traveler1116/iStock Unreleased via Getty Images

It is nearly a half-decade since I last reported on Hormel Foods Corporation (NYSE:HRL). That article had me recommending the stock, and since then, the total return on the shares outpaced the S&P 500 by roughly 15%.

While Hormel is an easy-to-understand investment, dissecting the company leaves one with a number of points to ponder. The food-away-from-home trend, a proliferation of private labels, and the introduction of meal kits were all negatives in 2017 that persist today. In 2022, investors must add inflation and supply chain woes to the headwinds HRL faces.

Trends That Are Not Hormel’s Friends

There is a persistent move in the US to increasingly consume food-away-from-home. In 1970, around a quarter of the average family’s food budget was spent eating outside one’s residence. A seemingly inexorable evolution occurred, and in 2015, for the first time, Americans spent as much eating out as eating in.

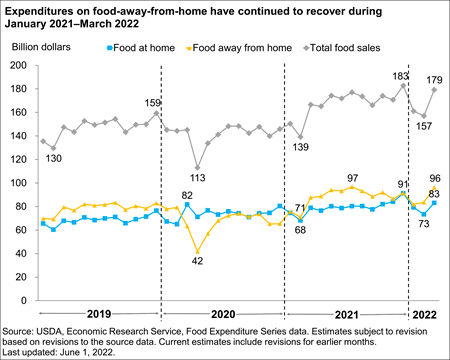

COVID led to the nation returning to the kitchen table for meals. For a time, food-away-from-home spend dropped below 50%, but with the easing of restrictions, the penchant for dining out in America returned. Food-away-from-home spending was higher than food-at-home spending throughout 2021.

USDA

Obviously, more folks eating in restaurants means fewer dollars spent in grocery stores. Additionally, there is another point to consider when weighing the food-away-from-home movement’s potential effect on Hormel’s bottom line.

Inflation is driving food prices in both categories, but prices are increasing more rapidly for food-at-home than for food-away-from-home. In April of 2022, the price of food purchased in restaurants was up 7.2% year-over-year. In that same time frame, grocery store prices increased 10.8%. While it seems counterintuitive to think of consumers continuing to patronize restaurants during a period of high inflation, should this trend continue, it might actually make sense.

Even so, studying stats from the Great Recession, we learn that from 2007 through 2009, the percentage of food-away-from-home purchases dropped from 44% of total spend to 41%.

Another persistent headwind facing Hormel is a transition towards private labels. Consumers’ move to private brands has increased steadily since my last Hormel article debuted in 2017. In that piece, I reported that $150 billion of store-brand groceries were sold in the U.S. in 2016. According to Supermarket News, sales of private-label grocery products have since increased markedly, hitting $199 billion in 2021.

Adding fuel to the fire, analysts for Morningstar noted Walmart (WMT) customers are trading down to private labels. During the last quarterly report, Walmart management repeatedly mentioned customers moving to private brands in an effort to combat inflation’s toll on their pocketbooks. The following are some excerpts from the earnings call.

Consumers are feeling inflation pressures as evidenced by an increase in grocery private brand penetration.

We see categories like deli, lunch meat, bacon, dairy, where we see customers trading from brands to private brands.

…as I said, with some consumers more so than others, we do see some switching, which would include switching specifically from brands to private brands.

Kroger (KR), the largest supermarket chain in the US, launched 660 new private label items in FY22 alone. That company has four private labels with annual sales of $1 billion or more.

Currently, Kroger operates 35 food production or manufacturing facilities producing private label products. The last 10-K states the company’s supermarkets, on average, stock over 14,000 private label items, and those products generated nearly $28 billion in sales in 2021.

