Chip Somodevilla/Getty Images News

Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) goes from strength to strength. Over the past few months, things have been working in its favor at every level, starting with excellent operational results. At the same time CEO Warren Buffett has managed to deploy capital in productive ways. He has done this partly through buybacks, partly through buying publicly traded stocks, and partly through the recent bid for Alleghany (NYSE:Y). Meanwhile the market has seen Berkshire as the perfect stock to own in the present environment. It’s a large cap stock with steady and consistent growth and diversification which provides a defense against many economic conditions. Its portfolio of publicly traded stocks includes a position in Apple (AAPL) which was bought when it was cheap between 2016 and 2019 and now amounts to more than 20% of Berkshire’s total market cap.

This is Berkshire’s moment. The market has finally caught on to the strengths in Berkshire’s business model with the result that it has outperformed the S&P 500 by over 20% so far in 2022. Shareholders should allow themselves to sit back and enjoy it. Berkshire is and has always been a stock for long term investors. If you do not follow the market closely, it has been the one stock which it was safe to hold without paying close attention. The market attitude toward Berkshire may shift with periodic changes of fashion, but Berkshire continues to power along with increases in value almost every year. If you don’t own Berkshire at this point, you have missed some great results but it isn’t too late. Having gained about 50% in market cap since the beginning of 2021 Berkshire is no longer dirt cheap, but given its virtues it is still worth a close look in a very expensive market environment. In relative terms it’s not seriously overpriced. I will have more to say about that in the conclusion.

Two specific actions over the past year have important ramifications. The first was the major leap Buffett took into Occidental Petroleum (OXY) while at the same time adding to his position in Chevron (CVX). Buffett is clearly a believer in carbon energy as a bridge to a future of mainly renewables. The other important development is the recently announced all-cash bid for Alleghany Corporation. I’ll take the Alleghany bid first.

Why Is Warren Buffett Buying Alleghany?

On March 21 Berkshire Hathaway and Alleghany Corporation jointly announced that Berkshire would acquire Alleghany in an all-cash deal for $11.6 billion or $848.02 per share, an odd number generated by Buffett’s deduction of Goldman Sachs’ $27 million fee. The deduction was a statement about Buffett’s negative view of investment bankers. The price otherwise would have been a round $850 per share. That’s a premium of 29% compared to the average price at which Alleghany traded over the 30 days prior to the bid. Its previous high price had been $836 per share just before the pandemic lock down bear market in 2020. What made the deal particularly satisfactory for Berkshire was the fact that it was done entirely in cash. That meant an immediate deployment of $11.6 billion from Berk’s large cash hoard and, more important, did not require issuing Berkshire shares.

Alleghany is in the reinsurance business with subsidiaries writing specialty insurance. It invests its float in both bond and equity portfolios as well as wholly owned subsidiaries contained in a division called Alleghany Capital. The presentation of 22 years of book value on page one of its Annual CEO Letters mimics the format of Buffett’s Annual Shareholder Letters which have a first page comparing book value and now market price to the S&P 500 over its 57 year history. The text that follows is an overall review of its three main areas: insurance operations, public portfolio, and wholly owned businesses. In broad outline Berkshire and Alleghany might be described as similar. Alleghany has sometimes been called a mini Berkshire.

The mini-Berk appellation strikes me as somewhat misleading because Berkshire is about sixty five times the size of Alleghany as measured by market cap. Scale matters. I am reminded of the statement by quantum gravity physicist Carlo Rovelli that the universe is very different on micro and macro scales and one shouldn’t think that the subatomic particles contained in a bicycle look like tiny proto-bicycles. It’s like that in comparing the giant conglomerate which is Berkshire with the miniature conglomerate which is Alleghany.

Each element of Alleghany has notable differences from the corresponding unit in Berkshire. Its insurance business, for instance, is entirely reinsurance, one of four such publicly traded companies, while Berkshire has various insurance units including GEICO and several property and casualty subsidiaries. The wholly owned businesses inside Alleghany are nothing like Berkshire’s subsidiaries in size, quality, or synergy. Berkshire Hathaway was put together with careful attention to the way its separate parts interact. Alleghany’s businesses seem more randomly assembled. One major qualitative difference is that Berkshire’s operating businesses have thrived to a degree that they far outrun the original cost at which they are carried on Berkshire’s books. As a result Berkshire book value is gradually phasing out as a measure of overall value and is already much less relevant than it once was. Alleghany is still primarily an insurance company for which book value continues to be the single most important measure.

