Brandon Bell/Getty Images News

Walmart (NYSE:WMT) released second quarter earnings results which helped the stock recover losses stemming from pre-announcement of the same results. While the company continues to work through inventory issues caused by inflation and the difficult macro-environment, the big-box long term thesis remains intact. WMT is improving its e-commerce offerings which further help to strengthen that thesis from the threat of other e-commerce competitors. The stock is trading at 24x forward earnings, a generous multiple but reasonable considering the clarity of the thesis and solid shareholder cash returns.

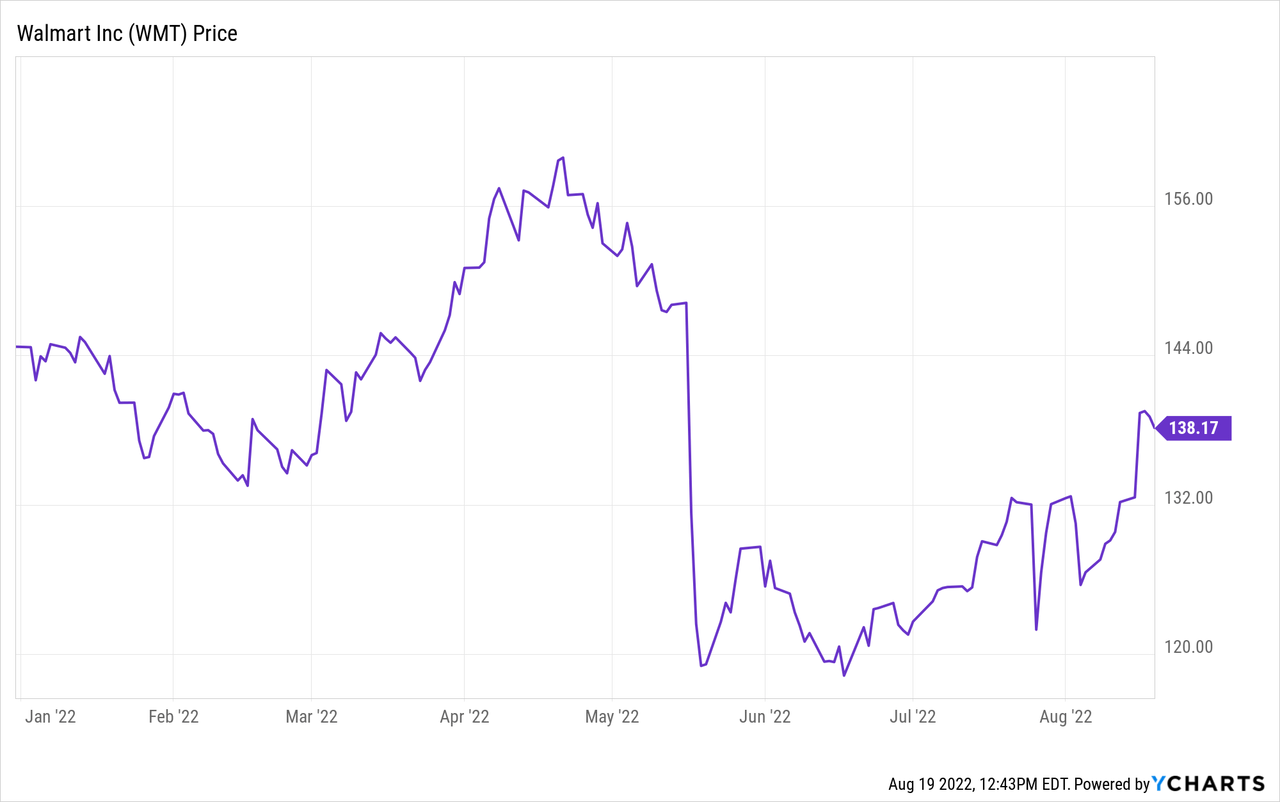

WMT Stock Price

WMT achieved its all time high just above $160 per share earlier this year but plunged drastically after first quarter results.

