Joe Raedle/Getty Images News

Altria Group, Inc. (NYSE:MO) is a well-known dividend stock that has been plagued by controversy over the years by its strong association with smoking. Somewhat similar to oil companies, cigarette companies are typically critiqued for the production of products that many people feel are harmful.

In spite of this, MO has grown its share price and dividend over the last 10 years.

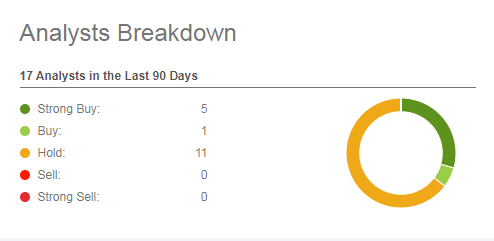

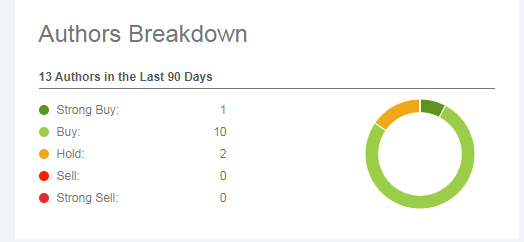

Currently, it is highly rated by both Wall Street analysts and Seeking Alpha authors.

Seeking Alpha

Seeking Alpha

Note that combined the ratings include 17 Buy recommendations and zero Sell recommendations meaning MO is well-liked by people who should know the most about Altria’s future investment possibilities.

Since the beginning of 2022, MO has risen by more than 15% making many investors wonder if MO is now over-priced.

In this article, I will look at the main issues confronting MO and potential MO investors.

MO Stock Key Metrics

Altria performed well in 2021 compared to 2020 with improvements in all major financial categories but the improvements were small compared to the increase in share price which was up 16% over the same period.

Seeking Alpha and author

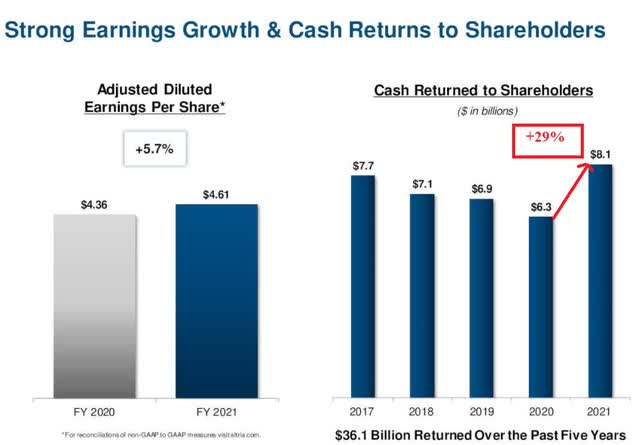

In two other key categories, adjusted earnings and cash returned to shareholders, Altria did much better increasing by 5.7% and an impressive 29% respectively.

Altria

Looking at the usual metrics it would seem MO had grown more than perhaps it should have. But when you look at the cash returned to shareholders, the increase in price seems to be easily warranted.

Is Altria Stock Overvalued?

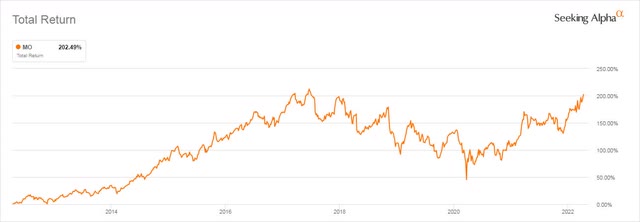

Altria has returned over 200% to shareholders over the last 10 years on a Total Return basis or an annual rate of return of over 11%.

Seeking Alpha and author

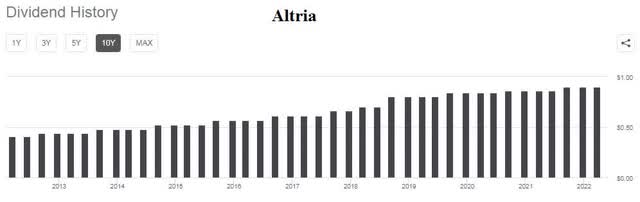

That consistency is mainly due to its dividend which has increased 120% over the last 10 years from $0.31 per quarter to the current $0.91 per quarter.

Seeking Alpha

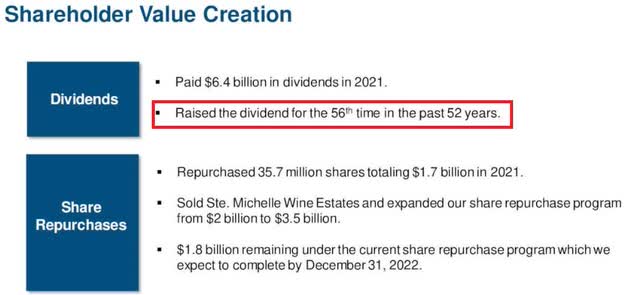

Altria has stated in no uncertain terms that it is committed to returning money to shareholders via dividends and share buybacks. The following chart is from the earnings call presentation on January 27, 2022.

