Mark Wilson/Getty Images News

JPMorgan Chase & Co. (NYSE:JPM) is set to kick off the Q1 earnings season among mega-cap banks this week, reporting on Wednesday, April 13th before the market opens. It’s been a whirlwind quarter with plenty of macro developments, meaning these results will be closely followed to set the tone for the financial sector and the broader market.

Shares of JPM have underperformed over the last several months, down by more than 20% from its 2021 high. The concern here is that the market cycle may be turning with high inflation setting the stage for a slowdown in consumer spending and softer momentum in the U.S. economy. While the trend in climbing interest rates with the Fed embarking on a tightening cycle is typically positive for bank earnings, the other side is the headwind of potentially weaker lending activity.

That said, we believe there’s still a bullish case for the stock. Expectations are low heading into this report with the recent selloff likely already pricing in some of the near-term headwinds. The possibility that JPM outperforms expectations with CEO Jamie Dimon offering a more upbeat assessment of conditions could be enough for the stock to kick into rally mode. We preview JPM’s Q1 earnings with the themes to watch and our thoughts on what’s next.

What To Expect From JPM Earnings

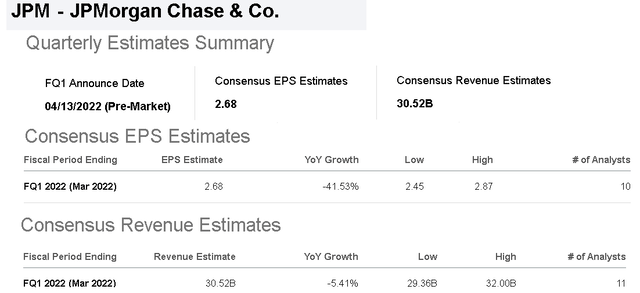

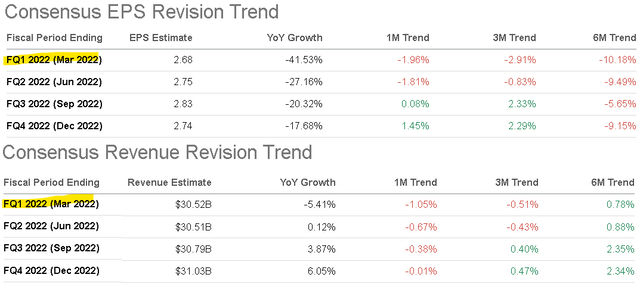

The headline estimate for JPM is that the bank will report EPS of $2.68 which represents a -41.5% decline from $4.59 in the period last year. The setup here considers what was a particularly strong Q1 2021 which was defined by the start of the post-pandemic recovery at the time with the economy and financial market conditions gaining momentum. In this regard, the lower earnings, as well as the expected 5.4% y/y drop in revenue to $30.5 billion, reflects the more difficult year-over-year comparison.

One factor in play this quarter is that JPMorgan, as an industry theme, is expected to again increase loan loss provisions. This is a measure banks update on a quarterly basis to account for internal estimates for non-performing loans and potential defaults.

For context, during the early stages of the pandemic in Q1 2020, JPM took a conservative approach and set aside $8.3 billion as a provision for credit losses with the line item working as an expense on the income statement. As it became clear the worst-feared scenarios did not pan out, the bank reversed or “released” those reserves into improving financial conditions which boosted earnings every quarter in 2021.

In the last reported Q4 results, JPM captured a benefit of $1.2 billion on this metric, reflecting a reserve release across all its operating segments. The setup for this Q1 is likely going to be a return of a marginally higher provision on a net basis compared to the large reversal of $4.2 billion in the period last year.

To be clear, there are many moving parts to JPM’s earnings. By operating segment, we believe the core consumer & community banking group will have maintained some momentum in Q1 supported by the resilient labor market data and consumer spending indicators thus far. This is an area where JPM will see a higher net interest margin from higher market rates as a positive on the results. Again, everything is up against difficult comps from Q1 2021 but there have still been some positives this year.

On the other hand, the corporate & investment banking (CIB) segment is one area that has faced more challenging market conditions. We can think back to the first half of 2021 which saw positive market returns along with historic levels of M&A activity. With valuations down materially, particularly in high-growth segments like tech, the expectation is that investment banking has cooled off this year.

There is a thought that the significant volatility may have boosted trading in the markets group including on the rates side, but the base case is that CIB will be a drag on results this quarter. Similarly, the weak market returns in equities and fixed income in Q1 likely pressured earnings from the Asset & Wealth Management division.

So putting it all together, we can observe the trend in revisions lower to earnings and revenue estimates over the last few months, with the Q1 consensus EPS about 10% lower from 6 months ago.

