Kimberly White/Getty Images Entertainment

Salesforce (NYSE:CRM), long seen as the pioneer of the entire software as a service (‘SAAS’) industry, has seen great volatility amidst the tech stock crash. Unlike some other tech stocks, CRM never saw its valuation bid up to bubbly levels and is now trading at compelling valuations. The company maintains a net cash position and has a track record of successful M&A. Yet the company may have surprised investors with a $10 billion share repurchase program and apparent commitment to begin returning cash to shareholders. CRM is highly buyable for those looking for a higher quality name in the tech sector.

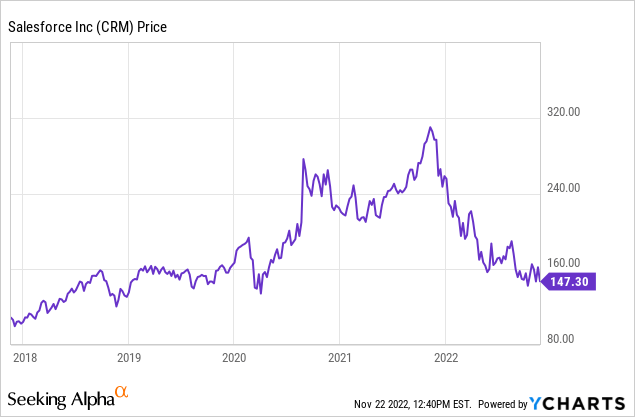

CRM Stock Price

CRM peaked at around $311 per share in late 2021 but has since fallen around 50%. It is now trading below where it did in 2018.

I last covered CRM in July where I explained why investors should not fear stock-based compensation. The stock is down 16% since then – offering a compelling entry point in a cloud titan.

CRM Stock Key Metrics

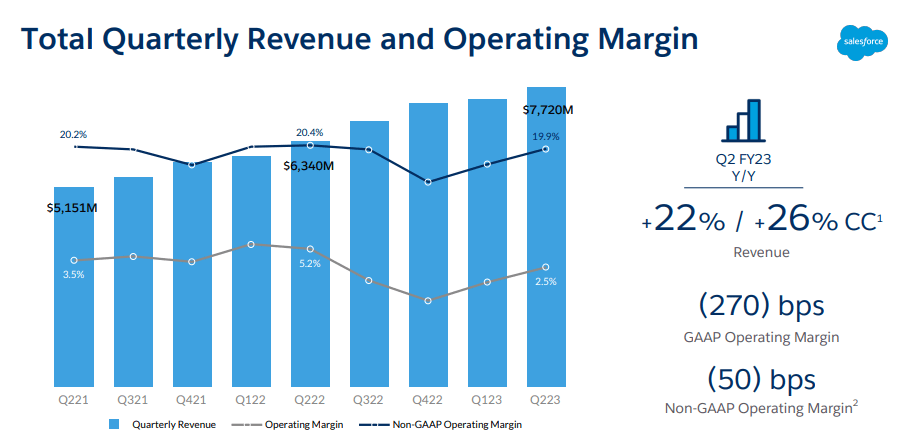

CRM can be considered a mature tech company at this point, yet it continues to grow rapidly. The company posted 22% revenue growth (26% constant currency) in the latest quarter – slightly beating guidance of $7.7 billion.