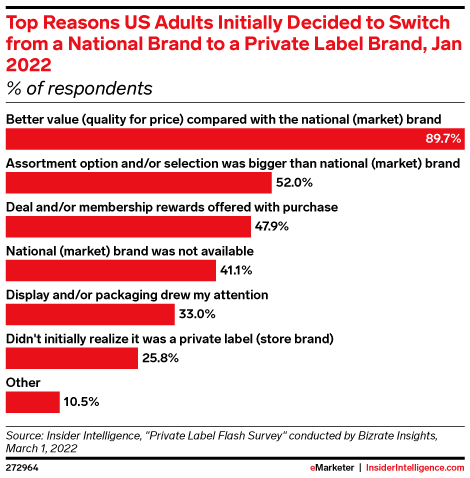

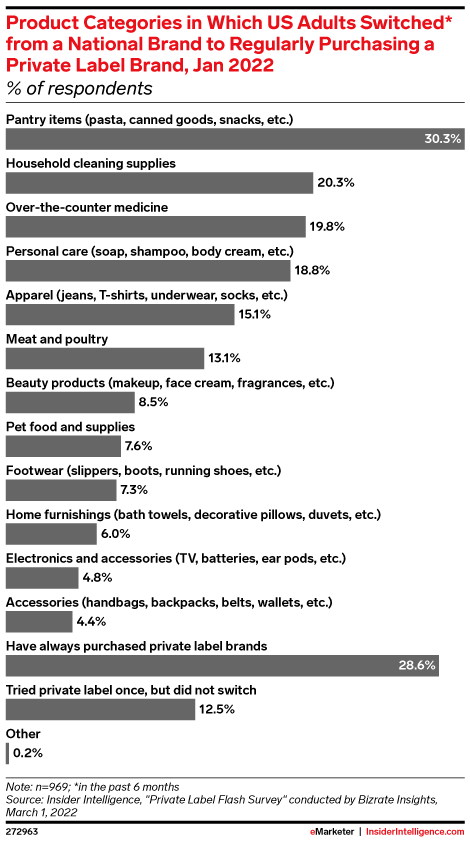

I view grocers’ moving to private labels as a troubling long-term headwind for every company in the packaged foods industry. This is particularly true in the current economic environment, in that 90% of US consumers that switched to private label brands were motivated by value. The following charts provide additional insight into the trend toward private labels by US consumers.

eMarketer eMarketer

There was a third negative trend that I outlined in my 2017 article. Food kits had burst on the scene, and subscription service sales of the kits were putting a dent in grocery sales. A study conducted a year ago of US and UK consumers by researchers at Piplsay determined that 52% of those surveyed tried a meal kit in the past year, and 58% have subscribed to a meal kit service. Fortunately for the likes of Hormel, not all of the dollars moving to food kit providers is coming from grocers: nearly half of respondents noted their use of meal kits cut down on restaurant visits.

Statista forecasts the meal kit market in the US will grow from $6.9 billion in 2021 to $10.4 billion in 2024.

New Storm Clouds On The Horizon

Practically every company on the planet is working through supply chain and inflationary pressures, and Hormel is no exception. As I previously noted, grocery prices are increasing at a faster rate than the cost of restaurant meals. In fact, grocery prices are also outpacing the consumer price index (CPI) by a wide margin: last Friday, the US Department of Labor stated grocery prices were up 11.9% in May versus 7.4% for meals outside the home. That same day, it was reported that the CPI for May hit 8.6%. Both figures stand as the biggest increase in over four decades.

The old saying “folks gotta eat” should be supplemented with “folks gotta drive from point A to point B.” Food and gasoline are inescapable costs in most consumers’ budgets. Furthermore, rising fuel prices touch the supply chain on several levels. Vendors are forced to up prices, and grocery store guests are adapting to the current climate by changing their buying habits.

A series of articles by the Wall Street Journal looked at the problems food companies and grocers are facing in the current environment. They are in a tug-of-war as the food companies struggle with rising input costs while grocers fear the loss of loyal customers should prices continue to escalate.

We continue to battle extreme input cost volatility and inflation. We have seen increases across all our input, including raw materials, packaging and supplies, freight and logistics and labor.

Jacinth Smiley – EVP and CFO for HRL

The WSJ pieces provided a laundry list of prominent companies that are increasing prices while noting major supermarket chains are at times refusing to accept the price increases. Don Clark, Chief Merchandising Officer of Giant Eagle, Inc. is quoted as saying, “We don’t just accept cost increases.”

In the same article, WSJ noted that Kroger, one of the heavyweights in the grocery space, is checking the prices of every commodity to ensure suppliers are justified in raising prices. Kroger has gone as far as to advise manufacturers that they will cease stocking products of companies that won’t negotiate on pricing.

