Sundry Photography

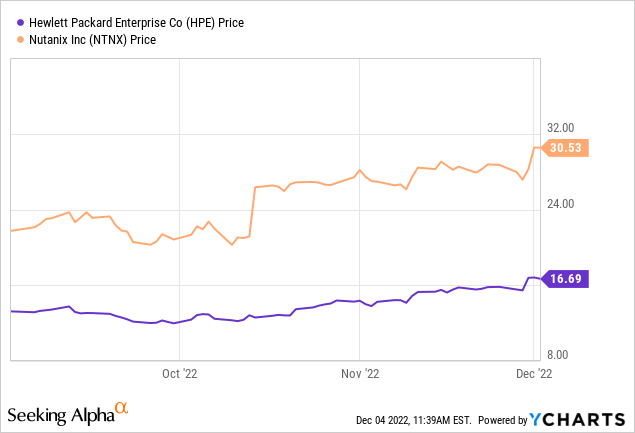

On the first of this month, there was news about Hewlett Packard Enterprise (NYSE:HPE) possibly acquiring hyperconverged specialist Nutanix (NASDAQ:NASDAQ:NTNX) whose stock had already benefited from a 24% upside in October (orange chart below) after analysts sensed a possible takeover interest from a number of contenders also included International Business Machines (IBM), Cisco (NASDAQ:CSCO), and private equity.

My objective with this thesis is to show why it is HPE that should benefit the most from such an acquisition, while at the same time, I will elaborate on how Nutanix is profiting from the uncertainty surrounding VMWare (VMW).

HPE and the other Contenders

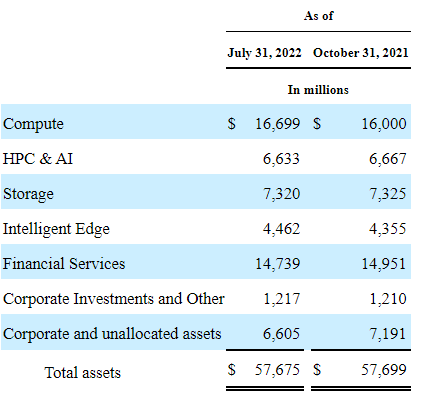

First, for those new to HPE, it operates across five segments as pictured below with compute (including the server business) which contributed to the bulk of revenues in the fourth quarter (Q4) for fiscal 2022 which ended on October 31.

SEC filing (seekingalpha.com)

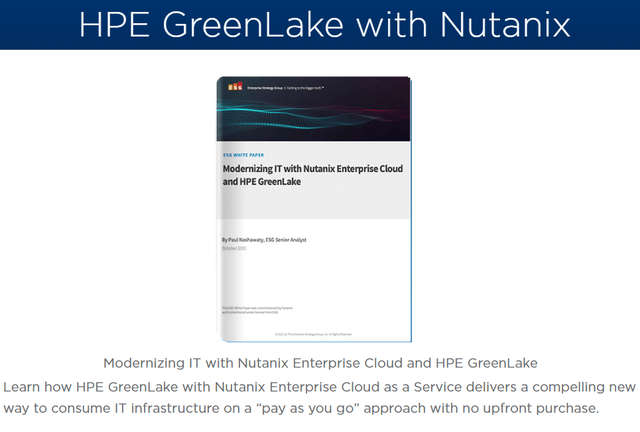

Its annual revenues have been progressing, rather erratically over the last years, but Q4’s sales of $7.87 billion constituted a record with the company issuing a strong forecast for FY 2023. However, Compute is a lower-margin business explains the company’s lower profitability compared to the likes of IBM and Cisco as shown in the table below. Now, while these three companies differ in industry, the difference between their gross margins remains significant.

Exploring further, one of the reasons for this difference in profitability is the degree to which these companies have re-engineered their technologies to contain a higher dose of software as part of the product mix. As I explained in a previous thesis, for the last three years, Cisco has been increasingly focusing on software-based networks as exemplified by its SD-WAN (Software Defined Wide Area Network). As for IBM, with its Red Hat acquisition in 2019, it has virtualization software that enables IT Admins, to build systems compatible with the cloud.

Comparison with peers (seekingalpha.com)

As for HPE, it has surely innovated with its Greenlake offering which allows customers to invest less Capex in hardware and instead consume infrastructure in an as-a-service fashion. For this purpose, the company has had to forge partnership agreements with both Nutanix and VMWare, and its Greenlake offering is gaining traction with ARR or annual recurring revenue increased by 25% in Q4

The Rationale of Nutanix as an Acquisition Target

Focusing on the HPE-Nutanix partnership, it enables customers to purchase hardware and cloud-native stuff together with hyper-converged infrastructure simultaneously.

