fatido

Article Thesis

2022 hasn’t been kind to equities, which also holds true for most bank stocks. JPMorgan Chase & Co. (NYSE:JPM) is one of the most dominant banks in North America, and following the recent pullback, its valuation has become quite attractive. At the same time, the dividend yield has also risen to a compelling level. Buybacks will not be too much of a growth driver this year, and lower investment banking fees are a headwind. But with interest margins likely rising over the coming quarters, JPMorgan could be a solid investment at current prices.

JPMorgan Stock Key Metrics

JPMorgan Chase is one of the largest banks in the world. In North America, it is the largest one by market capitalization, being valued at $330 billion today. It also is the most profitable one, likely generating around $35 billion of net profit this year.

In recent quarters, the bank generated solid growth in its core lending business, although investment banking revenue is more fickle. During the first quarter, JPMorgan has seen its loans grow by 5% year over year, while deposits grew 13% over the same time frame. Strong deposit growth suggests that JPMorgan does not have to worry about growing funds available for loans, which should come in handy in the current environment of rising interest rates. JPMorgan can demand higher rates on loans, while its strong deposit base should keep its own interest expenses pretty low. Banks generally are able to expand their net interest margins during times when interest rates rise, as they increase the rates they demand at a faster pace compared to the rates they pay. In JPMorgan’s case, that will likely hold true as well.

JPMorgan’s CIB business unit, Commercial & Investment Banking, has not performed greatly during the most recent quarter. Higher interest rates and worries about inflation and a potential recession have made companies warier when it comes to inorganic growth, which led to lower equity deal value. JPMorgan was not alone in that, instead, the whole industry suffered from less expansionism. JPMorgan remained the #1 global investment bank in terms of fees generated, showing it held onto its strong market position. Still, equity markets revenue was down 7% year over year, and total CIB markets revenue was down 3% year over year. During the second quarter, deal volume likely was lower as rising rates and recession worries were more impactful, which is why another CIB revenue decline would not be too surprising. Thanks to the low valuation and the tailwinds for JPMorgan’s other business units, such as expanding interest margins, lower investment banking fees are far from disastrous, however. When JPMorgan was trading for $160 or $170 and was priced for a lot of growth, that was different. But at the current valuation, an investment banking slowdown seems to be more than priced in already.

At the end of June, the Fed released this year’s annual stress test results. These are important, as they have an impact on banks’ ability to return cash to their owners via dividends and share repurchases. JPMorgan did not perform very well during this year’s stress test. It made the cut, but its common equity tier 1 ratio was not a lot higher compared to the regulatory minimum. This was at least partially the case due to the Fed modeling a pretty harsh recession, with unemployment jumping to 10% and commercial real estate prices dropping by 40%.

As a result, JPMorgan’s stress capital buffer (or SBC) rose to 4% from a previous level of 3.2%, one of the highest among US banks. The increased capital reserve level means that JPMorgan’s ability to return cash to its owners will be somewhat limited this year. The company has, as a result, decided to keep its dividend at the current level of $1.00 per share per quarter instead of going for a dividend increase, which the bank had generally done following the Fed stress test results in previous years. Still, even with the dividend being maintained at current levels instead of being raised, the dividend yield is pretty solid, at 3.5%. That is not only higher compared to what one can get from treasuries, it is also more than twice as high as the S&P500’s dividend yield.

I do believe that there is a good chance that JPMorgan will get back on the growth track when it comes to its dividends in the not-too-distant future, and even a dividend raise next summer would in practice result in the company maintaining its dividend growth streak, as 2022’s dividends ($4.00 without a raise) will be higher than those from 2021 ($3.70) even without a raise this year, and since 2023’s dividends would be higher than 2022 even if it takes another year for the company to announce the next dividend increase.

JPMorgan currently has an active buyback program worth $30 billion, which is equal to around 9% of the company’s market capitalization today. That’s pretty meaningful and should have a considerable impact on earnings per share growth once completed. But due to the increased stress capital buffer, it is unclear whether there will be lots of buybacks during the back half of the year. JPMorgan might only exercise a smaller portion of the current buyback program this year, which would result in a smaller but still positive impact on its earnings per share growth.