The stock tumbled again in July after pre-announcing second-quarter results. The actual results were a bit better and the stock has bounced solidly off lows, perhaps also induced by improved investor sentiment of the broader market.

What Are/Were Walmart’s Expected Earnings?

When WMT pre-announced earnings in July, it guided for 7.5% consolidated net sales growth in the quarter and 4.5% for the full year. WMT expected operating income to decline up to 12% excluding divestitures and for adjusted earnings per share to decline 12% (again excluding divestitures).

Did/Will Walmart Beat Earnings?

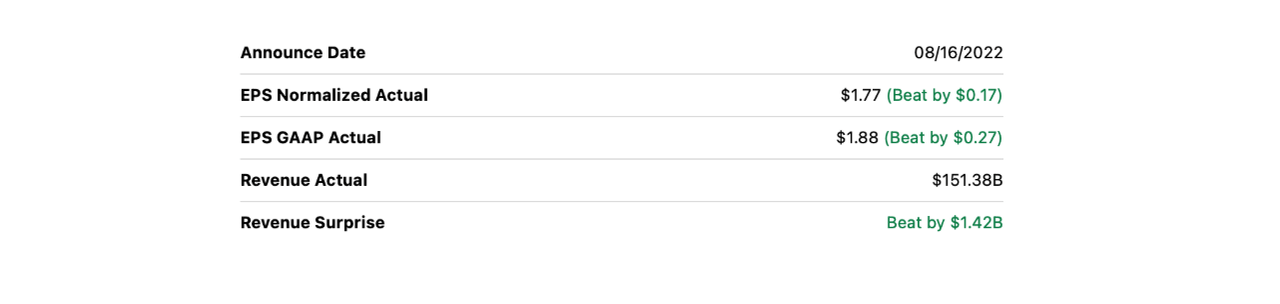

WMT ended up handily beating consensus estimates on both revenue and earnings metrics.

Seeking Alpha

WMT Stock Key Metrics

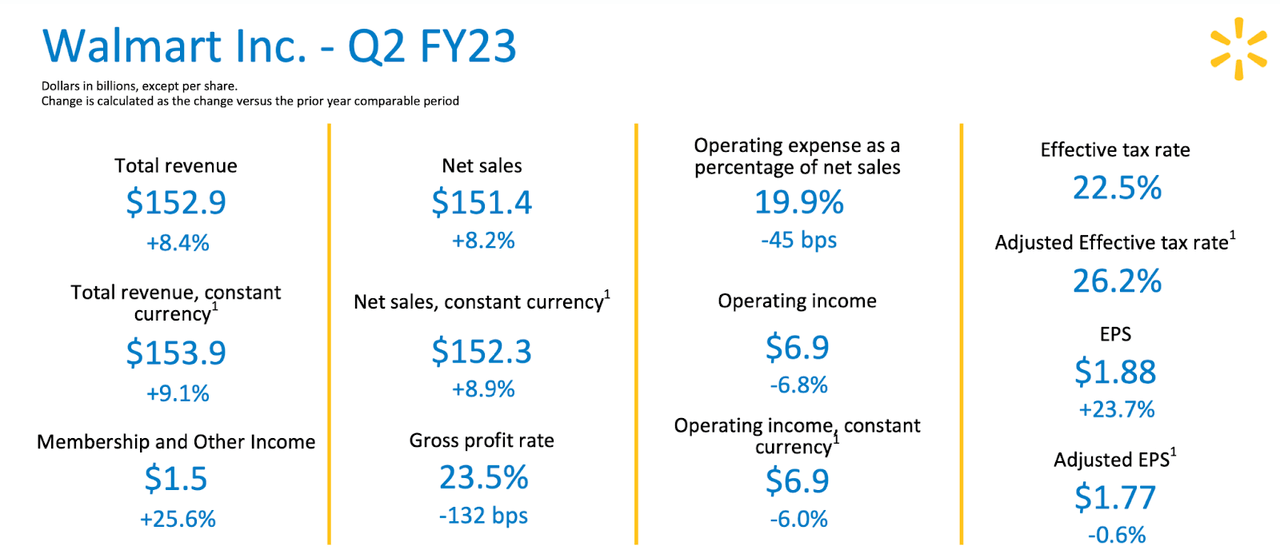

In the quarter, WMT generated 8.2% sales growth and a 6.8% decline in operating income – both metrics handily beating the pre-announced results.

