martiapunts/iStock via Getty Images

Investment Thesis

Lemonade (NYSE:LMND) is a ~$1 billion company that’s trying to disrupt a multi-trillion dollar industry. Unfortunately, the company has had to deal with both high inflation and the Texas Freeze since company public, and this has resulted in loss ratios getting worse & the company’s shares getting whacked.

Yet it’s worth highlighting that Lemonade operates within a recession-proof industry, although it is negatively impacted by inflation in the short-term. Everybody needs insurance, recession or no recession, so does that make Lemonade a solid investment in today’s environment? I put it through my investing framework to find out.

Lemonade Business Overview

Lemonade is an AI-driven insurance company, with a mission to “Harness technology and social impact to be the world’s most loved insurance company”. Using its AI chatbots, Lemonade can approve insurance claims in minutes and grant insurance policies in seconds.

The company initially focused on renters insurance, but now it offers homeowners, pet, life, and recently moved into the lucrative car insurance market, bolstered by the recent acquisition of Metromile (MILE) which is set to close in Q2. Lemonade has grown rapidly, going from ~729,000 customers two years ago to just over 1.5 million today.

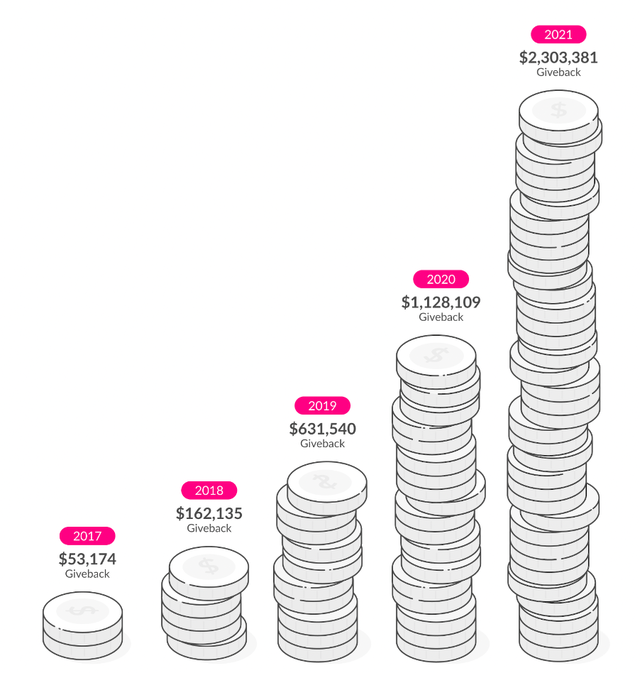

It also has a different business model to classic insurance companies; Lemonade takes a fixed fee of 25% of premiums and passes the remaining 75% to reinsurers. At the end of each year, whatever is left over from that 75% is donated to charities chosen by Lemonade customers.

Lemonade.com

For me, the most important question to ask about Lemonade’s business is “does their AI actually work, and does it underwrite insurance policies in a more accurate way than traditional insurers?”. As with any company using artificial intelligence, it’s often a ‘black box’ that is near-on impossible to judge from the outside, but there are metrics that investors can monitor in order to gauge its effectiveness.

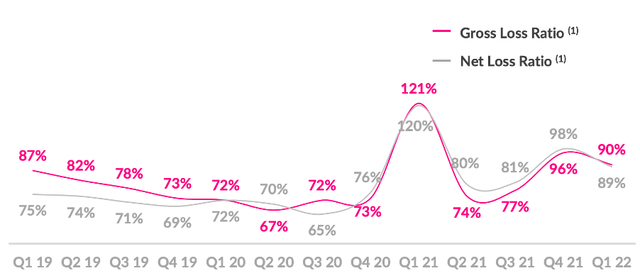

One such metric for Lemonade is their gross loss ratio, which is calculated as the amount paid out as claims divided by the total premiums received. Whilst I am glad that we have this information available to monitor the effectiveness of Lemonade’s AI, I’m less pleased by the results:

Lemonade Q1’22 Shareholder Letter

Lemonade’s targeted gross loss ratio is below 75%, and if we just look at the left-hand side of this chart, we would be very impressed. A gradual downward trend is a great sign, and implies that the AI is learning and improving – unfortunately, there’s the right-hand side of this graph that paints a very different picture.