Grocers have significant leverage with HRL: in FY 2021, Walmart was the source of 15% of revenues, while the top five customers combined for over a third of Hormel’s sales.

Even so, in many cases, Hormel has no other recourse than to raise prices. For example, the company stated that last May, costs for corn and soybean meal needed to feed livestock increased by 125% and 40%, respectively.

Another headwind HRL is facing is an outbreak of avian influenza. Known as Highly Pathogenic Avian Influenza or HPAI, a recent outbreak of the disease led to the death of nearly 40 million birds. Consequently, the price of eggs and turkey products spiraled upward.

Surprisingly, during the most recent earnings call, management noted “HPAI had an immaterial impact on the segment’s results for the second quarter”.

Where Hormel Stands Strong

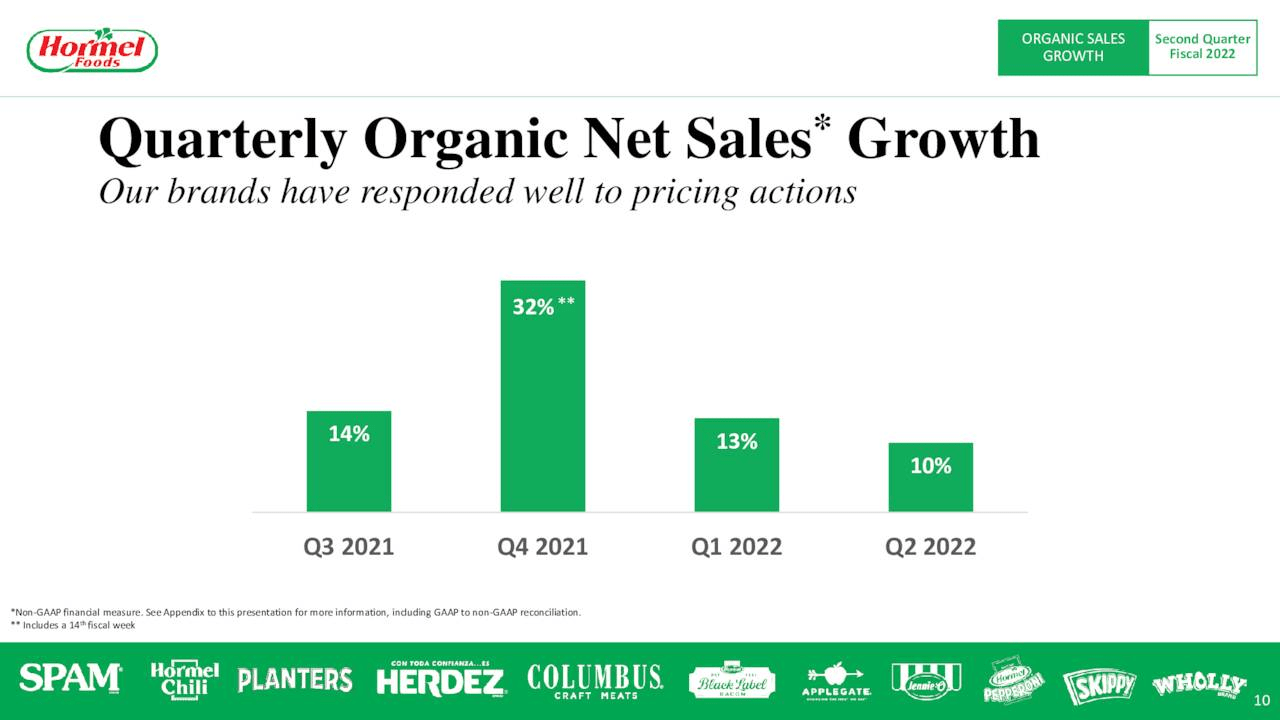

So far, what some might see as strong headwinds have served as no more than speed bumps for Hormel. Posting Q2 2022 revenue of $3.1 billion, and GAAP EPS of $0.48, HRL not only beat on the top and bottom line, the company also notched its sixth consecutive quarter of record sales and its third consecutive quarter of earnings growth.

