Morsa Images/DigitalVision via Getty Images

NetApp (NASDAQ:NTAP) is a technology company focused primarily on delivering data management and enterprise storage solutions.

Shares have pulled back 23% year-to-date, suggesting that NTAP stock could be setting up as a potential buy-the-dip candidate. On top of that, with the recent stock price decline, NetApp is now selling for just 13 times forward earnings. Sounds interesting. There are some reasons for hesitation before taking a position, however. But first, let’s address the company’s most recent earnings report.

Did NetApp Beat Earnings?

Last Wednesday, NetApp reported its Q4 2022 earnings (the company uses a non-standard reporting calendar).

Though the company’s revenues merely were in-line with expectations, the company’s earnings per share topped the analyst consensus by a healthy margin.

Revenue growth of 7.7% year-over-year might not sound particularly compelling at first glance, but given that NetApp has struggled to grow the top line at all in recent years, this was a significant step in the right direction. Q4 billings also grew 16%, giving another hint at improving momentum for NetApp overall.

Still, it wasn’t enough to change NetApp’s overall picture. Shares moved up slightly after the earnings release, but quickly gave back those gains. NetApp would need to show a stronger outlook on the revenue growth front to really change the narrative around the company.

NetApp Key Metrics

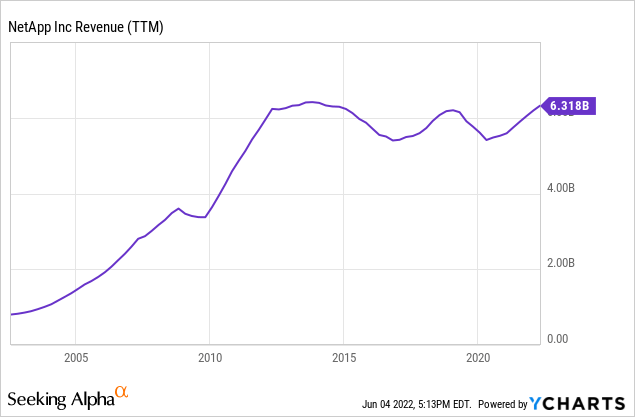

The big issue with NetApp is that, for a technology company, it has shown very little growth in recent years. Here’s the past two decades of NetApp’s annual revenues:

As you can see, NetApp was a highly successful growth company in the 2000s. However, around 2012, the company was no longer able to achieve much, if any growth. Revenues actually declined from 2013 on to 2021, and are only just now getting back to their peak levels from nearly a decade ago. After accounting for inflation, this looks even worse.

However, things aren’t as bleak as the top-line revenue picture would suggest. That’s because NetApp has been able to more than double earnings over the past decade despite the lack of any sales growth.

How’d NetApp pull this off? For one thing, NetApp has gradually boosted its gross margin from 59% to 66% in recent years. Improving the efficiency and profitability of a business is one way to do more with less, and a good chunk of those cost improvements have trickled through to the bottom line.

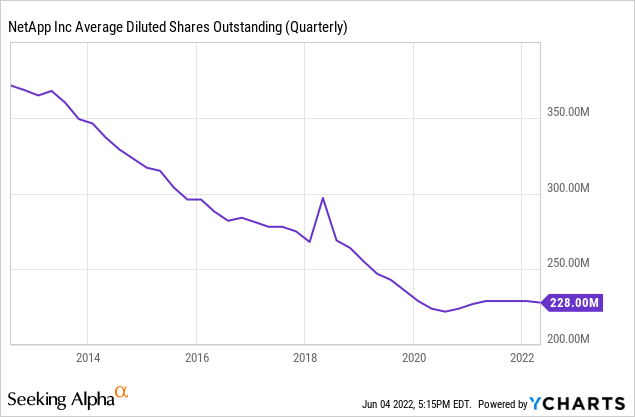

The other big factor for NetApp has been an exceptionally aggressive share buyback program. The results speak for themselves:

Since 2012, the company has gone from 370 million shares of stock outstanding to just 228 million now. This means that the company’s operating profit is split across 38% fewer shares than they were a decade ago. This has allowed NetApp to grow earnings per share rather dramatically despite the underlying business’ stagnation.

