Sundry Photography

Cisco (NASDAQ:CSCO) jumped after reporting earnings and an outlook that were better than feared. While growth is still expected to remain muted next year, the stock is not trading at “tech-like” valuations which means that there are not tech-like expectations. The company’s net cash balance sheet suggests that shareholders can expect aggressive share repurchases moving forward, which in conjunction with the 3.1% dividend yield make this look like a shareholder yield story. Trading at just under 14x forward earnings, the stock is offering an attractive price as investors wait for potential multiple expansion.

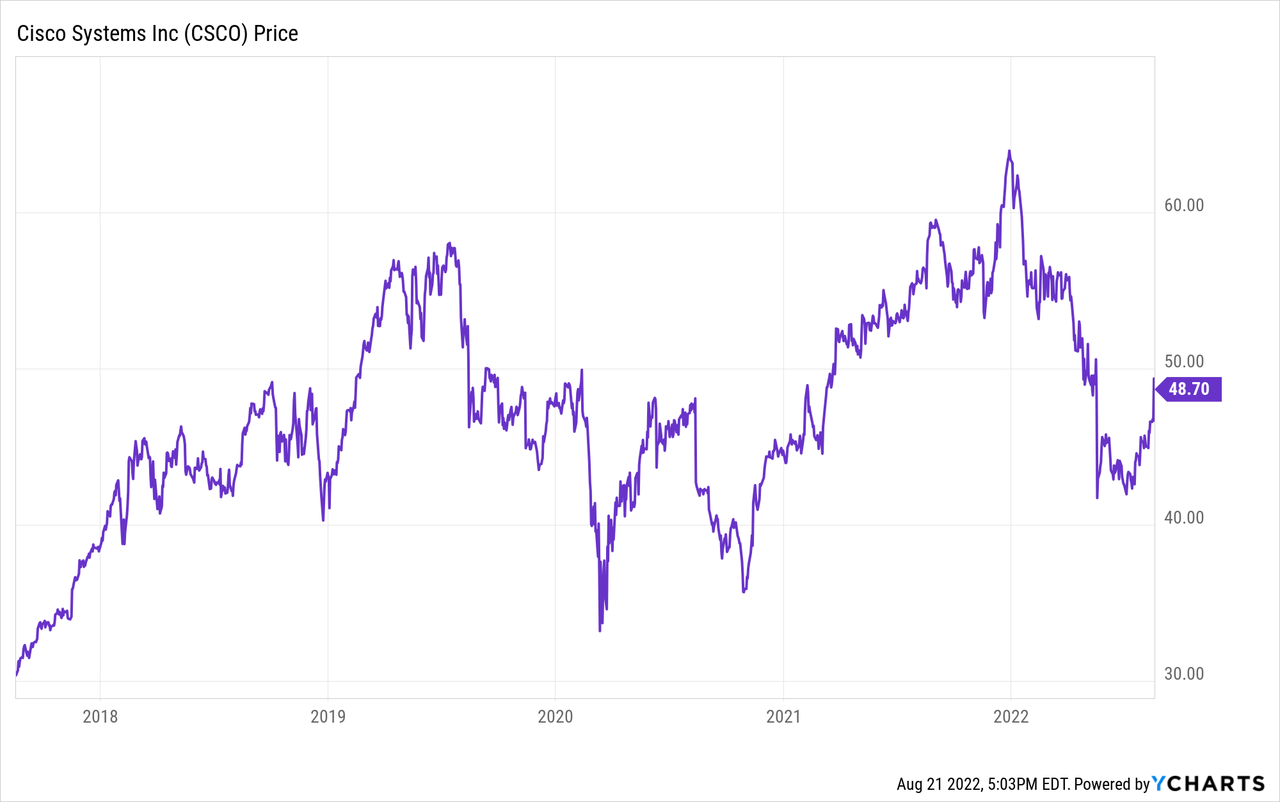

CSCO Stock Price

CSCO shareholders have not had a lot to celebrate with the stock down from all time highs and roughly flat over the past five years.

