Nikada/E+ via Getty Images

Notable features of the ETF

Prospective investors looking for access to equities based in South East Asia’s largest economy may consider the iShares MSCI Indonesia ETF (NYSEARCA:EIDO). Over its listing history of more than two decades, the fund has managed to amass AUM to the tune of ~$500m. EIDO tracks the MSCI Indonesia IMI 25/50 Index which covers around 87 Indonesian stocks across different market-caps; large-caps account for ~56% of the total holdings, mid-caps account for 26%, and the rest is made up of small and micro-cap stocks.

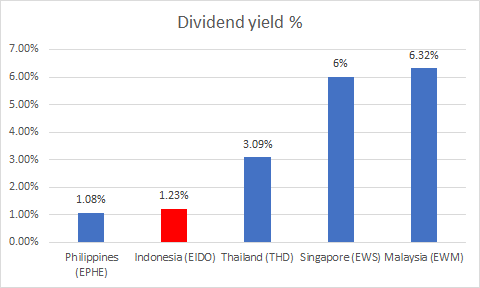

One of the other striking qualities of EIDO’s portfolio is that it is relatively stable with very limited churn; the asset class median annual turnover ratio is typically around 25%, but EIDO’s corresponding turnover figure is only 10%. EIDO’s income angle is fairly unremarkable with a current yield of 1.23%; this is not even half as much as the average yield of other southeast Asian based ETFs and miles behind the iShares MSCI Malaysia ETF (EWM) which offers 6.3%, and the iShares MSCI Singapore ETF (EWS) which offers 6%. Also note that EIDO’s dividends have been curtailed over the last three years (down by -15%) even as this asset class has typically seen dividend growth of around 8% during the same period.

YCharts

Indonesian macros look encouraging

One of the compelling reasons for gravitating toward Indonesia is that its growth runaway over the next two years looks quite attractive; quite unlike most other advanced and emerging economies that will see their GDP rates contract between FY22 and FY23 (for instance, advanced economies will see the GDP only grow by 2.6% in FY23, after 3.9% growth in FY22, whilst EMs will see 4.8% and 4.7% growth over the next two years), Indonesia will actually see an improvement over the next two years (GDP growth is expected to come in at 5.4% growth this year followed by 6% the following year).

Also consider that whilst most other economies are facing some rather crippling inflation dynamics, the situation in Indonesia appears to be well-controlled for now. The most recent reading of 2.06% was below consensus expectations of 2.2% and is well within the central bank’s comfort range of 2-4%. This means the central bank is under no pressure to hike its 7-day repo rate from record lows of 3.5% which has been in place for over a year. Ideally, in a global environment where central banks are pivoting to higher rates, this could have stimulated drastic portfolio flows and weakened the Indonesian Rupiah but that has not been the case. The country’s resource-heavy export basket has come to the fore and it has been able to leverage the effects of strong commodity prices in recent months which in turn have aided the current account. In February, exports were recently up by an impressive 34%! Consequently, note that the IDR has held up relatively well vs the dollar, and volatility has actually contracted over time. Note that the 14-day ATR, at the bottom panel of the chart which was quite pronounced in November has since declined over time.

Trading View

So far so good, but I believe inflation pressures could start picking up in the months ahead; firstly, note that there will likely be a pickup in food prices which typically occurs during the month of Ramadan. Then you’re also likely to see some inflationary pressures on account of a carbon tax and an increase in the VAT which will come into force by mid-April. The country has also recently lifted all pandemic restrictions and with borders re-opening, inflation risks on account of increased consumer spending look high. Then there’s also the effect of subsidies on fuel, gasoline, LPG, cooking oil, etc. Because of this, even as global crude oil prices have spiked, Indonesian state-owned oil firms haven’t been able to leverage the effects of this and this has consequently put pressure on state finances. The government could now be prompted to hike retail prices for gasoline and Maybank estimates that a 10-15% increase in retail fuel prices could lift Indonesian inflation by 1-1.5%.

This could prompt the Indonesian central bank to hike rates sometime in H2-22 and it could be beneficial for EIDO’s bank heavy portfolio (48% of the total portfolio). Note that even otherwise, structurally, Indonesian banks are some of the most profitable banks in the Asia-Pac region with average net interest margins of almost 5% (Source: Market Intelligence). Indonesian banks are likely to tap the foreign markets for capital raising plans alter this year. As per regulatory requirements, all Indonesian lenders are expected to have at least 3 trillion rupiah of Tier 1 capital by the end of this year; currently, less than 40% of these banks have capital below 2 trillion rupiah.

Closing thoughts

Whilst the Indonesian macros appear to be in fairly decent shape, I’m not sure the risk-reward is particularly attractive for a long entry at this juncture. Consider EIDO’s standalone chart below; for over much of its lifetime, this ETF has trended in the shape of a broad descending channel pattern and currently, it is close to hitting the upper boundary of the channel. Even if it does break past this channel, you’re looking at further hindrances just below the $28 levels.

Investing

Then if you juxtapose EIDO vs an ETF that covers the broader Southeast Asian region- FTSE Southeast Asia ETF (ASEA), note that there isn’t much of a compelling edge in owning EIDO at this juncture. The relative strength ratio of these two ETFs is around the mid-point of not only the long-term descending channel but also the range that has been in place since 2018.

Stockcharts

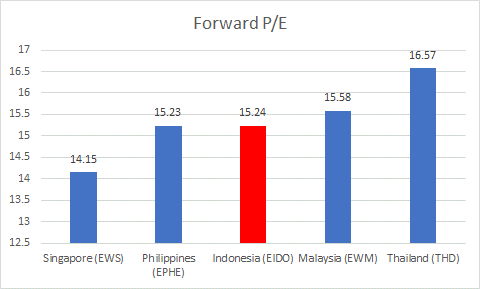

Finally, also consider the forward P/E valuations of EIDO versus other ETFs from the Southeast Asian landscape. All these ETFs currently trade within a range of 14-16.5x and EIDO’s multiple is more or less in line with the regional average of 15.3x.

YCharts

Be the first to comment