Justin Sullivan/Getty Images News

Coca-Cola (NYSE:NYSE:KO) is a business that appeals to long-term investors who put emphasis on strategy over quarterly earnings and steady value creation over get rich quick schemes.

It has now been almost two years since I first covered the company and explained why this Warren Buffett favorite deserves attention. Defensive stocks were out of favor back then and the high growth tech names were the only game in town for most retail and institutional investors.

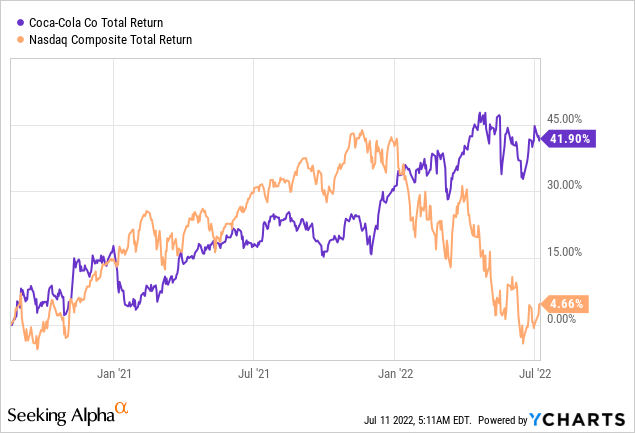

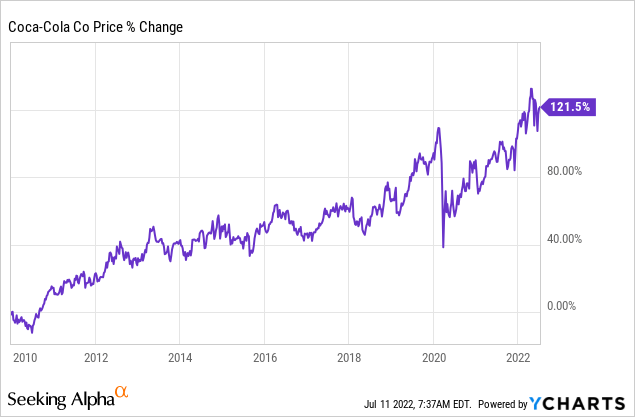

Holding KO was not seen as a smart move given all the bright prospects of the disruptors of our day. However, the graph below speaks for itself and clearly illustrates why steady value creation is far more important than short-term hype and excitement around narratives.

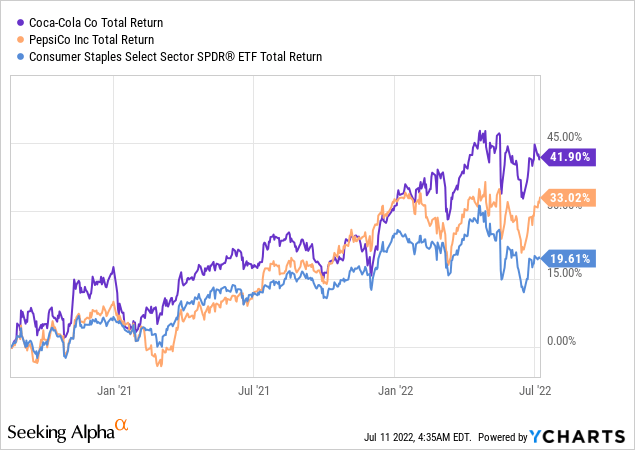

Moreover, Coca-Cola also significantly outperformed its major peer PepsiCo (PEP) and the consumer staples industry as measured by the Consumer Staples Select Sector SPDR ETF (XLP).

As the company is about to release its quarterly results soon, fears of inflation are picking up and will likely continue to haunt any narratives around KO.

After a promising start to the year, the operating environment soon changed with very significant geopolitical conflict, a resurgence of COVID in various places, record-high inflation and continued challenges on the supply chain front.

Source: KO Q1 2022 Earnings Transcript

However, once again we should not forget that narratives of excitement or fear should not have an impact on any sound long-term investment strategy. On the contrary, in the lines that follow we will have a sober look at Coca-Cola’s business and try to answer the question of whether now is a good time to buy or hold KO.

Focus On Margins And The Strategy

One of the main differences that set Coca-Cola apart from its other peers is the company’s strategy. In particular, KO remains focused on being an asset light pure beverages global business.