FY23 Q2 Presentation

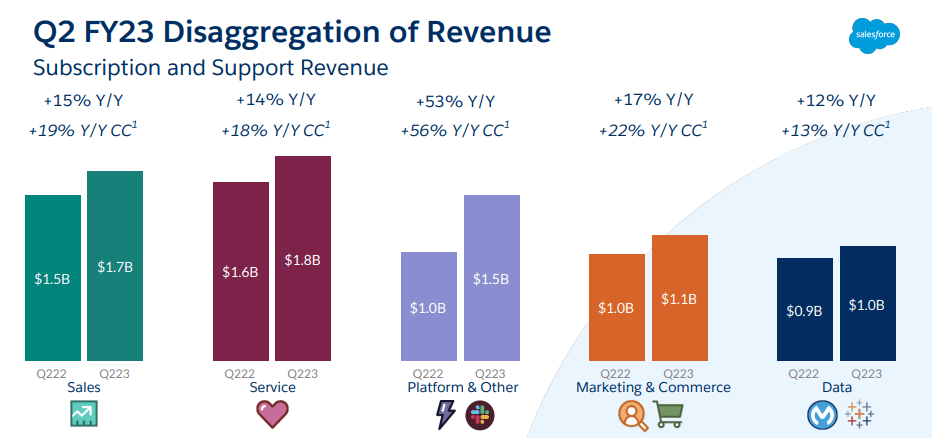

CRM has put together a diversified portfolio of tech products – Slack continues to be a strong driver of revenue growth.

FY23 Q2 Presentation

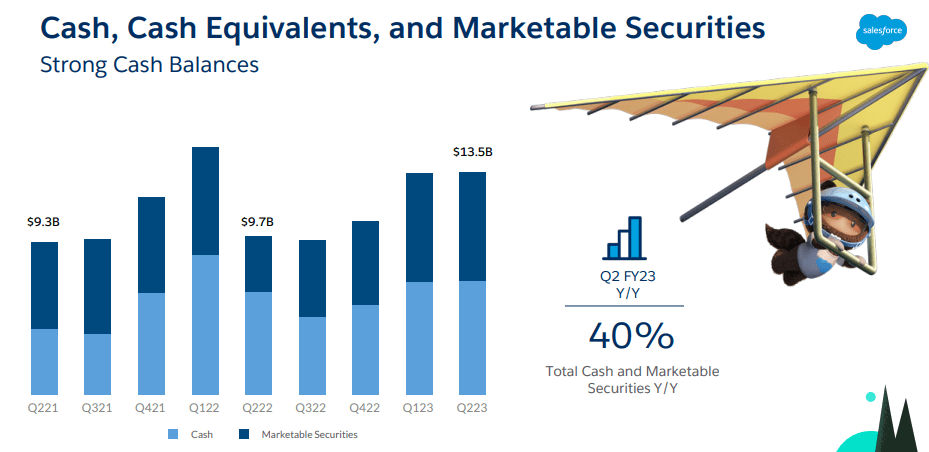

CRM ended the quarter with $13.5 billion of cash & marketable securities versus $10.6 billion of debt. That $2.9 billion net cash position might not appear so significant as compared to the $148 billion market cap, but the key point here is that this is a company willing to leverage the balance sheet, and the current tech crash may give management the chance to be opportunistic.

FY23 Q2 Presentation

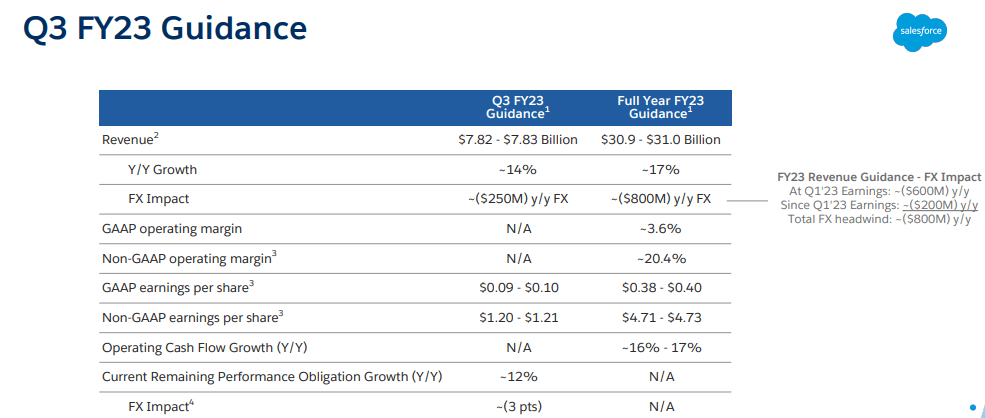

Looking forward, CRM expects 14% revenue growth in the third quarter and $31 billion for the full year. CRM had previously been guiding for up to $31.8 billion in revenue for the full year. Currency fluctuations continue to heavily weigh on results.