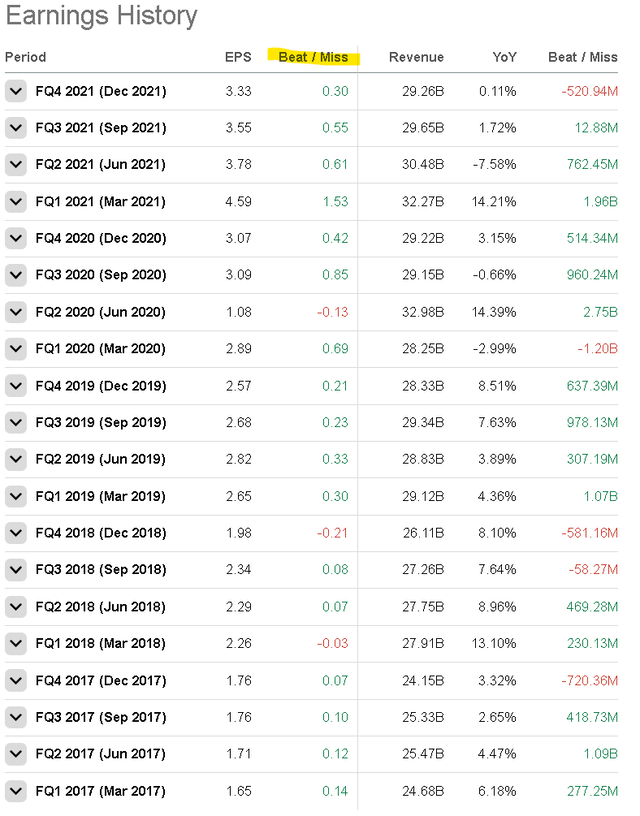

One of the curiosities about JPM is that the company has a strong record of beating the earnings estimates. Over the past 5 years, quarterly EPS has come in above the consensus in 17 of the last 20 quarters. On the revenue side, the history has been more variable but the point here is to say that it’s a good bet that JPM can beat what we view as a low bar of expectations, or at least that the headline results won’t have too many surprises. Many of the challenges JPM is facing right now have been known for some time – we can hold some confidence the management team is on top of it.

Is JPM Stock Overvalued Now?

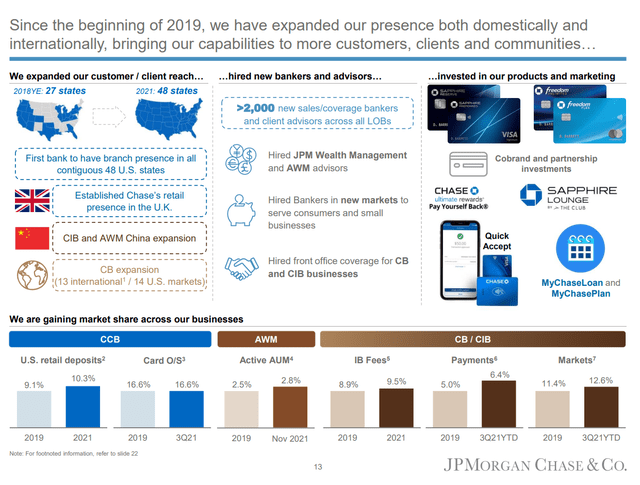

With JPM, the attraction is its quality as the largest bank in the world by market value with a diversified business and leadership position. The company notes its continued growth efforts including through an international expansion along with a climbing market share against competitors in the core operating segments. An important fundamental driver and secular tailwind for the company is the importance of technology and scale which has led to a consolidation of the global banking industry. We believe JPM is well-positioned to navigate any market environment over the long run.

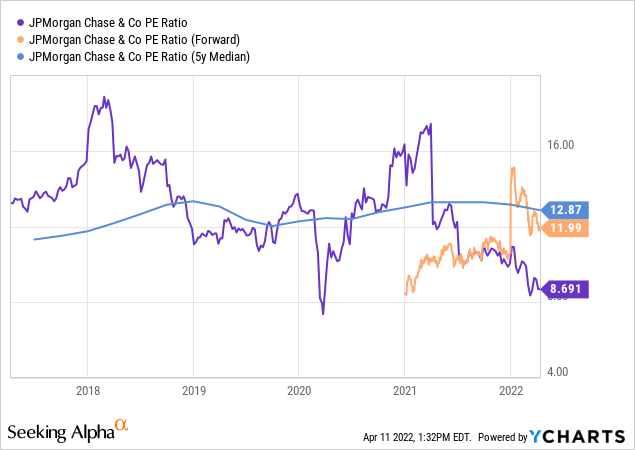

The silver lining of the recent selloff in shares of JPM is that valuation has taken a discount. According to consensus estimates, JPM is expected to reach EPS of $11.13 for the full year 2022, implying a forward P/E multiple of 12x. Even with the earnings headwinds this year against an exceptional 2021, we highlight that shares are trading below what is a 5-year average P/E ratio for the stock closer to 13x. By this measure, we believe JPM is slightly undervalued.