Value investors know that long periods of underperformance can lead to a future of outperformance, though there are of course no guarantees.

What Were Cisco’s Expected Earnings?

Heading into earnings, the market was quite pessimistic considering the broader tech crash – the stock had dropped nearly 30% before the print.

Did Cisco Beat Earnings?

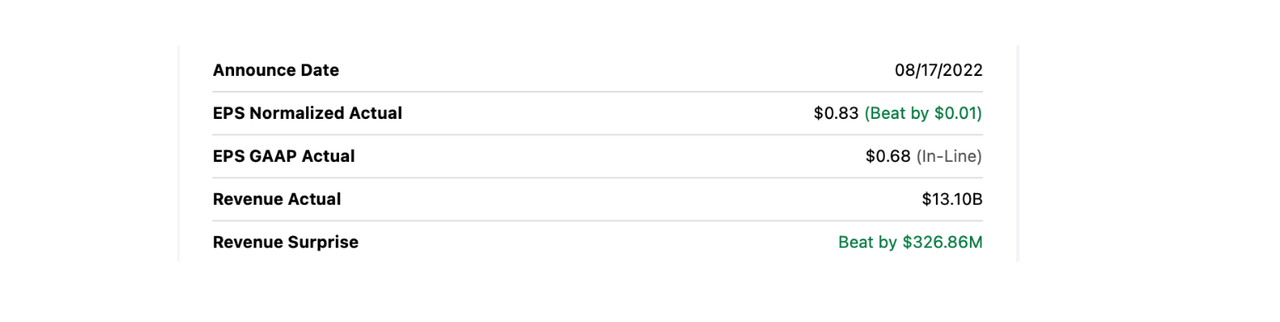

While CSCO did not deliver outstanding growth, its results were better than feared, leading to the stock jumping after the report.

