ShahinOlakara/iStock via Getty Images

2022 has vividly illustrated that if look carefully enough, opportunities could be found even when it seems investors are selling everything, everywhere, and prices are tumbling at a disheartening pace.

At times, it is necessary to look beyond borders, tolerating regional risk discounts to maximize returns. While the U.S. was burdened by excruciating inflation and the Fed was quickly wringing out the excesses, from the economy and the stock market alike, some corners of the global equity universe were awash with investor cash.

The iShares MSCI Qatar ETF (NASDAQ:QAT) is an around $98.3 million passively managed fund with a financials-heavy portfolio consisting of 32 equities from the MSCI All Qatar Capped Index.

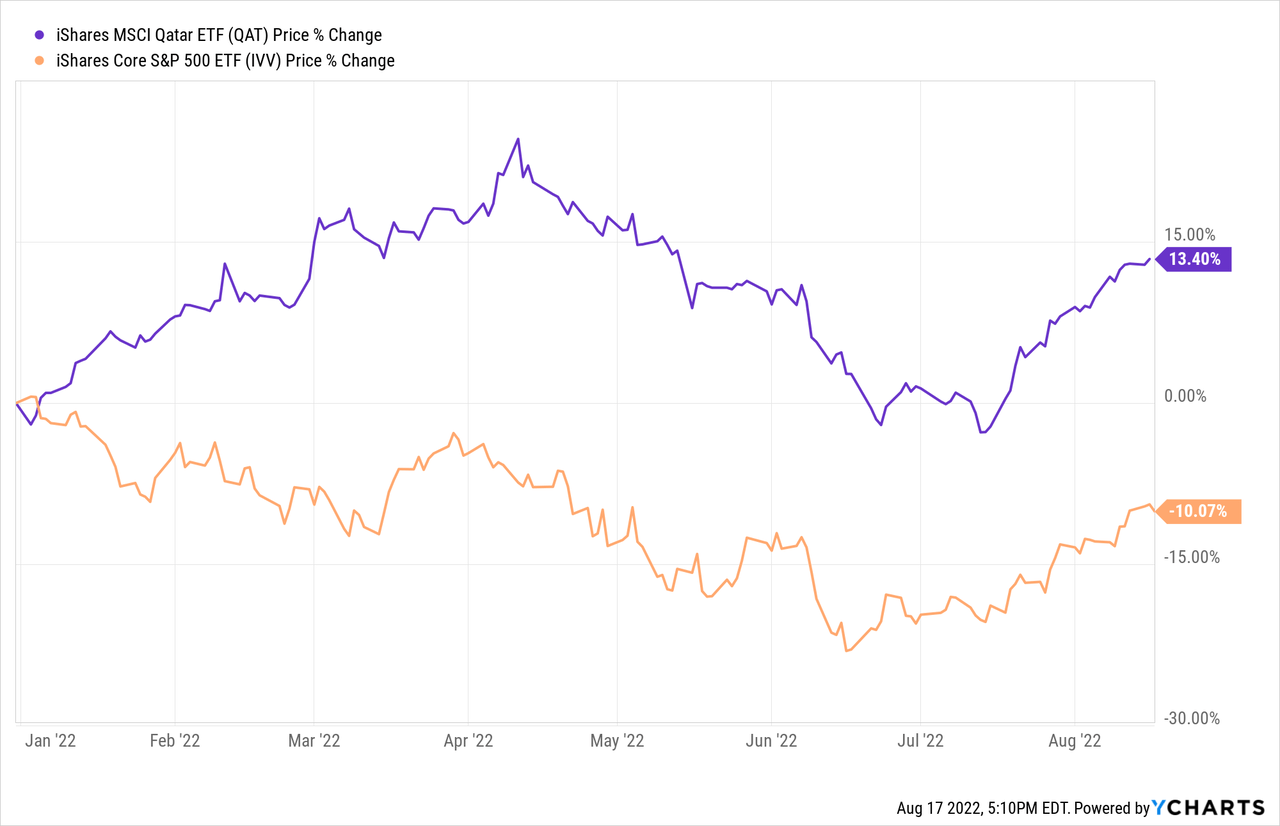

Its 2022 performance is a vivid illustration of how a small emerging market economy can deliver meteoric gains when stars align, defying the sell-off in stalwart markets like the U.S. To corroborate, the Qatar ETF beat the iShares Core S&P 500 ETF (IVV) five times in the first full seven months of the year, and the first half of 2022 had been the strongest since it began trading in 2014.

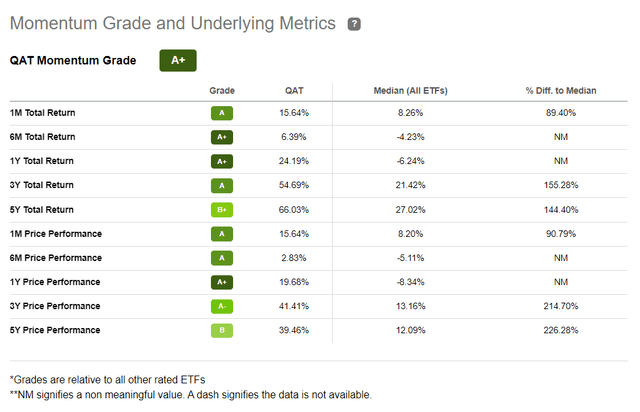

For better context, being one of the top momentum plays in the ETF universe at the moment, QAT boasts the A+ rating.