Firstly, let’s take a look at that massive spike in Q1’21. This was driven primarily by the Texas Freeze (Lemonade was quite concentrated in Texas at the time), a one-off event resulting in an elevated number of claims that caused gross loss ratios to spike. On the plus side, because Lemonade passes through 75% of claims to reinsurers, they were less financially impacted by this event.

But as you can see, the downtrend stopped as gross loss ratios hit 96% and 90% in Q4’21 and Q1’22 respectively. There are two reasons given for this: inflation, and a change in the product mix.

Starting with inflation, it’s important to note that the premiums received from customers cover the year ahead, but if prices rise during the year due to inflation, then the cost of paying out claims will rise for Lemonade. But, the price of premiums charged to customers won’t increase until they get renewed the following year – hence an increase in the value of claims without the offsetting increase in higher premiums, and a higher gross loss ratio.

The product mix is also bound to impact Lemonade, as customers continue to take up their newer policies such as pet, life, and car. As with any artificial intelligence or machine learning technology, it needs more data in order to improve. As a result, new products mean that Lemonade’s AI has a lot of new data to learn from, and so the AI is going to be less effective at underwriting policies when the products first launch. It’s also worth mentioning the following quote from Co-Founder and Co-CEO Shai Wininger, where he talks about the fact that they are expecting a substantial gross loss ratio improvement soon:

We’re now using our fifth generation of machine-learning LTV prediction models, and these provide an ever-improving estimate of the loss ratio of each new customer, as well as their likelihood to churn or cross-sell. The combination of these factors supports our real-time view of customer lifetime value. Despite a 90% gross loss ratio for the quarter, these efforts show that the business we generated in Q1 is expected to have a lifetime loss ratio comfortably within our 75% gross loss ratio target. As we’ve spoken about before, loss ratios are lagging indicators, and changes in pricing, underwriting and segmentation take time to develop and then get approved through regulatory filings and yet more time to earn in.

Clearly there are some concerns here, but if management are to be believed then things will start improving. Perhaps this goes some way to explaining why Lemonade shares are down almost 90% from their all-time high! However, I think that if they can get these gross loss ratios under control and come up with a better, technology-driven way of underwriting policies, then there is a lot to like about their business model.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition. Perhaps surprisingly, I believe that Lemonade has quite a few economic moats, with the caveat that all of this is pointless if their AI doesn’t work.

The first economic moat I see here relates to switching costs, and there are a couple of reasons for this. The fact that Lemonade offers a multitude of different products (renters / homeowners, pet, life, car) means that an individual could have many different policies with Lemonade, and as long as they are happy with the service and the price, they are unlikely to switch. In fact, in states such as Illinois where all 4 Lemonade policies are available to bundle, the Annual Dollar Retention rose to 90% in Q1’22 compared with 82% for Lemonade overall.

I also believe that there are switching costs due to the completely different approach Lemonade takes to insurance. As someone who sits somewhere between a Millennial and Gen-Z, the idea of being able to obtain insurance in minutes through an app on my phone is very appealing. Once I’ve done this once, I won’t be in any rush to go through a more time consuming, painstaking ‘traditional’ route.

Lemonade also benefits from counter-positioning, which is when your business model would actually hurt your competitors should they choose to adopt it. Firstly, I think the current dinosaurs (sorry, I mean incumbents) would struggle to adopt a data-driven approach to insurance, but that’s not actually the economic moat here.

One of the ways in which traditional insurance companies make their money is by keeping hold of excess premiums, which disincentivises them from paying out claims. Lemonade, on the other hand, has the approach of paying any excess claims above a certain level to charity, meaning that Lemonade has no financial incentive to keep as many premiums as possible. This removes the conflict of interest between Lemonade and their customers that exists with existing insurers, who would take a big hit to their top and bottom line if they switched to this business model.

Lemonade also benefits from a weak network effect related to their artificial intelligence. As the company acquires more customers, they obtain more data which allows the AI to learn and (in theory) more effectively underwrite policies. As Lemonade gets better at underwriting more policies, it should be able to draw in more customers as it improves its accuracy and experience, and more customers give the AI more data to learn from. It’s a weak network effect, and I’m still somewhat sceptical, but it is there nonetheless.

Another moat that is weak but growing quickly relates to its brand. Insurance companies are not exactly the most loved businesses in the world, but Lemonade is trying to change this – and appears to be succeeding. The following extract from an article on Smart Company sums it up:

Customers absolutely love it. In a category where the average net promoter score (NPS) is under 20, Lemonade’s is an astounding 70. In fact, customers love it so much that an estimated 5% of policyholders returned the money they received after making a claim, when a lost or stolen item was subsequently found.

