META: To Infinity or To Extinction

Lemon_tm/iStock via Getty Images

Is META a bad investment?

Year to date, Facebook (NASDAQ:META) has declined 50% in value from a share price of $338 to $170.

Sure, the entire market is down, but the S&P500 (SPX) is only down 18% from 4,796 to 3,912.

So why has Facebook fallen so much further than the broader market?

I’ve been discussing this with a number of investment professional and I have compiled my findings in this short article.

META breaks its business down into two parts. FoA (Family of Apps) and RL (Reality Labs):

-

Family of Apps includes Facebook, Instagram and WhatsApp

-

Reality Labs produces virtual reality and augmented reality hardware and software, including virtual reality headsets such as Quest and Oculus. It has Spark AR, Facebook’s augmented reality team, and Portal, Facebook’s video conferencing smart screen device. The final piece of the jigsaw is its “metaverse” platforms such as Horizon Worlds.

Clearly Mark Zuckerberg, founder and CEO, sees the future in RL which is why he changed the name of his business from Facebook (the FoA part of the business) to META (the RL part of the business) last year.

Why would he do this? Well, some might argue that FoA is in a state of terminal decline and Zuckerberg recognises that.

Is FoA In Decline?

In Q1 of 2022, META reported 2.87 billion daily active users of at least one of the company’s core products (Facebook, WhatsApp, Instagram, or Messenger). If this is true, it has one in every three people on the planet using its FoA products.

Is that likely? Consider this:

-

According to World Bank figures, in 2021 an estimated 3.3 billion people (40% of the global population) were living in poverty on less than $5.50 a day. It is highly unlikely that these people were spending their time on social media. They are unlikely to have access to the requisite tech to access FoA products.

-

9% of the global population are over 65 years of age and almost another 9% of the global population is made up of infants and toddlers. That’s close to 20% unlikely to be using FoA products daily.

-

China, the most populous country on the planet, doesn’t use Facebook. Its equivalent is WeChat which has 1.2 billion active users (approximately 15% of the world’s population).

Against this backdrop is the META data reliable? The bullets above suggest that around 60% of people on the planet don’t use FoA products, which means that META has pretty much all of the remainder as users. Is that feasible?

For me, the jury is out, but I’ll leave you to make up your own mind.

Either way, it would almost be better for the company if there were less active daily users because that would give it scope to grow. If we take the company at its word and assume that one in three people on the planet uses its products daily and we have seen that a large percentage is certainly outside of its TAM (target addressable market), then we need to conclude that there is very little or no room for it to grow FoA from here.

In reality META is coming up against the law of diminishing returns due to size. When it had 100 million users, it if added another 100 million users then it doubled (100% growth). Today if it were able to add 100 million users it would only see 3.5% growth. So the same achievement results in a far smaller return in terms of valuation uplift for shareholders.

The most likely scenario from here is that it loses market share in its FoA business segment.

The last twenty years saw the birth and the evolution of internet based social networking. In the beginning there was little competition and so all age cohorts co-existed on the same platform owned by the same company. That happened to be Facebook.

The attractive returns of the early entrants in this space attracted plenty of competition. Now we are witnessing a real fragmentation in terms of users. Children of the baby boomers typically still use Facebook, possibly because it is increasingly more difficult to teach an old dog new tricks. Meanwhile, Millennials wouldn’t be caught dead using the same technology as their parents and so have moved to using Instagram, Pinterest and Snapchat instead. Finally the Gen Z generation are spending more time on TikTok. Sure, there will be some overlap but each generation dominates a particular platform. This cycle is highly likely to continue.

META can replicate or introduce new features which, combined with its current distribution and network effect, ought to enable it to maintain usage by the current generations that use it. However, attracting other generations and providing them with an incentive to move from the hip new app will be difficult if not impossible. Accordingly, attrition is inevitable.