FY23 Q2 Slides

Adjusted EPS of $1.77 declined by only 0.6%. These results showed that the second quarter was much stronger than expected – perhaps justifying the stock price rally.

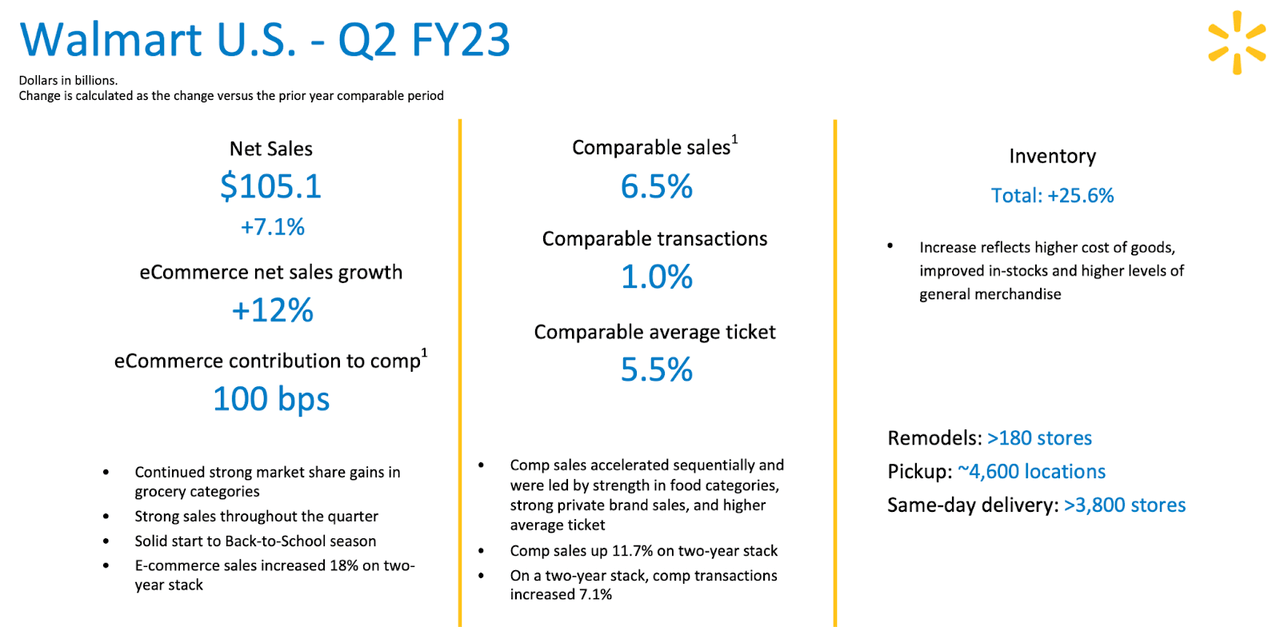

In the US, WMT delivered strong 6.5% comparable sales growth boosted by 12% e-commerce net sales growth. These results are particularly impressive considering that the company is lapping tough 2021 comparables, which were boosted by social distancing regulations.