FY23 Q2 Presentation

How Were Salesforce’s Previous Earnings?

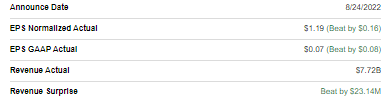

Those numbers were good enough for a moderate beat against consensus estimates on both the top and bottom lines.

Seeking Alpha

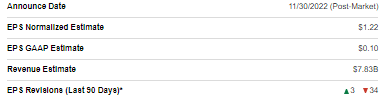

Is Salesforce Expected To Beat Earnings?

Looking forward, consensus estimates have been falling with 34 downward revisions.

Seeking Alpha

What Can You Expect From The Upcoming Earnings?

The consensus $7.83 billion revenue estimate is squarely within guidance – it appears that many analysts are not expecting a typical beat and may even be expecting misses. I expect analysts to focus mostly on the guidance, as investors appear worried that the macro-environment will muddy the growth picture.

What Is The Long-Term Outlook?

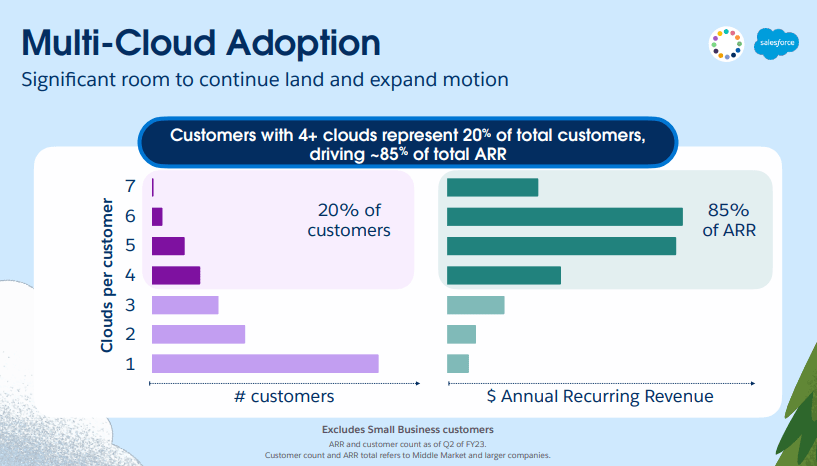

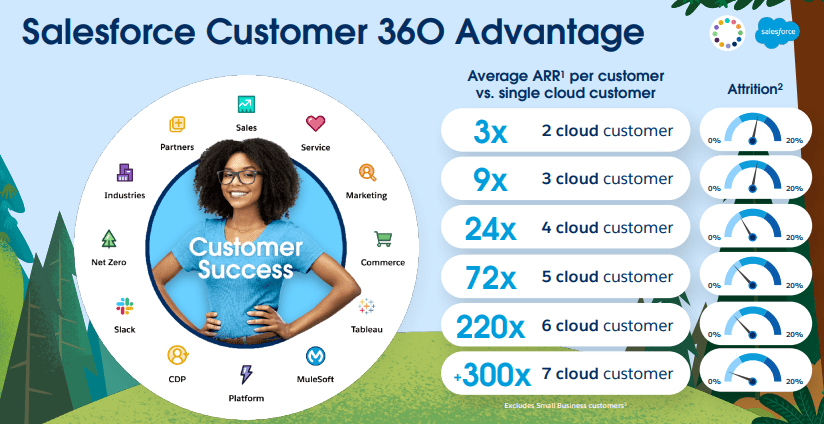

Over the long term, CRM remains an investable play on the digital transformation secular growth story. Like many other cloud companies, one typical growth strategy is to cross-sell new products to existing customers. 85% of CRM’s total ARR comes from customers that have purchased 4 or more cloud products (20% of total customers).

2022 Investor Day

As customers become more comfortable with CRM and add more cloud products, ARR grows dramatically and revenue retention also improves greatly.