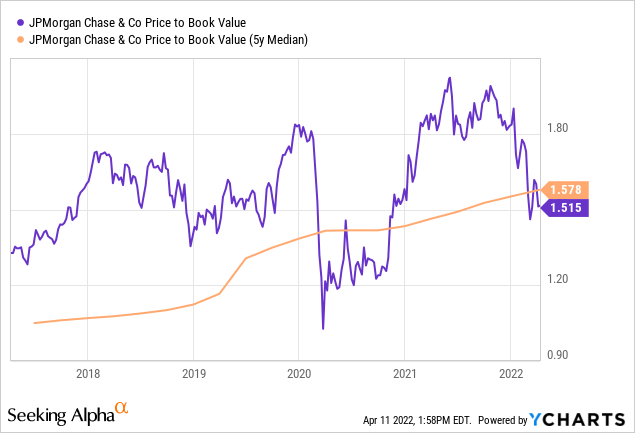

Another valuation metric that is important for banking stocks is the price to book value. The P/B metric reflects the market value of JPM in terms of its balance sheet equity. From the chart below we find that JPM’s P/B multiple at 1.5x is just below the 5-year average for the metric around 1.6x, but well below the peak level of 2x reached last year.

Our interpretation here goes back to the perception of the bank’s quality. JPM trades at a premium to mega-cap banking peers in part given its high profitability with measures like the return on average tangible common equity (ROTCE) that ended 2021 at 23%, which compares to Citigroup Inc. (C) at 13.4% and Wells Fargo & Co. (WFC) at 14.3% for reference. Even if these measures slide going forward, JPM should be able to maintain a spread that is positive for its valuation.

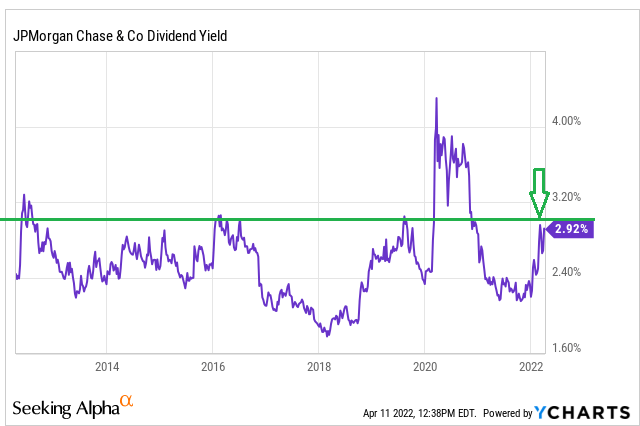

We also note that the yield on JPM which is currently at 2.92% is well above the decade average for the stock closer to 2.5%. Except the Covid crash in shares in the first half of 2020, the 3% dividend range has represented a buying opportunity in the stock several times since 2012, when JPM ended up rallying pushing the yield lower. JPM last hiked its quarterly dividend rate by 11% to $1.00 in Q3 of last year. We believe there is room for another increase later this year likely in the single-digit range based on the recurring profitability and underlying earnings.

YCharts

What Is JPM Stock Price Forecast?

Making a bullish call on JPM over the near term is largely a macro bet at this point. We believe the stock has a value at the current level and maintains a positive long-term outlook but it’s important to recognize what are some real headwinds.

Without a resolution to the Russia-Ukraine conflict that has clouded the global outlook, the expectation is for shares to remain volatile. For JPM with its exposure to the U.S. economy, we also believe it’s important to see inflationary trends stabilize and some confirmation that consumer spending and credit growth can maintain momentum over the next few quarters.

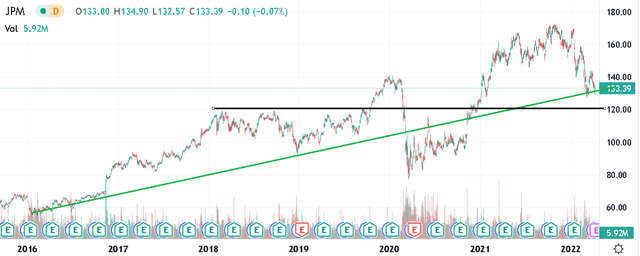

On the upside, if JPM is going to rally, now would be a great place considering shares are hugging a long-running trendline going back to 2016 that was only briefly interrupted by the 2020 Covid crash. On that point, shares currently around $133 are back to a level first reached in late 2019 as a pre-pandemic benchmark while there is an argument that the company’s long-term earnings outlook has improved in the period since.

The bearish case here would consider a further deterioration of the global macro outlook reinforcing signs of a pending recession. A slowdown in consumer spending or persistently higher inflation despite Fed rate hikes would undermine the company’s operating outlook and pressure shares lower. From the chart, $120 is going to be the critical level of support the stock needs to hold.

Is JPM Stock A Buy, Sell, Or Hold?

We rate JPM as a hold with a price target for the year ahead at $150.00 per share representing a 13.5x multiple on the current 2022 consensus EPS. While our price target is about 12% higher than the current share price, it’s not enough upside in our view to take an aggressively bullish position.

As it relates to this week’s Q1 earnings report, we believe the stock can rally on some favorable management comments but it’s hard to see shares sustaining momentum back to its all-time high in this market environment. The strategy we recommend is to sit on the sidelines for the opportunity to pick up shares a bit lower to improve the reward to risk setup. We are buyers of the stock on any pullback under $125.

Be the first to comment