Robert Way/iStock Editorial via Getty Images

The Gores Guggenheim (NASDAQ:GGPI) stock, alongside its SPAC and electric vehicle (“EV”) peers, have been victim to the ongoing market turmoil this year, as investors stray away from risky assets amidst rising macroeconomic uncertainties. The stock fell below the $10 threshold – the typical per-share value in trust within a pre-merger SPAC – earlier this month, and plummeted to an all-time low at the $8.50-level last week.

The steep decline occurred immediately following the Fed’s 75 bps rate hike last Wednesday (June 15), as investors braced for heightened risks of a recession later this year. Even GGPI’s confirmation on its upcoming Stockholder Special Meeting to vote on the proposed merger with EV pureplay Polestar did little to salvage the stock’s valuation. But a “post-Fed rally” late Friday helped recoup some losses, with GGPI trading at above $10 again, though still a farcry from its year-to-date peak of $13+ apiece.

Momentum is likely picking up, as the stock continues to trade higher pre-market leading up to the shareholders’ vote on Wednesday, which determines if its ticker will switch from “GGPI” to “PSNY” by the end of the week. Based on the stock’s current market value of approximately $10 per share, it is trading near its pro-forma post-merger enterprise of about $20 billion, which represents approximately 3.1x of management’s projected 2023 sales. This is a significant discount compared to the NTM EV/sales trading multiple of more than 20x and EV/FY’23 sales trading multiple of more than 8x observed across EV peers like Lucid (LCID) and Rivian (RIVN) at the time of their respective SPAC mergers and IPOs.

Recognizing the current market climate, where valuation multiples have compressed across all industries in response to rising interest rates and dampening consumer sentiment amidst record-setting inflation and increasing risks of a recession, the upcoming GGPI-Polestar merger might not experience as generous valuation premiums as those awarded by the market to its EV peers immediately post-close during the bull rally over the last two years. But considering Polestar is already in production and delivery ramp up phase with a strong balance sheet post-merger to support expanding operations across core EV markets spanning Europe, Asia Pacific and the U.S., the GGPI stock remains well-positioned for a post-close valuation booster, nonetheless, especially at current levels.

What is the Planned GGPI-Polestar Merger?

The GGPI SPAC and Swedish premium EV maker Polestar announced their planned business combination last September. The transaction marks one of the latter in a pact of EV pureplays that have rushed to capitalize on burgeoning public market funding availability through SPAC mergers and blockbuster IPOs over the past two years.

However, the hype for SPAC mergers and EV stocks have undoubtedly faded this year. In addition to faltering valuations across growth stocks due to mounting macroeconomic headwinds, SPAC investors have also been stung by series of mergers that have been subject to federal investigations for fraud and misleading disclosures. The SEC is also stepping up its scrutiny on SPAC transactions, bolstering rules on disclosure requirements that akin to those of traditional IPOs and holding SPAC underwriters accountable for both SPAC IPOs and subsequent de-SPAC transactions.

Yet, given Polestar has already been in productions for close to two years, leveraging the expertise of its parent companies Volvo (OTCPK:VOLAF / OTCPK:VLVLY / OTCPK:VOLVY) and Geely (OTCPK:GELYY), its upcoming merger with GGPI marks one of the most promising and differentiated de-SPAC transactions of the year. Polestar is the first EV pureplay to go public via a SPAC merger in recent years that is already operational and revenue-generating. Polestar’s promising outlook is further corroborated by its ability in meeting planned production timelines and delivery volume targets in 2021, a stark contrast to peers that have cited production ramp up challenges and supply chain constraints for their respective misses.

How Big is the GGPI-Polestar Merger?

Following the anticipated shareholders’ approval of the transaction coming Wednesday, Polestar will go public via the completion of its reverse merger with GGPI later in the week at an implied valuation of about $20 billion post-close (see more here). The transaction is expected to add about $1 billion in cash proceeds to Polestar’s balance sheet, which consists of $800 million in “SPAC cash” held in trust and $250 million from PIPE investors, less related transaction fees.

