Scharfsinn86/iStock via Getty Images

Introduction

Cenntro Electric Group Limited (NASDAQ:CENN) is a noted design and manufacturing entity focused on global electric light and medium-duty CVs (ECV) with a presence in over 26 countries, across North America, Asia, and Europe. The company only became public on the 31st of December 2021, via a merger with the Naked Brand Group.

What Market Does Cenntro Electric Serve?

Commercial vehicles serve as ineluctable cogs of the broad global commerce ecosystem, and this is unlikely to change any time soon. These vehicles are instrumental in facilitating last-mile delivery and other commercial applications. Within the CV space, conditions appear to be tilting in favor of electric-powered vehicles on account of factors such as stricter regulatory requirements/emission norms, the superior cost efficiency of EVs, and financial incentives linked to EV ownership. Global commerce is fast becoming a cutthroat arena (if it isn’t already), and facilitators in that space will be latching on to transport infrastructure that will not only be cost-efficient, but sustainable as well.

From a currently unremarkable industry sales figure, Wood Mackenzie thinks global commercial EV sales could surge to 3m by 2025 and then triple even further to 9m by 2030! This appears to be a market poised for exponential growth, and it pays to be exposed to entities such as CENN that are at the vanguard of the ECV movement.

What Should Investors Know About Cenntro Electric’s Business Model?

I believe CENN has an edge over its peers on multiple fronts. Investor interest in commercial EVs may have kickstarted only over the last few years, but do consider that CENN has been laying down the building blocks for a while now (since 2013), and we’re already seeing the benefits of this translate into first-mover advantages across some key global markets (it may not be a mind-boggling figure, but as things stand, at over 3300 units, no other entity has delivered more ECVs than CENN).

Also, note that CENN is gaining acceptance in key markets ahead of its peers. For instance, it recently became the first foreign ECV maker in Japan to receive the Kei Car homologation approval (incidentally approval was granted even ahead of other local Japanese names which gives you a sense of how highly regarded the company’s tech is, in the global ECV space). Japan is a market brimming with opportunities for something like a CENN as you have a rapidly aging society which makes the prospects of home delivery particularly promising. The country also has some rather ambitious emission goals to attain by 2030, which would call for 90% of its auto portfolio in that year to be battery-electric vehicles. All in all, the ECV market in Japan is expected to be one of the fastest-growing global regions growing at 23.1% CAGR until 2026.

Why is the market gravitating towards CENN? Over the last few years, the company has been able to establish a solid IP infrastructure which has seen it being granted over 238 patents! This innate IP capital also serves as the bedrock against which the company has been able to make waves in artificial intelligence and autonomous driving. Consider the utilitarian effects of something like their SOC (System On Chip) technology which is an integrated single-chip that inculcates hardware, software, and driving control all in one place. The SOC enables the vehicle to be controlled by a smartphone app where users can monitor the vehicle in real-time and gain insight into driving performance, speed control, replacement schedules, etc. Also, note that Cenntro itself develops and owns this chip, rather than outsourcing it; this would give it an edge when the industry is facing supply-chain-related chip issues.

Then you also have something known as the iChassis which could be a gamechanger in the commercial autonomous driving market; here different commercial apps can be loaded for different autonomous driving applications, be it city sanitation, mobile vending, city delivery, etc., and you could see how useful this could be for commercial entities. Production of this is due to go live in 2023 and you would think this would open up a potentially stable route of monetization via a subscription model which I don’t believe the market has yet fully priced in when gauging the CENN stock’s potential.

Currently, CENN also looks well-poised to scale up its operations and the auto industry is ripe with examples of how a much broader product portfolio has helped stimulate the prospects of a brand. For the longest time, CENN had relied primarily on sales of its light urban ECV – Metro but since late 2021, and early 2022, the product portfolio has been beefed up with the introduction of four new vehicles- a) Logistar 400 – a last-mile vehicle specializing in mobile vending, b) Logistar 200 – a last-mile vehicle for general urban purposes in Europe, c) Neibor 200 – a neighborhood delivery service vehicle and d) Terramack ORV – an off-road utility vehicle primarily used for agricultural purposes.

Are There Any Events Surrounding Cenntro Electric That Investors Should Be Watching?

