Scott Olson

Introduction

Electronics retailer Best Buy Co. (NYSE:BBY) and its favorable characteristics first caught my eye when I analyzed several U.S. retailers back in August. In my subsequent in-depth analysis, I concluded that the market was – as always – forward-looking and expected Best Buy to suffer greatly in an impending recession, making the stock relatively cheap. While I acknowledged a number of risks and headwinds, I ultimately thought the stock was fairly cheaply valued in the low $70 range.

On November 22, 2022, Best Buy reported better-than-expected third-quarter results and slightly raised its full-year 2023 sales forecast. In this article, I will discuss whether the stock is still a buy after the earnings topper and emphasize why great management is helping the company’s financial performance in such difficult times. After all, Best Buy is largely dependent on electronic product sales and has been feeling a deterioration in consumer sentiment for several quarters.

Best Buy Fiscal 2023 Q3 Earnings And Expectations For Q4

When the company announced its second quarter results, which became available just a month after the start of the third quarter, management was still projecting a decline in comparable sales in the range of 11% and a non-GAAP operating margin of about 4% for fiscal 2023. In my previous article, I suggested that management was probably under-promising to over-deliver. Indeed, third-quarter results were better than expected, and the company now expects full-year comparable sales to be about 10% below fiscal 2022. At the same time, management emphasized that it does not expect fourth-quarter sales to exceed previous expectations. It is likely that management is once again under-promising to over-deliver, as the team already has some visibility into the holiday season (the fourth quarter is already three weeks old). Admittedly, and especially in the context of a cyclical retailer like Best Buy, I prefer such a management style to the opposite behavior often observed – missing forecasts due to overly optimistic expectations.

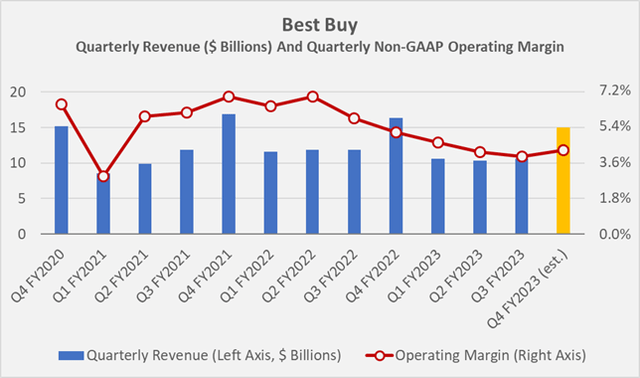

In other words, taking into account the good Q3 results, management expects the 2022 holiday season to be similar to 2019 (Figure 1). Obviously, however, like all other retailers, the company is facing increased input costs and is struggling to pass those on to the end consumer, as evidenced by a weakening operating margin. To some extent, however, this effect is likely to be temporary, and as a well-run company, I expect Best Buy to emerge stronger.

According to management’s updated guidance, operating margin bottomed out in the third quarter, as it now expects a full-year operating margin of just over 4%. To achieve a full-year operating margin of 4.1%, Best Buy would need to achieve an operating margin of 3.9% in the fourth quarter, which seems like a low bar to clear. For full-year margins of 4.2% and 4.3%, the company’s fourth-quarter operating margins would have to improve to 4.2% and 4.5%, respectively. These estimates also do not seem too aggressive to me, given the company’s effective management of costs, due in part to the company-wide restructuring initiative that began in Q2. In my view, this is another sign of management’s tendency to under-promise.

Figure 1: Best Buy’s historical quarterly revenues and non-GAAP operating margins (own work, based on the company’s earnings press releases for Q4 fiscal 2022 to Q3 fiscal 2023, an expected sales decline by 10% for fiscal 2023 and a non-GAAP operating margin of 4.2%)

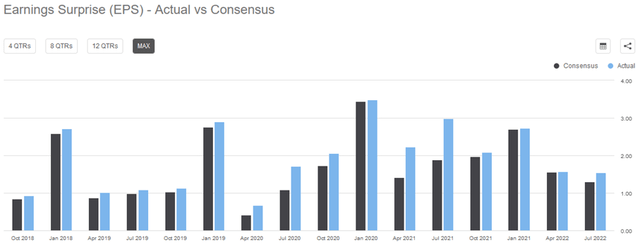

Taken together, I do not think it is unreasonable to expect the company to report full-year results that exceed expectations. Indeed, if management were to currently see a further deterioration in consumer sentiment as the holiday season becomes increasingly visible, it would be unreasonable for them to maintain expectations for the fourth quarter. In this context, it seems worth noting that Best Buy’s management has a surprisingly flawless track record, beating quarterly earnings estimates for at least 16 quarters (Figure 2). On an annual basis, the company’s track record is also impeccable. Finally, management’s positive attitude towards the future performance of the business is underscored by a statement from the company’s chief financial officer:

“From a capital allocation perspective, we resumed share repurchases in November after pausing during Q2 and now expect to spend approximately $1 billion in share repurchases this year.“

Matt Bilunas – Chief Financial Officer of Best Buy Co.

