georgeclerk/iStock Unreleased via Getty Images

The selling in 2022 has been indiscriminatory, hitting just about every sector, and even taking down former market leaders. One such leader is Amazon (NASDAQ:AMZN), still one of the largest companies in the world despite two years of massive underperformance against the rest of the tech sector. Amazon used to be a consumer goods company, and it still is to an extent. But I believe it should be viewed (and valued) as a tech company because of AWS, and as such, selling based on fears of a recession are overdone. The core retail business has taken on much less importance in recent years, so continuing to view Amazon as just a retailer is a fallacy. Based upon that, I see the recent consolidation as a great buying chance with very favorable risk/reward characteristics.

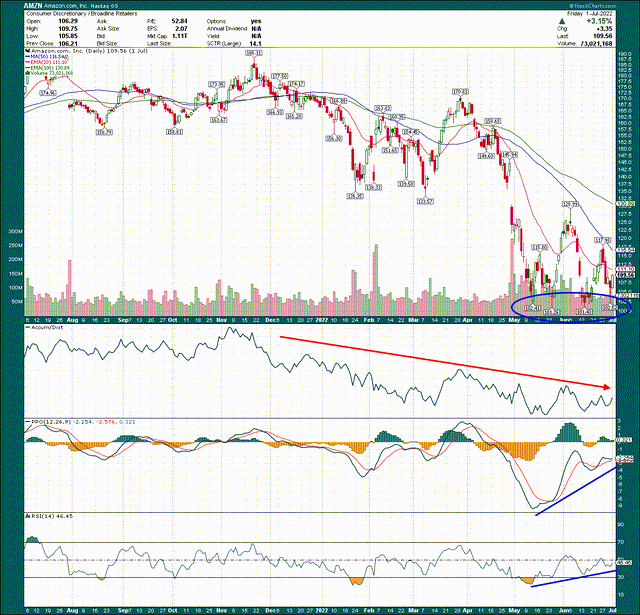

We’ll begin with a daily chart to show the consolidation I just mentioned.

I’ve circled the bottoming action we’ve seen in Amazon that began in May, and it’s clustered around the 102 area. The stock produced a waterfall decline during the worst of the tech stock selling in April/May, but it hasn’t made a new low since then.

That’s step one, and it’s a big one. But the chart still has other issues to resolve. The accumulation/distribution line remains very weak, although I’ll say it arrested its declines a couple of months ago. Ideally you want improvement, but lack of further deterioration is okay.

On the bright side, the PPO is making a much higher low on this most recent test of the 102 area, which is exactly what we want to see. The stock is going nowhere from a price perspective, but selling momentum has diminished greatly.

We see a similar story with the 14-day RSI, which is a shorter-term indicator than the PPO. We see the same thing, though, as momentum is improving while price consolidates. That doesn’t guarantee a bottom, but it is certainly indicative of one.

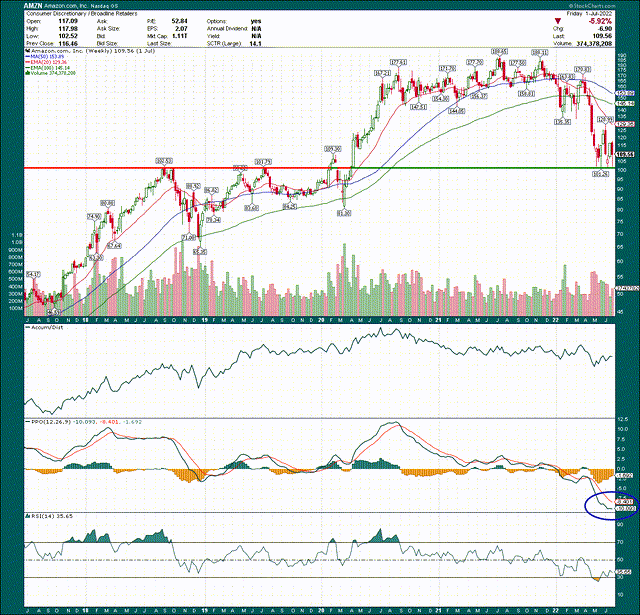

Now, I’m bolstered as well by the weekly chart, which shows that the fact that Amazon consolidating at 102 is no accident.

That level is support dating back to 2018, as well as 2019. That should make this level very difficult for the bears to break, which is why I see this as a high probability trade at the moment. The weekly PPO is extremely oversold and is starting to turn higher. This lends credence to the idea that the stock is setting the bottom right now. Again, this is no guarantee, but this has the look and feel of a tradable bottom.