At the same time, people interested in furthering their careers spend a great deal of time on LinkedIn and those that want to share ideas and be at the forefront of breaking news favour Twitter (TWTR). So Facebook has increasing competition for user engagement amongst its existing user base from these other platforms.

A probable decline in user numbers combined with lower user engagement from those that remain on the platform is not good for revenues or profitability.

All of this to say that the pie that Facebook used to have to itself is now being carved up between a greater number of competitors and so it is almost inconceivable that META’s share of the market will not decline over time.

I imagine that this problem is what keeps Mark Zuckerberg awake at night.

One solution to this problem being attempted by META is to strive to build organic new apps to cater for other generations and user groups. META’s New Product Experimentation (NPE) team has been assembled to do exactly that, but it isn’t easy. Zuckerberg won the lottery once with Facebook by being in the right place at the right time. Winning the lottery for a second time is far less probable.

Zuckerberg also has to contend with a number of other operational issues including:

-

A very zealous regulatory environment creating operational challenges

-

Apple (AAPL) is going to cost META upwards of $10 billion due to the iOS 14 privacy features called App Tracking Transparency

-

A recession on the horizon which will see a decline in discretionary spending (read advertising revenue).

This is almost certainly the reason that Zuckerberg has attempted a pivot to the RL segment including a name change from Facebook to META to underscore the new game plan.

The list of problems with this new plan, and there are many, is topped by the fact that it is incredibly speculative relative to the capital being deployed by the group in pursuing it.

The greatest long term entrepreneurs and business leaders (Buffett, Malone, Singleton, etc) focus on risk adjusted returns. That means keeping risk contained while growing earnings. More particularly, they take calculated risk, manage the risk away and in so doing they convert an opportunity into tangible value.

That is not the case with Zuckerberg. He is deploying almost a scatter-gun approach in the hope of hitting something rather than using a sniper rifle to aim at something in particular. This is uncalculated risk and very dangerous for an investor. It verges on speculation rather than intelligent capital allocation.

Additionally, the Metaverse is a virtual world concept that originated from the 1990s novel Snow Crash by Neal Stephenson. If something like that ever comes into being then it will exist as an infrastructure used by everyone but owned by no-one, just like the internet today.

The fact that Zuckerberg has attempted to claim the Metaverse for himself by way of company name change appears to evidence a vulgar level of arrogance combined with a large dose of naivety. The one thing that Zuckerberg would have achieved by claiming the name META is that if a virtual world comes into existence it will be called anything but the Metaverse because other businesses will not acquiesce in Zuckerberg claiming any kind of ownership. Zuckerberg is surfing in dangerous waters and it could go horribly wrong.

What should META be doing differently?

In my humble opinion there are two wonderful opportunities for META. I shall explain my thoughts on both:

1. Entrenching its share of the social media market

Facebook and Instagram rely on users generating lots of engaging content for friends and family. In truth, people like to create content based on their interests and expertise, something not usually shared with friends and family. Instead they like to create content for like minded strangers. Zuckerberg’s nod to this fact was his attempt to launch the app named Blue. Unfortunately that failed.

Wouldn’t it have made more sense to simply acquire Twitter which has that segment of the market sown up?

Ignoring the overvaluation ascribed by Elon Musk’s bid for Twitter (something that he is seemingly trying to escape from), the current market cap of Twitter is $30bn and its intrinsic value, I believe, is closer to $20bn which is probably where it will be if Musk pulls out of the deal (see: Can Twitter Stock Rebound To $50? (NYSE:TWTR)).

If you consider that Zuckerberg is pumping $10bn – $13bn per year into speculative projects, wouldn’t it make more sense for him to use that money to acquire Twitter and to monetize the opportunity that Jack Dorsey squandered?

Zuckerberg has previously described Twitter as the “Clown Car in the Gold Mine“. He clearly sees the opportunity, so why not take it?