During the June 2nd earnings call, management reported year-over-year sales were up 9.6%, net earnings increased from $227.9 million to $261.7 million, and EPS rose from $0.42 to $0.48. Operating cash flow for the quarter increased 24% to $193 million, and for the first half of the fiscal year, operating cash flow grew 60% to $577 million.

Segment sales increased for grocery products, (up 7.1%), refrigerated foods (up 10.7%), and Jennie-O Turkey Store (up 16%). International reported lower sales, down 3.4%, but that segment only constituted 6% of sales in FY 21.

HRL Quarterly Presentation

Hormel possesses a number of strengths. One lies in the company’s near-ubiquitous brands. Hormel holds the number one or two market share in over 40 brand categories. The popularity these brands have with consumers creates a virtuous circle: grocers display high-demand products so as to attract shoppers’ attention. In turn, this results in higher sales, thereby creating additional demand.

Another is management’s various strategies to drive growth. Unlike its chief competitors, HRL employs a direct sales group for the food service segment. The company’s sales force works directly with operators to identify their needs. This results in Hormel adapting their product lines to meet the evolving restaurant environment. One example lies in a variety of labor-saving products designed to combat the current worker shortage. Hormel’s management claims the growth of its food-service business outpaces the industry by 2-3 times.

HRL is also shedding many of its commodity businesses as it pivots to branded consumer products. That shift was bolstered by the acquisition of Planters from Kraft Heinz (KHC) in 2021. Morningstar analysts forecast the company will reduce sales of commodity products in 2022 from 10% to 15% of revenues down to 5% to 10%.

Veteran investors can be excused for looking at acquisitive management teams with a jaundiced eye. Too often, highly touted acquisitions turn into debt-building boondoggles. Hormel’s management has an enviable record of making deals that serve the company and investors well.

A partial list includes Jennie-O in 2001, Farmer John in 2004, Valley Fresh in 2006, MegaMex Foods and all of its Mexican food subsidiaries in 2009, Country Crock in 2010, Skippy peanut butter, the acquisition of Ceratti, a Brazil-based producer of deli products, Justin’s nut butters, and Planters.

I’ll add that only 8% of the firm’s revenues are generated outside the US. Hormel could increase growth markedly through expansion of its businesses internationally.

HRL Stock Key Metrics

With over 50 years of dividend increases, Hormel is a Dividend King. The stock yields 2.27%, with a payout ratio of 55.49% and a 5-year dividend growth rate of 9.9%.

HRL currently trades for $45.23 per share. The average one-year price target of the seven analysts that follow the stock is $47.83. The two analysts that provided ratings following the most recent earnings report have an average price target of $46.00

Hormel’s forward P/E is 24.59x, roughly in line with its average P/E over the last five years of 24.52x. The current 5-year PEG ratio is 3.69x, a bit below the average PEG over the last five years of 4.29x.

Is HRL Stock A Buy, Sell, Or Hold?

In the body of this article, I outlined three longstanding trends that serve to erode Hormel’s market share. To some extent, Hormel has blunted the problem presented by the food-away-from-home trend by growth in its food-service business.

Inflationary pressures will likely curtail the growth of the food kit industry for the short- to mid-term.

However, I see the move towards private labels as a long-term threat to all food producers. Where Hormel has an advantage over others is in the company’s portfolio of very strong brands. I will add that management has demonstrated an admirable ability to identify acquisitions that work to strengthen the company.

Hormel’s business was once focused on meat production. Meats of all sorts are generally commodities, and by definition, producers of commodities lack pricing power. HRL has evolved away from that business model, and the company’s progress continues. One side of that metamorphosis is that Hormel is shielded from the vagaries associated with meat production, such as sudden swings in feed prices, unpredictable costs associated with weather patterns, and the associated changes in hog, poultry and beef pricing.

Today Hormel is a company with a portfolio of premiere brands and a strong food service division.

Hormel is not a growth stock (although there is significant potential for expansion in international markets). Rather, HRL is a safe, steady investment that can provide good returns, especially when one invests when the shares trade at a discount.

Unfortunately, I view the stock as somewhat overvalued at this juncture.

I rate HRL as a HOLD.

Be the first to comment