Tero Vesalainen/iStock via Getty Images

When things go right, people tend to ascribe the outstanding performance of a company on their superior stock-picking skills. On the contrary, when things go terribly wrong, we tend to blame external factors that are outside of our control or simply labelling the market as being irrational.

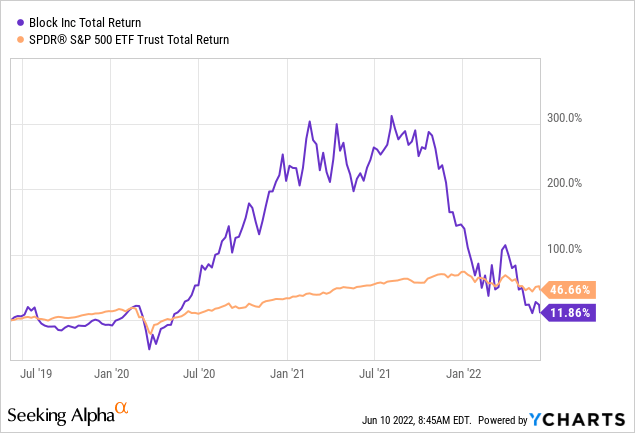

This holds true when judging the recent performance of Block (NYSE:SQ). The company’s share achieved nearly 300% return from mid-2019 to mid-2021 period, only to plunge down over the recent months. As a result, the company has now significantly underperformed the broader market on an absolute basis over this 3-year period. Adjusted for risk, the situations is even worse.

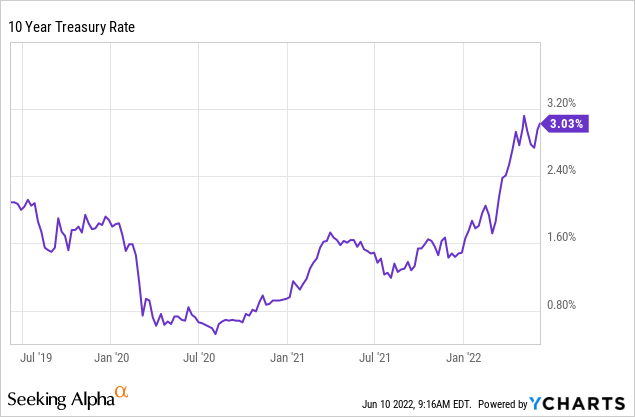

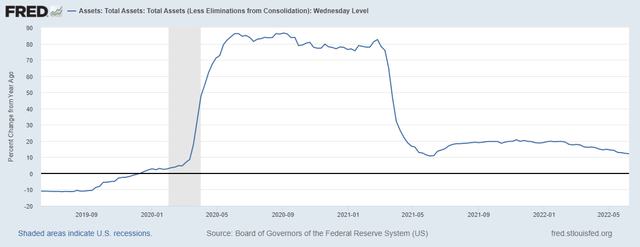

Simply observing this trend, should raise a major red flag for any shareholder. Block’s outstanding share price performance up to mid-2021 seems to have been entirely driven by the loose monetary conditions, as opposed to a superior business model and corporate strategy. Even without more in-depth research, the impact of low yield and ample liquidity on high momentum stocks, such as Block, is plain to see.

FRED

Of course, there is a possibility that this unprecedented monetary experiment is far from over. Although it is less probable in an inflationary environment and a world heading to deglobalization, the chances of yet another massive quantitative easing or yield curve control are not zero.

But we can’t select out long-term investments based on such hopes. What any long-term oriented investor should be looking at is the quality of the business model, the sustainability of competitive advantages & margins, the relevance of the corporate strategy, the stewardship role of management, financial risks and finally valuation.

Therefore, when judging the attractiveness of Block’s share price I will abstain from the possibility of future liquidity injections by the government or central bankers and will also stay away from exciting narratives that often rely on ever increasing optimism about the future. Instead, I will focus on three major areas of the business that in my view hold significant risks for future returns, even as Block gets closer to its short-term fair value equilibrium.

Block’s profitability problem

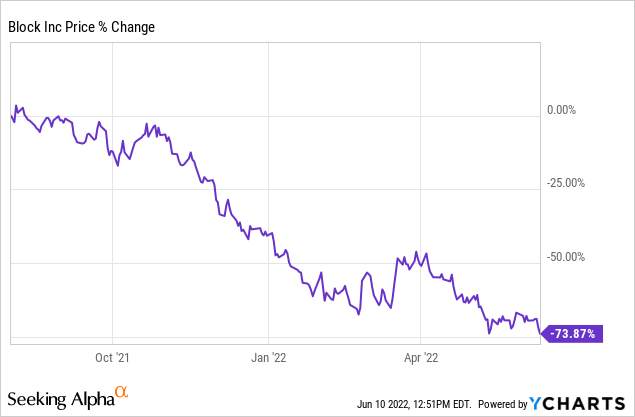

As we mentioned earlier, Block’s share price lost nearly three quarters of its value in a matter of just few months.