Seeking Alpha

CSCO Stock Key Metrics

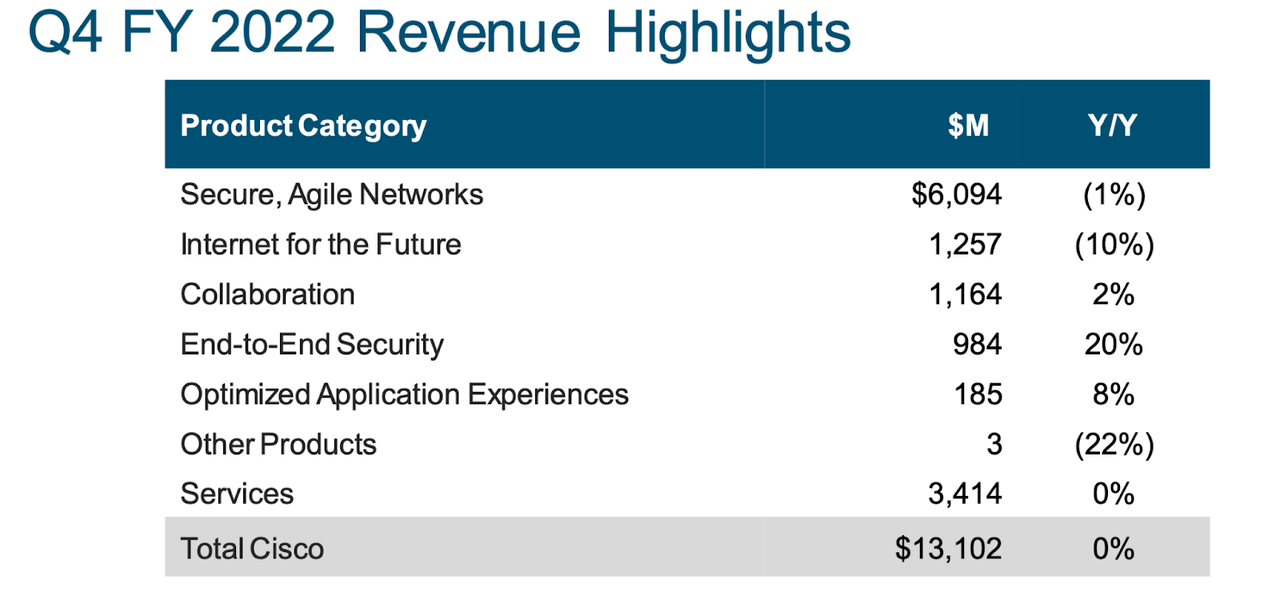

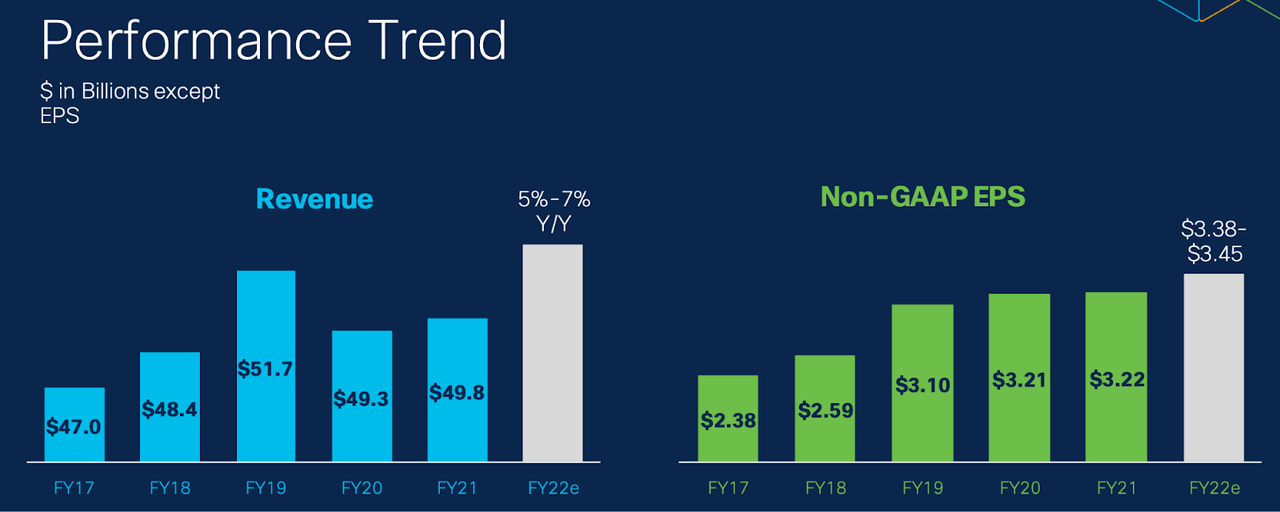

CSCO closed its fiscal 2022 year with flat revenues, as “Internet for the Future” revenues (this segment houses 5G, cable, and data center spend) declined 10% to drag down strong results from their zero trust offerings.

Q4 FY2022 Slides

The flat revenue growth led the company to close the fiscal year with 3% full-year revenue growth. Non-GAAP earnings per share came in at $0.83 in the quarter, down 1% year over year. For the year, non-GAAP earnings grew 4% to $3.36 per share.

