Marina113/iStock Editorial via Getty Images

Elevator Pitch

Toyota Motor Corporation (NYSE:TM) is a Hold after the company’s stock buyback announcement. I have a positive view of the company’s plans to repurchase shares as a means of returning more capital to shareholders, but I don’t think it was the best option from the perspective of capital allocation. In addition, the near-term outlook for TM is mixed, considering both foreign exchange tailwinds and chip shortage headwinds.

TM Stock Key Metrics

Prior to discussing TM’s share repurchase disclosure, it is worth highlighting two key metrics relating to Toyota Motor’s most recent quarterly results announcement first.

One key metric is TM’s most updated production volume guidance for fiscal year 2022 (YE March 31) announced on February 9, 2022.

As per the company’s Q3 FY 2022 financial results presentation slides, Toyota Motor has reduced its estimates for the expected number of Toyota and Lexus vehicles to be produced in FY 2022 from 9 million units (as per earlier guidance) to 8.5 million units. In its third-quarter earnings presentation, TM attributed this lower production volume guidance to the “uncertain outlook due to the spread of COVID-19 and the shortage of semiconductors.”

Specifically, the semiconductor chip issue is likely to remain a key headwind for Toyota Motor and its automotive peers in the short term. A February 9, 2022 Seeking Alpha News article noted that “Toyota officials acknowledged the chips problem could continue through next fiscal year (FY 2023)”. Separately, market research firm Argus Media published an article on March 28, 2022 that cited data from AutoForecast Solutions which suggested that the ongoing chip shortage could lead to actual North American vehicle production falling short of market expectations by as much as 300,000 units this year.

Another key metric relates to foreign exchange.

TM changed its foreign exchange assumptions for full-year fiscal 2022 from “110 yen per dollar” previously to “111 yen per dollar” as per its Q3 FY 2022 results presentation slides released on February 9, 2022. At the time of writing, the USD/JPY exchange rate is approximately 122.

The depreciation of the Japanese yen versus the US dollar is positive for Toyota Motor which is a key exporter with a significant proportion of its costs incurred in its home market Japan and denominated in yen. This is reflected in TM’s recent financial results. Toyota Motor noted in its Q3 FY 2022 earnings presentation that its operating income rose by JPY1,023.9 billion YoY for 9M FY 2022, of which an increase of JPY445 billion over this period was due to foreign exchange tailwinds.

In summary, the recent Q3 FY 2022 results for TM shows a mixed picture, with the benefits of a weak Japanese yen being offset by semiconductor chip shortage issues.

Why Is Toyota Buying Back Stock?

On March 23, 2022 Toyota Motor announced a new share buyback program, which allows the company to potentially spend up to JPY100 billion on share repurchases or buy back 80 million shares between March 24, 2022 and May 10, 2022.

In the announcement, TM explained that it is buying back stock because the company aims to “promote capital efficiency.”

Notably, a December 14, 2021 Reuters article highlighted that “investors have long criticized Japanese firms for hoarding cash rather than investing it or returning it to shareholders, hurting their returns on equity.”

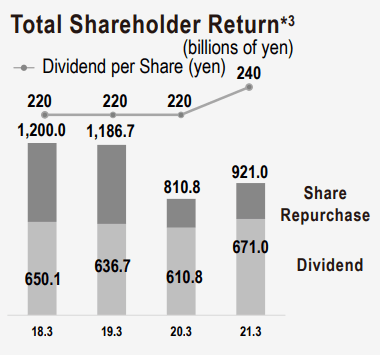

As per the chart below, Toyota Motor has been returning capital to shareholders in the form of dividends and buybacks in the past, but there is room for more of such shareholder-friendly actions.

Toyota Motor’s Shareholder Capital Return For The Past Four Fiscal Years

TM’s Q3 FY 2022 Results Presentation

TM has approximately JPY7,853 billion of “liquid assets” on its books as of December 31, 2021 as indicated in its third-quarter earnings presentation which is roughly equivalent to about a quarter of its current market capitalization. As such, Toyota Motor is not very “efficient” with respect to its capital utilization much like many other Japanese listed companies.

In the next section, I analyze if the new share repurchase program is positive for investors from a capital allocation perspective.

Is The Stock Buyback Good For Investors?

I think that there are three key considerations in determining whether the new stock buyback program is good for investors.

Firstly, the current price levels and valuations of Toyota Motor matter a lot, as it will be unwise for the company to repurchase its own shares if they are not “undervalued.”

TM’s last traded share price of $180.62 as of March 30, 2022 is only -15% below its all-time historical high stock price of $213.74 registered during intra-day trading on January 13, 2022.

Separately, the market values Toyota Motor at consensus forward FY 2023 and FY 2024 P/E multiples of 10.3 times and 9.4 times, respectively as per S&P Capital IQ data. This appears to be consistent with TM’s consensus FY 2022-2025 earnings per share CAGR of +9.4% and its expected ROEs in the low-teens percentage level over the same period.

In other words, Toyota Motor seems fairly valued at best, so the stock buyback might not be the optimal way of returning excess capital to shareholders.

Secondly, it might be better that Toyota Motor raises its ordinary dividend or distributes a special dividend instead of buying back shares.

Based on financial forecasts sourced from S&P Capital IQ, TM boasts consensus forward FY 2023 and FY 2024 dividend yields of 2.8% and 3.1%, respectively. These are decent numbers, but a much higher mid-single digit dividend yield would definitely make Toyota Motor even more attractive for yield-focused investors. As a reference, TM’s dividend payout ratio for fiscal 2021 was 29.8% which is satisfactory, but there is obviously room to raise the dividend payout ratio to 50% or even higher.

If Toyota Motor is concerned about the sustainability of future regular dividend payouts, it could also have considered paying out a non-recurring special dividend to reduce its equity base and boost future ROEs. In contrast, repurchasing its own shares at a time where TM isn’t exactly undervalued might not be the best decision.

Thirdly, TM also has the option of reinvesting its excess capital.

In the middle of 2017, it was reported by Reuters that Toyota Motor “may consider mergers or acquisitions to procure new automotive technologies.” Last year, TM bought out Lyft’s (LYFT) self-driving business and an automotive software business Renovo, so this indicates there are business areas where the company can engage in M&A to drive future growth.

In summary, I like the fact that TM continues to return excess capital with share buybacks. But dividends and acquisitions could be potentially better choices with respect to capital allocation at this point in time considering Toyota Motor’s current valuations.

What Is Toyota Stock’s Forecast?

Toyota Motor has guided for the company to achieve revenue of JPY29.5 trillion and an operating profit of JPY2.8 trillion for full-year fiscal 2022, as per its quarterly results presentation. The sell-side analysts are slightly more optimistic, with market consensus pointing to TM delivering a top line of JPY30.9 trillion (+13%) and an operating income of JPY3.0 trillion (+38%) in the current fiscal year as per S&P Capital IQ.

The key thing to note about TM’s updated forecasts is that the company cut its FY 2022 top line guidance by -JPY0.5 trillion, while increasing its operating profit margin guidance by +0.2 percentage points when it disclosed its Q3 FY 2022 results. This is aligned with what I highlighted earlier in this article, where Toyota’s profitability benefits from the weakening Japanese yen, but its sales are hurt by lower-than-expected production volumes due to chip shortages.

Is TM Stock A Buy, Sell, or Hold?

TM stock is a Hold in my opinion. The near-term business outlook for Toyota Motor is mixed, and I think that the company should have allocated more capital to dividends and acquisitions (as opposed to buybacks).

Be the first to comment