This happened at a time when the S&P 500 fell by about 10%. Such abysmal performance is possible either if the company in question is having financial health issuer, or there are significant discrepancies between the profitability & growth expectations and reality. In case of Block, the issue appears to be the latter.

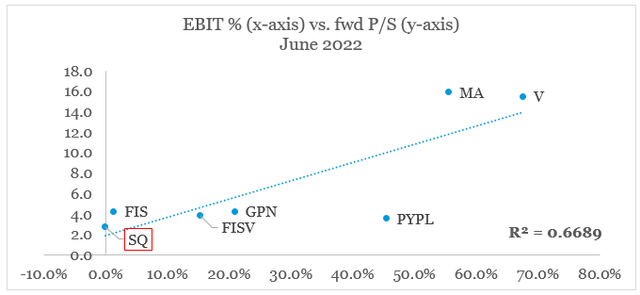

As of today, the company’s forward price-to-sales multiple of 2.5x is in-line with its operating margin of a negative 0.1% on a cross sectional basis.

prepared by the author, using data from Seeking Alpha

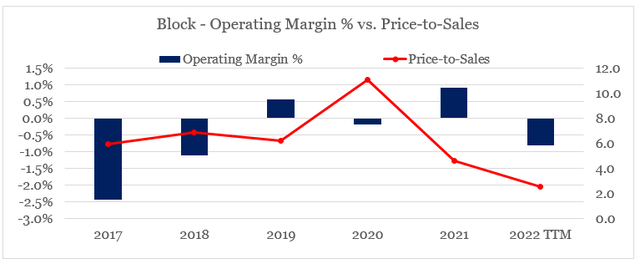

While both variables have been moving in unison over the past, that does not mean that EBIT margin of barely 1% was enough to support price-to-sales multiple in excess of 10 (see the graph below). We already established that the exuberant prices of Square achieved during the 2020-21 period were due to the excessive liquidity pumped into the system that resulted in unsustainable valuations not only for Block, but also for many high momentum stocks.

prepared by the author, using data from Seeking Alpha & SEC Filings

Based on all that, it is now reasonable to assume Block’s valuation will be more in-line with those of its peers, once we control for future growth and margins. I will expand more on the issue of revenue growth in the next section.

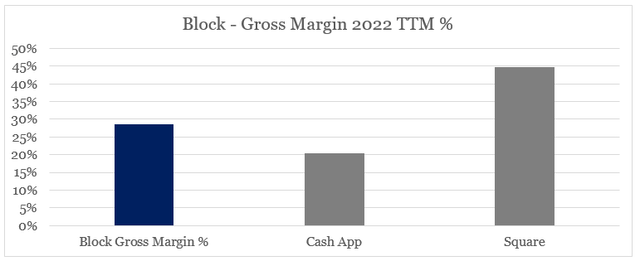

To generate high EBIT margins, a company’s business model needs to be able to support these through high gross profitability. From thereon larger scale and efficiency is usually enough to achieve the much needed operating profitability.

Having said that, the two major business units of Block generate vastly different gross margins, with the Cash App currently churning only 20% gross margin.

prepared by the author, using data from SEC Filings

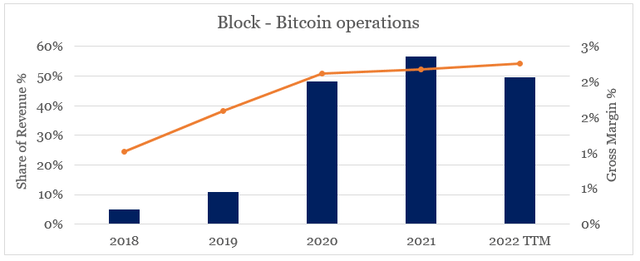

We should recognize that this low margin of the Cash App came predominantly as a result of the company’s bitcoin operations, which generate a mere 2% gross margin and increased significantly since 2020.

prepared by the author, using data from SEC Filings

The reason for that is that Block reports its bitcoin operations on a gross basis, but more on that later.