One thing that Berkshire and Alleghany share is a lumpiness in results. Another is the difficulty and complexity involved in estimating fair value. The Berkshire bid was priced at 1.26 times Alleghany’s book value meaning that Alleghany sold almost exactly at book value before news of the deal caused the stock price to jump. Berkshire now sells at about 1.55 times book value. Does that meant that Berkshire got a bargain price? Perhaps, but the higher Berkshire BV also reflects the tremendous quality and business value of its subsidiaries which have pulled away from the price at which they are carried on the balance sheet. An effort to value both companies involves separate methodologies for their insurance businesses and other businesses.

Alleghany is probably a bargain at the deal price of $11.6 billion, but it isn’t a game changer for Berkshire. The deal price amounts to only about 1.5% of Berkshire’s market cap and doesn’t move the needle much for Berkshire. On the other hand it is the largest acquisition by Berkshire in six years and the second largest insurance acquisition ever after General Re. Berkshire paid $22 billion for Gen Re in 1998. One of Buffett’s great regrets was having used Berkshire stock to accommodate Gen Re, a successful reinsurer to be sure (especially after some remedial actions taken by Buffett after 9/11) but it hasn’t been as strong a capital compounder as Berkshire. Swapping Berkshire shares for Gen Re was a mistake Berkshire has been determined not to repeat.

As with Berkshire, Alleghany’s reported earnings are not helpful to analysts because they are distorted by the requirement of ASU 2016-01 (in effect since 2018) to report both realized and non-realized gains or losses in their investment portfolios. This is a common problem with reported insurance company earnings. As Buffett has pointed out repeatedly, transient investment returns now often overshadow more significant operating results. In the case of Alleghany, as with most insurance businesses other than Berkshire’s, there’s a large fixed income position which outweighs the equity portfolio. Berkshire is unique and uniquely advantaged in having size and an extremely conservative balance sheet which together permit it to cover future insurance liabilities largely with equities.

Alleghany more closely resembles Markel (MKL), which is about twice its size and also has an investment portfolio heavily weighted toward fixed income. As with Markel, Alleghany’s fixed income portfolio serves as the primary vehicle for covering future claims, with 72% fixed versus 16% equities (plus cash and “other”). Fixed income investments have produced poor returns generally over the past decade and outright losses since rates began to rise in 2021. Like many other insurance companies Alleghany has depended on buybacks to create per share growth in earnings.

For Alleghany the best measure of growth over an extended period is simple compound return on book value, which has been about 8% over the past decade though trailing off to 6% over the past three years because of catastrophe losses. Over the long term, its number for book value growth closely tracks the compounded annual growth in premiums. While Berkshire has a decades-long history of exceeding that rate of return, the 8% compound return at Alleghany means that the deal will be highly accretive for Berkshire. At the current near zero rate of return on Berkshire’s cash hoard, the 8% rate of increase in Alleghany’s book value adds around $1 billion annually to Berkshire’s annual pre-tax return. This is not a huge number on the scale of Berkshire but not trivial either. Even if a series of Fed rate increases cause short-term rates to climb to 3% or so, the pre-tax return for Berkshire would still be strongly positive. It’s further worth noting that unlike some insurance companies Alleghany does have top line growth, and the return should continue to compound at a rate round 8%.

Potential Synergy And Intangibles From The Deal

There are several other ways in which Berkshire should benefit from the acquisition. An additional advantage of investing in an insurance business is the relative immunity to inflation or recession as customers are unable to dispense with insurance because of either hard times or price increases. As noted in the 2021 Alleghany Annual Letter, the pricing for reinsurance has begun to improve after a decade of stagnation. Over the past two years Alleghany has benefited from general price increases and expects this trend to continue, although recent Annual Letters continue to complain that pricing does not yet fully reflect catastrophe risks.

In the announcement of the deal Buffett also went out of his way to mention that he was particularly delighted that he would once again work together with his long-time friend, Joe Brandon. Brandon, who was elevated from president to CEO of Alleghany effective January 1, had previously been CEO of Berkshire subsidiary General Re. Under SEC pressure he left Gen Re in 2008 because of the scandal involving sham transactions to help AIG appear to improve its loan loss reserves. The agreement with AIG was in place at the time Brandon took over, however, and Buffett clearly felt that blaming him was unfair. Brandon was fully exonerated in 2011.