Now, if Amazon does break the 102 level and trades below 100, that could signal there’s another very sizable decline coming. I don’t think that will happen, but if it does, you have to get out. Stop losses are critical when trading around support like this, so find the risk level you’re comfortable with and set your stop. Taking a small loss is okay; bag holding is not.

Let’s now take a look at the fundamental case for Amazon.

A bumpy road, but heading in the right direction

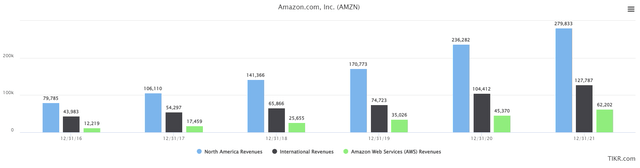

I mentioned in the open that I don’t view Amazon as a retailer any longer, although that’s obviously still an important part of the business. But if we look at how Amazon actually derives its operating profits, it’s clear the retail business is a bit secondhand in comparison to AWS. Let’s start with revenue by segment for the past few years in millions of dollars.

The retail business, as well as the international business, continue to grow revenue at very strong rates. That’s great, but remember that fulfillment costs continue to go through the roof for these businesses. In addition, Amazon sells at rock-bottom margins in order to take market share, so the retail business isn’t exactly printing money.

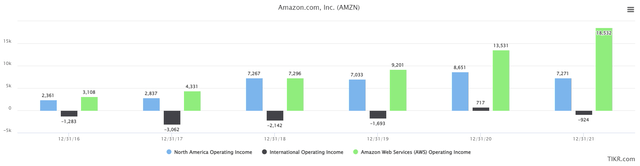

By comparison, at least on a revenue basis, AWS is miniscule. However, the margins AWS achieves turns the tables in terms of operating profits, as we can see below. This is the same time period and in millions of dollars.

AWS was responsible for about two-thirds of total operating profit last year, and it is no surprise Amazon continues to invest very heavily in this area. The international business is a dud and always has been, and we can see the US-based retail business has produced about the same operating profit since 2018. That’s not amazing, so let’s just say it’s a really good thing Amazon has AWS to fall back on.

Now, it is my belief that Amazon has sold off at least in part due to fears of a consumer spending recession. Those fears are real, and it’s entirely possible we’re already in a recession. That may hurt spending in Amazon’s retail business, but even if it does, I don’t see an enormous impact on operating profits from it. Much of what Amazon sells are staples that aren’t necessarily that susceptible to reduced consumer spending. Is anyone going to stop buying paper towels? Pet food? Probably not. Will some marginal spending be reduced? Almost certainly. But a decline in the share price from 188 to 102 based upon that is ludicrously overdone.

Given AWS is by far the most important thing to Amazon’s profits, and the fact that this revenue is derived by enterprises that are investing long-term in their businesses, I don’t see huge cause for concern if we do get a brief recession.

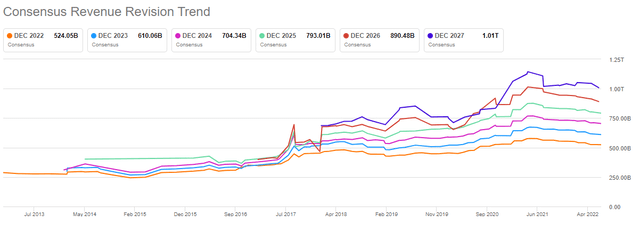

That’s hard to imagine if we look at analyst revisions, which have been overwhelmingly negative in recent months.

The magnitude hasn’t been huge, but these lines are pointed the wrong direction and that’s tough to reconcile if you’re bullish. However, I think before we see these lines move higher again, the stock will have already bottomed in anticipation, and the easy money will have been made. I believe the 102 level is the point from which that will take place, but we shall see.

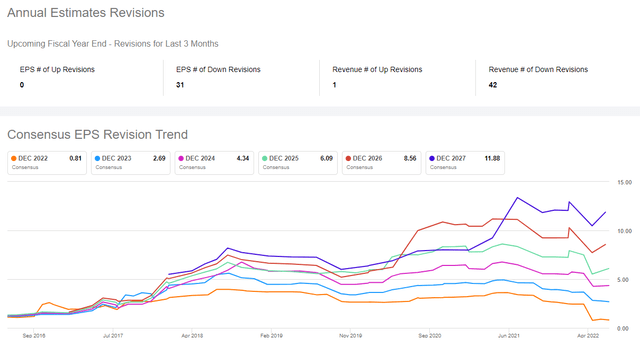

We have a decidedly less bullish look to EPS revisions, as seen below.

