Andrii Yalanskyi

Thesis

Back in August we signaled to retail investors the decision by the Delaware Ivy High Income Opportunities Fund’s board to pursue a merger with the Aberdeen Income Credit Strategies Fund. The merger has now been approved by the fund’s shareholders as well:

PHILADELPHIA–(BUSINESS WIRE)–Today, Delaware Ivy High Income Opportunities Fund (the “Acquired Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “IVH”, announced that it held its Special Meeting of Shareholders (the “Meeting”) on November 9, 2022. At the Meeting, shareholders of the Acquired Fund voted to approve the reorganization of the Acquired Fund into abrdn Income Credit Strategies Fund (the “Acquiring Fund”), a New York Stock Exchange-listed closed-end fund trading under the symbol “ACP” (the “Reorganization”).

As of the record date, August 11, 2022, the Acquired Fund had outstanding 16,570,234.60 shares of common stock. 61.07% of outstanding common stock were voted representing quorum.

The shareholders of the Acquiring Fund approved the issuance of shares of the Acquiring Fund at a special shareholder meeting held on November 9, 2022, subject to the approval of the Reorganization proposal by shareholders of the Acquired Fund. It is currently expected that the Reorganization will be completed in the first quarter of 2023 subject to the satisfaction of customary closing conditions.

Delaware Management Company, a series of Macquarie Investment Management Business Trust, is the investment manager of the Acquired Fund. Aberdeen Asset Managers Limited is the investment adviser of the Acquiring Fund and abrdn Inc. is the investment sub-adviser of the Acquiring Fund.

Since all the approvals have now been obtained, what remains are operational procedures for the funds’ assets to be merged and new shares to be issued under the ACP ticker to cover the new assets. As per the above press release, the expectations are for these operational actions to be completed by the first quarter in 2023.

We correctly predicted in our prior article that the IVH investors would approve the merger, and the market was anticipating it as well with the fund’s discount to NAV narrowing substantially back in August when the initial corporate action was announced. What now? It is just a matter of time before the two funds become one, yet IVH and ACP are not trading at the same discount to NAV. The market is not always efficient, and although pretty much baked in, there is a very slight outside chance something goes astray or delays the actual operational merger. The probabilities here are extremely small and not justifying the current 5% difference in discount to NAV between IVH and ACP. Expect the merger to go through and this discount to disappear. An investor interested in high yield debt with leverage and ACP should buy IVH now instead given the additional free merger arbitrage discount of 5%.

Premium / Discount to NAV

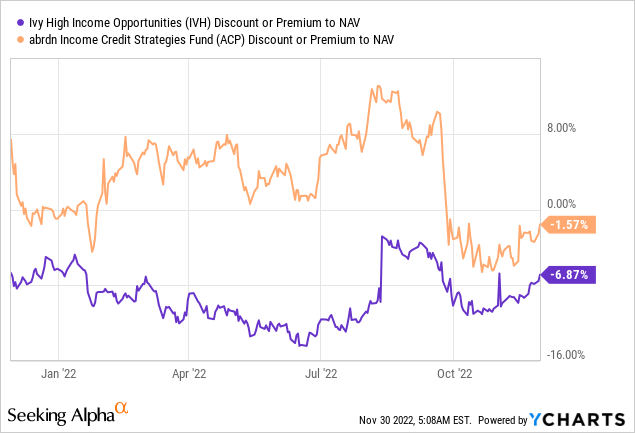

Ivy High Income Opportunities saw a substantial narrowing in its discount to NAV when the potential merger was announced back in August:

We can see how the discount narrowed by almost 10% back in the summer. With the risk-off move in the wider markets that occurred in September, the fund moved slightly wider for its discount, but more importantly there is still a basis between ACP and IVH.

Since the merger has now been approved, the basis will disappear once the funds operationally start trading under the same symbol. Assets will be merged and the prevailing ticker will be ACP, hence the combined fund will exhibit the same mechanics as we currently see in the Abrdn Income Credit Strategies Fund.

Conclusion

The Delaware Ivy High Income Opportunities Fund‘s (NYSE:IVH) is a high yield CEF. The fund is getting merged into Aberdeen Income Credit Strategies Fund (ACP) after the CEF’s board of directors put the corporate action forward back in August. On November 9, shareholders of both funds approved the merger and issuance of new shares. The operational part of the merger will conclude by Q1 2023. With both funds focusing on the riskiest pieces of the capital structure (single “B” and “CCC” credits), the collateral pools are fairly similar. Despite the merger approval, the two entities are still trading with different discounts to NAV. We expect this differential to extinguish as the operational part of the merger occurs. Investors looking for exposure in the HY CEF space and contemplating ACP should buy IVH now instead, given the additional free merger arbitrage discount of 5%.

Be the first to comment