Whilst it is still growing & the brand is not global or instantly recognisable, there is no doubt that Lemonade has succeeded in delighting customers. They are on the right path to having one of the strongest brands out there, but this moat needs more time to grow.

Outlook

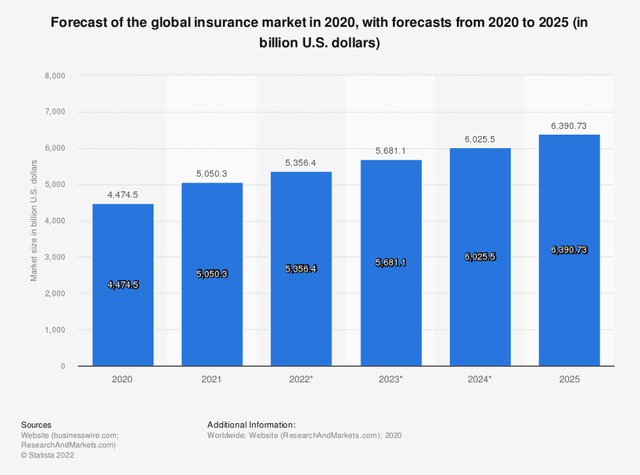

Lemonade is still a very young company, and so outlook is key. Clearly there is a lot of room for Lemonade to grow, as it’s currently a ~$1 billion company operating in an industry that is forecasted to be worth more than $6 trillion by 2025 according to Statista. To put that into perspective, Lemonade’s current in-force premium is less than 0.01% of the estimate size of the global insurance market in 2025.

I do also believe that this approach to insurance will be much more appealing to the tech-savvy generations, and if executed successfully, could be one of the largest disruptions we see this century.

Management

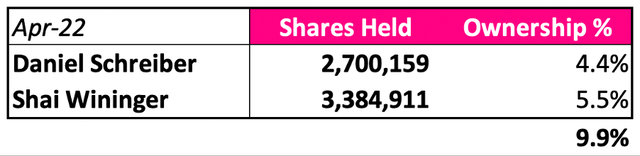

When it comes to fast-paced, disruptive companies, I always aim to find founder-led businesses where insider ownership is high, and Lemonade ticks this box for me. The two Co-Founders are CEO & Board Chairman Daniel Schreiber and Co-CEO Shai Wininger, who also founded Fiverr (FVRR), another company I’m a big fan of.

I always like to see insider ownership from management, a level of skin in the game, and we do see that here with Lemonade, as the two Co-Founders own just under 10% of all shares outstanding as of 14th April 2022.

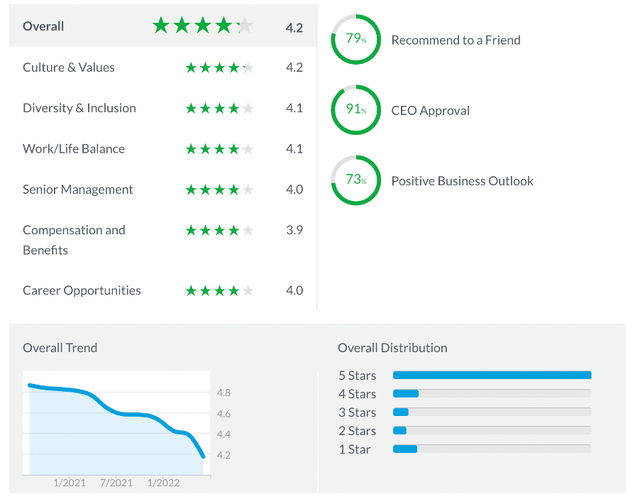

I also like to have a quick look on Glassdoor to get an idea about the culture of a company, and Lemonade gets some great scores from its 317 reviews. Any score over 4.0 is impressive, and Lemonade achieves this almost across the board – with a particularly high score in Culture & Values, which helps create a great work environment that is key for a mission-led business such as Lemonade.

I will, however, call out one negative. These scores used to be insane, I mean the best Glassdoor scores I’d ever seen – ratings above 4.5 across the board. I’ve left in the overall trend in the bottom left-hand corner, and things have been going south recently. This could be driven by poor share price performance (sad times for employees holding stock options) or any shake-up driven by the Metromile acquisition, but I don’t like to see the culture of a company appearing to deteriorate this rapidly – still good scores, but something to keep an eye on.