Suffice it to say that announcing a resumption of share buybacks in the face of a looming recession is a particularly positive statement, especially coming from the arguably conservative management of a retailer.

Figure 2: Earnings surprises by Best Buy on a quarterly basis (taken from BBY’s stock quote page on Seeking Alpha)

BBY Management Should Consider Divesting Its International Operations

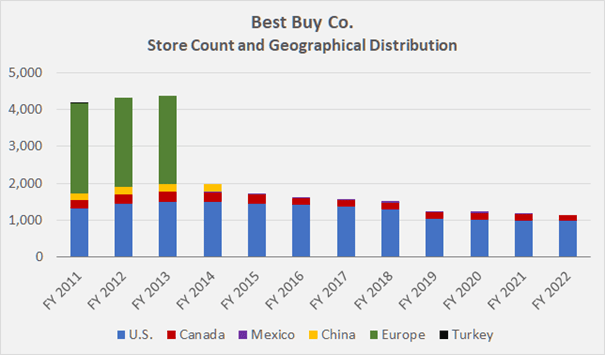

In its recently announced restructuring program, the company is focusing on “better align[ing] its spending with critical strategies and operations,” which draws my attention to Best Buy’s international operations. In my previous article, I pointed out that Best Buy closed most of its international operations in Europe and China nearly a decade ago. Similarly, the company reduced the number of its stores domestically (Figure 3).

Figure 3: Historical count and geographical distribution of Best Buy stores (own work, based on the company’s fiscal 2011 to fiscal 2022 10-Ks)

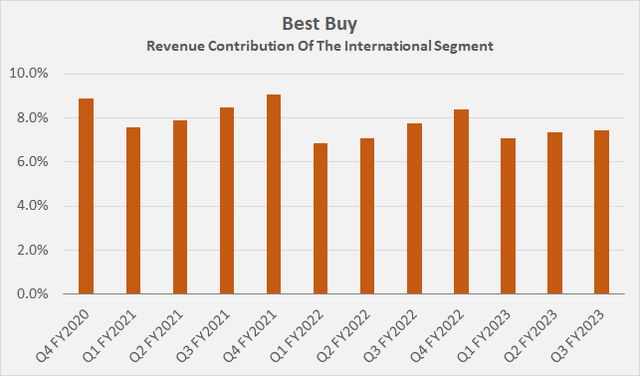

Even if the company’s business in Canada performs similarly to its domestic business in terms of revenues (typically about 8% of total revenues, Figure 4), the company should reconsider its international exposure, primarily because of the likely disproportionate overhead costs. Of course, the argument that international exposure helps the company hedge against the risks of a recession at home has some merit. However, given that the U.S. and Canada are closely linked economically and that the two currencies also move largely in lockstep (except for an occasional flight-to-safety tailwind for the U.S. dollar), this argument should not be overstated. The COVID-19 pandemic and related government-mandated measures were also at least partly responsible for the higher volatility of the operating margin in the international segment (three-year average of 3.4% ± 2.6%) compared to the domestic segment (three-year average of 5.3% ± 0.5%).

Figure 4: Quarterly revenue contribution of Best Buy’s International segment (own work, based on the company’s earnings press releases for Q4 fiscal 2022 to Q3 fiscal 2023)

All in all, I see no clear benefit from this rather small exposure and suspect that the company’s earnings and free cash flow would benefit significantly from a divestment. However, I am aware that a rising interest rate environment, the associated increase in risk premiums, and the reduced availability of private equity financing (which was likely at least partially responsible for the failed sale of Kohl’s (KSS)) make such a transaction unfavorable from a shareholder perspective at this time. However, I would very much like to see management address a possible divestment once market conditions improve.

Where Best Buy Stands Out – Working Capital Management

The quality of leadership in retail companies becomes particularly clear when one takes a close look at the management of working capital. Such companies typically operate on very low profit margins, so management must be extremely adept at managing costs and inventory. As an aside, I have covered the topic of working capital management in detail in a separate article, highlighting the common misconception that companies with negative working capital are not necessarily in financial distress. On the contrary, such companies are often extremely profitable and therefore give rise to above-average shareholder returns.

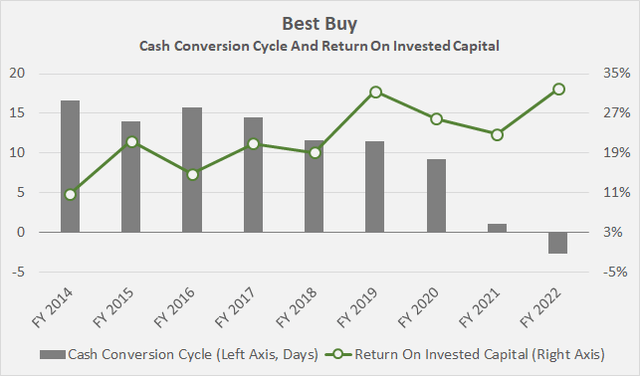

In Best Buy’s case, I was pleased to see that its cash conversion cycle has been steadily declining since at least fiscal 2014 (Figure 5). This metric measures the time in days it takes to convert money spent on production/inventories into cash. Obviously, the lower this number, the better. This development – surprising for a retailer – raises the question of how Best Buy was able to achieve such a strong performance, which is partly responsible for the steadily increasing return on invested capital (ROIC) – a key metric related to excess shareholder return.