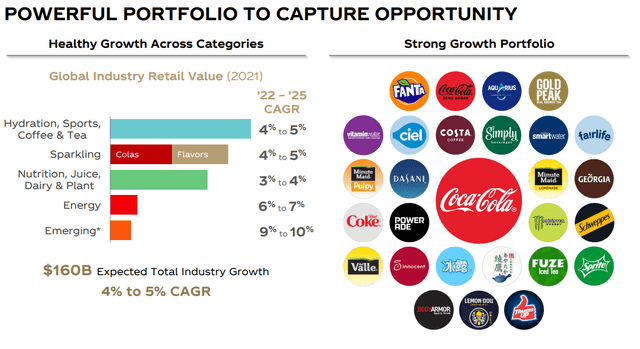

As fear of fading demand for Coke’s iconic fizzy drink brands was creating yet another pessimistic narrative around the company, the management has continued on executing on its long-term strategy. As a result, KO has become a major player across most soft drinks sub-categories where it also owns some of the strongest global brands.

Coca-Cola Investor Presentation

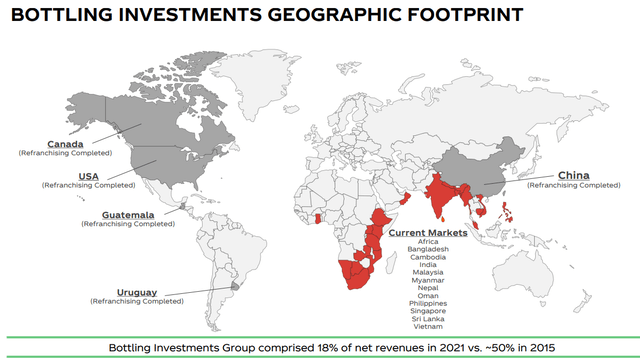

In the meantime, Coke continued to divest its bottling operations and they now make up only 18% of net revenues, compared to roughly 50% only a few years ago.

Coca-Cola Investor Presentation

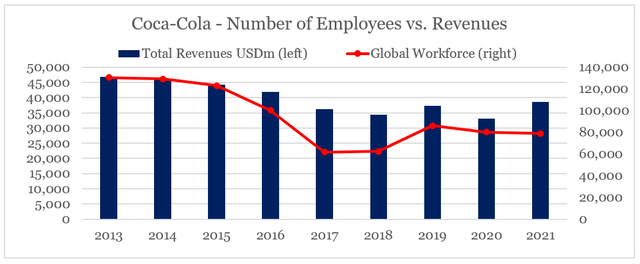

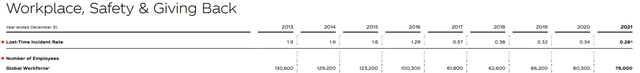

Thus the company has become significantly less capital intensive and the global workforce has shrunk from 130,600 in 2013 to only 79,000 in 2021.

As a result, KO has become more efficient with sales per employee improving significantly over the past decade or so.

prepared by the author, using data from Seeking Alpha and Annual Reports

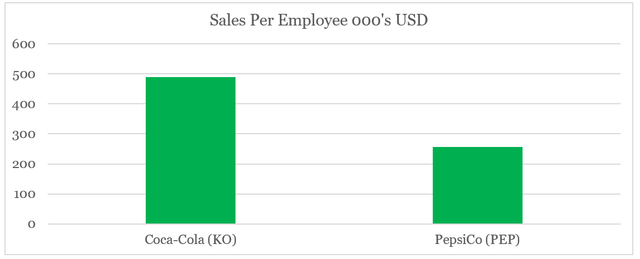

Compared to PepsiCo, for example, Coca-Cola earns significantly more revenue on a per employee basis which makes the company better equipped to retain profitability during periods of rising labor costs.

prepared by the author, using data from Seeking Alpha and Annual Reports

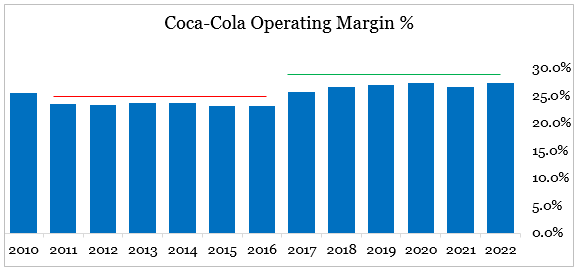

Coca-Cola’s strategy is also paying off in the form of higher operating margins, which remained resilient even during the pandemic lockdowns.