2022 Investor Day

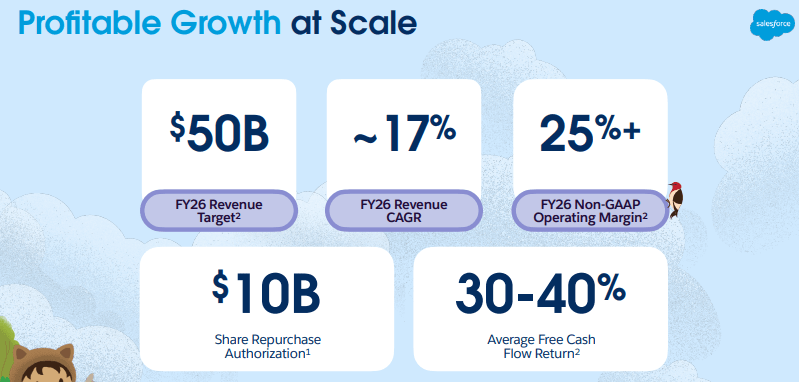

At its 2022 Investor Day, CRM gave ambitious long term targets of $50 billion in revenue by FY26 (for reference, the latest quarter was FY23 Q2) representing 17% CAGR. CRM also guided towards at least 25% non-GAAP operating margins by FY26.

2022 Investor Day

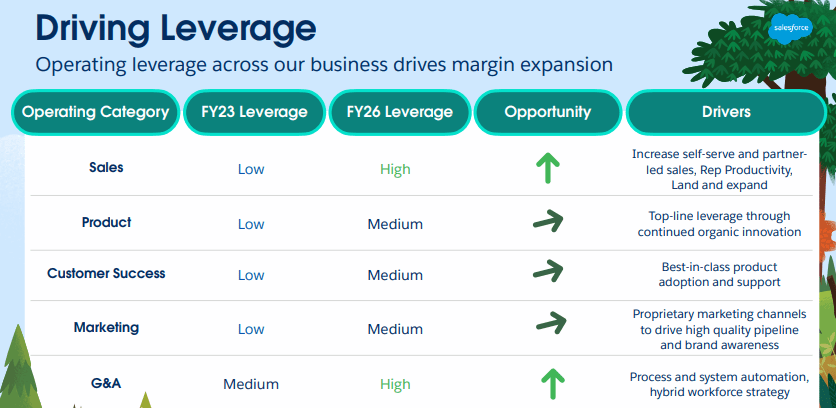

That margin target represents a sizable jump from the current ~20% profile. CRM expects to drive the greatest leverage from sales and G&A, driven by initiatives such as self-serve sales and a hybrid workforce strategy.

2022 Investor Day

Is CRM Stock A Buy, Sell, or Hold?

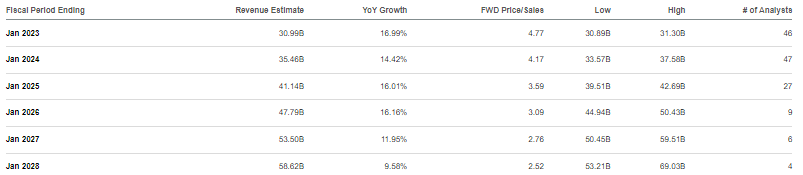

Consensus estimates appear skeptical, with analysts expecting only $47.6 billion in revenue by FY26.

Seeking Alpha

The stock is trading at 3x FY26 consensus revenue estimates. Assuming 13% growth exiting FY26, a 30% long term net margin, and 1.5x price to earnings growth ratio (‘PEG ratio’), I could see CRM trading at 5.9x sales, representing a stock price of $289 per share or 20% compounded returns over the next 3.5 years.

