Steve Jennings/Getty Images Entertainment

Shareholders of Fastly (NYSE:FSLY) have seen it all. The stock was a pandemic winner, driven largely due to its meme-stock status. That meme-status disappeared when the company lost much of its business from TikTok, with overall growth decelerating rapidly thereafter. The stock now trades just around the same price as its IPO, and investors may be wondering if it is a good metaverse stock. I discuss the valuation and long-term outlook with the stock trading at these low levels.

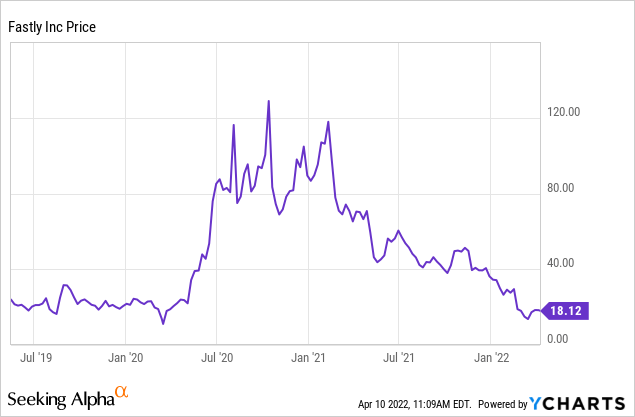

FSLY Stock Price

FSLY priced its IPO at $16 per share in 2019 and closed its first day of trading 50% higher at $23.99 per share. The optimism made sense, as content delivery networks offer a way to invest almost directly in the growth of the internet. That optimism eventually turned into euphoria as the stock peaked just under $129 per share in late 2020. It has been downhill from there.

Priced at $18 per share, the stock now trades barely higher than its IPO price in spite of three years’ worth of developments. Is the stock a buy?

FSLY Stock Key Metrics

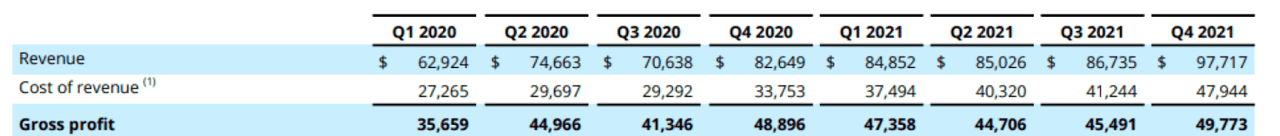

We can best see the financial developments by analyzing the results from several quarters. We can see below that FSLY was growing revenues at 26% sequentially and 49% year over year in the second quarter of 2020. That growth has slowed down to 12.7% sequentially and 18.3% year over year as of the latest quarter.

Fastly 2021 Q4 Supplemental

Gross margin has been trending in the wrong direction. Gross margin peaked at 60.2% in the second quarter of 2020 and stood at 50.9% in the last quarter. What’s more, the company has struggled with profitability, as the company is guzzling cash and is not profitable even on an adjusted EBITDA basis. These financial results are unusual considering the sustained growth and solid cash flows seen at the top dog Cloudflare (NET). What’s the issue?

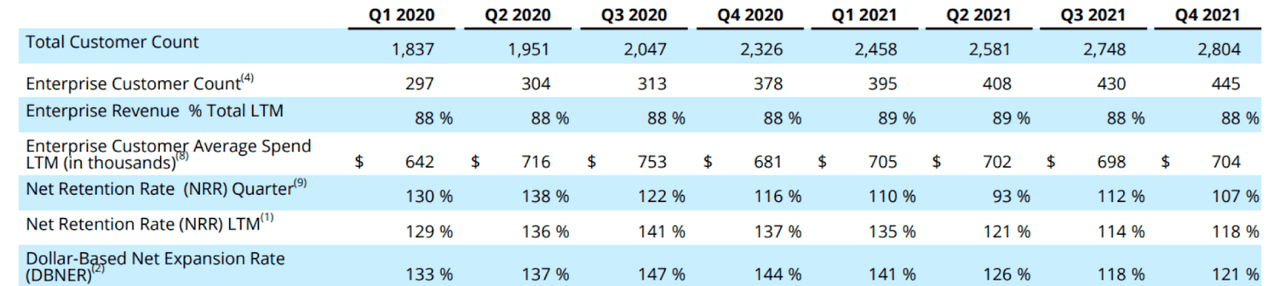

We can see below that whereas the dollar-based net expansion rate stood at 121% in the latest quarter, the net retention rate stood at only 107%. Furthermore, customer growth has been very slow at only 20.6% year over year.