HPE Greenlake with Nutanix (www.nutanix.com)

Looking deeper into hyper-convergence, this is the combination of computing, storage, and networking together in an all-in-one infrastructure called HCI or hyperconverged infrastructure. Now, Nutanix has gained popularity with its HCI software which makes the task of IT administration in an enterprise less complex, namely by consolidating discreet components in an integrated way.

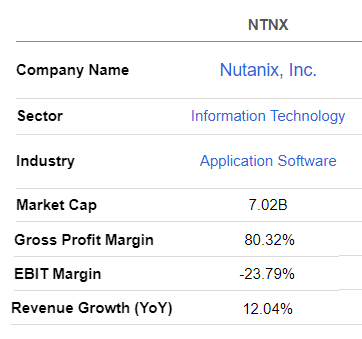

Looking at the financial aspect, with its HCI software, Nutanix enjoys a gross margin of above 80% as seen in the table below. Thus, in case it merges with HPE, the latter’s profitability can improve significantly, to be more at par with IBM and Cisco.

Key Metrics (seekingalpha.com)

There are other nice things about HCI, but as seen by Nutanix’s negative EBIT margins above, it is currently operating at a loss.

Therefore, an acquisition by a larger company also makes sense for the company to grow profitably as part of a merged entity. I have covered the company before and its management certainly prioritizes “profitable growth“. Thus, the operating loss has seen a downtrend over the last five years, with the company also delivering first-time positive non-GAAP operating profits in its first quarter (Q1) for fiscal FY2023 which ended in October.

However, given an economic environment that is characterized by high wage inflation, it may not be possible for the company to further optimize costs in 2023, and heightened recession risks also diminish the company’s ability to increase product pricing, out of fear that clients may switch to the competition.

Investigating the reason for the operating loss, the SG&A (sales, general and administrative) expenses as a percentage of revenues in Q1 was 65%, signifying that the company is incurring relatively high marketing costs, a consequence of competition.

Nutanix Competes with VMWare and SimpliVity

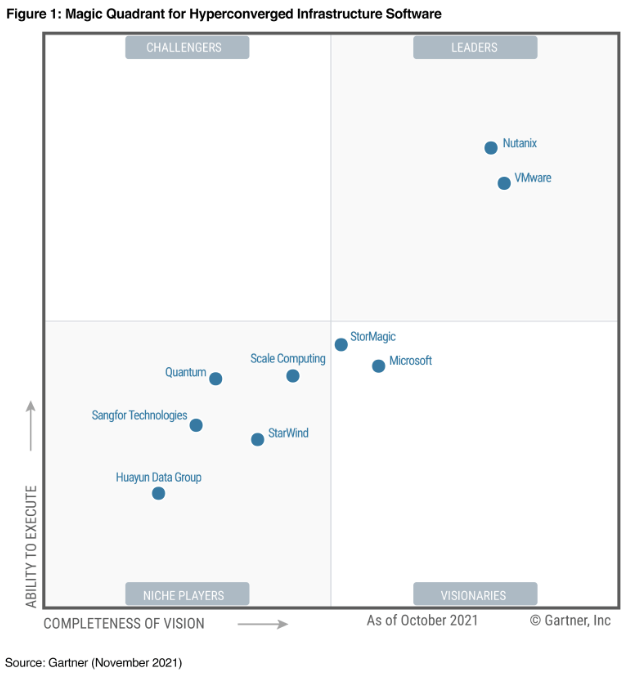

Looking deeper into the competition, in addition to Nutanix, VMWare is also a leader in HCI software in Gartner’s magic quadrant dated November 2021 as pictured below.

Magic Quadrant (www.nutanix.com)

Moreover, with Broadcom’s (NASDAQ:AVGO) acquisition of VMWare to become part of its infrastructure software division, there is some uncertainty about the way its technology will evolve. In respect, just like Advanced Micro Devices (NASDAQ:AMD) was adversely impacted by the VMware per-CPU pricing model in 2020, any change in this respect can have an impact on HPE’s margins. Furthermore, in case Cisco or private equity acquires Nutanix, HPE could again be faced with further uncertainty as to a partner, all depending on the objectives of the merged entity.

Looking at the potential contenders, with its $34 billion acquisition of virtualization and HCI play Red Hat in 2019, there is less probability of IBM going for Nutanix. As for Cisco, in addition to shifting toward software-centric solutions for networking, it also manufactures the UCS range of servers. In this respect, it acquired HCI developer Springpath for $320 million in 2017 and has a partnership with Nutanix for delivering the latter’s enterprise Cloud OS software on its server platforms.

This implies that Cisco should also be interested, but, being primarily a networking and security play, the company is more focused on maintaining its market share in switching, firewalls, routing, and optical as well as bringing more resiliency and flexibility in its supply chain.

Instead, acquiring Nutanix will be a logical step for HPE, not only to obtain full control of its HCI value chain for its Greenlake product offering but also advances its strategy in the fast-growing and high-margin hyperconverged market. Looking further, this move towards software-driven higher margins originates in HPE’s acquisition of SimpliVity in 2017 for $650 million in order to design complete, built-for-enterprise HCI offerings for customers.

Furthermore, HPE’s gross margins have indeed improved by around 4% from 2018 to 2021, partly due to Simplivity. Now, just imagine how much profits can improve by acquiring Nutanix which is valued at about 12 times more.

Valuing HPE and Nutanix for a Potential Merger

First, based on the $61 billion Broadcom spent on VMWare which translates into approximately 4.6x VMWare’s FY2021 sales, Nutanix with revenues of $1.9 billion for its last fiscal year could fetch around $8.74 billion (1.9 x 4.6). In order to finance such a deal, HPE has cash of $4.16 billion but debt totaling $12.46 billion. However, with a debt-to-capital ratio of only 24.26%, it has the capacity to borrow.

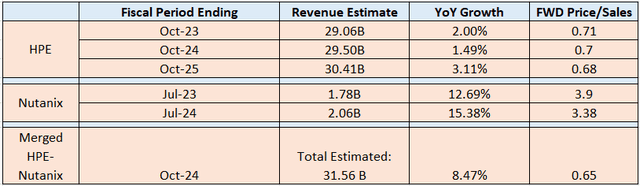

Second, looking at the growth prospects, I assume a potential merged HPE-Nutanix entity to impact HPE fiscal year 2024. This would boost HPE’s revenue growth from analysts’ forecast of 1.49% to 8.47% pictured in the table below as the $29.5 billion forecast gets added to Nutanix’s $2.06 billion. Conversely, the price-to-sales multiple should be down to 0.65x from the initial figure of 0.7x. This translates into a target of $17.3 ((31.56/29.5)*16.3)) based on the share price of $16.3.

Table built using data from (www.seekingalpha.com)

This estimate does not consider margin gains, which should be significant given Nutanix’s gross profits.

As for Nutanix, currently priced at around $30, the stock, while having resisted the volatility impacting the broader technology sector better since the beginning of 2022, is still below its pre-Covid high of $37 by more than 23% as shown by the chart below.

Comparison with S&P 500 and QQQ (www.seekingalpha.com)

One of the reasons for its recent outperforming of both the broader market and the Invesco QQQ Trust (QQQ) is that it is profiting from the uncertainty created by the Broadcom-VMWare deal among MSPs (managed service providers) which sell and support technology in different parts of the world.

Thus, both the uncertainty factor and acquisition-related momentum could propel the stock back to the $37 level. For this matter, analysts have a buy rating with a $31-$32 target on the stock, but, they also add that interest from a strategic buyer could skew the price higher. Now, HPE is indeed a strategic buyer.

Conclusion

HPE

Therefore, when considering a strategic buyout, it is HPE that should benefit the most from revenue synergies as it essentially buys out one of Simplivity’s competitors, in addition to better positioning it’s Greenlake infrastructure-as-a-service offering. This should also be both revenue and earnings accretive acquisition, but, I have a hold position as tech should be grappled by more volatility with a stronger-than-expected U.S. economy implying that the Fed may have to raise interest rates for longer.

Nutanix

On the other hand, I am bullish for Nutanix with a $37 buy rating as the company is approached by more VMware customers concerned about their data center infrastructure solutions for support, and costing. As a result, the company is getting more business and ended its fiscal 2022 results with a record level of backlog. Also, ACV billings in Q1 were significantly above guidance and represented a year-over-year growth of 27%. Thus, while not being completely immune to economic slowdown risks, its HCI enables hybrid data centers to benefit from a cloud-like scale together with the associated economics, without having to sacrifice factors like resiliency and performance.

Be the first to comment