FY23 Q2 Slides

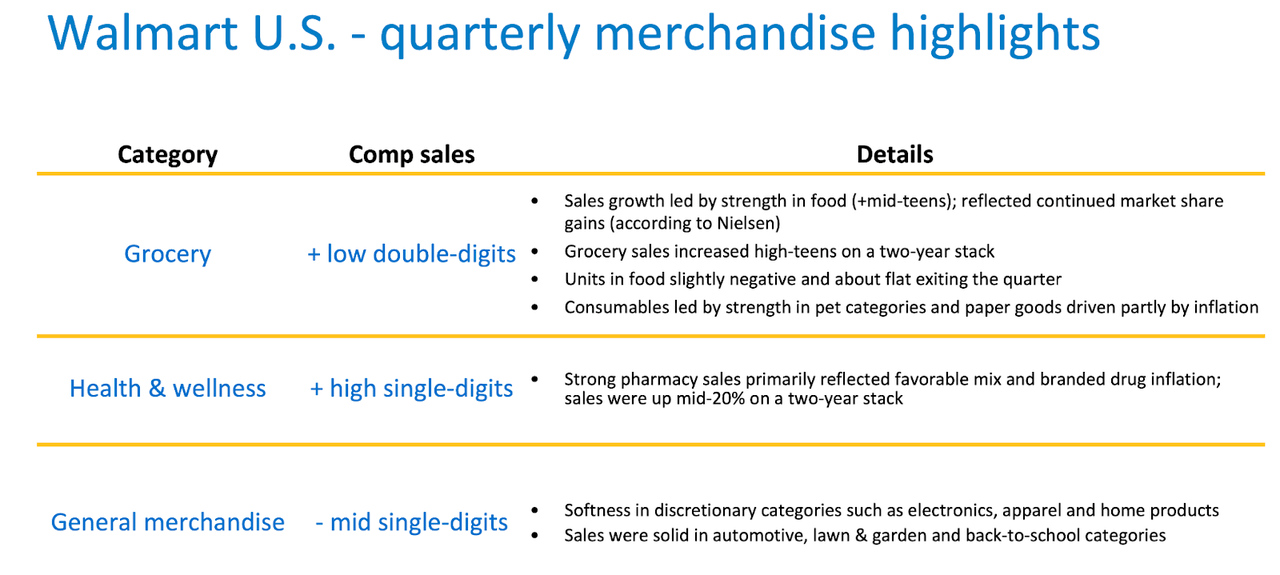

WMT saw continued double-digit comp sales growth in groceries and high single-digit growth in health & wellness, but otherwise saw mid single-digit comp sales declines elsewhere. This is a good moment to remind readers that in addition to being a play on the consolidation of retail, WMT is also a play on the consolidation of grocery business as many shoppers may prefer to do their groceries while also shopping for general merchandise.