Financials

I won’t sugar coat it – the financials of this company are difficult to wrap your head around, unless perhaps you specialise in insurance companies (which I do not). Just to make matters more fun, Lemonade changed the way that it calculates revenue about a year or so ago, so looking at long term trends is even less useful.

That said, let’s take a look at some of the key financial metrics.

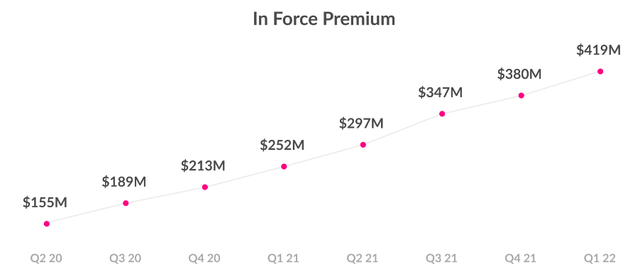

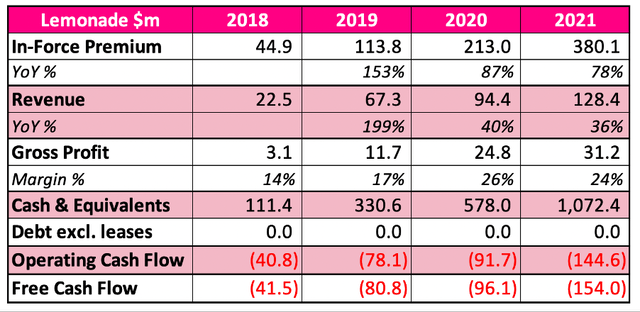

In Force Premium refers to the annualised premiums for customers as of the period end date, and demonstrates how much money customers are spending with Lemonade. The good news is that the IFP is increasing rapidly, with an impressive 78% YoY growth in 2021 following two years of 153% and 87% YoY growth. Whilst there are several metrics that don’t particularly impress me, this rapid IFP growth is certainly a big positive.

Lemonade Q1’22 Shareholder Letter

As mentioned, Lemonade’s financials are complex – and they changed the calculations for revenue and gross profit, meaning that the 36% YoY growth in 2021 is extremely skewed. Personally, I am focusing on the IFP growth and the gross loss ratios for now, as they give a much clearer view of how the business itself is performing.

Lemonade is also burning cash, and it is burning cash fast. The accumulated FCF burn over the past 4 years is $372.4m, and there is no sign in this easing up. On the plus side, Lemonade has $1,072m in cash and investments – so there is certainly no risk of liquidity issues in the next few years, and CEO Daniel Schreiber indicated in the Q1’22 results call that Lemonade’s losses may peak soon:

So that’s really the way we view the path toward profitability. It will emerge. As we turn this corner, we hit peak losses in the not-too-distant future, and then you will see these effects compounding all the way down to profitability

Valuation

Unsurprisingly, given the huge industry and Lemonade’s potential within it, combined with heavy losses and complex financials, this is a tough company to try and value.

I’ll take a very basic approach: Lemonade currently has a net cash position of $1,072m and a market capitalisation of $1,080m – so the company is essentially trading at net cash.

Clearly if the business succeeds, it’s currently undervalued, and if the business does crash and burn and fail, then any price is too expensive. Frankly, I do not think valuation matters one bit for Lemonade at the current level; it is all about whether or not the business itself succeeds.

Summary

It’s clear that an investment in Lemonade is not for the faint hearted, and this is a business that still has an awful lot to prove to investors. The combination of its high cash burn and the worsening loss ratios have left investors at a bit of an impasse: this is a company with a huge opportunity, but do we trust in its ability to execute on its plans?

This is a decision that each individual investor must make for themselves. Anyone who chooses to invest in Lemonade right now must not be surprised if the company fails, and anyone who chooses not to invest in Lemonade right now must not be surprised if the company succeeds.

I personally buy management’s explanations behind the increasing gross loss ratios, and I do believe that there is a better way to underwrite insurance policies using the technologies available to us. I’m under no illusions that this investment carries a fair amount of risk, but this company has all the traits I look for to be successful in the future.

If these shares are lemons, then I have faith in management to turn my investment into lemonade, rather than leaving a sour taste in my mouth.

Be the first to comment