Chris Hondros

Elevator Pitch

My investment rating for Philip Morris International Inc.’s (NYSE:PM) shares is a Hold before the company’s upcoming Q2 2022 earnings announcement. PM appears to be a Buy, considering its resilience in an inflationary environment, and the low likelihood of an earnings miss for the second quarter. But I view Philip Morris as a Hold instead, given that its valuations are fair and the timeline for the achievement of its smoke-free revenue contribution target might need to be pushed back.

PM Stock Key Metrics

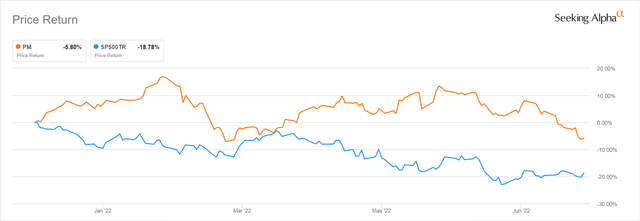

The key metrics for PM are the stock’s absolute and relative share price performance in 2022 thus far.

Philip Morris’ 2022 Year-to-date Stock Price Chart

As per the chart above, Philip Morris’ shares have declined by a mere -5.8% in 2022 year-to-date. In the same period, the broader market as represented by the S&P 500 has corrected by a more substantial -18.8%.

My view is that PM’s stock has outperformed the S&P 500 in the first seven months of the year, because the company’s financial performance is very likely to be resilient thanks to the unique characteristics of the tobacco industry.

Philip Morris has the ability to raise prices for their products without impacting sales volume to a large extent. This is because demand for tobacco products is largely inelastic, and consumers will typically cut back on spending for other items that account for a larger proportion of household budgets. At the company’s Q1 2022 results briefing on April 25, 2022, PM referred to “pricing” as one of the “powerful drivers” which will help it to offset “inflationary pressures to deliver strong top line growth, organic margin expansion” in the second half of 2022.

Separately, tobacco leaves, a critical raw material for PM, are less susceptible to inflationary cost pressures. According to a November 2020 report published by Market Research Future or MRFR, the industry practice is that “leaf merchants enter into long-term contracts with tobacco growers.” This stands in contrast with other consumer companies which purchase raw materials via short-term agreements (typically a few months or less) and where there are multiple buyers for the specific raw material (e.g. resin, palm oil etc).

In summary, Philip Morris is expected to be among a small percentage of companies that will do well in an inflationary environment, and this explains why PM’s shares have done much better than the broader market in 2022 year-to-date. It is noteworthy that PM has guided at its first-quarter investor call that it expects its “pro forma adjusted operating income margin to be organically zero to plus 100 basis points higher” for full-year fiscal 2022, which supports my view that PM is resilient in an environment of high inflation.

Is Philip Morris Stock Fairly Valued?

Philip Morris’ stock is at a fair valuation, and this is to be expected taking into account PM’s share price outperformance relative to the S&P 500 in this year thus far.

PM is now valued by the market at 16.5 times consensus forward next twelve months’ normalized P/E as per S&P Capital IQ, and this is on par with the stock’s historical averages. As a reference, Philip Morris’ three-year, five-year and 10-year mean consensus forward next twelve months’ normalized P/E multiples were 15.4 times, 16.3 times and 17.2 times, respectively.

Separately, Philip Morris appears to be fairly valued based on an assessment of its key financial metrics.

On one hand, PM has historically generated reasonably high ROAs (Returns on Assets) in the high teens to low twenties percentage range, which warrants a valuation premium. On the other hand, the company’s bottom line growth expectations are relatively modest. In its Q1 2022 earnings press release, PM highlighted its “mid-term” goal of achieving at least a “9% (growth) for currency-neutral adjusted diluted EPS.”

In a nutshell, the current mid-teens forward P/E multiple for Philip Morris is justified based on the company’s annualized earnings growth rate of under 10% and an average ROA close to 20%.

When Does Philip Morris Report Earnings?

Philip Morris has previously disclosed on July 14, 2022 that its Q2 2022 financial results will be released on July 21, 2022 before the market opens.

What To Expect From Earnings

PM’s Q2 2022 financial performance won’t be as good as what the company delivered in the first quarter.

Based on financial data obtained from S&P Capital IQ, Philip Morris is projected to see its revenue contract by -11.4% YoY in the second quarter of 2022, as compared with its +2.1% top line expansion in Q1 2022. PM’s normalized EPS decline is expected to worsen from -0.6% YoY in Q1 2022 to -20.6% YoY in Q2 2022. This isn’t surprising, as PM has cautioned earlier about certain factors that will adversely affect the company’s second-quarter financial results as highlighted below.

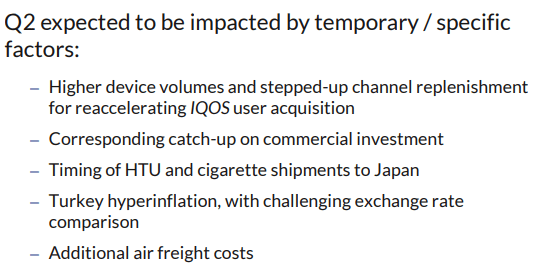

Headwinds For PM In Q2 2022

Philip Morris’ Q1 2022 Results Presentation

Notably, 11 of the 17 Wall Street analysts who are covering PM shares have lowered their bottom line projections for the company in the last three months. On the flip side, Philip Morris noted at the recent Deutsche Bank (DB) Global Consumer Conference on June 14, 2022 that “we expect Q2 to be probably better than what we thought.” In my opinion, PM’s Q2 2022 financial results should be at least in line with the market’s consensus forecasts, and I won’t rule out a minor earnings beat.

What Is PM Stock’s Long-Term Forecast?

PM’s key long-term forecast relates to the company’s “ambition to become a majority smoke-free business by net revenues in 2025” as indicated in its first-quarter results media release. This is the key valuation re-rating catalyst or driver for Philip Morris, so there is upside to PM’s valuations if it can realize its ambitions.

However, I have a mixed view of Philip Morris’ progress in achieving its 2025 target.

On the negative side of things, PM acknowledged at its Q1 2022 investor call that “we may be in a situation that we’ll deliver this (smoke-free revenue contribution) target, but with about a 12 months delay.”

PM has encountered a minor setback with respect to its long-term smoke-free goal. This is due to Philip Morris’ decision to exit Russia, a key market for the company especially relating to the sales of its iQOS heated tobacco products as indicated at the recent quarterly earnings call.

On the positive side of things, Philip Morris announced earlier in May that it proposed to “buy the chewing tobacco company Swedish Match (OTCPK:SWMAF) for about $16 billion”, and the transaction is expected to be completed by the end of this year assuming all the necessary regulatory and shareholder approvals are secured.

At an investor call hosted on May 11, 2022, PM revealed that Swedish Match is the largest seller of nicotine pouches worldwide with a volume share of about 40%, and noted that smoke-free products contributed around two-thirds and three-quarters of SWMAF’s top line and operating income, respectively in the recent fiscal year. This should boost Philip Morris’ plans to grow revenue and earnings contribution from smoke-free products in the future.

Is PM Stock A Buy, Sell, or Hold?

PM stock is a Hold. Philip Morris’ shares are neither undervalued nor overvalued, and there is uncertainty over the company’s ability to deliver on its 2025 smoke-free target. As such, a Hold rating for Philip Morris is appropriate.

Be the first to comment