Returning as CEO of the Alleghany subsidiary, Brandon brings extensive experience in the reinsurance area and also, in his years as president, in the broader areas involving Alleghany Capital. He is ten years younger than Ajit Jain, the current chief of Berkshire’s insurance businesses. Once considered a possible successor to Buffett, Brandon might eventually come to play an important role in acquisitions along with Greg Abel who has been involved in acquisitions on the non-insurance side of Berkshire. With that team in place, acquisitions at Berkshire could encompass the areas now dependent on Buffett himself, although no individual or group will ever match his more than sixty years of experience.

Another major area of synergy in which Berkshire and Alleghany might improve together is underwriting, with close attention to climate change and catastrophe losses. In three of the past five years Alleghany has had a combined ratio well over 100 with catastrophe losses included. The combined ratio measures the amount by which premiums exceed or fall below payments on claims. Numbers below 100 are positive and numbers above 100 mean more money goes out than comes in. Berkshire’s numbers are relatively consistent and negative results have a low frequency of once or twice a decade.

Catastrophes like the winter storm Uri and related Texas freeze and power outage, as well as summer storms and flooding in Europe and Hurricane Ida, made a dent in Alleghany’s otherwise strong underwriting in 2021. This may result from its relatively small size, the fact that it is a reinsurer with specialty coverages, or the fact that Alleghany’s business involves buying from insurance brokers, where pricing is highly competitive and involves smaller companies than Berkshire’s clients. It remains to be seen whether Alleghany will open smaller business reinsurance to Berkshire along with the use of brokers or whether Berkshire, protected by its size and ability to wait, will push its longtime policy of requiring higher prices or turning away business.

In sum, Alleghany is a good deal for Berkshire, sweetened by the fact that it did not require issuing Berkshire shares. It’s a little too early to celebrate, however. The deal has no breakup charge and as I write this two weeks remain for the 25-day “go shop” provision allowing a higher bid. Today I noticed that Alleghany traded about 1% above the deal price. Hmmmm. I don’t know why anyone would buy at that level unless they had some expectation that a higher bid might be on the way. I’ll say a bit more about this later.

Alleghany Isn’t The Only Major Area In Which Buffett Deployed Cash In Recent Months

Energy investments in Occidental Petroleum and Chevron as well as a continuation of share repurchases amounting to $6.7 billion during the 4th quarter of 2021 have enabled Berkshire to use 100% of cash thrown off by its operating businesses for the past year. That’s a major accomplishment at a time when most assets appear to be overpriced. The three actions sum to about $28 billion. A headline in Barron’s congratulated Buffett for getting his “deal mojo” back, but Buffett himself hasn’t changed. The reality is that Buffett was patient and allowed the market to come to him. The approximate $1 billion in Chevron and $8 billion in Occidental accord with his often articulated view that renewable energy is and should be the energy source of the future, but carbon energy is essential for a longer period than many people realize. In both cases he bought and sold and bought again before ultimately driving both CVX and OXY into the area of major positions.

The OXY position began as a $10 billion preferred stock which Buffett provided in 2019 to help OXY succeed in buying Anadarko. The preferred stock yield was 8% and was accompanied by warrants enabling Berkshire to buy an additional $5 billion of OXY at a price now around $58 per share. The collapse of the oil price in 2020 led to a close brush with bankruptcy for OXY, but the sharp and persistent oil price recovery has led to record free cash flow and an opportunity to retire debt from the Anadarko deal quickly. If oil prices remain at anything close to the current level the debt required to buy Anadarko will be gone in a year or two and the Anadarko deal, which roughly doubled its reserves, will have paid for itself. With the detailed knowledge gained on OXY at the time of the $10 billion preferred deal, Buffett did the math and saw that OXY presented a one of a kind opportunity. Because I wrote on this here in my most recent SA article, I won’t go further into the details. The takeaway is that Buffett waited patiently until two opportunities presented themselves.

Berkshire’s Structure And Its Major Business Groups

Berkshire Hathaway is a diversified company often described as a conglomerate although not in the derogatory sense in which the term was once used. Earlier conglomerates of the 1960s and 1970s were often a hodge-podge of businesses thrown together randomly by a manipulative management which used its own overpriced stock as currency. Berkshire by contrast was carefully constructed of companies which provide balance and diversification able to withstand a variety of business conditions.