Figure 5: Best Buy’s historical cash conversion cycle and return on invested capital (own work, based on data by Morningstar)

Best Buy’s customers make significant purchases on credit. In fiscal 2014, for example, the company reported receivables amounting to more than 24% of inventories (p. 56, fiscal 2014 10-K). By consistently shortening its payment terms, the company is reducing the duration of credit it gives to its customers, thereby reducing its credit risk. By the end of fiscal 2022 (p. 40, fiscal 2022 10-K), receivables as a percentage of inventories have fallen to just 17%. The significantly improved situation on the assets side of the company’s balance sheet is also reflected in the steady decline in days sales outstanding (see my aforementioned article for an explanation), which is partly responsible for the improved cash conversion cycle.

Keeping improving days sales outstanding in mind, the company can actually improve its free cash flow by granting itself de facto free credit. Therefore, it must at least keep payment terms with its suppliers steady and as long as possible. As a rule, retailers are not in a favorable position in this context because they operate at the end of the value chain and manufacturers usually try to aggressively reduce their own accounts receivable – one company’s receivables are another company’s payables. Therefore, I consider it an indicator of excellent management if days payables outstanding are at least maintained. In Best Buy’s case, this is the case, as the company has maintained its payment duration at 59 days ±3.6 days since fiscal 2014.

Finally, and most importantly for retailers, management must keep a close eye on inventory management. Management’s skills in this regard can be assessed, for example, by calculating inventory days, a metric that measures the time it takes a company to sell its inventory. At Best Buy, this metric declined from over 66 days in fiscal 2014 to under 53 days in fiscal 2022, contributing significantly to the steady decline in the cash conversion cycle.

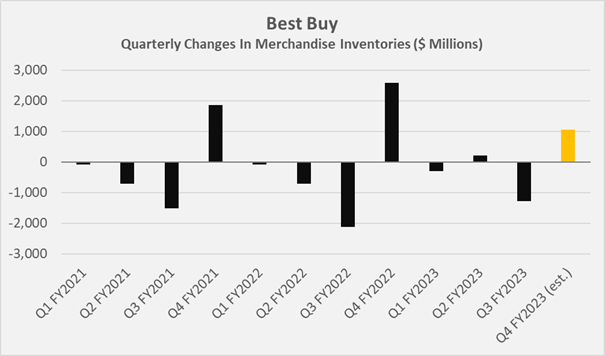

Finally, I would like to draw your attention to the fact that, unlike many other retailers, Best Buy has largely been able to defy supply chain issues. Of course, the uncertainties surrounding supply chain issues in fiscal 2022 are highlighted by the 14.7% decline in inventory reported in the third quarter of fiscal 2023, but the company still did very well. The great performance is particularly evident in Figure 6, which shows quarterly changes in inventory levels according to Best Buy’s cash flow statements. Unlike some other retailers, Best Buy does not suffer from excessive inventory, which typically leads to markdowns, which in turn are a major reason for margin compression. To be fair, however, it should not be forgotten that Best Buy, unlike fashion retailers, for example, is more focused on what can be described as durable goods. At the same time, this focus makes the company more vulnerable to economic downturns.

Figure 6: Best Buy’s quarterly changes in merchandise inventories (own work, based on the company’s fiscal 2021 to fiscal 2023 10-Qs and 10-Ks)

Key Takeaways

- Best Buy’s management continues to navigate these arguably difficult times very well, as evidenced by its conservative guidance and better-than-expected third quarter results.

- The company’s working capital management is excellent and a major reason why I am a big fan of BBY. It is precisely in difficult times that the qualities of good management pay off – especially for retailers, who by their very nature operate with very low margins.

- Although it is only speculation at this point, I suspect that management is considering a sale of the international segment as part of the restructuring process currently underway. The segment accounts for only 8% of consolidated revenues, and such a transaction would be a final step on management’s agenda to streamline the business.

- As a more cyclical retailer, Best Buy will obviously suffer in an upcoming recession, but I consider this to be more or less priced into the stock.

- A rise in the share price due to better-than-expected results and management’s tendency to under-promise and over-deliver was to be expected. However, I do not like to buy in times of increasing optimism, so I keep the stock on my “recession watch list”.

- With a long-term mindset, however, the stock is likely not a bad deal in the $70 range. After all, the dividend appears safe and serves as a reasonable consolation in times of lack of capital appreciation.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment