Editor’s note: Seeking Alpha is proud to welcome Chase Fida as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan/Getty Images News

The J. M. Smucker Company (NYSE:SJM) is a leading manufacturer of multiple food and beverage products. The company has great fundamentals, with rising revenues, surging earnings, and a strong gross margin. Its total debt is decreasing, while it has enough cash to protect it from a possible upcoming recession. The company also benefits from strong customer loyalty to its brand, as its products are proven, trusted, and beloved. Smucker puts a strong emphasis on its customers and this is a key reason why people keep coming back to it. Its line of products have a long and stable shelf life, but have also run to problems with contamination recently. Although the stock is down this year, it is still far outperforming the general market and may see upside in the upcoming periods. I therefore believe buying SJM stock may return great value to investors.

Strong Fundamentals and Still Growing

J. M. Smucker has strong fundamentals and is proving to solidify its position in the food & beverage market. Total revenue has grown from $7.39 billion to $8.00 billion from FY16 to FY21. The company has been pretty consistent with its revenue which shows how it utilized its pricing power to increase sales during the pandemic and its brand loyalty to maintain its long-time customers. In FY21, earnings rose by 12% and sales increased by 3%. These increases can be partially attributed to its new commercial delivery model which emphasizes e-commerce sales. This new model accounted for 12% of Smucker’s US retail sales last year and could support further growth in the future.

Smucker’s cash is in a strong position at $169.9 million. Its debt has decreased from $5.40 billion to $4.61 billion from FY16 to FY21. These indicate that the company’s fundamentals are proving to be strong and trending in the right direction. The company has plenty of cash to survive a possible upcoming recession and continues to succeed through market downturns.

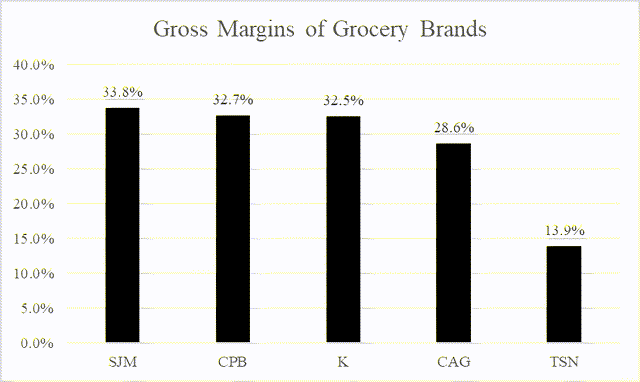

J. M. Smucker has a very strong gross margin, which remains the highest among its major competitors. I believe this margin will likely not be impacted because the company has pricing power and can easily adjust to inflation by raising its prices.

Gross Margins of Grocery Brands

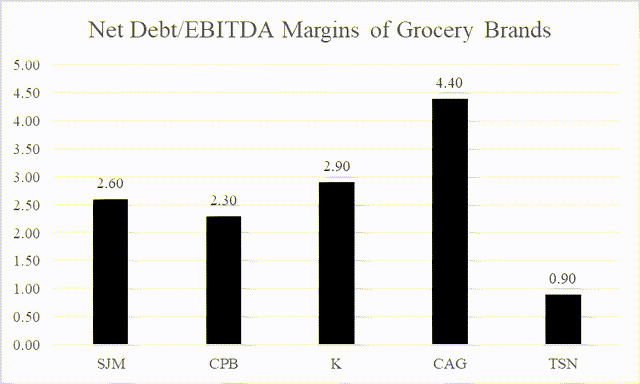

With a Net Debt/EBITDA currently at 2.6, Smucker is in a good position to pay off its debt if needed. This metric is also line with that of its competitors.

Net Debt/EBITDA of Grocery Companies

4Q Earnings Beat Estimates and Show Promise

J. M. Smucker recently reported 4Q22 earnings and beat investors’ expectation. The company generated $2.03 billion in revenue while analysts were expecting $1.98 billion, implying a top line growth of 6% Y/Y. However, inflation caused its gross margin to see a decline. Due to higher commodity, ingredient, packaging, and manufacturing costs, its gross margin decreased from 37.9% to 32.2%.

On the other hand, Smucker’s operating margin increased by 1.1 points to 17.3%. This increase was caused by lower SD&A expenses and allowed the company to record $350.9 million in operating income, up 13% from one year ago. The bottom line also beat analyst estimates. It reported an EPS of $2.23 while analysts were expecting $1.88. This is a surprise of 18.62% and is higher than last quarter’s surprise of 12.02%. This could mean analysts are underrating the company, leading investors to possibly receive much higher value from future earnings surprises.