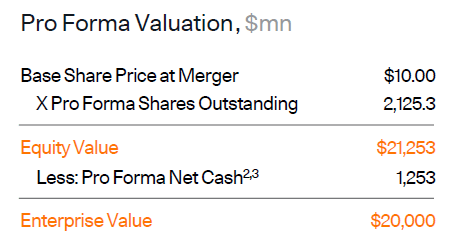

Management has calculated the transaction’s implied valuation as follows:

Polestar Pro Forma Valuation (Polestar May 2022 Investor Presentation)

- Base share price at merger @ $10 apiece: This is the per-unit valuation ascribed to shares sold/attributable to existing Polestar shareholders, GGPI SPAC shareholders, PIPE investors and GGPI sponsors. Prior to the completion of the GGPI-Polestar merger, the GGPI SPAC itself is valued at approximately $1 billion based on the last traded share price of $10.09 on June 17 and approximately 80 million GGPI shares outstanding (vs. IPO value @ $10 apiece x 75 million shares of common stock, plus authorization to issue up to 440 million shares of common stock).

- 2,125.3 Million Pro Forma Shares Outstanding: This is the anticipated number of shares of Polestar stock outstanding post-close. The incremental units to the initial ~80 million shares of GGPI common stock outstanding pre-merger represents additional shares attributable to existing Polestar shareholders, PIPE investors, and GGPI sponsors following the completion of the reverse SPAC merger. The ownership structure is disclosed as follows:

- Polestar Rollover: This cohort represents existing Polestar shareholders, which will control 94.1% of the company post-close. Volvo will remain Polestar’s largest shareholder post-close through a 49.5% equity interest, while Geely, the owner of Volvo, will become the second largest shareholder through a direct equity interest. Existing Polestar shareholders also include famed Hollywood actor Leonardo DiCaprio.

- GGPI Shareholders: Current shareholders of GGPI pre-merger are expected to account for 3.8% equity interest in Polestar post-close.

- PIPE Investors: Top-tier institutional investors that have contributed $250 million to the transaction through PIPE is estimated to represent 1.2% equity interest in Polestar post-close.

- GGPI Sponsor: Current GGPI sponsors, including Gores Group and Guggenheim Capital, is expected to retain 0.9% equity stake in Polestar post-close.

- Pro-Forma Net Cash: Based on pro-forma net cash of $1.253 billion post-close, and estimated cash on hand of $20.0 billion disclosed in Polestar’s May 2022 Investor Presentation, the EV maker is likely operating on about $18.75 billion of debt.

At an implied equity value of about $21 billion post-close based on $10 per share, the upcoming GGPI-Polestar merger would be the second largest of its kind after EV peer Lucid’s $24 billion business combination with Churchill Capital Corp IV last summer.

What Is the Implication of Polestar’s Post-Close Ownership Structure?

In contrast to most EV SPAC mergers which have the majority of their respective post-close valuations attributable to PIPE and SPAC shareholders, much of Polestar’s post-close value would be attributable to its existing shareholders (i.e. Volvo, Geely, and DiCaprio).

The implication of having more than 94% of Polestar’s projected post-close value attributable to its existing shareholders depends on whether these related parties intend to sell for profit in the near-term. The three key existing shareholders in Polestar currently count Volvo, Geely and DiCaprio. Based on Polestar’s intricate relationship with its parent companies Volvo and Geely, to which it depends on for manufacturing expertise as well as shared vehicle platform technologies, it is unlikely the two auto OEMs will dispose of their respective equity interests in the EV maker following the post-close lock-up period. All of Polestar’s existing shareholders have also entered into a “Declaration of Intent to subscribe to a potential future equity or equity linked securities issued by Polestar” pertaining to its upcoming public listing, which further corroborates their respective intentions to remain long-term investors in the Swedish EV maker.

This leaves a share float of just under 6% post-close pertaining to interests held by GGPI shareholders, PIPE investors, and GGPI sponsors, should they decide to sell post-close. Based on this consideration, any future requirement for Polestar to become a component of EV-related ETFs or other index funds could serve as a key catalyst for the stock’s valuation upsides, in addition to its fundamental strengths, given the lack of share supply.

When Will the GGPI-Polestar Merger Take Place?

The GGPI-Polestar merger was initially planned for completion in the first half of 2022. With the second quarter-end fast approaching, GGPI has confirmed via a SEC filing last week that its shareholders will vote on the transaction on June 22nd at market open. Should GGPI shareholders vote in favour of the Polestar merger, the stock will begin trading under the new ticker PSNY by the end of the week.

What to Expect on Polestar’s Post-Close Valuation?

Based on the GGPI stock’s current market share price of about $10 apiece, Polestar will likely make its debut on Nasdaq later this week at a market cap of about $21 billion (i.e. current share price of ~$10 apiece x pro forma post-close share count of 2,125.3 million units) and enterprise value of about $20 billion (i.e. $21 billion equity value, less post-close pro forma net cash of $1.25 billion). This represents a forward EV/FY’23 sales multiple of about 3.1x based on Polestar’s guided revenues of $6.55 billion (guided +166% y/y) on the sale of 124,000 vehicles (guided +148% y/y) in the next fiscal year.