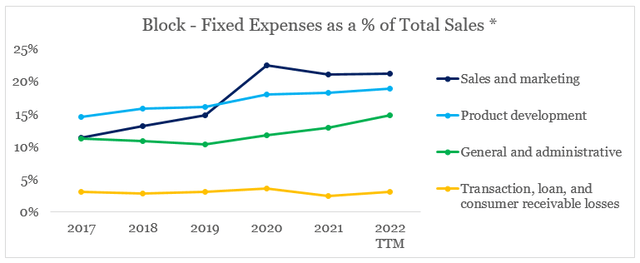

If we ignore Bitcoin operations and adjust the company’s total sales figure for all crypto-related revenue, we will see that almost all of Block’s fixed expenses continue to increases as a share of revenue. This is very concerning given the huge growth tailwinds experienced during the pandemic that are now subsiding.

prepared by the author, using data from SEC Filings

* excluding revenue from Bitcoin operations

The problem with sales growth

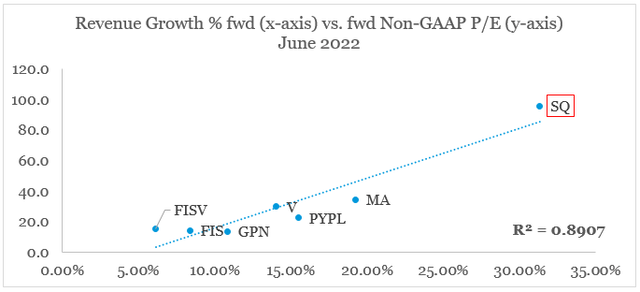

One comment that is often made is that profitability doesn’t matter as long as Block continues to grow at such high rates. To an extent this statement is true since the market could turn a blind eye on the lack of profitability as long as a company continues to grab market share. This view is supported by the graph below, where Non-GAAP forward P/E ratios are plotted against companies forward revenue growth rates.

prepared by the author, using data from Seeking Alpha

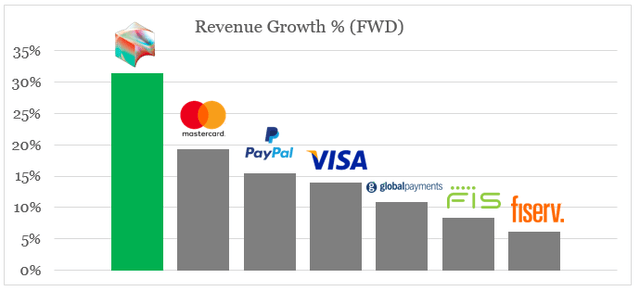

Compared to other large businesses in the electronic payments space, Block is an absolute leader by a very wide margin.

prepared by the author, using data from Seeking Alpha

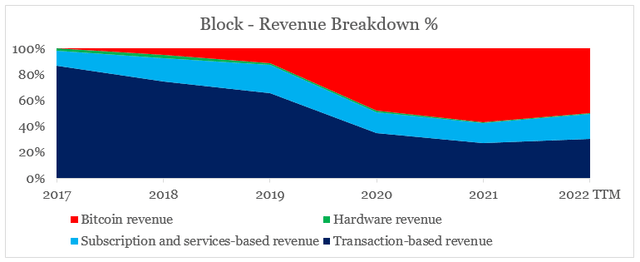

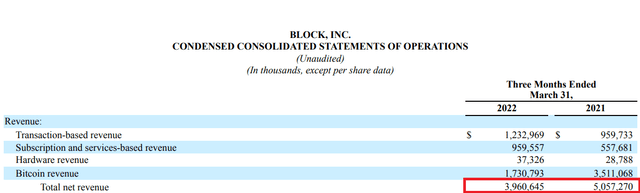

But there are two problems here. Apart from this number being affected by the massive deal for Afterpay, which I will cover later on, Block topline growth was also largely impacted by its bitcoin operations. A breakdown of the company’s revenue shows that from non-existent in 2017, bitcoin now makes up nearly half of total sales.

prepared by the author, using data from SEC Filings

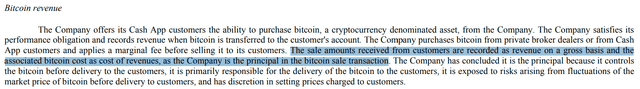

If we dig into Block’s SEC Filings, however, and more specifically have a look at the revenue recognition part, we will understand why this is. It is not because, the company suddenly tapped into a segment that brings billions of dollars, but rather due to accounting treatment. In its bitcoin operations, Block allows Cash App customers to buy and sell bitcoins and for that it charges a commission. However, these transactions are recorded on a gross basis, meaning that the company records the full amount of bitcoins purchased by a client as revenue and is then expensing the cost to obtain those bitcoins.

Block 10-K SEC Filing Block 10-K SEC Filing

From an accounting point of view, there’s nothing wrong with this treatment since Block assumes ownership of these bitcoins, before they are sold to clients.