In the short term, the most important event to watch out for would be the FY results due to be announced this month (a specific date has not been picked). CENN is not covered by the sell-side analyst community so there won’t be any consensus estimates to watch out for, but investors may consider seeking clarity in the following areas:

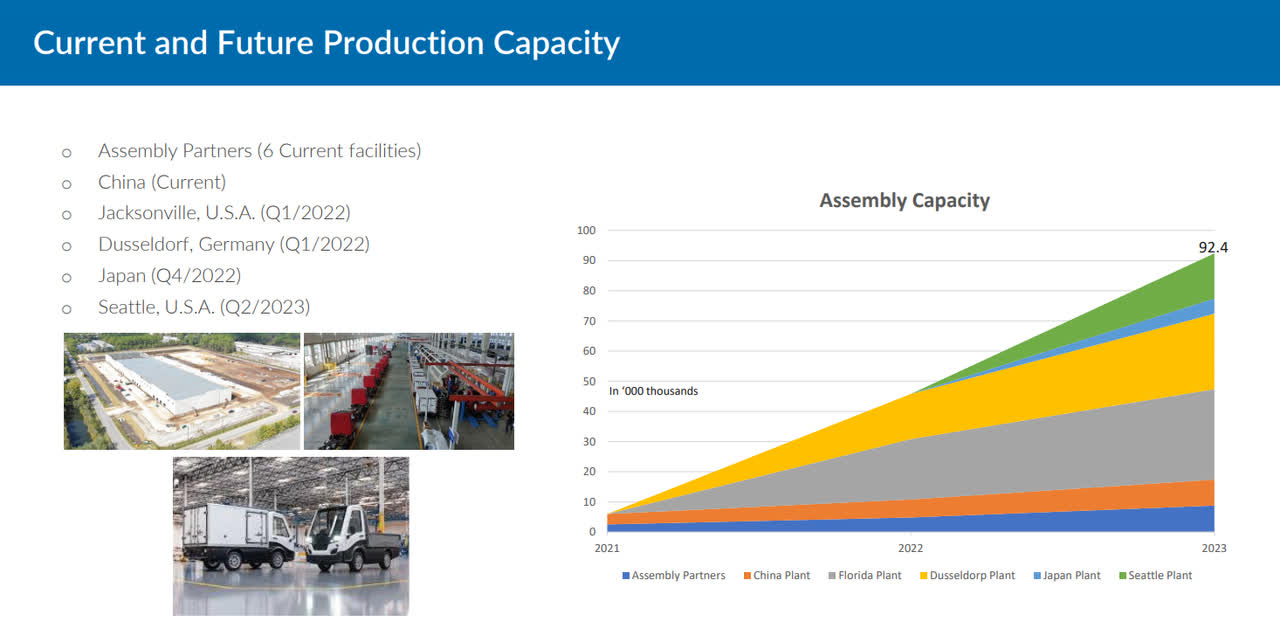

Is there a slowdown in the EMEA market and how does their competitive positioning change following the majority stake acquisition of Tropos Motors Europe GmbH (TME)? In keeping with the TME deal, is this theme of buying acquisition stakes in its existing customers likely to recur (TME has been one of CENN’s largest customers since 2019) What’s the reception been like for products that were introduced in Q4-21/Q1-22? Are there any other new products in the anvil? How did CENN manage the volatility in nickel prices in Q1 and are there downside risks to its cost estimates for the year? Considering CENN is poised to significantly ramp up its production targets, what does CENN’s liquidity position look like over the next 12-18 months, and will it be looking to raise further cash during this period? FY21 year-end cash figure was $250m which was believed to be sufficient to meet investments in Dusseldorf and Jacksonville. Over the next two years, the company is due to expand production in different regions ranging from Japan to Seattle; is the company on course to meet these timelines as laid down in the image below or will there be delays?

Nov 2021 presentation

Closing Thoughts – Is CENN Stock A Buy, Sell, Or Hold?

Existing CENN stock owners can be forgiven for feeling disillusioned with the stock as it has lost around 60% on a YTD basis. The Russian-Ukraine fiasco has upended the supply-demand dynamics in the EV related commodity space, and investors are also somewhat fearful of the company’s current impetus towards the European markets, particularly considering how vulnerable conditions look there currently (the majority interest in TME, valued at roughly $17m, including the absorption of the company’s debt, shouldn’t be financially crippling for CENN, as the latter finished FY21 with $250m in cash). I’ve also seen some criticisms with regards to the specifications of some of VENN’s product portfolios. Naysayers have questioned the limited range of CENN’s vehicles, but when you’re looking at something like last-mile delivery (which is what CENN vehicles may largely be used for), I don’t believe the range potential has to be a hindrance.

Regardless, I believe the bulk of the risks tied to CENN are relatively transient in nature, and at a current market cap of just around $600m, the risk-reward for a long position in the CENN narrative should not be dismissed.

This is not just a case of picking up garbage at dirt cheap prices. Rather, I believe the Cenntro Electric Group is poised to enter a rather exciting phase where production and sales numbers could potentially explode over the next two years. Between FY22 and FY23, they plan to produce a total of over 96000 units in aggregate, and this should likely result in FY23 sales of over $2100m. As noted previously, we’ve also recently seen evidence of how CENN has been able to overshoot its previous production and sales growth targets (as against an initial target of 1563 electric CV units, they ended up hitting 1623 units for the whole of 2021). Considering the sales potential on offer (incidentally the highest amongst all commercial EV makers) I believe the market is grossly undervaluing the CENN stock.