Altria

I would say raising your dividend 56 times in 52 years is a pretty good sign that not only is the dividend safe, but it is also likely to be increased as time goes on.

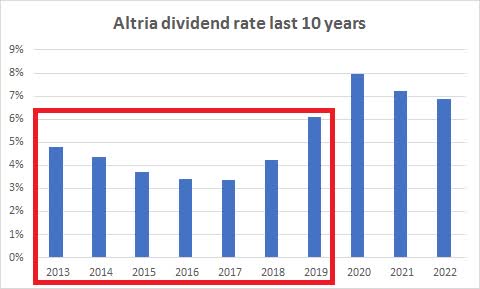

Since the dividend is so important to MO’s future investment value it would be useful to see how the dividend rate of today compares to historical rates.

Seeking Alpha and author

It is easy to see that in seven out of the last 10 years the dividend rate returned to shareholders was lower than what it is now. This is one indication that the current share price is not overvalued and may indeed represent a very good investment value.

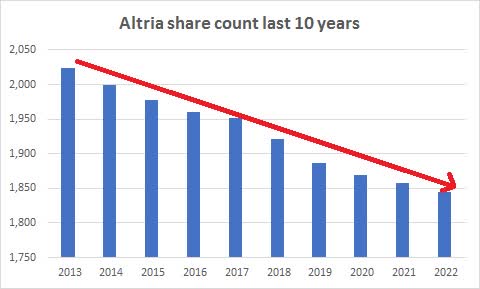

Adding to the security of a dividend currently paying nearly 7% after having been raised 56 times in the last 52 years, is management’s consistent effort to lower the share count year after year via buybacks.

Seeking Alpha and author

Altria recently sold its interest in Ste. Michelle Winery for $1.2 billion and added those dollars to the share buyback schedule which currently has $1.8 billion remaining. Since Altria also owns more than $10 billion in InBev (BUD) one has to wonder if all or some of the BUD shares would be sold too in order to give a considerable boost to the buyback program. In the worst case, the BUD investment offers a means to cover the dividend or increase share buybacks if management ever saw the need.

What Is Altria Stock’s Forecast?

Though Altria has struggled over the years with bad investment choices including huge writedowns on Juul, it seems to now have its house in order.

While using the steadily decreasing, but hugely profitable tobacco business to fund expansion into other growing areas such as smokeless products and vaping, it is able to maintain its dividends and profit profile.

Although combustible products (traditional cigarettes and cigars) are slowly decreasing over time, most of the lost revenue is being replaced by newer products in the oral tobacco and e-vapor business.

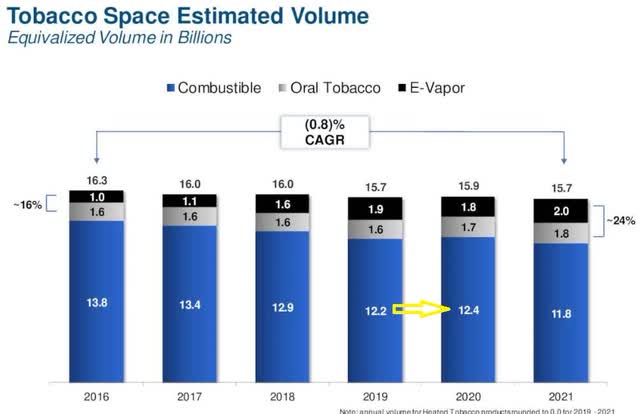

The following chart shows that since 2016 combustible volume is down 2 billion units (13.8 to 11.8), but oral tobacco and e-vapor are up 1.2 billion units. So the race is on to keep volumes up even as cigarette unit sales slowly drop over time.

Altria and author

Note that volumes actually increased from 2019 to 2020 perhaps due to the stress of COVID-19. But the fact remains that total volume in 2021 was the same as in 2019 possibly a good sign for future results.

At this point in time, I would say that Altria is not overvalued.

Is MO Stock A Buy, Sell, or Hold?

Altria has managed to increase its dividend right through the COVID-19 problems and I fully expect an increase in the dividend again this year.

As far as the current price at about $54 is concerned, it is down more than 29% from its high of $77.28 in June of 2017. At that time the dividend was $.61 per share compared with $.90 per quarter now an increase of almost 50%.

Seeking Alpha

It is easy to imagine the price returning to the 2017 levels sometime before 2027 which means it is currently undervalued on a long-term basis.

The risks, of course, are mainly government regulatory and tax policy changes between now and 2027. Increased tobacco taxes and such things as required nicotine reductions could both have a negative effect on Altria’s price.

On the other hand, tobacco companies have been under the regulatory gun for decades now and have still managed to survive and one could argue, thrive as Altria’s 200% total return over the last 10 years suggests.

Altria is a buy for dividend-oriented investors with some risk tolerance.

Be the first to comment