prepared by the author, using data from Seeking Alpha

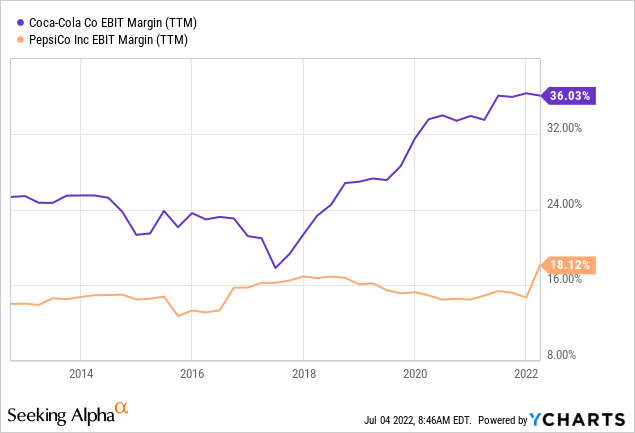

Needless to say that profitability gap between KO and PEP has continued to widen during recent years.

That is why PepsiCo relies on its much higher asset turnover and leverage ratios in order to achieve high return on capital. While there’s nothing inherently wrong with such a strategy, Coca-Cola’s business model is more resilient through cyclical downturns.

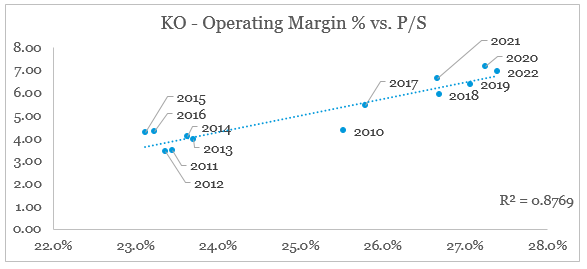

Most importantly, however, Coke’s high operating margins are closely linked to the company’s Price-to-Sales multiple.

prepared by the author, using data from Seeking Alpha

In that regard, KO still appears to be trading at fair value, even after accounting for its extraordinary total return since August of 2020.

Free Cash Flow Perspective Of KO

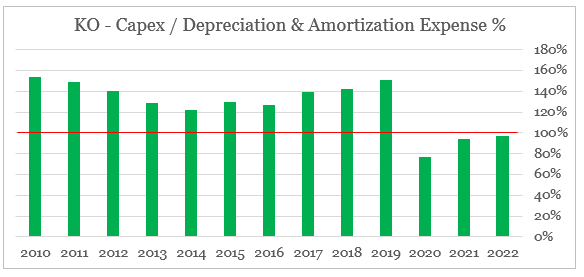

From a cash flow perspective, KO has significantly reduced its capital expenditure following the pandemic in order to preserve cash through the period of high uncertainty. Although this dynamic has somehow reversed over the course 2021, in the coming years the Capex to Depreciation and Amortization ratio is likely to return to pre-pandemic levels as new and existing business units continue to grow.

prepared by the author, using data from Seeking Alpha

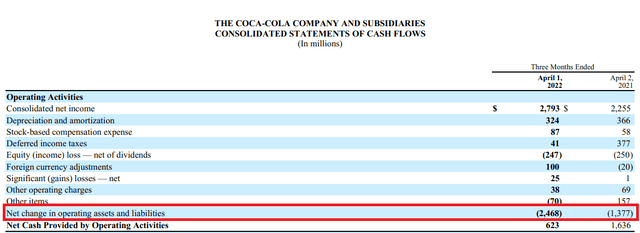

Additionally, certain working capital benefits realized during 2020-21 period are now fading and will thus have an additional negative impact on free cash flow over the coming years.

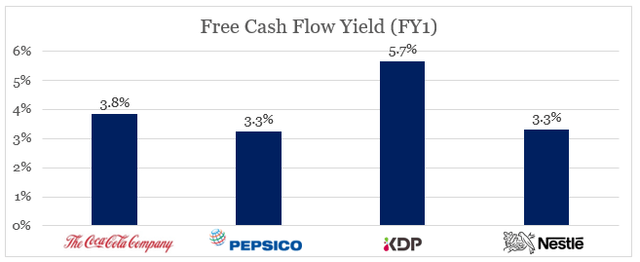

Therefore, Coca-Cola’s attractive free cash flow yield is likely to become aligned with those of PepsiCo and Nestle (OTCPK:NSRGY) all else being equal.