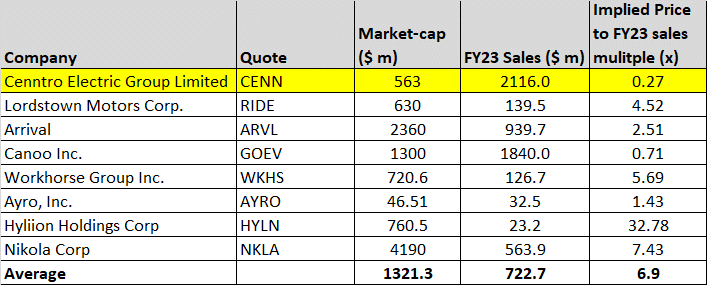

To reiterate my case, I’ve compared Cenntro Electric’s expected FY23 sales number to seven other peers in this space. Considering the best-in-class sales figure, a forward price to sales multiple of just 0.27x feels criminally low (note for instance, whilst CENN will likely deliver close to 75000 units by FY23, something like a Lordstown Motors will likely only deliver 2500 units of the Endurance in that period, yet, this is a company that trades at a multiple of 4.5x).

Seeking Alpha

Also consider that Cenntro Electric is a company with some compelling IP infrastructure, above industry gross margins (25% GMs vs the broad auto industry average of only 19.25%), a pipeline of new products, and a first-mover advantage in some key markets such as Japan (where last-mile delivery in commerce is of great value, even as the population there ages).

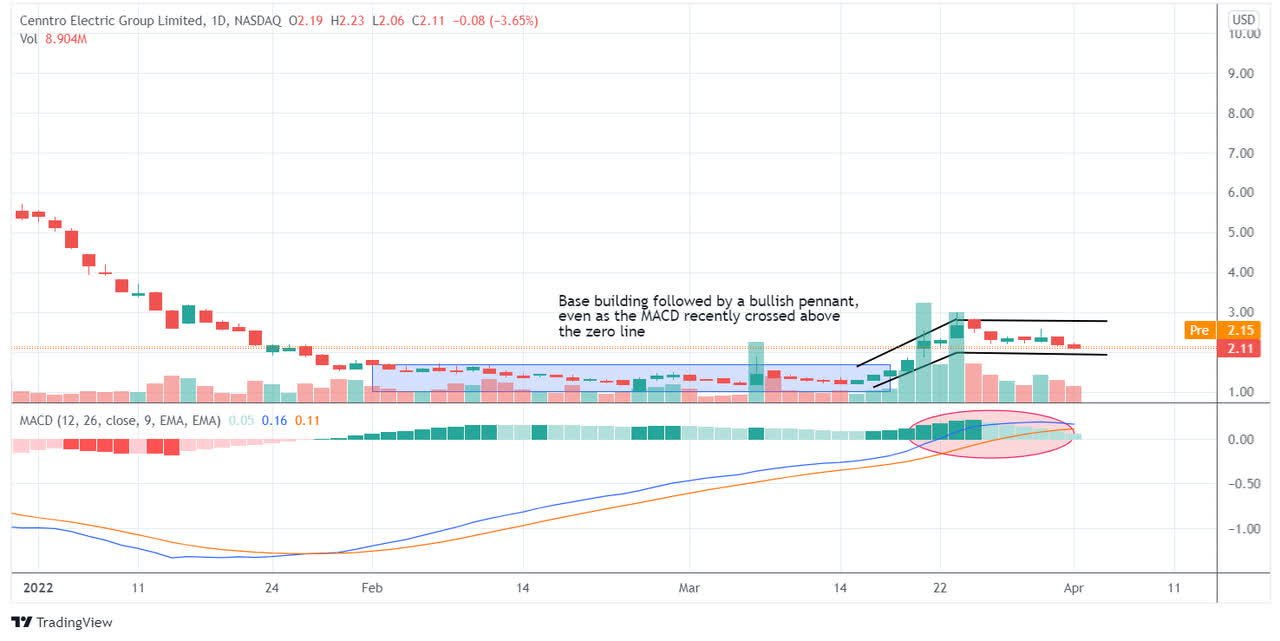

TradingView

Then, if I switch over to the standalone chart of CENN, I believe things are looking up. After weakness during the start of the year, the CENN stock has indulged in some bottom formation from February to mid-March. After forming a long base during this period, we’ve seen bullish momentum visit this counter in late March, and currently, the stock appears to be making imprints in the shape of a bullish pennant pattern. Also note that the MACD has recently crossed above the zero line, typically a sign of further bullish momentum.

To conclude, CENN’s outlook over the next two years looks promising, valuations are dirt-cheap at this price point, and the technicals also appear to have turned a corner; the CENN stock is a BUY.

Be the first to comment