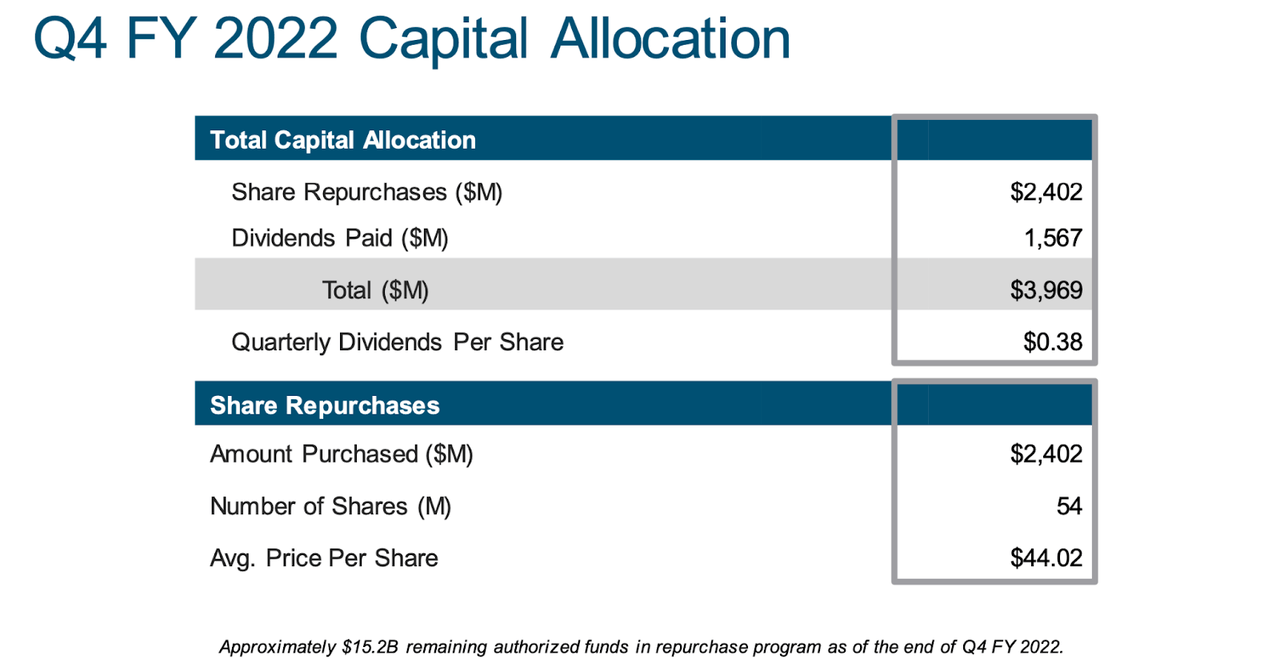

CSCO repurchased $2.4 billion in the quarter, bringing its full-year count to $7.7 billion. The company also paid $6.2 billion in dividends in the year. I have noticed that tech companies paying dividends and share repurchases have held up stronger than most.

Q4 FY2022 Slides

CSCO ended the quarter with $19.3 billion of cash and investments versus $9.5 billion of debt. While this net cash position has been declining over the past few years, it still represents a long term leverage opportunity.

What To Expect After Earnings

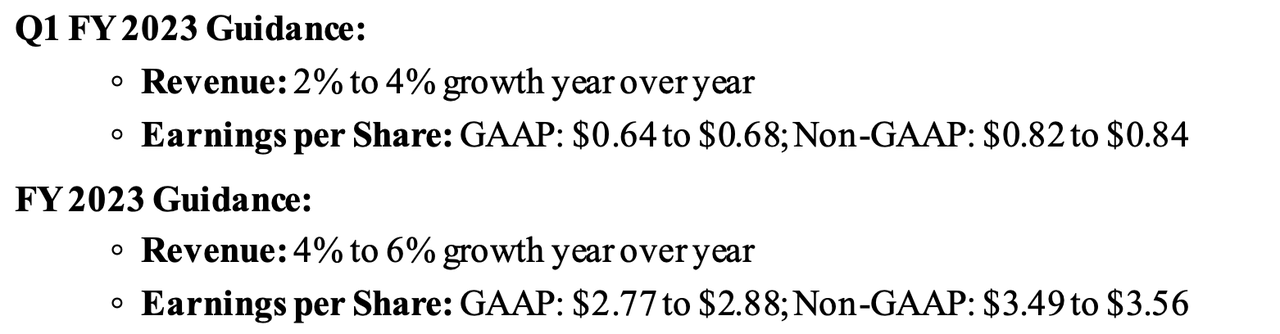

Those results weren’t that exciting – it was instead the guidance that provided the spark in the stock price. CSCO guided for up to 4% revenue growth in the next quarter and up to 6% revenue growth for the full year.

