martin-dm/E+ via Getty Images

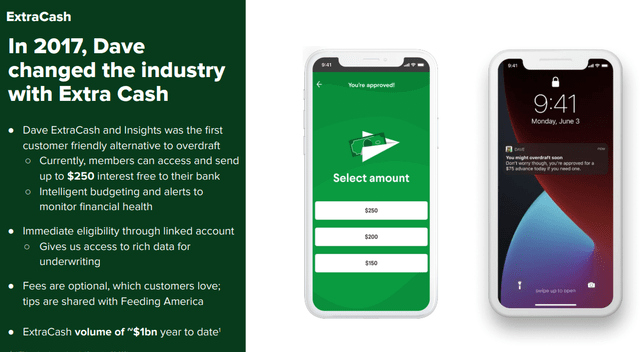

Dave Inc. (NASDAQ:DAVE) offers a suite of financial products and services for consumers as an alternative to traditional banks. From the free Dave Banking digital checking account, the company is recognized for its 0% interest “ExtraCash” advances of up to a few hundred dollars that users can quickly access with no credit check. While the proposition is compelling, the challenge for Dave is to translate its user base into a sustainable business model. Indeed, the company just reported its latest quarterly results highlighted by a widening loss and recurring cash burn. As an investment, we are skeptical that DAVE will be able to effectively compete with larger fintech players that are better positioned to offer similar solutions. There’s a bullish case for DAVE that could generate significant upside, but we believe the risks are tilted to the downside.

source: company IR

DAVE Stock Key Metrics

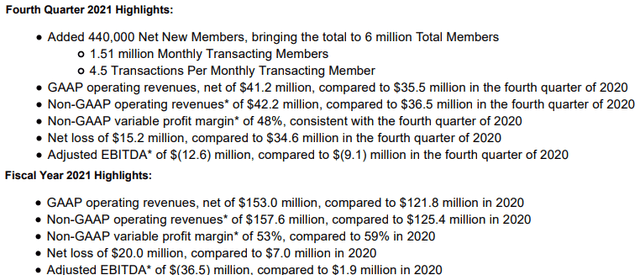

DAVE reported its fiscal 2021 Q4 earnings on March 21st with a headline net operating revenue of $41.2 million, climbing 16% year over year. A net loss of -$15.2 million on a GAAP basis technically narrowed from -$34.6 million in the period last year, although this considers a tax liability provision recorded in 2020. An adjusted EBITDA loss of -$12.6 million this quarter compared to -$9.1 million in Q4 2020 better reflects the underlying financial trend. For the full year 2021, operating revenue of $153.0 million was up 26% y/y, while the adjusted EBITDA loss of -$36.5 million reversed a small positive result of $1.9 million last year.

source: company IR

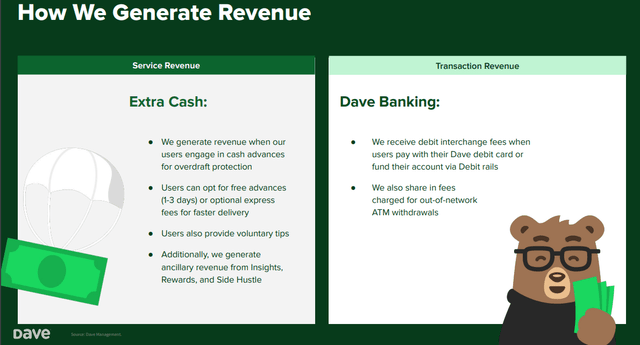

The company currently generates revenues through two primary services. With Dave ExtraCash, the option for cash advances typically processed in 1-3 days is free but users can choose an instant transfer with a charge between $1.99 and $5.99. On the Dave Banking side, the company receives a small interchange fee from merchants when users pay with their Dave debit card.