Berkshire is operationally decentralized with more or less independent CEOs running each of its major subsidiaries. The corporate headquarters in Omaha has only about 30 employees (Alleghany similarly has a small corporate headquarters staff) and its major activity is allocating capital both within and without Berkshire, directing cash flow to subsidiaries which can use it productively in capital expenditures and reallocating capital not needed in operating businesses to buy publicly traded stocks or make acquisitions. This is done by Buffett himself in consultation with his vice chairman Charlie Munger along with his two lieutenants, Todd Combs (since 2011) and Ted Wechsler (since 2012). The operating businesses are divided into two groups with vice chairman Ajit Jain in charge of the insurance side and vice chairman Greg Abel in charge of all non-insurance businesses. Abel is Buffett’s designated successor.

In his 2020 Shareholder Letter Buffett stated that the four largest business units were Berkshire’s “crown jewels.” They consequently come first among units to be stress-tested notwithstanding the fact that by some measures the aggregated Manufacturing, Service and Retailing subsidiaries are larger. So for that matter is the Cash position, which for all practical purposes is now also a business unit. Berkshire thus has the following business units in order of significance along with a brief commentary:

- Berkshire Hathaway insurance businesses. By far the largest business unit, the insurance part of Berkshire involves all areas of the industry involving vehicles, property and casualty, specialty, and reinsurance. It has moderate growth and over the years has provided the “float” generated by premiums received which will not produce claims for many years. Insurance is a stable business with little correlation to business cycles. The main risk stems from potential losses from a low probability confluence of catastrophe losses.

- Apple, and other major holdings in Berkshire Hathaway’s publicly traded stock portfolio. Apple is Buffett’s greatest success in recent years and was a breakthrough into tech investing which in the case of Apple combines with a powerful consumer brand. The rest of Berkshire’s portfolio is heavily weighted in financials, including BAC and American Express (AXP), an area which Buffett understands well. Buffett treats the publicly traded stocks Berkshire owns as businesses and suggests “looking through” earnings and dividends to capital reinvested.

- Burlington Northern Santa Fe Railroad subsidiary. Berkshire’s most successful acquisition of the past two decades BNSF is comparable to Union Pacific (UNP) with excellent growth and less cyclicality than one might expect.

- Berkshire Hathaway Energy, which is comprised of a number of utilities and energy companies and also incongruously includes a major real estate brokerage. BHE, long run by Greg Abel, has extremely stable returns little affected by business cycles. Along with BNSF, the utility units are required to follow rules and meet requirements of regulators but are at the same time assured that required capex will be compensated. BHE has a strong long term renewable energy project in place. It has, surprisingly, been Berkshire’s strongest growth area since Berkshire bought controlling interest of MidAmerican Energy in 1999. Over two decades it has also had a number of successful bolt-on acquisitions, most recently acquiring pipelines and storage facilities from Dominion Energy (D) in 2019.

- Manufacturing, Service and Retailing subsidiaries. These diverse smaller businesses range from See’s Candy, a consumer company with a great long term record, to such manufacturing companies as IMC (International Metalworking, formerly Iscar and Marmon) as well a number of housing and housing-related businesses. This part of Berkshire is correlated with the economy’s ups and downs. Many of the dozens of businesses in this category bear some resemblance to the businesses owned in Alleghany Capital although the Berkshire subsidiaries are generally larger.

- Cash. Berkshire began 2022 with $144 billion of cash with roughly $30-$40 billion kept for possible need in case of catastrophe losses in its insurance businesses. The remainder is dry powder for use in investments like Alleghany and Occidental. The large cash position also serves to make Berkshire invulnerable in the case of a major economic crisis.

In sum, Berkshire Hathaway is a large company that continues to grow and is made up of parts that fit together synergistically. As a conglomerate Berkshire has no single industry or company as its major competitor. It serves many markets, and many of its subsidiaries are best of breed in their industry. The only cyclical companies are in the Manufacturing and Consumer areas. Berk has a great advantage in its insurance areas because neither regulators nor credit rating firms impose the necessity of holding “float” in fixed income. The overall risk of Berkshire’s separate parts is low. Taken together the risk profile is even lower.

Key Metrics For Berkshire And Alleghany

Berkshire’s SA Factor Grades accord in some ways with the opening paragraphs of this article. Valuation and Momentum have a more or less inverse correlation. As Berkshire moved from C- Momentum to A+ Momentum, its Valuation moved from B to C. In other words, as its price increased its Valuation became less attractive. No surprise there. Profitability, a longer term and more fundamental measure, remained at A+. Growth rose from D six months ago to B three months ago then eased to B-. It’s hard to know what to make of that exactly as earnings are distorted by changes in the contribution of realized and unrealized gains on its stock portfolio. Better to ignore those rankings I believe.