The weighty gains stand in striking contrast to the wider emerging market league, much of which is having a year to forget. Compare this with a D- grade for the China-heavy iShares MSCI Emerging Markets ETF (EEM).

But how did the comparatively small EM ETF become a momentum play?

There is a lot of moving parts here, but in essence, just two major themes could be whittled down: the structural changes in the global energy market engendered by geopolitics (namely the LNG supply/demand imbalances), and the 2022 World Cup factor. For the Gulf nation with a population of just 2.88 million, this mix was capable enough to send share prices of its top companies to heights never seen since 2015 in dollar terms.

First, investors who are following the commodity markets closely would immediately note here that 2022 has been a year of harrowing volatility as geopolitics wrought havoc both on the demand and supply sides. The principal theme is that Europe has been seeking to diversify its energy sources, and the Qatari producers are amongst those that are supposed to reap benefits. As a reminder, the country has one of the world’s richest natural gas reserves, also being the dominant player in the LNG market together with the U.S. and Australia. According to the 2021 BP Statistical Review of World Energy, it exported 106.8 billion cubic meters of liquified natural gas, accounting for 20.7% of the global total. Last year, most of its exports were destined for Asia, with South Korea and India being the primary buyers; notably, Europe received 3.4x less LNG than was shipped to the Asia Pacific. This year, since Qatar’s exposure to oil price-linked LNG contracts have traditionally been rather large, its revenues soared owing to the crude price rally, even though volumes surprised to the downside.

Nevertheless, the LNG thesis has vulnerabilities, which will be discussed below in the article.

Second, the 2022 World Cup also bolstered optimism. For instance, even though the government trimmed its expectations for the tailwinds from the Mundial, it is still forecast to contribute $17 billion to the economy. The major beneficiaries of massive spending surrounding such events are, of course, the Qatari banks, and for QAT which holds shares in nine financial sector players accounting for a massive 53.1% of its net assets the anticipation of a spending spree was an unambiguously bullish factor.

QAT performance: 2022 splash is in contrast to the 2010s sluggishness

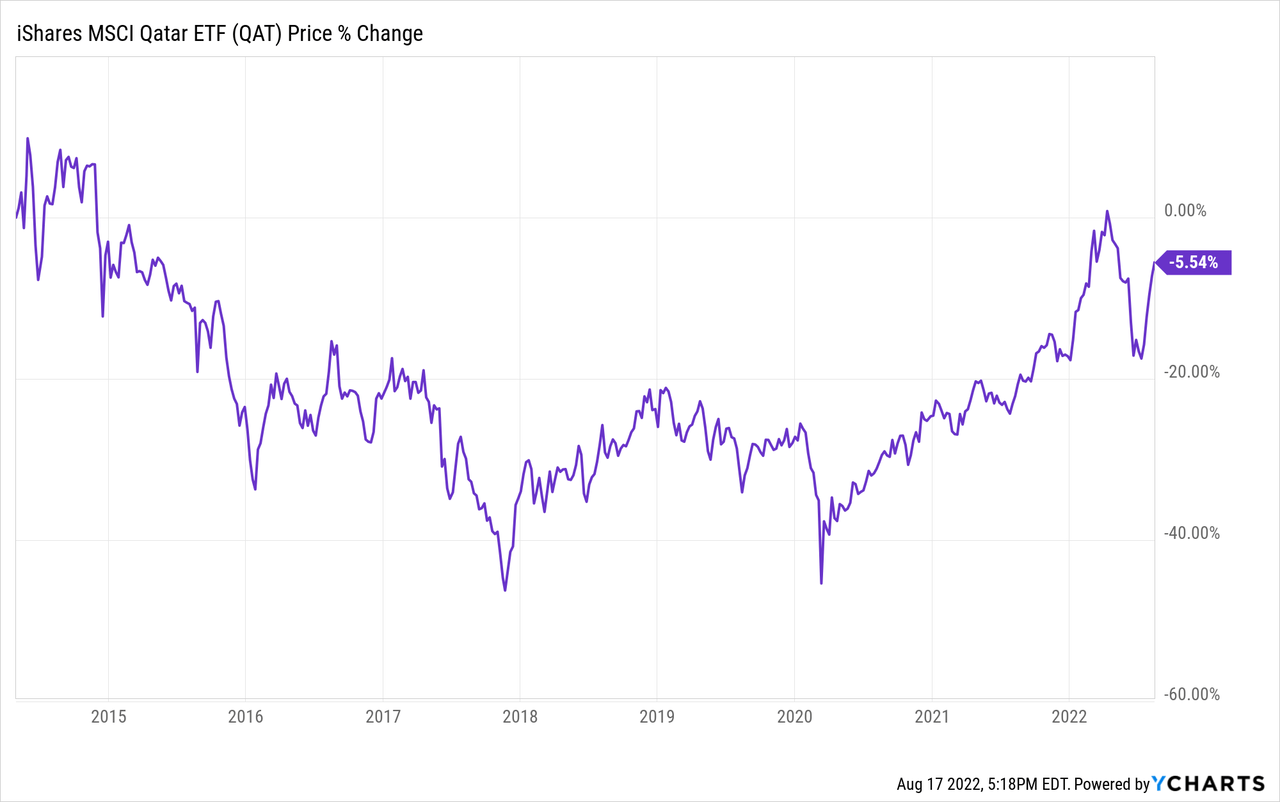

If we look a few years back, we would notice that QAT performance was far from being consistently upbeat.

