Ivan-balvan/iStock Editorial via Getty Images

Elevator Pitch

My investment rating for Apple Inc.’s (NASDAQ:AAPL) shares is a Buy. I did a comparison of Apple and Advanced Micro Devices, Inc. (NASDAQ:AMD) in my previous April 6, 2022, article, and determined that AAPL was the better buy. In this latest update for AAPL, I analyze whether a buying opportunity for Apple has emerged as a result of the pullback in the company’s share price year-to-date in 2022.

This is a good time to buy Apple’s stock, as the dip in its share price year-to-date has made its valuations more attractive with its forward P/E multiple reverting close to its five-year historical mean. There is room for AAPL’s valuation multiples to expand in tandem with higher profit margins resulting from a superior sales mix tilted towards services.

AAPL Stock Basics

Prior to touching on AAPL’s stock price correction, valuations, and outlook, it is relevant to revisit the basics for Apple. In other words, I will be discussing the company’s business model and the investment thesis for the stock in the current section of this article.

Apple’s business model is to continue expanding the installed base for its flagship hardware device, the iPhone, and cross-sell other hardware products and services to its iPhone users.

At the company’s earnings call for the first quarter of fiscal 2022 (YE September 30) on January 27, 2022, Apple disclosed that its “installed base of active devices” has set “a new all-time record of 1.8 billion devices.” AAPL updated investors at its Q2 FY 2022 results briefing on April 28, 2022, that the company’s “installed base (of active devices) has continued to grow”, while noting that “the iPhone active installed base reached “a new all-time high.” According to the Business of Apps website’s compilation of data on AAPL, the number of active iPhones (excluding other hardware devices such as iPads) on a worldwide basis had already crossed the 1.2 billion mark by the end of last year.

The investment thesis for AAPL is closely linked to its business model. Revenue for Apple’s services like the App Store is expected to grow over time in tandem with the increase in the installed base for AAPL’s iPhones and other hardware devices. This should translate into higher profit margins and faster earnings growth for Apple in the medium to long term, as AAPL benefits from a more favorable revenue mix with a rising proportion of sales contribution from higher-margin services.

The gross profit margin for Apple’s services segment was 72.6% in Q2 FY 2022, which was twice that of the products segment’s gross margin of 36.4% in the same quarter as highlighted at its most recent quarterly investor call. Also, AAPL only derived approximately 20% of its total Q2 FY 2022 revenue from services as per its quarterly earnings press release, so there is room for the company to further optimize its sales mix with a bias towards growing revenue contribution from services at a faster pace.

In the next section, I focus on Apple’s stock price decline thus far this year.

Why Did Apple Stock Drop?

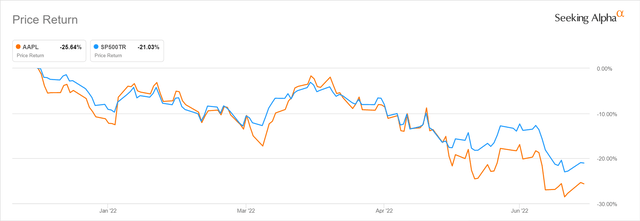

Apple’s stock price dropped by -25.6% in 2022 thus far, and it underperformed the S&P 500 which was down by -21.0% during the same period.

AAPL’s 2022 Year-to-date Share Price Chart

AAPL’s share price weakness is partly attributed to the correction in the broader stock market and technology stocks as a result of investors’ worries over higher-than-expected inflation and a potential recession. But there are also company-specific factors that have driven a decline in Apple’s stock price.

In the past three months, the Q3 FY 2022 consensus earnings per share estimate for Apple has been reduced by -7.5%. Specifically, 25 of the 44 Wall Street analysts covering AAPL’s shares lowered their third-quarter EPS forecasts for the company in the last three months. This is consistent with Apple’s forward-looking management guidance.

At its Q2 FY 2022 earnings briefing, AAPL had guided for a $4-$8 billion hit to its third-quarter revenue resulting from “COVID-related disruptions (more specifically lockdowns in China) and industry-wide silicon shortages.” The company also highlighted that it expects unfavorable exchange rate fluctuations and the suspension of sales in Russia to impact the YoY growth for its Q3 FY 2022 top line by -3.0 percentage points and -1.5 percentage points, respectively.

