mgstudyo

Article Thesis

The Southern Company (NYSE:SO) is one of the country’s largest utilities. Like its peers, it offers reliable income that isn’t vulnerable to recessions or economic downturns. Its dividend yield and valuation are on par with, or better than, many of its competitors, which makes Southern Company an above-average income pick for those seeking exposure to utilities.

What Should Investors Know About Southern Company’s Dividend?

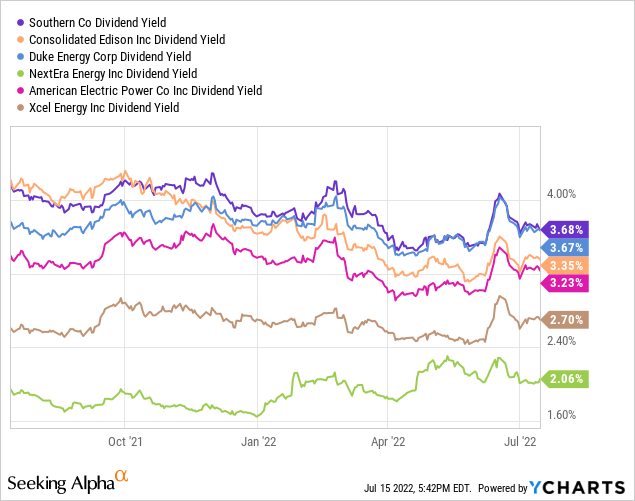

Income investors should look at a couple of metrics when deciding whether a specific stock is suitable as an income investment. Let’s start with the dividend yield. In Southern Company’s case, that’s 3.7% today, which is more than the average among large-cap electrical utilities:

Southern Company’s peers, such as Consolidated Edison (ED), Duke Energy (DUK), NextEra Energy (NEE), American Electric Power (AEP), and Xcel Energy (XEL) all offer dividend yields that are equal to or lower compared to the dividend yield Southern Company offers today. In fact, the average yield among these five peers is 3.0%, thus Southern Company offers an income potential that is around 25% higher compared to that of its competitors (3.7%/3.0%).

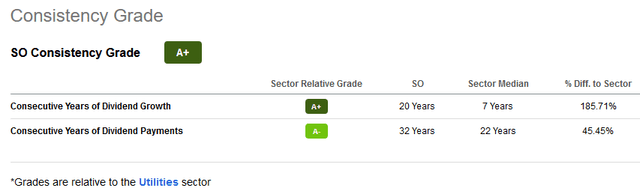

Southern Company also has a compelling dividend growth track record, having raised its dividend for 20 years in a row. Since that is well above the norm for utilities, Southern Company receives an A+ Dividend Consistency rating from Seeking Alpha’s scoring algorithm:

The same algorithm awards a B, B-, and B rating for Southern Company’s Dividend Safety, Dividend Growth, And Dividend Yield, which makes for a very solid overall grade in the B+ range.

Southern Company has raised its dividend by 3%-4% a year over the last five years. If the company were to keep that pace, investors could expect total returns in the 7% range in the long run, when we combine the dividend yield and the dividend growth rate. That’s not ultra-high, but solid for a lowish-risk utility that is primarily seen as an income investment, and not necessarily as a total return pick.

Southern Company’s dividend payout ratio is 76% based on this year’s expected earnings. That’s not low, but not overly high for a utility, either. Since utilities can fund growth projects via debt or by issuing new shares, there is no need to retain an overly large portion of net profits. A payout ratio in the 70%-80% range is thus sustainable in the long run, and it is also matched by many other utilities.

Is Southern Company A Good Dividend Stock?

Utilities aren’t total return picks, and those seeking very high dividend yields or 10%+ annual returns may want to look elsewhere. But for someone that is happy with a 3%-4% dividend yield from a regulated utility and that wants consistent dividend growth, Southern Company could be a very solid choice. With its yield being higher than that of most of its peers, and with its dividend track record better than average, Southern Company is an above-average income choice among utilities, I believe.

SO Stock Key Metrics

Southern Company reported its most recent quarterly results on April 28. During the first quarter, Southern Company generated revenues of $6.6 billion, which easily beat estimates and which was up by 12% year over year. This was partially driven by rate increases, but a growing customer count also played a role in Southern Company’s strong revenue growth. The company added 11,000 residential electrical customers during the quarter, and 7,000 residential gas customers on top of that. This is made possible thanks to Southern Company’s advantaged geographical positioning. The company is primarily active in the Southeast service territories, where population growth is stronger compared to many other markets. Inner-US migratory trends, such as people moving from high-tax, high-cost California to lower-tax, lower-cost states in the Southeast, help provide for a compelling business growth outlook for Southern Company. I do believe that there is a high likelihood that the company will be able to continue to grow its customer count over time, which, combined with rate increases, should make for solid revenue growth opportunities.