Even less helpful are the Revisions numbers as Berkshire doesn’t make quarterly projections. You are looking at the predictive success of a handful of analysts. One of four Wall Street analysts rates Berkshire a Strong Buy with three rating it a Hold; among SA writers 11 rate Berkshire a Buy or Strong Buy (about 75%) while the other five rate it a Hold. No analysts rate Berkshire a Sell.

Factor Ratings:

The Sector Ratings Are As Follows:

Ranked in Industry:Multi Sector Holdings

Ranked in Sector: Financials

Ranked Overall

Berkshire Hathaway isn’t widely covered, but Alleghany is even less well covered. Only two Wall Street analysts made calls on Y, both rating it a Buy. Of three recent SA articles one rates it a Buy and two rate it a Hold. It is ranked highly in Sectors and Industry, being #1 of 4 in the Reinsurance Sector, #8 of 623 Financials, and #68 of 4284 Overall.

As for Factors, the increase in Momentum correlates negatively with Valuation as one might expect, more or less as in the case of Berkshire. The Growth number of 35% YOY and a 13.5% five year average makes little sense. I can’t see any source for numbers like those in the Alleghany Annual Report, and they certainly don’t align sensibly with the 12% return on equity and 8% return on total capital, numbers which align with the ratio of debt to equity. Best, I think, to dismiss the high numbers for growth and use instead the annual average increase of book value of 8%, which is decent growth but hardly warrants an A rating.

Charting Performance of Berkshire Against The S&P 500

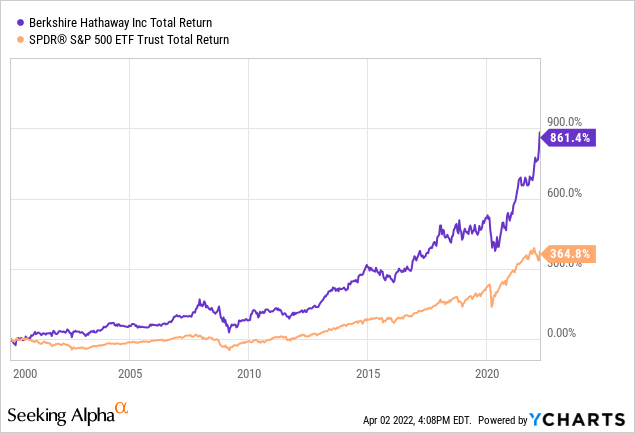

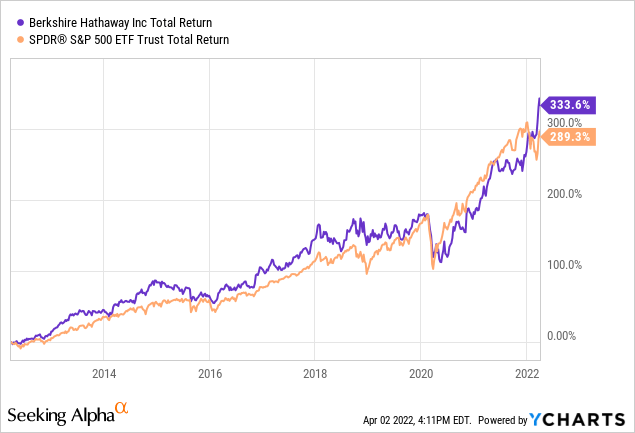

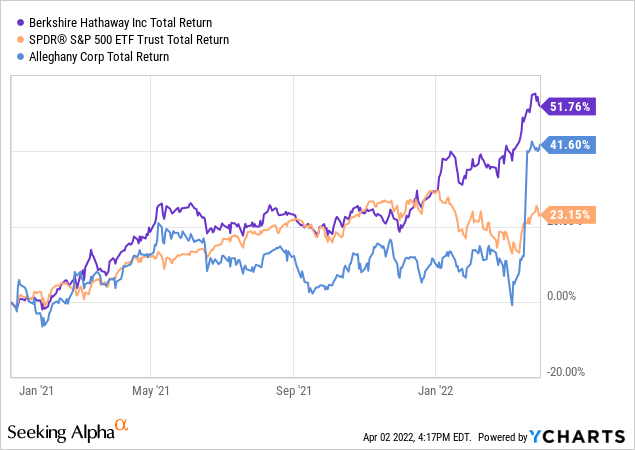

Because of its broad diversification the best comparison for Berk is the S&P 500 (SPY). As argued in this piece Berkshire and the 500 Index share the fact that their big winners tend to reduce the importance of relative losers. Buffett has noted that as Berkshire increases in size beating the index becomes increasingly hard. Viewed as a horse race between Berkshire and the Index a lot depends on where one’s measurement begins and ends. For that reason I will provide three graphs which cover both up and down cycles over long (since 2000), medium (10 years), and briefer (since January 1, 2021) periods. The chart from Jan 1, 2021, includes Alleghany.