Is JPMorgan Stock Overvalued?

Today, with JPMorgan trading at $114 per share, the bank is valued at around 10x this year’s net profit according to the consensus analyst estimate of $11.30 in earnings per share this year. It is worth noting that the bank has beaten earnings per share estimates in 10 out of the last 12 quarters, thus the likelihood of actual earnings per share coming in ahead of current expectations is pretty solid. But even if JPMorgan were to actually underperform current expectations by a couple of percentage points, shares would not be expensive. If EPS come in at $11 this year, below expectations, JPMorgan would trade for a little bit above 10x net profit right now.

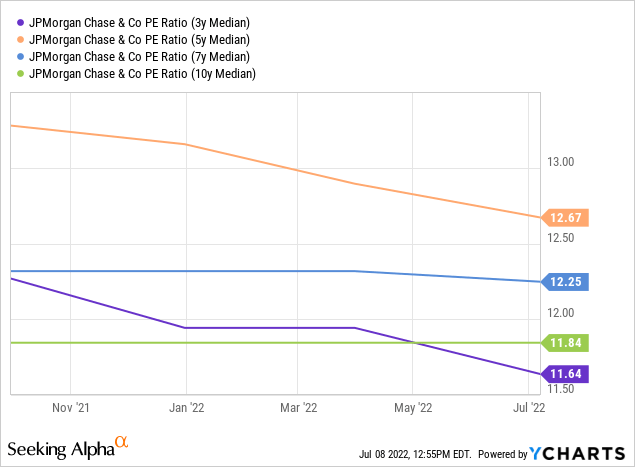

The bank’s earnings multiples over the last 3, 5, 7, and 10 years averaged 11.6, 12.7, 12.3, and 11.8, respectively. Even compared to the lowest of these averages, a 10.3x net earnings multiple would represent a discount of a little above 10%. Compared to the highest of these averages, a 10.4x earnings multiple would represent a discount of a little more than 20%. If JPM manages to meet or beat the current consensus estimates, the discount naturally would be even higher. Likewise, it is expected that earnings per share will rise meaningfully next year. Rising net interest income and a recovery from the H1 market downturn are key factors for that expected recovery, while JPMorgan’s buybacks also will have an impact. Relative to the current 2023 EPS estimate of $12.75, JPMorgan is trading at just 8.9x net profit. If that rises to 11.5x net profits by the end of next year, which would still be below the median valuation for JPM stock, shares would climb by 29%.

On a price to tangible book value basis, JPMorgan also looks inexpensive. The current reading is 1.7, whereas the 5-year median tangible book value is a little above 2.0, suggesting a discount of around 20%.

We can thus sum up that JPMorgan is not looking expensive today. Shares were pretty pricey at the beginning of the year when they traded as high as $170. But following the recent decline, shares are now not pricey anymore. Instead, they look undervalued now, relative to how the bank was valued in the past.

What To Expect From Earnings

JPMorgan will report its second quarter earnings on July 14. Analysts are predicting earnings per share of $2.88, which would be up slightly versus the first quarter. Investors will want to look at how the bank’s CET1 ratio has changed, as that is important for the bank’s ability to hike its dividend in the second half of the year or in 2023. It also impacts how much buybacks the bank can do this year. Guidance regarding net interest income for the year is important as well, while management could also announce job cuts in the investment banking space which would be positive from a cost perspective, as business momentum in CIB has slowed down anyways.

Is JPM Stock A Buy, Sell, Or Hold?

Banks are facing lower investment banking revenues this year, but at the same time, net interest income should grow going forward. JPMorgan’s shares have pulled back quite a lot in recent months, which makes them trade at a discount compared to the historic valuation right now. JPMorgan’s dividend yield has also climbed to a pretty solid level of 3.5%. I do believe that total returns from the current level should be very solid going forward, although it is possible that an even better buying opportunity emerges if equity markets remain volatile in the coming months. JPMorgan is thus a hold or a buy today.

Be the first to comment