The company is forecasting earnings per share in a range of $3.50 to $3.60 this year, which is in line with the current analyst consensus estimate. This excludes some one-time items, such as losses on plants that are currently under construction. Southern Company also forecasts that its earnings per share will grow by 5% to 7% a year in the long run, which includes a medium-term forecast for earnings per share of $4.00 to $4.30 in 2024. At the midpoint of $4.15, that would be up by an even stronger 8% annually versus the guidance midpoint for the current year, $3.55. Utilities oftentimes do not generate earnings per share growth in the high-single digits range, thus I’m somewhat wary when it comes to forecasts of 7% or even 8%. But even if Southern Company grows its earnings per share by only 4% or 5%, that wouldn’t be a disaster for those that seek an income investment with reliable dividend growth and some appreciation over time.

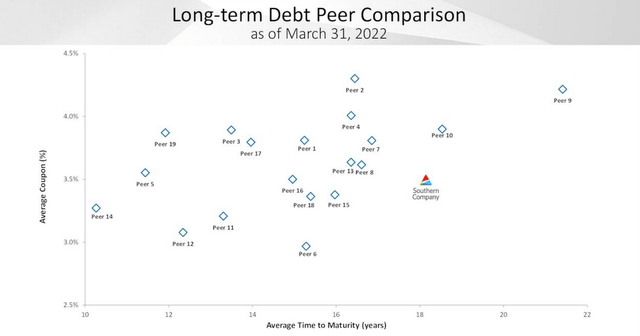

With interest rates rising considerably in recent months, it makes sense to take a look at Southern Company’s debt:

We see that Southern Company is in an advantaged position, as its average interest rate is in the middle of the pack, at 3.5%, while it has one of the longest average maturities, at more than 18 years. Compared to peers, the company managed to lock in solid interest rates for a very long time, which should help hold up its profitability in the coming years, whereas some of Southern Company’s peers might have to refinance at unfavorable rates.

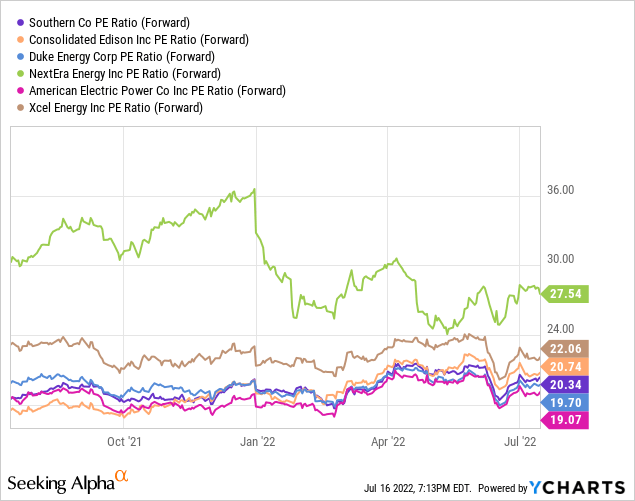

Looking at Southern Company’s valuation, we see that shares are trading relatively in line with how its peers are valued right now:

At 20.3x forward net profits, Southern Company is marginally more expensive compared to Duke Energy and American Electric Power, and slightly less expensive than Consolidated Edison and Xcel Energy. NextEra Energy is the outlier in the group, as it trades at a roughly 40% higher earnings multiple compared to the rest of the peer group. That can be explained by the fact that NextEra Energy is seen as a more renewables-focused investment by many investors, although I still believe that the current premium is too high, and that it is less attractive than its utility peers at the current valuation.

Southern Company’s 10-year median earnings multiple is 19.7, thus shares trade relatively in line with the longer term average. Both from a peer group comparison perspective, as well as from a historic perspective, Southern Company thus looks reasonably valued today. It is neither a bargain, nor is it especially expensive. One could argue that this makes SO a Hold at current prices.

Is SO A Good Long-Term Investment?

If Southern Company continues to grow its dividend by 3%-4% a year in the long run, investors could reasonably expect total returns in the 7% range once the dividend yield is accounted for. Southern Company aims for earnings per share growth of more than 3%-4% a year, however. Its longer-term growth goal is 5% to 7%, or 6% at the midpoint. If the company were to hit that target, future total returns could be in the 9%-10% range, although I personally do not believe that a 6% earnings per share growth rate and a similar dividend growth pace are a sure bet.

Is SO Stock A Buy, Sell, Or Hold?

No matter what, Southern Company offers a safe and growing income stream, and its dividend properties look favorable compared to what peers are offering right now. With shares trading around fair value today, Southern Company is a solid hold as a long-term investment. For those that want to maximize their total returns, waiting for a better entry point could pay off. In February, SO traded 15%-20% lower compared to where it trades right now. Waiting for such an opportunity would not only result in a higher initial dividend yield and thus a more pronounced income stream, but it could also lead to more meaningful share price appreciation in the long run.

Be the first to comment