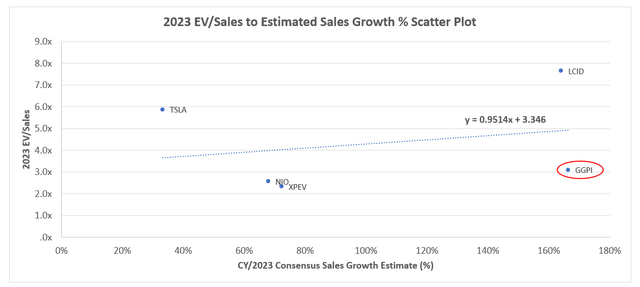

At a 3.1x EV/FY’23 sales multiple right out of the gate, Polestar will trade at a significant discount to peers like Rivian and Lucid at their respective Nasdaq debuts. Polestar will also be trading at a discount to the current EV sector’s performance based on its guided growth profile at $10 apiece later this week if shareholders approve the transaction:

Historically, EV SPAC mergers have been observed to benefit from a boost of about 11% to 13% on the day of their respective debuts. This means GGPI’s share price could rise from the current $10 to about $11.10 to $11.30 apiece later this week at its Nasdaq debut. This would represent an EV/FY’23 sales ratio of 3.4x (i.e. $11.10 to $11.30 apiece x 2.1 billion post-close shares outstanding, less pro forma net cash of $1.25 billion, divided by FY/2023E revenue of $6.55 billion), which is still a discount to peers with similar growth profiles.

What Are Some Near-Term Catalysts for Polestar?

Over the longer-term, we expect Polestar to be a profitable investment at current levels considering its fundamental growth prospects and margin expansion trajectory under a proven asset lite business model. The company is already in productions, with the Polestar 2 Electric Sedan selling at a rapid take rate across major EV markets spanning Europe, Asia Pacific and the U.S. The continued roll-out of planned new models and expansion of its global footprint will be positive catalysts for the stock this year:

Polestar 3: The Polestar 3 will be the brand’s first electric SUV built on the “Scalable Product Architecture 2” (“SPA 2”) platform. The vehicle will launch later this year in October, with productions to begin in 2023 at Volvo’s owned and operated facilities in China (Chengdu) and the U.S. (Charleston). Both facilities have annual production capacity of 150,000 vehicles each, which will be ample for supporting Polestar’s annual sales target of 24,000 units beginning next year and up to 77,000 units by 2025.

The Polestar 3 will target “one of the highest margin and growth segments” across the U.S. and Europe. SUVs currently account for about half of new car registrations across Europe and the U.S., two of Polestar’s core operating regions. The Polestar 3’s competitive range capability of 372 miles on a single charge, complemented by advanced autonomous driving and connectivity technologies powered by industry-leading hardware and software from Luminar (LAZR) and Nvidia (NVDA) also makes it an attractive option as EV adoption gains momentum – new EV registrations have continued to expand in strong double-digits, despite a broad-based slowdown in new auto sales this year.

Global Expansion: Polestar currently operates more than 100 physical showrooms across more than 23 markets in Europe, Asia Pacific and the U.S. The EV maker is also progressing positively towards its goal of having at least 150 retail locations in operation by the end of the year, with further expansion to more than 30 markets by 2023. Following our initial coverage on the GGPI stock in April, which touched on Polestar’s intentions to expand to Spain, Portugal and Ireland this year, the EV maker has since opened a store in both Madrid and Barcelona, with second Barcelona location to come online in early July. New locations in Israel and Italy are also expected to come online before the end of the year.

Considering Polestar’s proven ability to date in achieving its 2021 production targets, new vehicle roll-outs, and global store openings as planned, it already bolsters the company’s credibility compared to many EV SPAC peers, such as Faraday Future (FFIE) and Lordstown Motors (RIDE), which have found themselves in a regulatory rut over the past two years. Continued execution of its near-term business plan, which includes the upcoming launch of Polestar 3 in October and subsequent SOP in early 2023, alongside ongoing global expansion into more than 30 markets will be favourable to Polestar’s fundamental performance, and inadvertently, its valuation prospects in the months following its merger with GGPI.

What Are Some Near-Term Downside Risks for Polestar?