Q4 FY2022 Slides

That guidance seems to imply accelerating growth exiting the year, perhaps giving hope for sustained strength even in the following year. CSCO expects non-GAAP earnings per share to grow by as much as 6% – on the conference call, management confirmed that guidance did not assume any share repurchases.

Is CSCO A Good Investment Long Term?

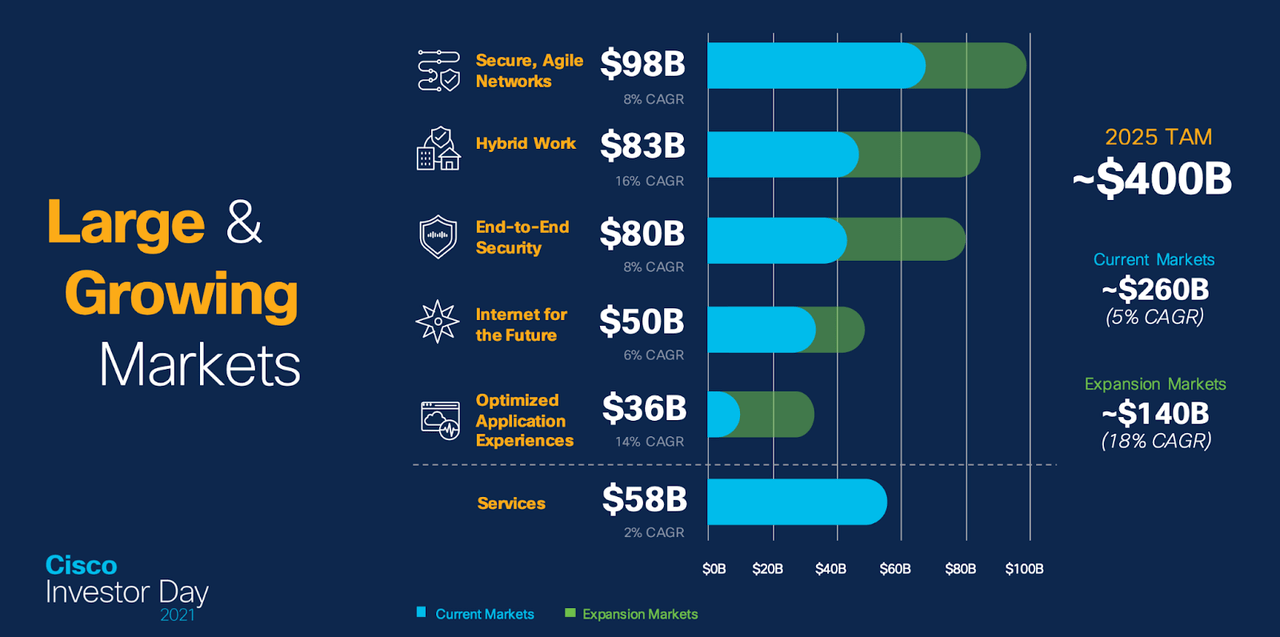

Over the long term, CSCO continues to address large and growing market opportunities.