Furthermore, there are other revenue streams including the company’s “Insights” financial budgeting tool that is priced as a $1.00 per month subscription that analyzes spending trends and makes tips on money management. The company also offers a “SpendNow” feature that works through the debit card or online wallets like “Apple Pay” and “Google Pay”.

source: company IR

DAVE ended the year with 6 million total members while adding about 400k new net members in Q4. Putting the revenue figures together, the average revenue per user was around $7.00 annualized to $28 as a forward run rate. The company notes a variable “gross” profit margin of 48% in Q4, which was flat from the period last year but has trended lower from 59% in 2020. This is based on the service mix shifting with higher growth from the smaller Dave Banking segment.

During the conference call, one of the key messages from management was that the company remains in an “investment mode” to drive growth which means an expectation for more spending and higher expenses. In terms of guidance, the company is targeting operating revenues between $200 and $230 million in 2022, which represents a 41% increase over 2021 at the midpoint. The outlook for the variable profit margin in a range between 44% and 48% is lower than the 2021 result of 53% as a continuation of the trends from Q4.

Notably, this was the company’s first earnings report as a publicly-traded entity following the completion of the SPAC business combination in January with “VPC Impact Acquisition Holdings III, Inc.”. The deal helped add approximately $202 million in net cash to the balance sheet. In March, Dave announced a strategic partnership with “FTX Ventures” which included a $100 million cash investment. The goal here is to incorporate digital asset payments into the Dave platform along with incorporating blockchain technologies as a new growth opportunity.

The company notes it has approximately $320 million in cash including the FTX capital against zero long-term financial debt. Management believes its liquidity position is sufficient to fund operations and growth over the next several years without the need to raise additional funds.

What Is The Long-Term Outlook For Dave Stock?

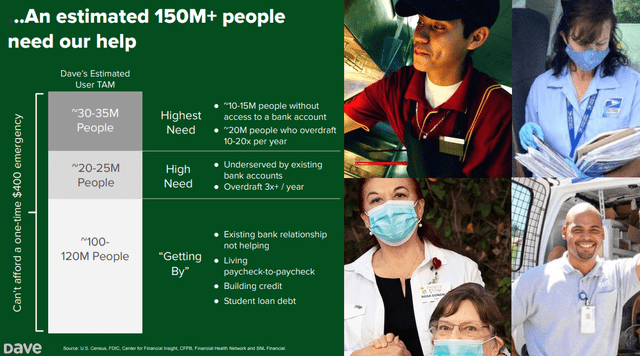

The main idea with the flagship product in Dave ExtraCash is to help people avoid overdraft fees or bridge themselves to their next paycheck for up to 14 days. The target user for Dave Inc. is anyone living paycheck to paycheck that could benefit from a free service to help avoid fees associated with traditional banking accounts. The company believes there are upwards of 120 million people in the U.S. that fall into the category of having a low or volatile income. Within this group, there is an estimated 50 to 60 million people who either don’t have a current bank account or are “underserved” by existing relationships.

source: company IR

A bullish call on DAVE sort of requires that the company will be able to break through and capture a significant portion of this group, that could likely benefit from the service. The bullish case for the stock is that the company will be able to build on these no-fee relationships by expanding and cross-selling new services over time. That said, what Dave is doing is not necessarily revolutionary and faces a competitive landscape.

We can point to several other emerging fintech players that also offer no-fee cash micro cash advances along with broader financial services like free online checking accounts and physical debit cards. These competitors include; MoneyLion Inc. (ML), “Chime”, and “Brigit” among others with varying extensions into other services. Dave also competes with consumer finance platforms as banking alternatives like Block, Inc. (SQ) with its “CashApp” service and PayPal (PYPL) through its “Venmo” personal transfers app.

To us, it’s unclear whether Dave is differentiated enough with a material advantage in strategy to significantly capture market share over the other players. The risk here is that the company fails to reach consistent profitability because either user growth slows or the expected positive margins don’t materialize.

Is Dave Stock Undervalued Or Overvalued?