Fastly 2021 Q4 Supplemental

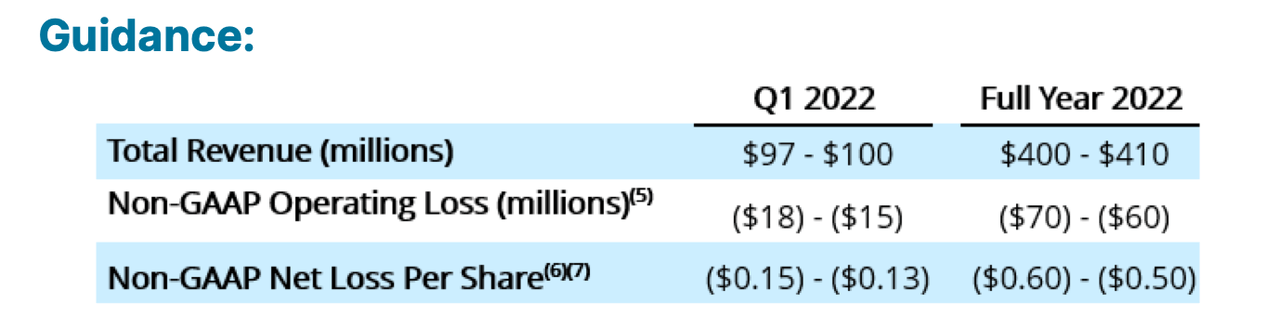

Looking forward, FSLY expects revenues to stall sequentially in the next quarter at up to $100 million. FSLY expects full year revenue growth to stand at just 15.7%.

Fastly 2021 Q4 Supplemental

The decelerating growth rate is a red flag considering that NET has guided for 42% revenue growth in spite of having a significantly larger revenue base.

Is Fastly Investing In The Metaverse?

This is an interesting question. While FSLY is not directly invested in the metaverse, its content delivery network stands to benefit as more data is transmitted online. Thus in some sense when FSLY invests in its business, it is also investing in the underlying infrastructure of the metaverse. That said, the company does not appear to be directly investing in the metaverse.

Is FSLY A Metaverse Stock?

FSLY is arguably a metaverse stock considering that the metaverse will most likely heavily rely on CDNs like FSLY. That said, the Roundhill Ball Metaverse ETF (METV) no longer believes that FSLY is a metaverse stock. As of June 30, 2021, FSLY was a 3.9% position in the ETF. As recently as December 31, 2021, FSLY was a 2% position in the ETF. As of present day, FSLY is no longer a position in the ETF. The ETF does have a position in NET, but that stock represents only 1.3% of overall assets. It is possible that the ETF manager wanted to focus more on names that are directly related with the metaverse.

What Is Fastly’s Long-Term Outlook?