prepared by the author, using data from Seeking Alpha

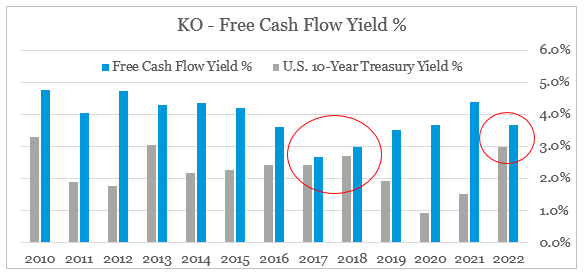

On a historical basis, the gap between KO’s free cash flow yield and the yield on U.S. 10-year treasuries is now at one of its lowest points since 2017-18 period.

prepared by the author, using data from Seeking Alpha and macrotrends.net

While the current upward swing in bond yields could easily prove to be short-lived, historically Coke’s share price performance is far less impressive during such periods.

Having said all that, it will be unreasonable to expect from KO yet another 40% total return over the next 2-year period. Nevertheless, the company has a significantly more resilient business model, which is of paramount importance during turbulent times for the global economy and equity markets.

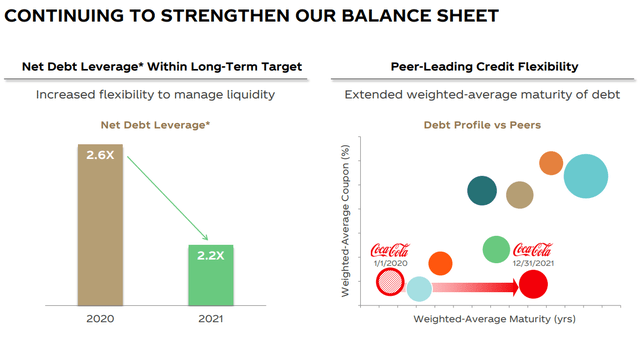

The Net Debt leverage ratio was reduced significantly in 2021, while weighted-average maturity of debt was also extended.

Coca-Cola Investor Presentation

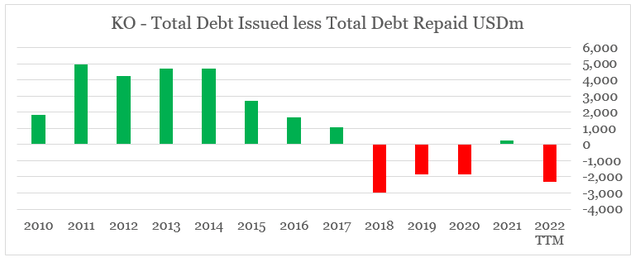

The company’s deleveraging efforts are also visible on a longer time frame, with the total debt repaid becoming higher than debt issued in recent years.

prepared by the author, using data from Seeking Alpha

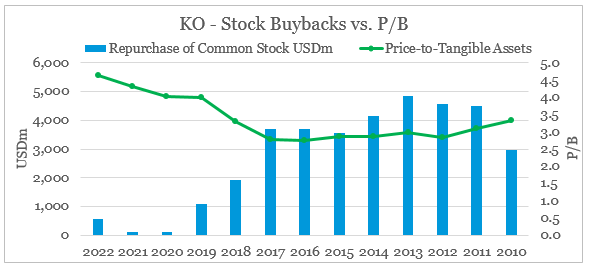

The management has also announced a 5% dividend increase, while also resuming its share repurchase program.

When it comes to capital allocation, our priorities remain the same, and we continue to balance financial flexibility with efficient capital structure. For 2022, we announced a dividend increase of 5%, a higher rate than in recent years; and we also announced the resumption of share repurchases with approximately $500 million in net share repurchases expected this year.

Source: KO Q1 2022 Earnings Transcript

The $500m share repurchase program, however, is tiny in comparison to the amount spent on buybacks prior to 2018 (see the graph below). Coke’s management was also spending significantly more on share repurchases during periods when the company was trading at significantly lower price-to-tangible assets multiples, thus improving returns for long-term shareholders.

prepared by the author, using data from Seeking Alpha

Conclusion

As Coca-Cola is about to report its second quarter results for 2022, most analysts and market commentators will remain focused on whether or not the company meets or beats expectations and the overall impact on current inflationary pressures. Long-term shareholders, however, should remain focused on the company’s execution on its strategy and capital allocation decisions. Although, there are signs that Coke is unlikely to repeat its spectacular performance of the past two-year period, the company remains a solid long-term investment.

Be the first to comment