From a financial point of view, however, these transactions significantly inflate Block’s topline growth and also result in much lower gross margins for the Cash App as we saw above. Nevertheless, as long as P/E ratios are predominantly driven by future expected growth, this trade-off between revenue growth and margins seems justified.

The problem with Afterpay

Large M&A deals are often frowned upon by the investment community as they tend to backfire in the long-run or could be interpreted as a sign of desperation as topline growth cools off. The last point is very sensitive for Block since future expected growth matters a great deal for the company’s high trading multiples.

I will not speculate whether or not the deal was made due to slowing growth of Square and the Cash App, but the deal for Afterpay is marked by a number of major red flags that need addressing.

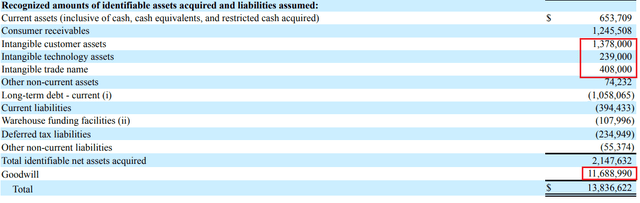

To begin with, a company such as Afterpay, is largely made up of intangible assets with assets such as property, plant & equipment and inventories being a tiny proportion of its overall business value. That is why the total value of intangible assets of only $2bn is a concern for such a large deal.

Moreover, goodwill that is used as a balancing number between total consideration and identified assets & liabilities is a staggering $11.7bn. This means that not only Block’s management was not able to identify a significant amount of intangible assets, but also that a large proportion of the price paid for the company is based on future expectations about the business.

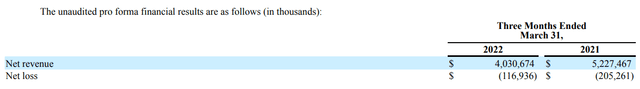

To get an idea of what kind of business did Block acquire, we should also have a closer look at the notes of Block’s SEC filings. The table below, shows SQ pro forma net revenue and net loss figures, as if Afterpay deal had occurred on 1st of January 2021.

The following table summarizes the unaudited pro forma consolidated financial information of the Company as if the Afterpay acquisition had occurred on January 1, 2021.

Source: Block 2022 Q1 10-Q SEC Filing

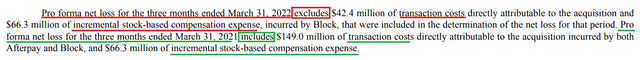

Based on Block’s actual reported net income (loss) figures of -$207m and $39m for Q1 2022 and Q1 2021 respectively, it appears that Afterpay has swung from large loss to profit over the course of one year. However, the notes reveal that certain transaction costs and stock-based compensation expenses were excluded from one of those figures and included in the other.

This makes comparison between periods extremely difficult for anyone relying on publicly available information.

While Afterpay profits appear as a black box at this point in time, we could get an idea of where the company’s revenues are currently standing by subtracting Block’s actual reported figures for the two quarters from their respective pro-forma results we saw above.

This gives us sales figures of $70m during Q1 2022 and $170m during the same quarter of the prior year. While quarterly results are hardly a trend, these numbers should be a concern for anyone believing in Afterpay’s massive growth potential.

Last but not least, there is the issue with the price tag that Block paid for its largest acquisition ever. Although, Afterpay seems to fit well within Block’s service offerings to customers and sellers, the $29bn deal for a company with roughly $650m worth of sales for FY 2021 resulted in a transaction value to sales multiple of nearly 45 times. Of course, since the deal was paid by using Block’s shares, as the share price of SQ fell, so did the transaction value for Afterpay. However, even if we use the $13.8bn total consideration for Afterpay recorded on Block’s Q1 2022 financial accounts, the multiple is still exceptionally high. The sales multiple already takes into account years, if not decades of high revenue growth and high margins, which as we saw above are both questionable already.

Conclusion

Block’s share price decline of nearly 75% over less than a year was extraordinary. From one of Wall Street’s high flyers, the company was suddenly caught between a rock and a hard place caused by lower market liquidity on one hand and idiosyncratic risks on the other. Block’s exceptionally high valuation further exacerbated the problems that the company was suddenly faced with.

Given all these risks that suddenly materialized, Block could now easily become oversold over the short-term as pessimism takes hold. Any short-term reversal, however, is unlikely to be sustainable in my view given the problems described above. Of course, monetary conditions could once again turn favorable for Block and all momentum stocks, but such a scenario does not seem appealing for anyone who aims to identify solid long-term investments.

Be the first to comment