The metrics we’re looking at show Dave Inc. has a current market cap of around $2.2 billion considering 324 million outstanding Class A common shares as of the latest annual report and a current price of $6.65. Taking management’s guidance for 2022 revenues to approach ~$215 million, DAVE is trading at a forward price to sales multiple of 10x.

While this type of growth premium can be justified for some high-growth stocks with a very promising outlook and disruptive business model, we haven’t seen enough from Dave to really warrant that type of enthusiasm. We believe the company is simply overvalued even following the 34% selloff from the original SPAC merger deal price.

We mentioned MoneyLion which is likely the most directly comparable stock to DAVE, given its similar business model. MoneyLion offers its “InstaCash” service which shares similarities to Dave ExtraCash while users can request advance limits above $250 by building history with on-time repayments.

ML is technically smaller than DAVE with about half as many users, but it has some advantages being active crypto and digital assets feature while also including more complex and traditional lending products. On the other hand, ML has also faced deep financial losses in its early growth stage which is reflected in the stock’s -40% decline in 2022, similar to DAVE in recent months.

Curiously, ML trades at a deep discount with its forward price to sales multiple of just 1.7x, compared to 10x for DAVE, even as some of its recent financials appear stronger. For example, ML generated a larger Q4 revenue at $54 million and higher quarter-over-quarter customer growth at 29% compared to just 8% for DAVE. ML expects to break even with adjusted EBITDA in 2022.

Recognizing that the companies have key differences, our take is that DAVE is unnecessarily expensive and ML deserves a closer look. One explanation may be Dave Inc.’s connection with celebrity investor Mark Cuban, who backed the SPAC vehicle and remains a shareholder, has added to the valuation spread and helps explain that 10x forward price to sales multiple.

Is DAVE Stock A Buy, Sell, or Hold?

DAVE Inc. is a difficult stock to assign a fundamentals-based intrinsic value given its lack of operating income, extreme sales multiple, and significant uncertainties regarding long-term earnings potential. The way we see it playing out is that the company will be forced to spend significantly on marketing and advertising to drive sales and new member growth which will end up limiting margins.

The potential that the operating trends disappoint over the next few quarters can open the door for another leg lower in the stock. DAVE remains exposed to macro trends. While a cyclical downturn could force people to turn towards lending alternatives for liquidity needs, we believe it would be a bearish headwind for the company’s growth outlook overall.

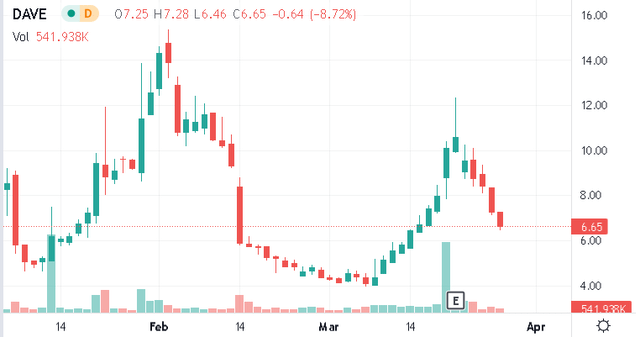

Seeking Alpha

With shares of DAVE down nearly 10% on the day as we are writing this note, and also around 45% lower just in the past week when it briefly approached $13.00, it’s hard to get aggressively bearish here and bet on more downside. It’s also hard to be against Mark Cuban which is likely one reason the stock will continue to command a premium for the foreseeable future. We rate shares as a hold which implies an otherwise neutral view on the near-term direction with an expectation that the extreme range of volatility will continue.

On the downside, the $4.00 level which was a low from early March now represents an important area of technical support. To the upside, the stock will need to firmly move above $10.00 to regain positive tactical momentum.

2022 will be a critical year for the company to confirm its operating momentum and execute on the next phase of growth. Trends like average revenue per user, monthly transactions per member, and the variable profit margin are key monitoring points.

Be the first to comment