In addition to looming macroeconomic uncertainties, rising competition within the increasingly crowded EV landscape, and tightening regulatory scrutiny over SPAC transactions, customary post-close conditions, such as issuance of additional shares upon completion of the SPAC merger and the lock-up expiry, could also add addition pressure on the stock’s near-term performance.

Post-Close Turbulence: As mentioned in earlier sections, the completion of GGPI’s merger with Polestar will add more than two billion shares to the existing pool of about 80 million shares attributable to GGPI shareholders to account for existing Polestar shareholders, PIPE investors, and GGPI sponsors. Typically, EV SPACs have declined in value in the weeks following its initial post-merger spike, as market mulls on whether the post-close valuation is sustainable given the underlying business’ fundamentals.

For example, the Lucid stock’s valuation surged from about $7 billion to more than $40 billion overnight following the completion of its merger with Churchill Capital Corp IV in July 2021. The EV stock subsequently fell to a post-merger low in 2021 (sub-$30 billion market cap, which is still a premium to its implied transaction enterprise value of $24 billion) in the month following its Nasdaq debut before posting a sharp rebound catalyzed by its flagship vehicle’s SOP and customer deliveries.

But in the case of Polestar, its post-close valuation is not expected to deviate as much from its implied enterprise value of about $20 billion, unlike the premium on Lucid at the time of its Nasdaq debut. Accordingly, the likelihood of a post-close valuation haircut similar to Lucid’s is reduced. It is likely that Polestar’s current performance already prices in the macro overhang on growth stocks, spanning record inflation and tightening economic conditions, as well as the company’s recently slashed 2022 delivery guidance from 65,000 vehicles to 50,000 vehicles due to COVID lockdowns in China during the second quarter.

The comparatively smaller share float for Polestar as mentioned in earlier sections is likely to insulate the stock from any near-term turbulence pertaining to its post-close valuation as well. The upcoming launch of Polestar 3 in October will also serve as a critical catalyst for the stock, as it transitions from a Swedish-based EV start-up to a recognized multi-product, global EV maker.

Lock-Up Expiry: Based on the lock-up agreement stipulated in GGPI’s latest 10Q filing in May 2022, “Parent Shareholders” and “Sponsor and Supporting Sponsor Stockholders” – which refer to Polestar’s existing owners, PIPE investors, and GGPI sponsors that have stake in the company post-close – will not be allowed to dispose of their shares until at least “180 days following the date of the [merger’s] closing”. These events have typically caused a protracted decline in a stock’s post-close value, as observed in Rivian’s recent decline after key investor Ford (F) reduced its stake in the EV maker upon the post-IPO lock-up expiry, compounding pains from this year’s broader market turmoil.

However, as mentioned in earlier sections, Polestar’s key backers Volvo and Geely, which along with DiCaprio holds more than 94% equity interest in the EV maker post-close, are unlikely to offload their respective positions in the EV maker following the lock-up expiry. The three-way relationship’s long-term prospects are bolstered by the fact that 1) Polestar is still in early stages of capitalization on global EV adoption trends, underscoring long-term value for Volvo and Geely, and 2) Polestar relies significantly on Volvo and Geely for the viability of its core asset lite strategy.

Is GGPI a Buy Ahead of Its Merger with Polestar?

While the upcoming GGPI-Polestar merger is not expected to be a blockbuster valuation-altering event for the EV maker like those observed in Lucid and Rivian’s respective Nasdaq debuts given the current risk-off environment in equities, the stock still makes an attractive opportunity at current levels. As outlined in earlier sections, Polestar’s post-close valuation is expected to stay in the $20 billion range, with close to no premium to its implied transaction enterprise value. This would represent an EV/FY’23 sales ratio of 3.1x, which is a discount to its EV peers with similar growth profiles and geographical reach.

We remain optimistic about the $18 near-term price target for Polestar post-close, which would represent upside potential of close to 80% based on the GGPI stock’s last traded share price of $10.09 on June 17. Although the EV industry’s valuation multiples have contracted further since our last coverage on the stock in April, we are maintaining the near-term PT unchanged after additional consideration of Polestar’s market discount to peers with similar growth profiles, its anticipated post-close valuation boost, as well as its nominal share float. Specifically, Polestar’s lack of a share float (potentially < 6%) will heighten the frequency of a demand-driven spike ahead of near-term catalysts, such as new vehicle launches and achievement of fundamental growth milestones (e.g. achieving/outperforming guidance, positive progress on global expansion plans, etc.) later in the year.

Be the first to comment