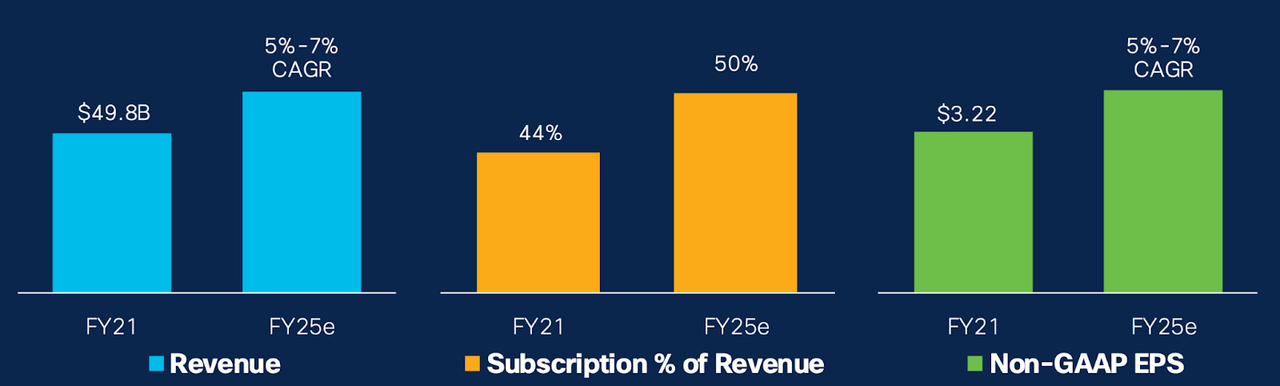

2021 Investor Day

That said, it may be smart to reel in expectations. CSCO has shown solid growth over the past few years, but growth has clearly decelerated rapidly in the recent years.

2021 Investor Day

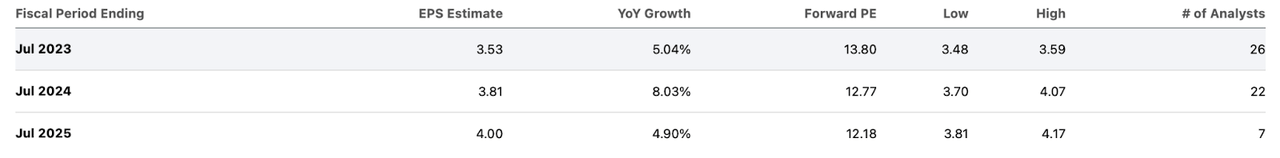

Consensus estimates call for low single-digit revenue growth over the coming years.

Seeking Alpha

That is expected to lead to single-digit earnings growth.

Seeking Alpha

These consensus estimates trail the company’s own medium term guidance of up to 7% revenue and earnings growth.

2021 Investor Day

While CSCO remains a solidly profitable company, its sheer size has caused it to come face to face with the “law of large numbers.”

Is CSCO Stock A Buy, Sell, or Hold?

In return for the slower projected growth, CSCO offers a cash cow trading at reasonable valuations. The stock recently traded at just 14x forward earnings. This is a company which typically converts most if not all net income to free cash flow. What’s more, the company has a net cash balance sheet which means that there isn’t any reason why the company couldn’t continue returning all of free cash flow to shareholders through dividends and share repurchases. I could see the company eventually increasing leverage to as much as 2x debt to EBITDA if not much higher. At 2x debt to EBITDA, CSCO would have approximately $40 billion in debt capacity available which would be enough to retire 20% of shares outstanding.

Without assuming any multiple expansion, the current 7% shareholder yield and 6% forward growth rate might lead to annual double-digit returns. Yet I could see the company eventually re-rating higher to an earnings multiple in the 18x-22x range, falling more in-line with the multiples of consumer staples. That could add in another 3% to 5% annual return potential depending on how quickly the multiple expansion occurs. The main catalyst for multiple expansion might simply be ongoing execution on growing dividends and share repurchases, as that has arguably been a tried and true method to earn higher multiples. The biggest risk here in my opinion is for the slow growth rates to eventually turn negative, at which point lower multiples would not be out of the question. Being an incumbent in many of the markets it operates in, CSCO potentially faces threats from innovative disruptors. The fear of such disruption, rational or not, might prevent the projected multiple expansion from taking place. I rate CSCO a buy on account of the attractive valuation and high shareholder yield.

Be the first to comment