Chinnapong/iStock Editorial via Getty Images

Elevator Pitch

I have a Hold or Neutral investment rating for Marathon Digital Holdings, Inc’s (NASDAQ:MARA) shares. MARA offers good exposure to crypto as a proxy stock for the listed bitcoin miner space, and its current valuations seem appealing. But there are execution risks associated with the company’s ability to ramp up its mining operations, and stiffer-than-expected competition could increase the network hash rate and lower future revenues. In comparison, owning bitcoin directly is more straightforward if one has a positive view of future bitcoin prices.

What Is Marathon Digital Holdings?

Marathon Digital Holdings describes itself as “a digital asset technology company that mines cryptocurrencies, with a focus on the blockchain ecosystem and the generation of digital assets” on its investor relations website.

It is worthy to note that although MARA was first established in 2010, the company only made a significant pivot to grow its cryptocurrency mining operations in 2020. Marathon Digital noted in its March 2022 investor presentation slides that 2020 was the year where it began “upgrading mining portfolio with next generation miners.” Furthermore, MARA only changed its corporate name from “Marathon Patent Group” to “Marathon Digital” on March 1, 2021, which is a reflection of the company’s formal shift away from its prior focus on its legacy intellectual property licensing business.

I touch on how Marathon Digital is related to cryptocurrencies in the next section.

How Is MARA Related To Crypto?

MARA is related to crypto in two key ways.

Firstly, Marathon Digital is a leading bitcoin miner.

A January 28, 2022 Barron’s article cited a research report from Jefferies (JEF) which suggested that Marathon Digital “was on pace to become the largest public miner in 2022.” Notably, MARA also refers to itself as “one of the largest enterprise Bitcoin self-mining companies” in the US in its media releases. MARA’s market leadership in the bitcoin mining space is backed up by the size of its mining fleet. On its investor relations website, Marathon Digital revealed that it is “on-track to deploy (a significant) 133,000 miners” by the middle of this year.

Secondly, MARA disclosed that it has 8,956 Bitcoin (BTC-USD) on its books as of the end of February 2022. Based on BTC’s price of approximately $44,718 at the time of writing, Marathon Digital’s current bitcoin holdings are worth around $400 million or close to 14% of the stock’s current market capitalization.

MARA Stock Key Metrics

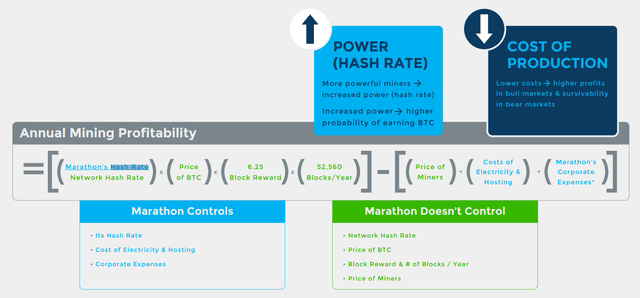

The key metrics for MARA (and other bitcoin miners as well) are bitcoin price and the company hash rate-to-network hash rate ratio, which are the key drivers of the company’s future revenue as per the chart below.

Factors Affecting Bitcoin Miners’ Revenue And Profits

MARA’s March 2022 Investor Presentation

The price of bitcoin is influenced by multiple market factors and it is challenging to predict the future price fluctuations for the cryptocurrency. As such, the hash rate ratio is the most critical operating metric for Marathon Digital. In its FY 2021 10-K filing, MARA defines “hash” and “hash rate” as “the computation run by mining hardware in support of the blockchain” and “the rate at which it is capable of solving such computations”, respectively.

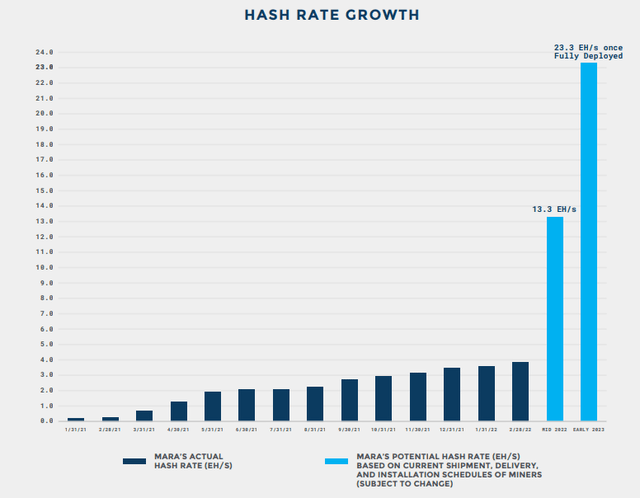

Marathon Digital’s Historical And Expected Hash Rates

MARA’s March 2022 Investor Presentation

MARA targets to increase its hash rate from 3.8 EH/s (exahash per second) as of February 2022 to 13.3 EH/s and 23.3 EH/s by mid-2022 and early-2023, respectively. This will be dependent on Marathon Digital’s ability to grow its mining fleet from 35,510 miners deployed in February 2022 to 133,000 in the middle of this year and 199,000 by early next year. If successful, MARA is expected to reach a daily production rate of 57.7 BTC (compared with 15.6 BTC daily production rate in December 2021) and achieve a company hash rate-to-network hash ratio of 7% (versus 2% as of end-2021) in the early part of 2023.

Marathon Digital Stock Fundamental & Technical Analysis

I will carry out fundamental and technical analysis for Marathon Digital’s shares to evaluate its attractiveness as a potential investment candidate now.

Peer Valuation Comparison For Marathon Digital

| Stock | Consensus Forward Next Twelve Months’ Price-to-Sales Multiple | Consensus Forward Next Twelve Months’ EV/EBITDA Multiple |

| Marathon Digital | 5.0 | 7.2 |

| Riot Blockchain (RIOT) | 5.3 | 8.8 |

| HIVE Blockchain Technologies Ltd.(HIVE) | 4.3 | 4.6 |

| Hut 8 Mining Corp. (HUT) | 4.3 | 7.8 |

| Core Scientific, Inc. (CORZ) | 2.5 | 5.8 |

| Argo Blockchain plc (ARBK) | 2.5 | 3.8 |

| Stronghold Digital Mining, Inc. (SDIG) | 0.7 | 2.1 |

Source: S&P Capital IQ

Marathon Digital’s forward price-to-sales and EV/EBITDA valuations don’t seem very demanding on an absolute basis, given that its shares have already corrected by -42% in the past one year. On a relative basis, MARA and RIOT trade at a premium to most of their peers, and this is justified based on the fact that these two companies are the two largest players in the cryptocurrency mining space in terms of revenue as per S&P Capital IQ data.

That said, MARA’s future revenue and earnings are heavily dependent on the price of bitcoin and the hash rate ratio as discussed above.

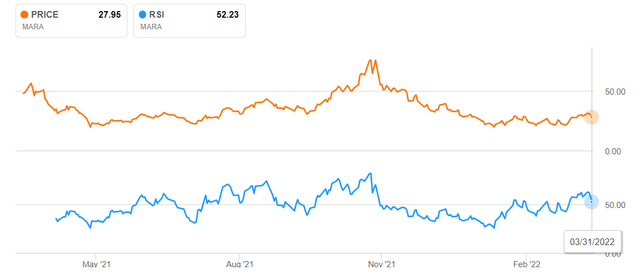

The Relative Strength Indicator Or RSI For MARA

Seeking Alpha

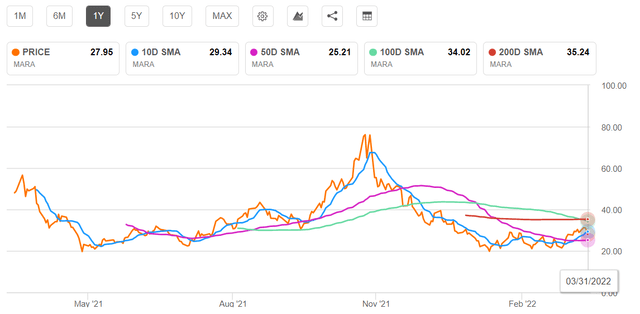

The Simple Moving Average Or SMA Indicators For MARA

Seeking Alpha

Moving on to technical analysis, Marathon Digital’s RSI was 52 as of March 31, 2022. Using simple rules of thumb indicating that a RSI of 30 and below indicates that shares could be oversold and a RSI of 70 or above suggesting that shares might be overbought, MARA’s current RSI offers no clear indication of future price direction. In terms of simple moving average or SMA indicators, MARA’s stock price is above the 50-day MA, but below the 200-day MA. This points to a long-term downward trend with a possibility of upward price movements in the near term.

For investors seeking to gain exposure to cryptocurrencies with listed companies, fundamental analysis and valuations should take precedence over technical analysis, although the latter could offer suggestions on potential entry points and purchase timing.

MARA Stock Long-Term Prediction

Market consensus’ forecasts suggest MARA’s revenue will increase by +285% and +119% to $579 million and $1.27 billion in FY 2022 and FY 2023, respectively. Only a single sell-side analyst (of the five analysts covering the stock) provides longer-term top line estimates for Marathon Digital and he or she sees MARA’s revenue expanding further by +26% and +22% to $1.61 billion and $1.96 billion for FY 2024 and FY 2025, respectively.

It is hard to determine if these long-term revenue growth expectations for MARA are fair.

Marathon Digital’s own hash rate is dependent on the company increasing the number of miners deployed in the future, and there are execution risks that might result in the company generating lower-than-expected revenue.

Another key factor is the network hash rate. As I mentioned earlier in this article, MARA’s revenue is influenced by the company hash rate-to network hash rate ratio. A February 7, 2022 research report (not publicly available) published by D. A. Davidson & Co found that “competition (i.e. a growing number of miners joined the network to mine bitcoin) has increased the network hash rate by 30%” between October 2021 and February 2022. In other words, the network hash rate is a function of supply, and an over-supply of bitcoin miners will lead to a higher network hash rate and weaker-than-expected top line expansion for MARA in the future.

Is MARA Stock A Buy, Sell, or Hold?

MARA stock is a Hold. I am of the opinion that buying cryptocurrencies directly is preferred to investing in listed crypto miners, assuming one has a favorable view of future cryptocurrency prices.

Be the first to comment