Ahmed Fahmi/iStock via Getty Images

In recent months, on account of geopolitical tensions between Ukraine and Russia and the consequent impact on the energy markets, notable OPEC+ member Saudi Arabia has received plenty of attention from the investment community. S&P Global recently lifted its outlook for the Kingdom and revised its rating from stable to positive. If you’re looking for options in this space, there are a couple of options to choose from the iShares MSCI Saudi Arabia ETF (NYSEARCA:KSA) and the Franklin FTSE Saudi Arabia ETF (FLSA). The latter is the more cost-efficient of the two with an expense ratio of only 0.39% (as against the expense ratio of 0.74% for KSA). But KSA is clearly the more popular of the two having amassed an AUM of over $1.3bn whilst FLSA’s AUM is less than $4.13m. This is also reflected in the respective average daily volumes of the two ETFs. KSA’s daily dollar volume is closer to $30m whereas FLSA’s is only around $54K. When one fishes for opportunities in relatively unchartered external regions it would be more prudent to gravitate towards products that are more popular as you’re likely to be supported with better liquidity and spreads. In light of this, I believe KSA ought to be the preferred choice.

General commentary

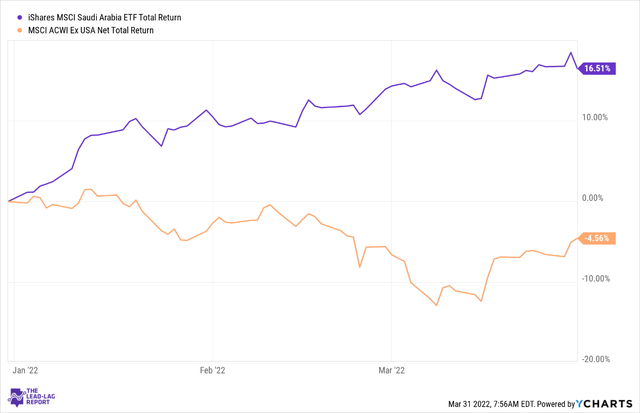

Sentiment towards KSA is likely to be heavily dictated by what happens in the energy markets as the oil and gas sector accounts for around of the country’s GDP and a whopping 70% of total exports. Interestingly, at a time when global markets have faced a rather underwhelming start to the year, KSA has ended up delivering returns of over mid-teens.

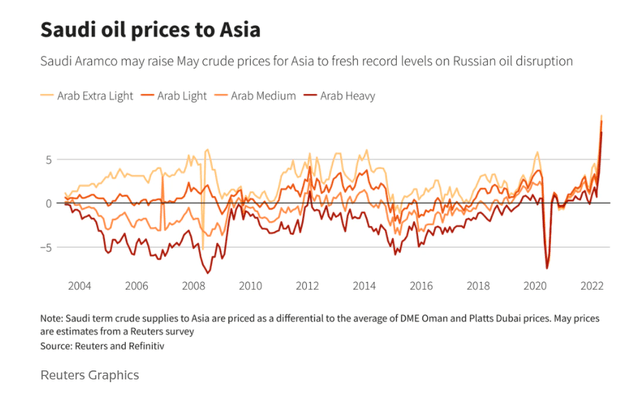

Whilst the other notable OPEC member- UAE has been more forthcoming in increasing crude production to help bring down prices, Saudi has been less willing to budge from its position. Recent reports also suggest that Saudi will likely jack up the prices it levies for its Asian exports in May, from anything between $5 a barrel to nearly $10 a barrel. As seen from the image below, prices across different grades are currently at extremely steep levels.

With crude where it is, one sector that is indirectly benefitting from the euphoria is the Saudi banking sector and this will have key ramifications for KSA as financials account for 47% of the total portfolio. Do note that even before this recent spike in oil prices, Saudi-based banks were witnessing some very strong numbers to close FY21. Last year they delivered impressive profit growth of over 40% and also note that in Q4-21, Saudi banks delivered impressive ROEs of 11.1%, 30bps higher than the 10.8% seen in Q3-21.

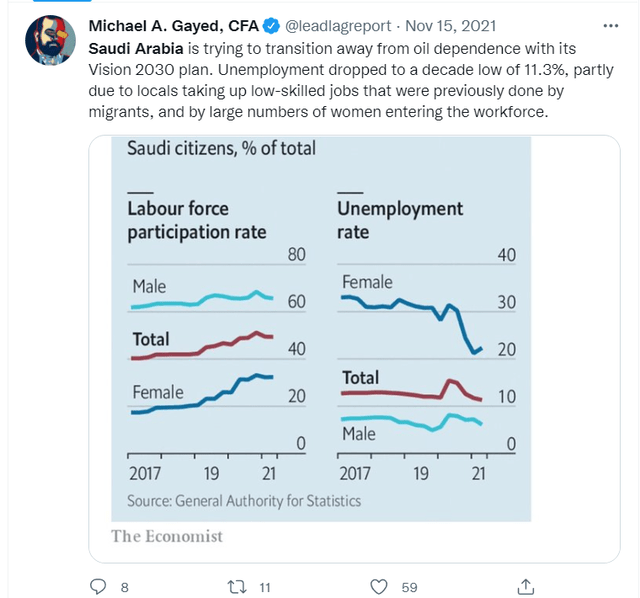

Longer-term, as highlighted in The Lead-Lag Report, one must acknowledge that the kingdom has been doing its bit to help the economy transition away from oil as part of its Vision 2030 plan. One of the sectors that is potentially expected to benefit from this is the financials sector. For instance, recently we’ve seen a spike in the number of early-stage fintech companies. According to reports there, there was an impressive 37% increase in operating fintech companies there last year, garnering record levels of VC investments to the tune of SAR1.3bn. If Saudi can beef up its fintech landscape, this will likely attract even more foreign portfolio flows, as investors have previously been skeptical of plugging in large investments to carbon-heavy landscapes.

Separately, one other important reason to pursue something like a KSA is that you’re unlikely to be vulnerable to currency-related risks. As Saudi is heavily reliant on exports, it can’t afford to have a volatile currency and thus this is pegged to the USD. So, quite unlike a number of global currencies that could remain vulnerable to portfolio outflows even as Powell and co. lift rates closer home, the Saudi Riyal could remain relatively well insulated. Needless to say, higher policy rates in Saudi will also aid the net interest margins of the banking stocks there.

Conclusion

Crude-heavy investment products are enjoying their time in the sun, but as pointed out in The Lead-Lag Report, once the Russian-Ukraine standoff ends, these energy heavy assets could witness some strong short-term downside and I don’t believe this has been priced in entirely. In light of this, I don’t believe KSA will be particularly immune to a shift in sentiment and investors ought to brace for that. Also note that valuations here are hardly cheap. As per YCharts, KSA trades at a forward P/E of 18x whereas other ETFs based in comparable regions such as UAE, Egypt, and Qatar trade at far cheaper multiples ranging from 7x to 14x.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment