max-kegfire/iStock via Getty Images

Strong 2022

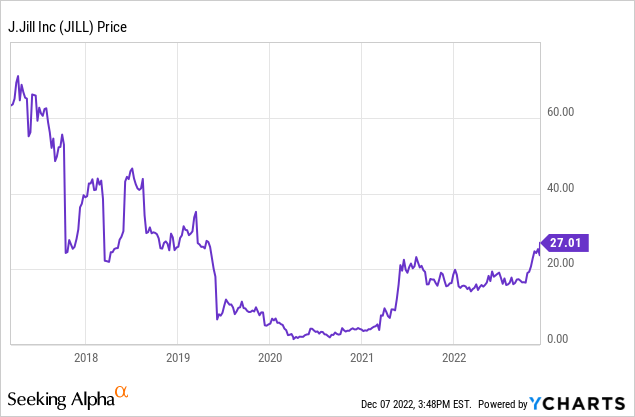

J.Jill (NYSE:JILL) has had a relatively strong 2022 so far. Note their fiscal year ends at the end of January 2023. Sales are up, and margins have improved due to pricing and operational leverage against SG&A.

On current guidance 2022 results should be:

- $103M EBITDA (low-end of guidance range)

- less $13M capex (guidance)

- less $20M tax (my estimate based on current run rate)

- less $17M interest (my estimate based on current run rate)

- Resulting FCF is $53M

Against a market cap of $260M that’s a 4.9x multiple, and then you have $90M of cash on the balance sheet. If you want to back that out from the market cap, it’s a 2.8x multiple.

Sales Relative To Pre-Pandemic

| 2016-2019 Max | 2016-2019 Min | 2016-2019 Average | 2022 est. | |

| Sales | $706M | $639M | $683M | $623M |

| Gross margin | 67% | 62% | 65% | 70% |

| Operating margin (adjusted for impairments) | 10% | 3% | 8% | 15% |

Source: author’s analysis, company filings (2022 is pro-rated for first 9 months)

So even though sales are below pre-pandemic levels, margins and generally a lot higher due to pricing. Is this sustainable?

The company has been clear that it has taken some pricing and focused deeply on its core customer. This process continues and a recent test of a Pure Jill Elements range may hit a higher price point. Also the company’s “welcome everybody” campaign could broaden its customer base. At the same time, J.Jill’s online fulfillment offers some operational efficiency.

A reduced store footprint may help, prior to the pandemic J.Jill had 280 stores, it now has 247. Clearly not all stores are equally profitable, and pruning of stores during the pandemic may have left the company with a more profitable store portfolio, despite the reduced operational leverage.

Guidance Risk

Against this the company’s guidance is somewhat conservative. They argue for gross margins return to comparable levels from last year in Q4, which I estimate to be 67% (vs. 70% for the first 9 months of the fiscal year). They also believe sales will dip slightly “flat to down 3%” in Q4.

Scenarios

Let’s assume the company can return to pre-pandemic sales of around $700M over time, and run some simple scenarios on operating margin for the business.

| Scenario | Pre-pandemic max margin | 2016-2019 average margin | 2016-2019 low margin | 2022 results sustained |

| Operating margin | 10% | 8% | 3% | 15% |

| Operating Profit | $70M | $56M | $21M | $105M |

| est. FCF | $30M | $18M | not meaningful | $58M |

| Resulting per share valuation with $90M cash and 15x multiple on 14.3M shares out | $37/share | $26/share | not meaningful | $67/share |

I find the above analysis encouraging. Yes, it assumes the company continues to grow sales over the coming years, but at a price of $27 at the time of writing it shows that the shares could still have some optionality going forward.

Either 2022 was something of a one-off, in which case the shares are fairly valued on 2016-2019 average performance, or the company has operationally improved, in which case the shares have some way to go.

As a further sanity check, pre-pandemic the shares traded is a range from $22-$70 share (though the capital structure is now slightly different).

Debt Refinancing

The company took on debt in September 2020 paying approximately LIBOR + 4%, as well as other terms that involved some share issuance, which it is looking refinance. Now the company is through the pandemic and holds $90M in cash on the balance sheet compared to $219M of debt J.Jill may be in a better position to obtain better financing. For example, with $90M of cash on the balance sheet and $50M of annual FCF the company could become debt-free by mid-2025 if operating results continue to trend well. Though I would expect more investment in capex related to store openings and fulfillment relative to debt paydown. Still, the company’s balance sheet is improving.

Risks

- Management is guiding fairly conservatively for Q4. Results for the first 9 months of 2022 may not be sustained.

- J.Jill is a retailer heading into what may be a recession in 2023, reducing sales.

- The company does need to refinance debt in the coming 2 years and may not be able to do some on favorable terms.

- J.Jill are subject to fashion trends, if their collections lose appeal that could hurt performance

Conclusion

J.Jill is having a great year, but though the easy money has perhaps been made, the company may still have some runway left to continue to deliver for shareholders into 2023.

It will be important to assess Q4 results and guidance to determine if relatively high margins compared to history can be sustained in 2023. However, if so, the shares have further upside potential.

I have slightly less conviction in the shares than earlier in the year. That’s because on more pessimistic assumptions the shares may now be fairly valued, but J.Jill could perform well into 2023, as the market evaluates the firm’s new level of profitability compared to the past 2 years.

Be the first to comment