META has the social media advertising infrastructure that would make a Twitter acquisition a simple plug and play. Twitter ARPU would immediately increase. The operational leverage of the Twitter business would improve markedly and the bottom line would swell. Twitter has approximately 220m daily active users with a two year target to hit 315m. Facebook could use its network effect to channel some of its nearly 3 billion daily users towards Twitter and so achieve that target early. Facebook would see an immediate return, not only on investment from a cash flow perspective, but also on a valuation basis. This would enhance the value of the META group.

Twitter is a well established social media platform which dominates a niche in which META has no real presence. In other words, Twitter is worth more to Facebook than it is to any other person or enterprise on the planet. It seems like a no-brainer and certainly a better allocation of capital than the options being chosen by META at present.

2. Investing in Metaverse Verticals

The other thing that META ought to do is to think outside of the box. If Zuckerberg wants to capitalize on a forthcoming virtual world there are better ways of doing it than changing the name of the company and investing in virtual reality headsets.

The virtual world already exists in the gaming sector (just play Call of Duty, Grand Theft Auto or Uncharted and you’ll see what I mean). That technology is now being applied commercially and will soon extend to the social media space.

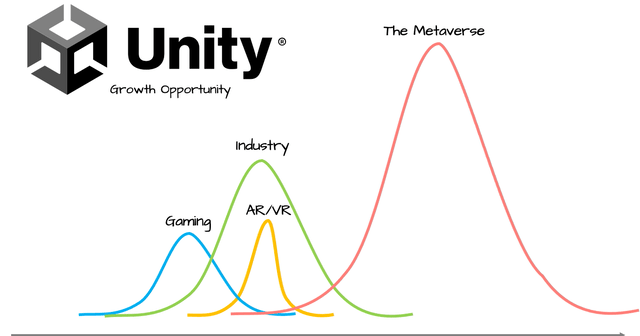

The virtual world, that you may call the Metaverse, is essentially achieved via powerful graphics engines that simulate the real world.

Two companies dominate the virtual graphics industry: EPIC Games with its Unreal Engine and Unity Software Inc (U) with an entire suite of Unity developer tools. If the Metaverse, or whatever it may be called, comes into being then it will be built principally with the tools provided by these two companies.

The Metaverse Exists Today, Unity Is At Its Core (Unity Software)

The Metaverse Exists Today, Unity Is At Its Core (Unity Software Inc)

EPIC Games is not a publicly traded company and so if you want exposure to EPIC then the best way to do that is to invest in Tencent Holdings (OTCPK:TCEHY) which owns 40% of EPIC.

However, Unity Software is listed on the NYSE and you can gain direct exposure to that, currently at a very attractive valuation (a subject for a future article that I may publish). In any event, the market cap of Unity is $13bn. So why doesn’t META just buy that instead of pumping $13bn a year into a speculative black hole?

Not convinced? How about this. If META succeeds in the virtual reality and augmented reality space, who do you think will be generating the graphics? Not META! It has no expertise in this very specialist field. So the graphics that it needs will become a cost line item on its income statement. Why not borrow from the Jeff Bezos playbook and turn cost line items into revenue streams (this is why Bezos established AWS in 2006)? META could do that with Unity.

Still not convinced? How about this. The Unity game engine is used by more than 2.8 billion monthly active users who play games or use apps with graphics powered by it. Compare the Unity 2.8 billion users to Facebook’s 2.9 billion active users. Now consider this, the total addressable market for gaming is estimated to exceed 4 billion active users and Unity serves nearly 70% of game developers, it is moving into other industries including architecture and automotive design, it is applying its expertise in the movie industry plus, as already stated, it will be a foundational building block of the Metaverse. It has such a long runway ahead of it that it will almost certainly see better success than Adobe (ADBE) (and we all know how successful that business has been). There is no reason to believe that the value of Unity should not surpass the market cap of META and it could eventually become a trillion dollar company in its own right, but it is available today for a mere $13bn (the same as META’s annual speculative RL investment).