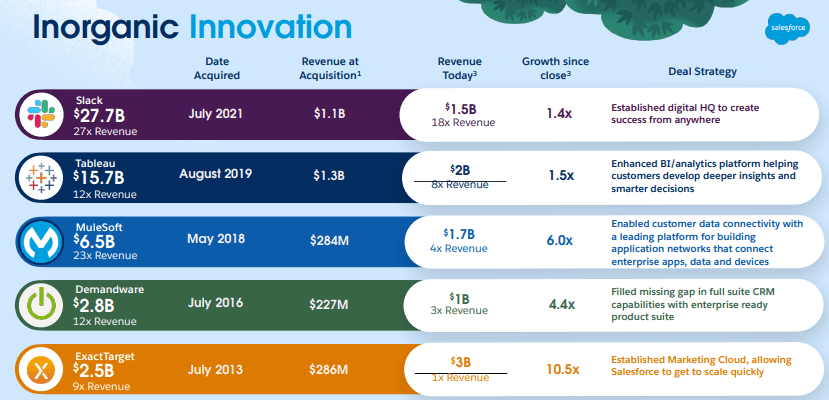

That should comfortably beat the market, but some readers might point out that there are cheaper alternatives in the tech wreckage. That is true – but we must acknowledge the higher quality story at play here. CRM management has shown strong execution as evidenced by their ability to drive sustained growth from their various acquisitions.

2022 Investor Day

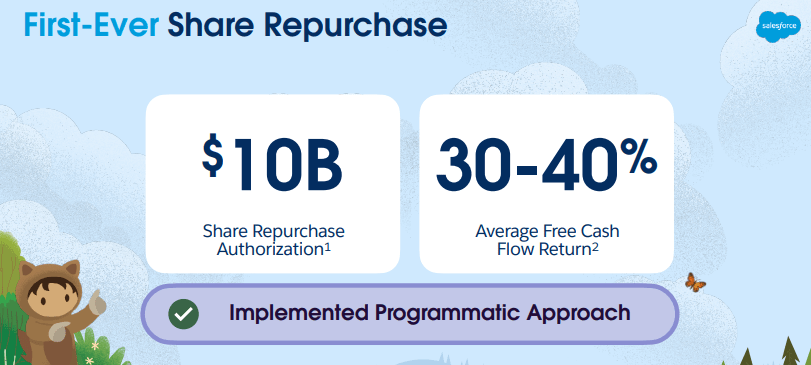

CRM appears to be taking yet another step towards becoming a mature tech company through its $10 billion share repurchase authorization. CRM has also guided to return between 30% and 40% of free cash flow annually to shareholders. For reference, I estimate CRM will generate around $5 billion of free cash flow this year.

2022 Investor Day

On the conference call, management humorously explained their decision as follows:

We have the right team, the right products, the right playbook, for getting to $50 billion in revenue in fiscal year ’26. We always get questions about our M&A strategy and what company we’re going to acquire next and what we’re going to do next from an acquisition cycle. I think we get this question every single earnings call that we do like this.

And it’s always one of my favorite parts of the call. And I’m excited to tell you we have found a great cloud company, growing revenue for 73 consecutive quarters through every economic cycle, it’s got great cash flow, number one market share, an incredible brand, one of the most admired companies in the world, great values, fantastic community of 17 million trailblazers, fantastic commitment to its community, runs across 90 countries and that company is Salesforce.

I view the share repurchase program with a mixed bag. On the one hand, one could make a strong argument that this share repurchase program will help the stock maintain a premium multiple relative to smaller tech names. On the other hand, one could also make an argument that M&A makes more sense considering the broader tech crash. It is possible that CRM has already become so big that it is difficult to find M&A targets that are both accretive and face low risk of antitrust regulation.

What are key risks? In my view, the biggest risk is an implosion of the growth story. The past several years have seen CRM stubbornly sustain 20+% revenue growth rates in spite of its large size. Over the same time period, CRM has invested heavily in acquisitions – it is possible that growth rates were supported primarily by M&A. Amidst a difficult macro environment, management will need to execute and prove that this really is a secular growth story that can sustain double-digit revenue growth even without M&A.

The valuation is elevated relative to more beaten-down names – I expect that premium to evaporate if growth disappears. CRM has generated positive free cash flow for several years even after deducting stock-based compensation and deferred revenues. Combined with the net cash balance sheet, I see low financial risk here. But CRM is also facing strong competition including mega-cap tech titan Microsoft (MSFT) – it is possible that competition ultimately leads to market saturation. As discussed with subscribers to Best of Breed Growth Stocks, I view a carefully chosen basket of undervalued tech stocks as being the best way of taking advantage of the tech crash. CRM fits right in such a basket as a higher quality allocation and remains highly buyable today.

Be the first to comment