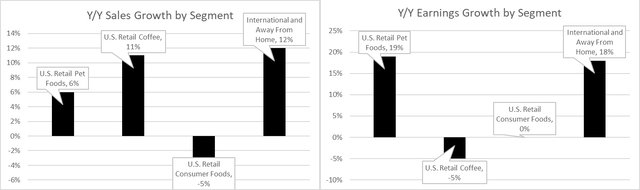

Smucker’s segments also performed mixed. The company’s pet foods, coffee, and international segments all increased their sales compared to last year. On the other hand, sales of the consumer foods segment decreased. The pet foods and international segments also saw Y/Y earnings growth while earnings for the coffee segment declined while consumer foods remained flat.

Sales & Earnings Growth by Segment (Created by Author)

Strong Brand Loyalty Offers Protection From Market Downturns

An important aspect of Smucker’s future growth is brand loyalty. Brand loyalty is huge during a recession because loyal customers will continue to fall back to a company’s products. Companies leading in brand loyalty have seen a 3x increase in returns compared with lesser-known companies during a recession period. Smucker is ranked #81 compared to Consumer Goods Brands and #2 compared to all of its main competitors in terms of brand loyalty. This will likely allow it to outperform competitors in future periods.

Smucker’s customer loyalty also helps it to market and sell new products as brand loyalty increases the chances that an existing customer will try new products. Existing customers are 60-70% more likely to buy a new product, while new prospects have a 5-20% likelihood of buying a new product. CEO and President Mark Smucker remarked in 2021 (as can be seen in the quotes below) how the company is focusing on its relations with its customers and has recognized the brand loyalty that many consumers have towards its products. In 2020, the company started selling its products to over 1 million new households and maintained these homes for recurring sales in the following year.

Consumers remained loyal to our brands as we maintained the 1 million net new households gained in the prior year, while dollars per buyer increased 10%…Over the past year, we increased our marketing investment by nearly $40 million, or 8%. Most importantly, we’ve significantly improved our market share performance, where, today, 55% of the brands in our portfolio are growing market share versus 26% 18 months ago. This is the sixth quarter of sequential share performance improvement for our portfolio.

Businesses and investors have acknowledged the importance of solidifying brand loyalty especially during recessions. 20% of finance directors and managers believe that companies with a loyalty program would come out of a recession with a significant competitive advantage. Since Smucker has strong brand loyalty, the company will likely thrive during a possible upcoming recession while many others could fall. This will provide safety to an investor’s portfolio during selloffs.

J. M. Smucker is a Strong Competitor in the Food Industry

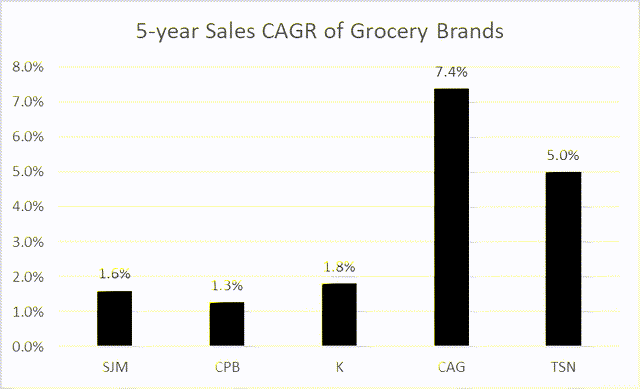

Smucker has a competitive growth rate for its 5-year sales CAGR. Campbell Soup Company (CPB) and Kellogg (K) experienced similar growth rates, while Conagra Brands (CAG) and Tyson Foods (TSN) outperformed the company. It is not in a bad CAGR position, but can certainly improve this growth rate to better compete against the stronger competitors.