As the company noted in its earnings release, NetApp returned 86% of cash from operations and 106% of its free cash flow in fiscal 2022 to shareholders. In addition to the robust share buyback, NetApp also offers up a healthy 2.8% dividend yield at the current stock price.

So while NetApp hasn’t been able to grow its business’ total size, it is doing a good job focusing on returning the ample cash flow it generates back to shareholders.

Is NetApp Expected To Go Up?

NetApp’s dedication to shareholder returns is admirable. However, there’s still the core problem that the business is merely maintaining its existing ground.

NetApp’s core data storage and management services operate in a mature market. Enterprises have long had on-premise data storage solutions in place, so NetApp doesn’t have many new markets to penetrate there. It can merely grow the business slowly via price hikes or taking market share from other legacy peers.

Meanwhile, the cloud looms as a long-term threat. Many enterprises will never turn to cloud storage due to pricing or data security concerns. However, at the margins, some businesses will choose to store much of their data in the public cloud, thus reducing the market opportunity for on-premise and private cloud providers such as NetApp.

NetApp isn’t taking the cloud threat lying down. It has generated solutions such as multi-site storage to allow customers to keep some data in public clouds and some on private solutions traditionally offered by NetApp.

Traditional storage isn’t a fast-growing market, nor is it a high-moat one. NetApp has to compete against a good deal of legacy players such as Hewlett Packard Enterprise (HPE), Pure Storage (PSTG), Dell Technologies (DELL) and many others in addition to the growing SaaS-based competitors.

There’s no reason to think that NetApp will see its business quickly erode. Enterprises tend to stick with legacy solutions for a great deal longer than analysts might expect. Still, competitive trends are not moving in NetApp’s direction.

And a 13x P/E, while optically cheap, isn’t really that cheap for a stagnant to slightly declining business. It’s a 7.7% earnings yield, but with little expectation of earnings increases beyond what can be generated through share buybacks. If you start at an 8% earnings yield and earnings drop a modest three percent a year annualized, for example, you end up with a pretty lackluster total compounded return. This is the classic “value trap” you often see at firms with low P/E ratios selling mature technology products or services.

I’m not the only one concerned about a potential value trap at NetApp. Following the most recent earnings report, Morningstar’s Mark Cash reiterated his view that NTAP stock is only worth $60 per share, suggesting 15% downside from the current share price. Cash assumes 4% annualized revenue growth for NetApp going forward. That would be a significant improvement versus its performance over the past decade. Even starting from that premise, however, Cash’s free cash flow analysis arrives at a price target of just $60 for NTAP stock.

Is NetApp Stock A Buy, Sell, Or Hold?

Tech companies such as NetApp are appealing to some investors. They screen as cheap on an earnings, cash flow, and price-to-sales basis. With so many tech companies tending to look overvalued on traditional valuation metrics, something like NetApp might seem like a diamond in the rough.

The problem is, however, that NetApp isn’t really a growth company. Thus, it’s more of a utility specialized in data storage, and deserves a much lower corresponding valuation. And unlike other types of commodity service providers, the underlying technology in NetApp’s business still can change fairly quickly, meaning that the company can outright lose revenues if it isn’t able to adapt to changing market conditions.

I’m not as negative as Morningstar’s Cash. I see shares as reasonably priced at $71. That said, this is the sort of company that can easily stay at 12-14x earnings for an extended period and generate fairly underwhelming total returns. As such, shares merit a hold. There’s likely not too much serious downside risk from here. But management will either need to find new growth avenues or make expert capital allocation decisions to unlock much additional shareholder value.

Be the first to comment