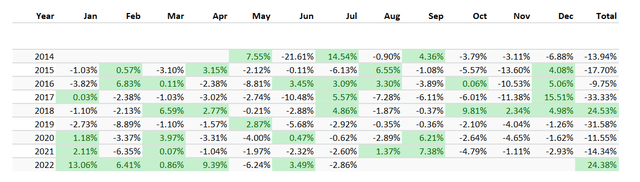

Incepted in April 2014, it underperformed the S&P 500 ETF (IVV) almost every year except for 2018 and 2022 YTD, as can be seen in the table below. Please note that data for August were not included.

Created by the author using data from Portfolio Visualizer

Specifically, it was the two oil market crises of the previous decade that took their toll. That is especially noticeable with the returns for 2015 and 2020.

In 2019, it seems that the trade war narrative spawned uncertainty for energy investors together with a deflationary recession in the country that resulted in the ETF delivering a negative total return of 33 bps while the U.S. market advanced by over 31%. The EEM cohort was up 18.2%. Interestingly, in 2020, when the oil prices were shortly teetering in the single-digit zone, QAT chugged along but it still underperformed the growth-heavy IVV by around 11.6%. In 2021, when the capital rotation gained momentum amid vaccine optimism, this financials- and industrials-focused fund failed to keep pace again.

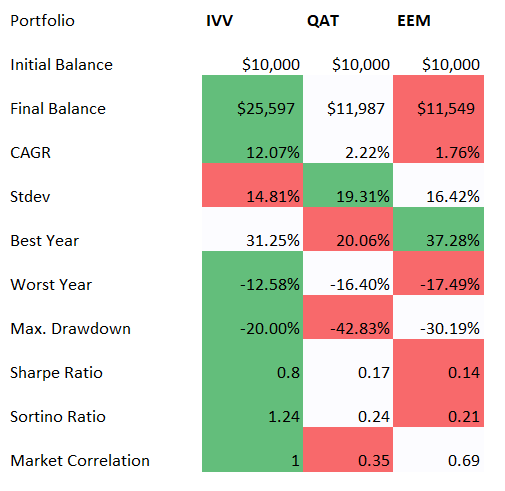

Overall, during the May 2014 – July 2022 period, its CAGR amounted to a measly 2.2%, slightly above IVV’s 1.8%. Although IVV has been hit hard by tech bears this year, it still delivered an over 12% CAGR. Volatility and drawdown are also not in QAT’s favor, but a measly correlation with the U.S. market is what diversification-seeking investors would likely appreciate.

Created by the author using data from Portfolio Visualizer

Final thoughts

With a pronounced tilt towards the nation’s banks, QAT is a highly concentrated bet not only on the Qatar economy but also on the global macro trends, mostly in the energy space.

The pivotal role of this Gulf country in the global natural gas supply allowed the QAT ETF to deliver impressive gains earlier this year, partly owing to the crude price rally, almost entirely erasing the painful losses of the patchy previous decade.

However, speaking about whether momentum can last, I have to respond with a somber warning not to bet on the fund to edge meaningfully higher this year.

Momentum investors could point out that the global commodity market imbalances and specifically Europe’s push for natural gas imports diversification are a macro backdrop fully supportive of the QAT price climbing higher well into the end of 2022.

However, my point is that the rally looks overdone, and massive outperformance will be hard to replicate, if possible, at all. I believe tailwinds from the World Cup are mostly priced in, while speaking of the LNG thesis, two issues should be taken into consideration, namely volumes and price.

For volumes to edge meaningfully higher, a larger capacity is needed. But North Field East, a massive LNG expansion project with Shell (SHEL) amongst investors, cannot be completed overnight.

QAT bulls would note here that even though volumes might remain flat, the ETF would still be a solid bet on the oil price to remain elevated as most of the country’s export contracts are linked to the crude benchmarks. Yet in case of a mild recession in major economies like China oil prices will edge lower, taking its toll on Qatar’s revenues.

And apart from that, investors seeking to test the LNG thesis can do this with U.S. equities, and a due remark here that the country is in the top trio of exporters.

In sum, QAT’s past performance is mixed, and risk-adjusted returns are suboptimal. So, a position opened when optimism is close to a peak means subpar long-term returns should things turn south (e.g., in case downbeat China economic data result in a longer correction in commodity prices). All in all, QAT is only a Hold.

Be the first to comment