5-Year Sales CAGR of Grocery Brands (Created by Author)

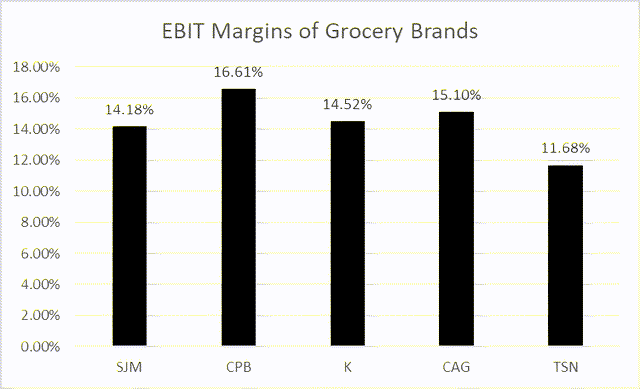

Smucker also ranks similar to competitors regarding its EBIT margin. The company fares well when compared to Campbell, Kellogg, and Conagra. However, it is outperforming Tyson Foods in this regard. As mentioned previously, its EBIT margin has recently been increasing, which means that it could become the industry leader in the future.

EBIT Margins of Grocery Brands (Created by Author)

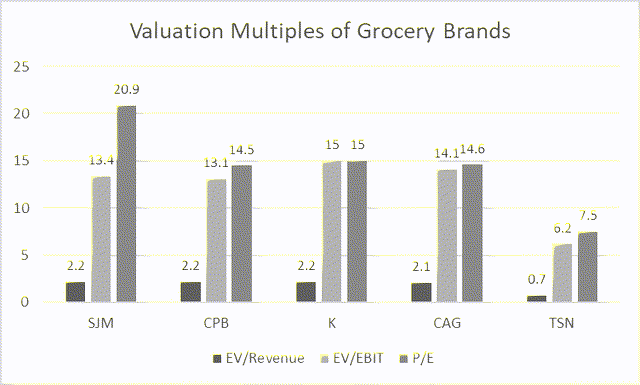

Smucker is comparable in terms of EV/Revenue and EV/EBIT to all of its main competitors. However, it has the highest P/E of its competitors. The company should try to decrease its P/E by increasing earnings, but this may be difficult at times inflation causes expenses to remain high.

Valuation Multiples of Grocery Brands (Created by Author)

Products Will Continue to Have High Demand Despite Future Developments

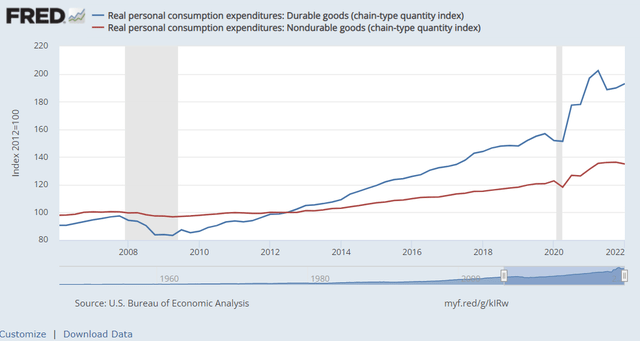

Smucker’s customers often prefer how most of its products have a long shelf life. Most of the company’s fruit spreads and ice cream toppings have a shelf life of 24 months. During the Great Recession, food items and other similar goods only saw a decrease in consumption of about 3% while the consumption of other items decreased by 12%. The products’ durability also decreases expenses for consumers during a recession as they can buy less food. This will cause the company’s products to continue to be popular during times of uncertainty.

Consumption of Nondurable vs. Durable Goods (FRED)

Optimizing shelf life allows companies to reduce total waste and increase profits. Don KRC, a division of George Weston Foods, saw an instantaneous surge in sales by over 80% in 2016 when the company decided to innovate its packaging and increase product shelf life from 14 to 28 days. This is a prime example that highlights how product durability will result in profitability and keep the demand for the company’s products high.

Recent Recalls Are An Issue But Will Not Jeopardize The Company

Some investors are concerned with recent recalls of some of the Smucker’s products. In late May, the company recalled peanut butter products due to potential salmonella contamination. This could cause it to potentially take on a $125 million hit in the full year from this recall. This is not a one-time occurrence, as the company had just issued a voluntary recall for its Natural Balance pet food in July 2020.

Recalls can damage the trust between companies and their consumers and could cripple smaller companies that don’t have the cash or brand name to recover from them. A similar recall of products from Peanut Corporation of America caused the company to file for bankruptcy. However, Smucker will likely be able to survive and recover from this recall as it has strong brand loyalty.

Valuation

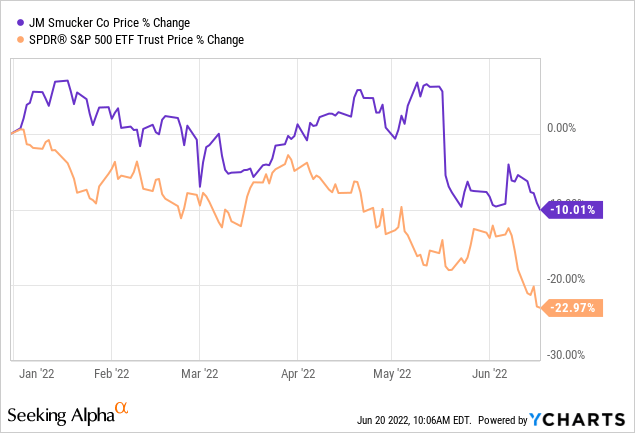

Although the share price is down over 10% YTD, it is still far outperforming the market. This drop could give investors great value for the future. However, getting in at the right price is crucial.

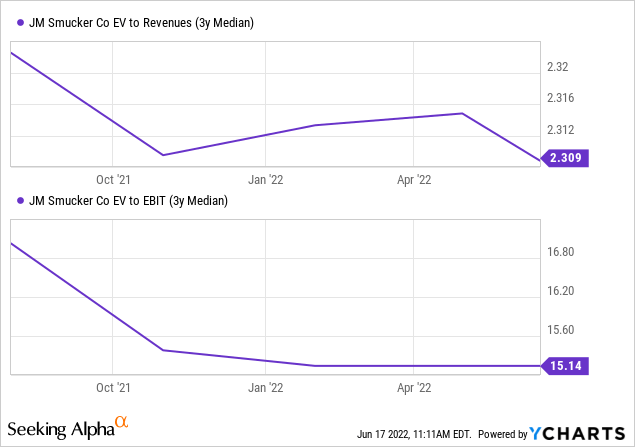

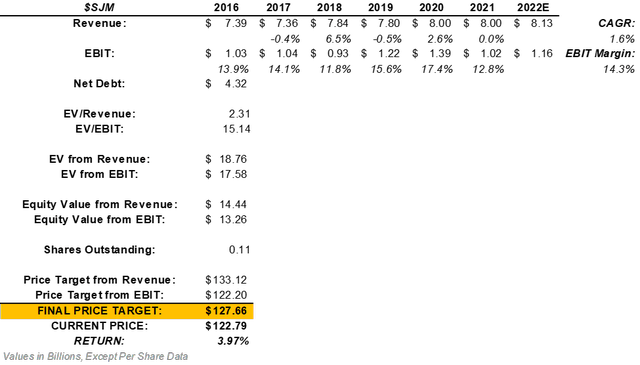

J. M. Smucker has increased its revenue from $7.39 billion to about $8 billion over the past 6 years. This means a CAGR of 1.6%. By extending this CAGR into the company’s next fiscal year, we can estimate the company will generate $8.13 billion in revenue. Also, the company has seen an average EBIT margin of 14.3%. By multiplying this margin by the projected revenue of $8.13 billion, we can expect $1.16 billion in EBIT in the upcoming fiscal year. After multiplying these projections by the company’s 3-year medians for EV/Revenue and EV/EBIT, we can come to its expected enterprise value.

After adjusting Smucker’s projected enterprise values for net debt, we can find the company’s projected equity value from revenue and EBIT. After dividing the equity values by the current number of shares outstanding and averaging the price targets, we arrive at a final price target of $127.66. This means the stock could return an upside of about 3.97%.

Valuation of SJM (Created by Author)

The other interesting point to note is that Smucker is an attractive pick for dividend investors. Currently, Smucker pays an annual dividend of $3.96 per share. This equates to a dividend yield of 3.24%. The company also has a trend of increasing its dividend having done so every year over the past decade, causing the dividend to raise from $2.00 (since 2012) to $3.96 currently. This calculates to a 10-year CAGR of 7.51%. Therefore, investors in SJM stock will likely experience a great return through both potential increases in the share price and dividends.

Takeaway For Investors

J. M. Smucker’s cash position is strong enough to protect it from a possible upcoming recession, while its total debt is on the decline. The company also benefits from strong customer loyalty to its brand that will potentially help it survive current and future recalls. The long shelf life of its products will also be favorable during economic downturns and help keep the fundamentals growing during times of uncertainty. Although the stock is down this year, it is still outperforming the general market, and may be undervalued. I therefore have a Buy recommendation on the SJM stock.

Be the first to comment