The above chart shows that because of its superior performance during market downturns BRK.B has beaten the S&P 500 soundly over a period exceeding 22 years.

Somewhat surprisingly BRK.B has also beaten the S&P over the past 10 years which almost exactly matches the period in which the popular tech/social media stocks rose to dominate the S&P 500 returns. BRK.B continued to surge while the major outperforming growth stocks stalled over the past year. The point to remember is that the market sometimes rallies strongly and sometimes corrects and an ideal stock does well under both conditions.

From January 1, 2021, BRK.B once again beat the S&P 500 soundly. Meanwhile Alleghany trailed both Berk and the index until Buffett’s bid to acquire it produced the spike of about 25%.

What Happens If The Alleghany Deal Fails To Go Through?

This is a small expansion of the note above that Alleghany stock traded last Friday at a price about 1% higher than the deal price of $848.02. On the one hand it makes little sense for a buyer to pay more than the price at which the deal is expected to close. Friday’s price could have been the result of a single badly informed trader or outright speculator buying at the market with little stock offered. It could also be a small investor who overheard something about another bid. On the other hand, with a maximum potential loss of 1% it could also be a more calculated speculator seeing an asymmetric risk/reward with a downside of $848.02 and a much larger upside if a higher bid comes along.

Less than two weeks remain in the “go shop” period in which an alternative bid could emerge. When such an overbid is likely, the price of the stock in question generally moves more than 1%. It wouldn’t be the first time Buffett lost a coveted asset. In 2002 Electricite de France topped a bid for Constellation Energy, which was in dire financial straits, but had valuable nuclear assets. In 2017 Sempra Energy jumped in to top his bid for Oncor, a bankrupt Dallas utility, in a deal that would have amounted to over $18 billion including debt controlled by Paul Singer’s Elliott Management. In both cases Buffett declined to raise his offer. In 2019 Buffett himself jumped into a “go shop” provision in Apollo Global’s bid for Tech Data only to be topped by Apollo Global in turn. The whole bidding process on Tech Data took place with about two weeks remaining on the “go shop” period.

Buffett has resisted, on principle, getting into bidding wars, and he likely priced the Alleghany bid so as to avoid a contest. Alleghany is probably worth more to Berkshire than to potential competitors because of the close fit of several parts of its business. Buffett stated that Alleghany would become a separate unit of Berkshire, although in the long run it could work very well broken up into bolt-on units attached to several other Berkshire subsidiaries. We will have the answers within a few days, and Berkshire will be fine in any case.

Is Berkshire Hathaway Stock A Buy, Sell, or Hold?

With or without Alleghany, Berkshire has an excellent long term outlook. Its businesses are well protected against competition and have long runways for compounding returns. Its major wholly owned businesses have a high predictability, especially BNSF railroad, Berkshire Hathaway Energy, and its various insurance companies. These three businesses combined amount to roughly 60% of Berkshire, depending on the valuation method used. Berkshire’s price action over the last 15 months shows that the market is fully aware of Berkshire’s bright prospects. As a result Berkshire isn’t dirt cheap as it was a year and half ago, but at its present price it isn’t expensive either, especially when compared to the market as a whole. If the Alleghany deal should fail to go through and Buffett decided to stop with his present position in OXY, we would learn more Buffett’s view of Berkshire’s price by watching the level of Berkshire buybacks.

Berkshire is extremely hard to value with any exactitude. To begin with there is insurance “float” and the assets that come with it. Should future insurance liabilities be subtracted from the value of those assets? Technically yes, but with continued strong underwriting, in practical terms perhaps not. Should operating companies like BNSF and BHE be valued at a multiple of earnings or cash flow or by a macro comparison of equivalent assets that are publicly traded? There is no single right answer. After summing up the details and taking a step back for the big picture it becomes clear that Berkshire is likely to be a very profitable investment over a period of 7 to 10 years.

If you own Berkshire and add periodically you might wait for a market correction. If you don’t own Berkshire and would like to establish a position you might start with a medium sized position and add periodically and opportunistically. The one thing I would be unlikely to do any time soon is sell any Berkshire shares.

Be the first to comment