The magnitudes here are larger in terms of declines, but there is a sign of life at the end of the lines here. The slight bounces in EPS estimates indicates they’ve likely bottomed, and if we do get some upward movement here, lookout above in terms of the stock price.

To be clear, you have to have some faith if you’re buying Amazon right now. The threat of recession, whether it makes sense to punish Amazon for this or not, is a real threat to a further decline in the share price. That’s why we keep stops in place, and why we buy at support levels. That limits risk while giving us full access to upside potential.

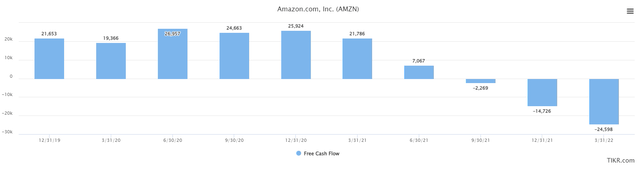

Now, one thing that Amazon has done a poor job of in recent years, as it has ramped AWS, is generate free cash flow. Amazon used to produce tens of billions of dollars annually in FCF, but as we can see now, it’s gone completely the opposite direction. Below we have trailing-twelve-months FCF in millions of dollars.

TTM FCF as of the March quarter was -$25 billion, which is a lot of money where I come from. This doesn’t have a good look, but remember that one of the primary components of FCF is capex, and Amazon is spending enormously on building out AWS and its fulfillment capabilities for the retail business. Those things won’t need tens of billions in annual investment forever, so I fully expect to see FCF bottom out and move higher over time.

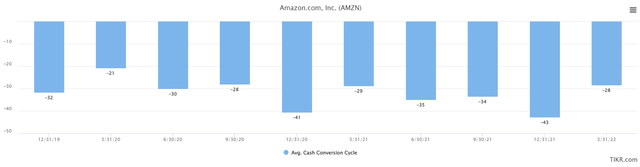

However, even if it doesn’t, I’m not bothered. Amazon is one of the best in the world at cash conversion, because it strings suppliers out for an average of almost three months before paying them. Since Amazon is paid much more quickly than that, its cash conversion cycle is actually negative.

It’s generally around -30 days, which is where we find it today. That essentially means Amazon constantly has billions of dollars in what amounts to free financing, courtesy of its suppliers. Amazon has the power to do this because of the enormous power of its retail platform. If you want to be on the world’s best marketplace, you accept Amazon’s terms that are built specifically to benefit Amazon. That, in my view, makes the FCF decline something we can ignore.

Is it cheap enough?

That’s the key question. A share price decline – in and of itself – is never a good enough reason to buy something. After all, if the stock declines by 50%, but earnings estimates fall by 80%, it probably still isn’t cheap enough. In light of that, let’s take a look at Amazon’s valuation by both revenue and earnings, with the latter first.

Amazon is trading for 66X next twelve months earnings, and about 40X 2023 full-year estimated earnings. That doesn’t sound cheap, but in the context of Amazon’s prior valuations, it is. It’s actually very near the bottom on a forward P/E basis and meaningfully below the average which is 76X NTM earnings in the past three years.

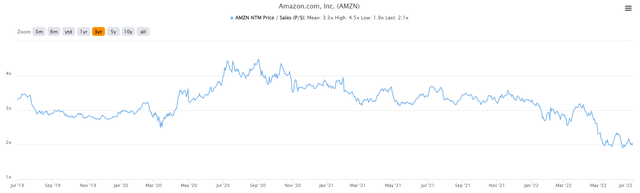

If we turn our attention to price-to-sales, we get an even rosier picture.

Shares go for 2.1X NTM revenue, which is just off the low, and well under the average of 3.3X. Now, for a company that is seeing its cash cow grow by leaps and bounds, the P/S ratio should be rising, not falling. However, I believe it is falling because the retail business is facing the threat of recession at the same time that fulfillment costs continue to set new records. That will cause the P/S ratio to fall, but as I’ve been saying, this should be temporary.

So is it cheap enough? To my eye it is, because the stock has been sufficiently punished to account for a mild recession. If we get a full-blown 2008-style meltdown, all bets are off. But if we don’t, and it’s short and shallow, Amazon in the low-100s will prove to have been a great buy.

That’s where I am today. I see the stock as a great buy so long as it doesn’t break down below 100. If we get a break down, my thesis is null and void and you must sell. If it doesn’t, however, this stock could be much, much higher this time next year.

Be the first to comment