Gaming Today, Metaverse Tomorrow (The Operator, Tyler Okland)

Gaming Today, Metaverse Tomorrow (The Operator, Tyler Okland)

If META were to buy Twitter and Unity, the intellectual property that it acquires would become on balance-sheet assets which could be amortized over several years which means that the bottom line swells far more quickly. Greater earnings means a stronger share price (Wall Street is still obsessed with EPS and earnings multiples decades after John Malone demonstrated that there is a better way!) Accordingly, these investments are the best options for shareholders.

If I were Zuckerberg I know what I would do! Buy them both and cement the dominance of the META business for decades to come.

The moral of the story is when organic growth has been exhausted, grow by way of acquisition instead!

META did it with Instagram and it did it with WhatsApp, so why not Twitter? It’s a great fit. In fact, it makes more sense than the acquisition of WhatsApp which seems to generate zero revenue for the group.

Is META a good investment?

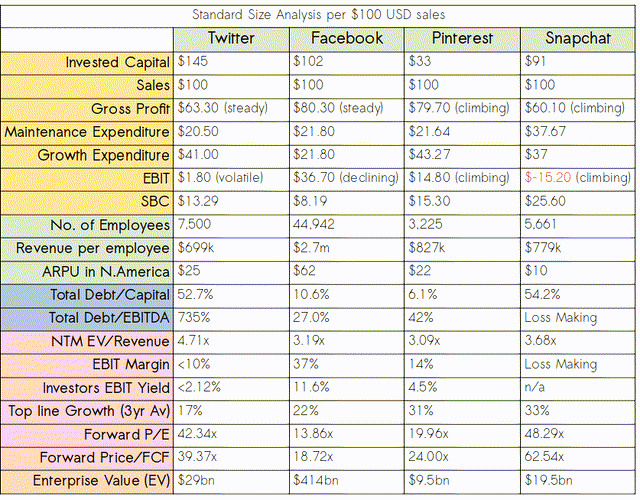

Here is a side by side analysis on a standard size basis that demonstrates that Facebook is far superior to its competitors.

Standard Size Sid-by-Side Analysis Twitter Facebook Pinterest and Snapchat (Author)

For a full explanation of the data on this table, please see my previously mentioned Twitter article: Can Twitter Stock Rebound To $50?

However, a quick summary is that amongst its peers META has the cleanest balance sheet, the highest revenue per employee, the best ARPU by a significant order of magnitude and the best profit margins. It is also less profligate than its competitors in terms of diluting shareholders through the grants of Stock Based Compensation, which is a big bonus. But it trades on the lowest multiple of earnings and of FCF.

Does that make it cheap?

Or is that a reflection that all of these other platforms have a great deal of growth ahead of them while META has hit a saturation point? For a company of its size (one third of the planet are active users) it is astounding that top line growth continues at 22%. If this is sustainable then its current valuation is too low. However, if it is unsustainable, if user numbers decline, if ARPU declines and if advertising revenue and margins fall due to recession or otherwise, then it may turn in to a value trap.

If you look at the numbers that Twitter is achieving and then consider what those numbers might look like if META were to acquire Twitter, you will instantly see that there is great deal of scope for margin expansion, ARPU expansion and daily users expansion at Twitter. Those factors all have a multiplicative effect.

Conclusion

In conclusion, META could go one of two ways from here and its fortunes very much depend upon the decisions of Mark Zuckerberg and his C-Suite. There are fantastic opportunities out there for this business to evolve but those involve acquisitions rather than speculative organic growth.

No matter how large something is, it if fails to evolve to its new environment it will eventually die. Facebook could become another extinct dinosaur if it gets this wrong.

Whether META is a buy, sell or hold is largely dependent upon which way Zuckerberg goes from here. If he were to acquire Twitter and Unity I would have strong long term conviction in taking a sizeable position. If he continues with the scatter-gun approach and sees FoA attrition without the generation of positive earnings from the RL segment then I would avoid at all costs. Being torn between the two, I’ll simply stay out and watch for now.

Be the first to comment