisitions, they have expanded into new business sectors outside bank technology. This strategy has occasionally required significant financial leverage.

On the other hand, Jack Henry has adopted a more natural, patient strategy and concentrates on the bank technology field. The company pursues acquisitions, but these are typically modest agreements, and management prefers expanding its capabilities internally.

Over time, this strategy has strengthened Jack Henry’s substantial moat. While its competitors are required to manage numerous platforms they have purchased, Jack Henry’s product line is far more simplified.

Despite its smaller size, the company can still retain comparatively excellent margins. I also think that by adopting this strategy, the business can keep a stable lineup of products that perform well in terms of growth and market share.

Risks

Any weakness or drawdown in the banking sector could cause banks to put off technology acquisitions, harming Jack Henry’s top line. Any significant changes to the banking industry’s structure could have unforeseeable effects on the companies selling technology to banks.

Increased replacement rates might weaken the company’s moat due to aging core processing systems and the growing need for system flexibility.

Data security is the company’s biggest risk, in my opinion. The industry handles sensitive data and is vulnerable to system hacks, which raises the likelihood of an occurrence. Contrary to other payment systems, internal bank system breaches have been relatively infrequent, yet, more serious effects could result from a big bank technology compromise.

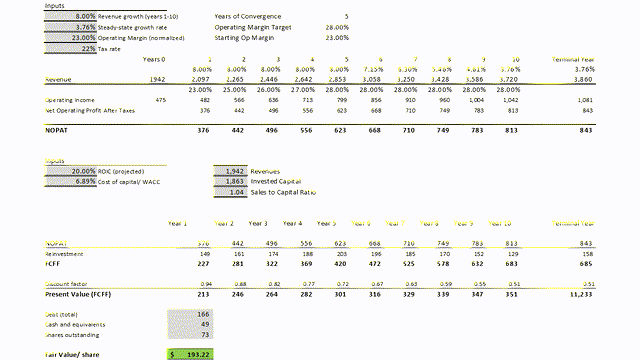

Valuation

There is no way to slice it; Jack Henry is not cheap, on a relative basis, or intrinsically. Over the last ten years generated 377% (a 17.66% CAGR) returns compared to the S&P’s of 147.58%.

Source: Seeking Alpha (Seeking Alpha)

Jack Henry trades at an FWD P/E of 35.76 and hasn’t traded below a P/E of 30 since 2017 and a P/E of 25 since 2015. So cheap is not a word I would associate with the company.

But if we look at the returns on capital and equity, we see the company excelling. The current 26.87% ROE and 19.59% ROIC far exceed their respective costs of equity and capital of 6.93% and 6.89%.

This would indicate the market thinks paying up for higher quality earnings and cash flows might be worth it. I agree and liken it to buying Visa (V); if you wait for the price to come back, you might never have a chance.

Below is a free cash flow to the firm valuation of Jack Henry, assuming the following:

- Revenue growth – 8%

- Operating margins – 23%

- Cost of capital – 6.89%

- Sales to Capital ratio – 1.04

Source: Author

All of this gives us a fair value of $193, with the current market price hovering at $182. If I adjust the revenue growth to see a range:

- 6% – $173

- 7% – $183

- 9% – $203

I feel the 6-8% revenue growth range is far more likely, and the company trades in the fair value range. But with the market in such turmoil right now, we might get a chance to buy if it drops with the overall market.

I am buying more Jack Henry at these levels, and I recommend you do so.

Investor Takeaway

Jack Henry is a well-run company operating in a niche they dominate. They have created a sticky product with customers who enjoy their relationship with Jack Henry.

The company has a reputation for creating easy-to-use, solid technology which fits its customer’s needs.

Along with their superior capital allocation, great returns on equity and capital, and good returns to shareholders via dividends and buybacks. Jack Henry continues to excel and produce for their customers and shareholders.

I recommend you buy while the market gives us an opportunity; I am long Jack Henry.

Be the first to comment