FY23 Q2 Slides

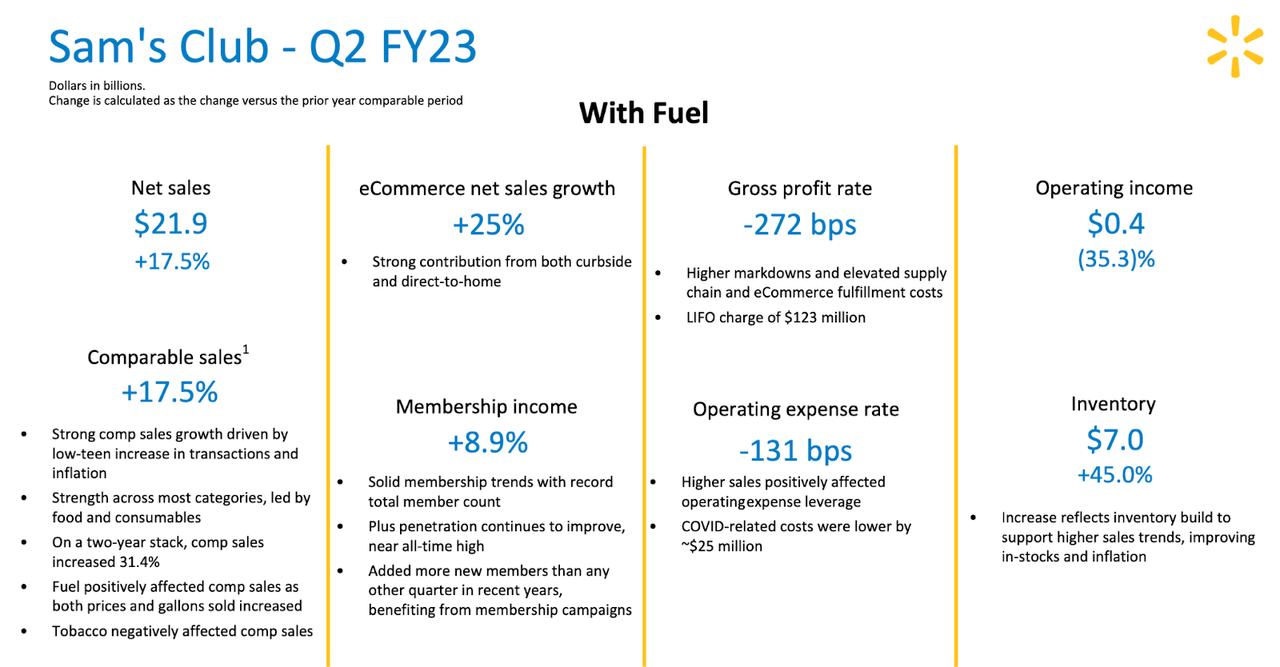

Sam’s Club, WMT’s answer to Costco (COST), delivered even stronger growth with 17.5% comparable sales growth.

FY23 Q2 Slides

In spite of the solid sales growth across the board, operating margins were pressured because WMT took aggressive steps to wind down inventory. These inventory struggles are not WMT-specific as was evidenced at Target (TGT) in the last quarter. On the conference call, WMT cited apparel and home goods as being the primary drivers of that margin compression. WMT noted that U.S. inventory growth was 26% versus the last year, reflecting 750 basis points of improvement sequentially. 40% of that increase was attributed to inflation.

In spite of macro-headwinds, WMT continues to reward shareholders with $8.8 billion of cash spread between $3.1 billion of dividends and $5.7 billion of share repurchases year to date.

FY23 Q2 Slides

I note that WMT had to fund some of those returns with cash on hand due to the lower free cash flow, but the company ended the quarter with a solid balance sheet with $31.8 billion of net debt, representing a less than 1x debt to EBITDA ratio (and that is before giving any credit to their $20 billion in long term investments).

What To Expect After Earnings

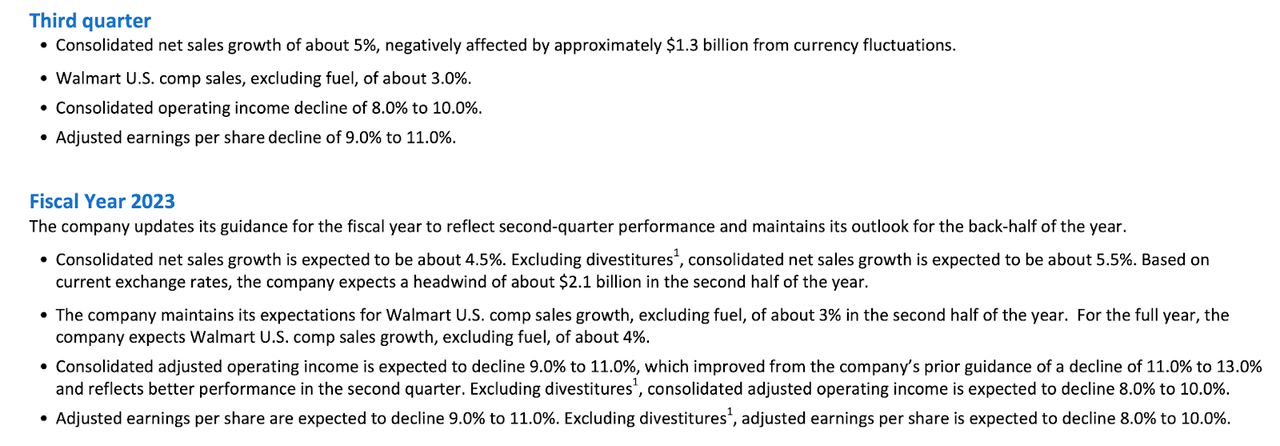

Looking forward, WMT guided for 5% net sales growth in the next quarter and 4.5% net sales growth for the full year.

