turk_stock_photographer

Dividend growth stocks offer a solid middle ground for investors who like both capital appreciation and dividend growth. Unlike most growth stocks, many dividend growers have a long track record of shareholder-friendly practices. And unlike most income stocks, their share prices have plenty of room to run.

Luckily, we live in an era where there is now an ETF for nearly every investment strategy. This brings me to iShares Core Dividend Growth ETF (NYSEARCA:DGRO), which fits the bill for investors seeking a “sweet spot” of getting paid a fast-growing dividend while waiting for capital appreciation.

Why DRGO?

DGRO is an ETF that’s designed to track the investment results of the Morningstar US Dividend Growth Index. Its holdings are primarily comprised of U.S. stocks, which represent 98.4% of the portfolio, with international stocks making up much of the rest, and its company sizes trend towards the larger end of the spectrum.

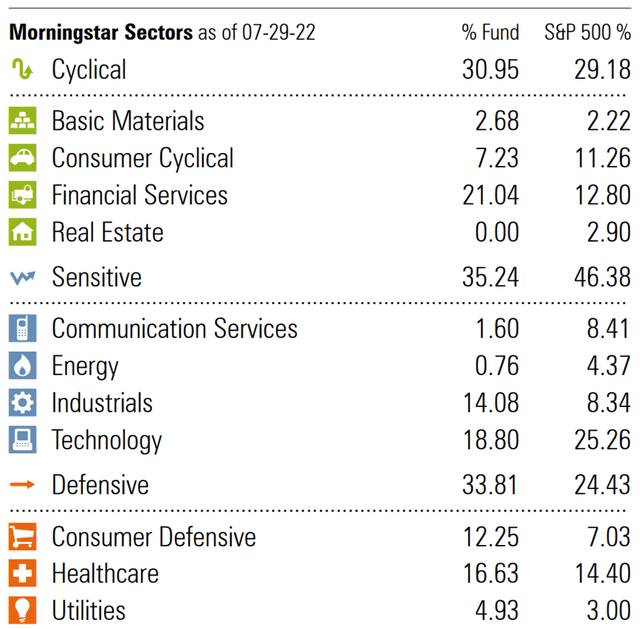

This is reflected by the fact that giant and large cap stocks make up 81% of the portfolio, with medium and small caps making up the remaining 16% and 3%, respectively. Unlike the S&P 500 (SPY), DGRO’s holdings are primarily geared towards financial services, industrials, and consumer defensive.

This makes sense because financial services companies generally trade at lower PE ratios compared to the rest of the market. This enables them to buy back their shares at attractive prices, enabling faster capital appreciation and dividend growth potential. As shown below, financial services make up slightly more than one-fifth of the total portfolio size.

DGRO’s top 10 holdings form a basket of familiar household names, such as Microsoft (MSFT), Apple (AAPL), Merck (MRK), Home Depot (HD), and Coca-Cola (KO). As shown below, the top 10 holdings comprise nearly a quarter of DGRO’s total portfolio.

DGRO Top 10 Holdings (Seeking Alpha)

I find the top holdings to be rather appealing, as they are leaders in their respective industries with durable competitive advantages and a long runway for growth. This is especially true for the largest holding, Microsoft, which has ample greenfield opportunities in the cloud, and Apple, which is as close to being cash cow as they come.

This is considering Apple’s very strong brand and vast installed base, which supports its ecosystem including its App Store, that takes an automatic cut on App Store sales, making it somewhat akin to ‘digital real estate’. Moreover, it’s exploring ways to run ads, which leads to a new growth avenue. The same brand strength and moat-worthy qualities can be said of the other top holdings in DGRO’s portfolio.

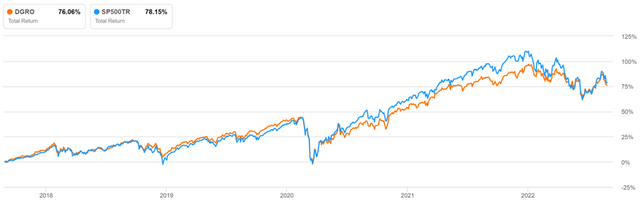

What’s also impressive is that it appears that DGRO has the “picks of the litter”, as its basket of high performing stocks has a performance that’s nearly matched that of the broader S&P 500 (SPY), all while paying a higher dividend. As shown below, DGRO has generated a 76% total return over the past 5 years (no 10 year history, as the ETF initiated in 2014), stacking up well against the 78% return of the S&P 500.

DGRO Total Return (Seeking Alpha)

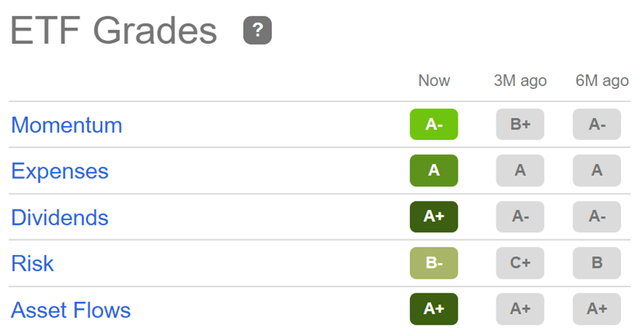

Meanwhile, DGRO sports a 2.1% yield with an appealing 5-year dividend CAGR of 9.2%, comparing favorably against the 1.5% yield of the S&P 500 with a 5.4% 5-year CAGR. Moreover, DGRO charges a low expense ratio of just 0.09%, sitting well below the median 0.45% expense ratio across the ETF universe, helping it to earn an ‘A’ Expense Grade.

I find DGRO to be attractive after the recent drop, as it now trades comfortably below its 52-week high of $56, from just earlier this year. DGRO is now trading closer to its 52-week low than its high. Moreover, DGRO scores a Buy rating from the Quant system. As shown below, it carries mostly A grades for momentum, dividends, and asset flows, and a B- for risk.

Investor Takeaway

DGRO appears to be a high-quality dividend growth ETF with a solid portfolio of holdings that have durable competitive advantages and long-term staying power. Its performance has held up well against the S&P 500, all while providing a higher yield and faster dividend growth. With the recent drop, I believe it’s a good option for long-term oriented income investors that are looking for exposure to a basket of high-quality income and growth.

Be the first to comment