In the next section I touch on whether Apple’s valuations have become more attractive after the year-to-date pull-back in its share price.

Is Apple Stock A Good Value Now?

Following the -25% decline in its stock price thus far this year, Apple’s consensus forward next twelve months’ normalized P/E multiple has compressed from its 2022 year-to-date peak of 31.9 times as of January 3, 2022, to 22.0 times as of June 22, as per S&P Capital IQ.

AAPL is currently trading at 22.0 times forward P/E, which is roughly on par with its five-year mean forward P/E multiple of 21.4 times. When the short-term headwinds (as discussed in the preceding section) eventually ease and the company manages to achieve a more optimal sales mix biased towards higher-margin services in the future, Apple should be able to trade at the high end of its five-year forward P/E valuation range (AAPL’s peak forward P/E multiple in the last five years was 36.6 times) again.

In conclusion, I think Apple’s stock is good value now, considering its historical valuations and future profitability outlook.

Is Apple Expected To Rise Again?

I am of the opinion that Apple’s stock price is expected to rise again in the short term.

According to JPMorgan’s (JPM) “Global Product Availability Lead Time Tracker” research report (not publicly available) published on June 19, 2022, the worldwide “lead times in general moderated for Mac and iPads” for the week ended June 17, 2022, which the JPM analysts highlight is “in line with the reopening in China.” Also, JPM’s recent research work found that the current lead times for AAPL’s other products such as the iPhone stayed low at below a week.

This is consistent with the findings from another bank’s research team. Morgan Stanley (MS) published its North American IT hardware “Monthly Data Tracker” report (not publicly available) on June 22, 2022, which noted that the lead time for the iPad decreased from 15 days as of June 9, 2022, to 14 days as of June 16, 2022. Similarly, the MS analysts’ research work suggests that the lead time for the MacBook Pro M1 declined from 62 days to 56 days over the same period.

In my view, an easing of supply chain constraints as evidenced by the improvement in lead times mentioned above should be a positive re-rating catalyst for Apple in the short term.

What Is The Long-Term Prediction For Apple Stock?

The key aspect of any long-term financial predictions for Apple is the potential improvement in the company’s profitability. As I discussed earlier in this article, a growing percentage of sales derived from higher-margin services should result in an expansion of Apple’s profit margins in the long run. Based on financial projections sourced from S&P Capital IQ, AAPL’s gross profit margin is forecasted to increase from 41.8% in fiscal 2021 to 43.5% by FY 2026.

The market’s expectations of increased services revenue contribution and improved profitability are reasonable. Apple has been putting in a huge amount of effort to make it easier for the company to cross-sell additional hardware devices and services to its iPhone users as seen with its recent press release.

On June 6, 2022, Apple revealed the features of its new operating system for the iPhone (iOS16), and also disclosed the introduction of two new laptops.

In this announcement, AAPL explained that certain “new features for Apple’s Macs and iPads are designed to make it easier to sync with the iPhone.” As an example, the iPhone can be utilized as “a webcam” for “video calls” on Macs going forward, as highlighted in an article published by The Verge on the same day of Apple’s announcement.

Separately, Apple’s new MacBook Air and MacBook Pro devices will come with Apple’s M2 chip. The company noted in the June 6, 2022, announcement that this is aligned with its goal of “helping people toggle from one Apple device to another.”

In summary, AAPL is moving in the right direction with new initiatives to enhance integration across the company’s various hardware products, which will increase user switching costs and boost cross-selling efforts (for other hardware devices and services). I predict that this should eventually lead to higher profit margins (consensus FY 2026 gross margin of 43.5%) and an expansion of valuation multiples (current forward P/E multiple of 22.0 times versus five-year P/E of 36.6 times) for Apple.

Is AAPL Stock A Buy, Sell, or Hold?

AAPL stock is a Buy. Apple’s current P/E valuations are undemanding, and there are both short-term catalysts (easing of supply chain constraints) and long-term drivers (profitability improvement) for the company’s shares.

Be the first to comment