FY23 Q2 Slides

WMT expects adjusted earnings per share to decline 10% excluding divestitures, reflecting the near term impact from inflation.

Is WMT A Good Investment Long-Term?

WMT is an investment thesis on consumer preference for convenience. WMT’s big box locations offer a one-stop shop for general merchandise and groceries – all at discounted prices. Perhaps at one point the threat of Amazon (AMZN) and e-commerce appeared to threaten that thesis, but WMT’s ongoing development of Walmart+ has thoroughly quashed such concerns. WMT announced that it would be offering the streaming service Paramount+ to Walmart+ subscribers. My personal view is that this offering is not so significant (I am a devoted Netflix subscriber) but it nonetheless shows that WMT is very serious about developing its subscription platform.

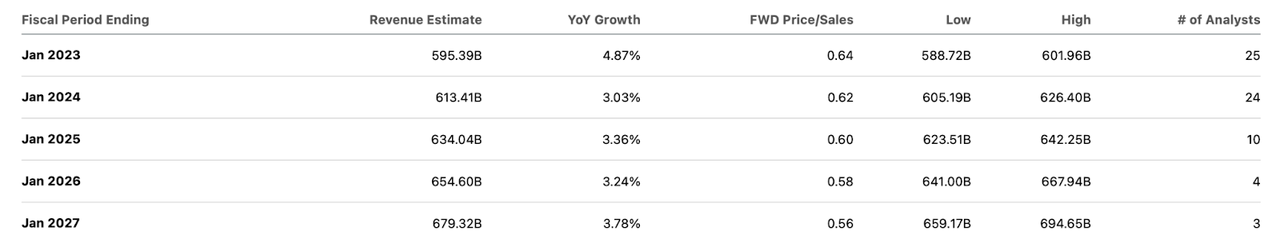

Consensus estimates call for WMT to sustain low-single-digit revenue growth for many years.

Seeking Alpha

That is expected to lead to high-single-digit bottom-line growth.

Seeking Alpha

WMT is not the kind of stock that is expected to generate huge earnings growth, but the consistency with which it takes market share makes it a decent long term investment.

Is WMT Stock A Buy, Sell, or Hold?

The stock is trading at around 24x forward earnings. I caution against valuing this on a sum of the parts basis with regards to the fast-growing e-commerce business because it is possible if not likely that the e-commerce business inherently cannibalizes some of the in-person sales. Compared against 8% projected earnings growth, a 24x earnings multiple looks quite rich at the implied 3x price to earnings growth ratio (‘PEG ratio’). But in return for the multiple, investors get a dominant retail platform with a thesis stronger than most. What’s more, I could see WMT eventually taking on significant leverage, perhaps as much as 3x debt to EBITDA. That would represent around $60 billion in additional debt capacity – assuming 4% interest rates this could lead to 12% earnings per share growth. This is a company which could deliver 10% to 12% total returns (based on the earnings yield and growth profile) with an additional long term kicker from increasing leverage. That isn’t a bad investment proposition from a typically recession-resistant business model. While I do not see material reason to believe in multiple expansion here, the current stock price appears to offer double-digit forward returns.

The key risks here include that of competition and multiple compression. WMT is competing against other formidable big box retailers such as TGT and Costco (COST). It is possible that these competitors eventually take market share – at least anecdotally, I greatly prefer the customer experience from these two competitors. The stock is not trading so cheaply even if the ongoing share repurchase program should theoretically add some support to the stock price. I wouldn’t be surprised if the stock dipped to as low as 15x earnings, which would make it more compelling, but still within what I would consider reasonable valuations. Those looking for a stock that at least feels safer on the surface might consider investing in WMT amidst the ongoing market volatility – I rate the stock a buy for long term investors.

Be the first to comment