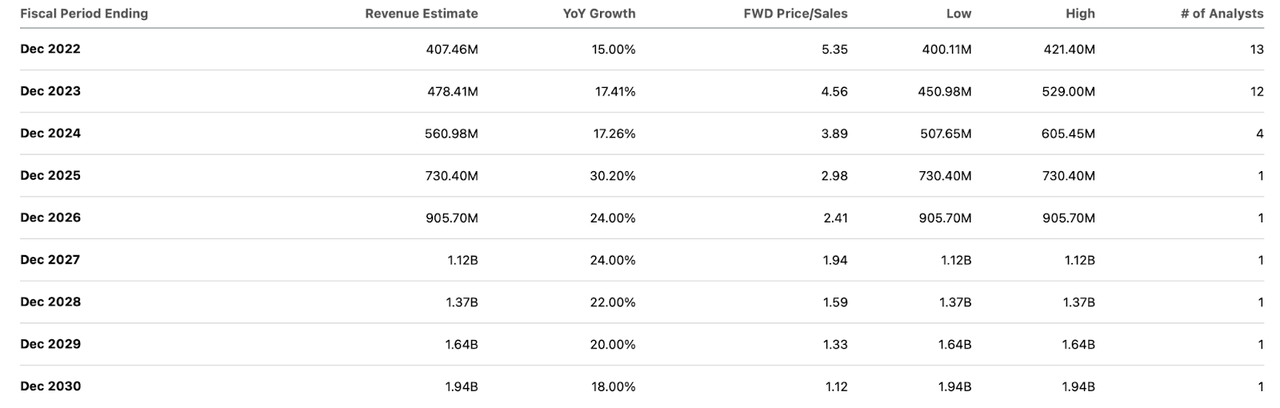

Consensus estimates call for revenue growth to slowly accelerate into 2025, where it would peak at 30%.

Seeking Alpha

Those estimates look aggressive, but there’s a reason why analysts are so optimistic. On the third quarter conference call of 2021, management guided to $1 billion of revenue by 2025. I note that consensus estimates call for only $730 million of revenue by then. To reach $1 billion in revenues, FSLY would need to grow at a 35% compounded annual rate from 2023 through 2025. Management stated that it can achieve this goal by investing more aggressively in developers which should enable it to better compete against the competition. When asked if the growth will be organic or inorganic on the same referenced conference call, management did not give a definitive answer though noted that they did not have any immediate acquisition plans.

Is FSLY Stock A Buy, Sell, or Hold?

My view is that the 2025 guidance looks very ambitious, if not overly optimistic. It is one thing when tech peer ServiceNow (NOW) guides for $15 billion of revenue by 2026 which would imply minimal decelerated growth over the next five years. But FSLY is guiding for growth to accelerate meaningfully and to sustain that acceleration through 2025. I understand any motivation to believe that guidance. The stock trades cheaply at 5.4x sales – far lower than the 38x sales at NET. Assuming the company can eventually get to 30% long term net margins, the stock is trading at only 18x long term earnings power and is still growing revenues at a double digit clip. If the company can achieve the 35% projected annual growth rate, then the multiple would likely expand to the 20x sales level (NET trades at 38x sales versus 42% growth), and the stock would be a home run from current prices.

Yet there is good reason to be skeptical. Why should investors believe that FSLY will be able to reach accelerated growth from 15.7% in 2022 to 35% in the next year? In my view, it seems far more likely that competitors like NET will aggressively take market share, making it difficult for FSLY to even sustain its 15.7% growth rate in 2023. It is far easier to sustain the status quo (like at NET) than it is to transform the underlying software (like at FSLY). The stock will likely deliver incredible returns if management can deliver on guidance. Yet what if they don’t? I could see the stock trading at up to a 1.5x price to earnings growth ratio (‘PEG ratio’), which arguably may be optimistic considering the slow growth rate and uninspiring margins. The stock offers just under 50% upside to that target, which in my view looks inadequate considering the risk-reward profile. FSLY’s balance sheet is not terrible, as it had $1.1 billion of cash & marketable securities versus $933 million of long term debt. That debt is primarily made up of 0% convertible notes due 2026 with a conversion price of $102.80 per share. Due to the high conversion price, this debt essentially acts as 0% debt for the next four years. The company burned through $38 million of cash in 2021 and thus should have enough cash on hand for some time, but if profit margins do not improve over the next several years, then the company may have to address the 2026 maturity by issuing high yield debt, which would substantially increase the risk profile of the business. That explains the simple bear thesis for tech stocks like FSLY: if you’re winning, then unprofitability can be tolerated for many years but if you’re losing, then the unprofitability can lead to debt, dilution and the stock eventually becomes a financial solvency concern. I am skeptical that management will achieve 2025 guidance and the stock is not priced low enough to take that leap of faith. I rate shares a “hold” or “avoid” as there are better opportunities elsewhere in the sector.

Be the first to comment